EX-97

Published on February 13, 2026

Huntington Bancshares Incorporated Policy Title: Financial Restatement Compensation Recoupment Policy Policy Level: Board, Segment Number: COMP-2301 Approved By: Human Resources and Compensation Committee Additional Reviewing Committees: N/A Policy Owner: Executive Compensation Director Publication Date: January 20, 2026 Effective Date: October 17, 2023 Policy Contact: Robert Nussbaum Next Review Date: January 2027 The information contained herein is confidential and proprietary information of Huntington. The Policy must be read and followed in conjunction with all other applicable policies, standards, training, and guidelines in effect at Huntington. Template Version 3.2 Internal Use Only 1 Table of Contents 1. Executive Summary ..................................................................................................................................................... 3 2. Applicability ................................................................................................................................................................. 3 3. Key Definitions ............................................................................................................................................................. 3 4. Requirements .............................................................................................................................................................. 4 4.1. Recoupments of Erroneously Awarded Compensation ...................................................................................... 4 4.1.1. Determination of Erroneously Awarded Compensation ...................................................................................... 4 4.1.2. Recovery Obligation ............................................................................................................................................. 5 4.1.3. Impracticability Exception .................................................................................................................................... 5 4.1.4. No Indemnification ............................................................................................................................................... 5 4.1.5. Method of Recovery ............................................................................................................................................. 5 4.2. Administration of the Policy ............................................................................................................................... 6 4.3. Amendment or Termination of the Policy .......................................................................................................... 6 4.4. Interpretation of the Policy ................................................................................................................................ 7 4.5. Other Compensation Recoupment Rights .......................................................................................................... 7 4.6. Legal and Administrative Provisions ................................................................................................................... 7 4.6.1. Incorporation into Compensation Agreements .................................................................................................... 7 4.6.2. Binding Effect ........................................................................................................................................................ 7 4.6.3. Governing Law ...................................................................................................................................................... 7 4.6.4. Dispute Resolution ............................................................................................................................................... 7 4.6.5. Severability ........................................................................................................................................................... 8 5. Roles and Responsibilities ............................................................................................................................................ 8 5.1. Committees......................................................................................................................................................... 8 5.1.1. Human Resources and Compensation Committee (the “Committee”) ................................................................ 8 5.2. First Line of Defense ........................................................................................................................................... 8 5.2.1. The Chief Human Resources Officer (CHRO) ........................................................................................................ 8 5.2.2. Segment Risk ........................................................................................................................................................ 8 5.3. Business Support Units (BSU) ............................................................................................................................. 9 6. Governance of this Policy ............................................................................................................................................ 9 6.1. Escalation ............................................................................................................................................................ 9 6.2. Policy Exceptions ................................................................................................................................................ 9 6.3. Policy Violations .................................................................................................................................................. 9 7. Contacts ....................................................................................................................................................................... 9 8. Revision History ......................................................................................................................................................... 10 Exhibit 97

Policy ID & Policy Name Template Version: 3.2 Internal Use Only 2 Appendix 1 References ................................................................................................................................................ 11 AP 1.1 Authoritative Sources ....................................................................................................................................... 11 AP 1.2 Guiding References ........................................................................................................................................... 11 AP 1.3 Supporting Documents ..................................................................................................................................... 11 Appendix 2 List of Policy Requirements ....................................................................................................................... 12

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 3 1. Executive Summary This Financial Restatement Compensation Recoupment Policy (the Policy) sets the requirements for the recoupment of certain executive compensation in the event of an accounting restatement by Huntington Bancshares Incorporated (HBI) and the Huntington National Bank (HNB, and collectively with HBI, The Company), resulting from material noncompliance with financial reporting requirements under U.S. federal securities laws in accordance with the terms and conditions set forth herein. The Policy is intended to comply with the requirements of Section 10D of the Exchange Act (as defined below) and Section 5608 of the Nasdaq Listing Rules. 2. Applicability The Policy is applicable to the compensation of Covered Executives and is administered by Human Resources and the Compensation Committee (the Committee). 3. Key Definitions Covered Compensation: Any incentive-based compensation received by a Covered Executive during the applicable Recoupment Period; provided that: • Covered compensation was received by such a Covered Executive: o After the effective date, o After service as a Covered Executive commences, o While The Company had a class of securities publicly listed on a United States national securities exchange; and • Covered Executive served as a Covered Executive at any time during the performance period applicable to such incentive-based compensation. For purposes of the Policy, incentive-based compensation is received by a Covered Executive during the fiscal period in which the financial reporting measure applicable to such incentive-based compensation (or portion thereof) is attained, even if the payment or grant of such incentive-based compensation is made thereafter. Covered Executive: With respect to The Company, an individual who is determined, by the Board or the Committee, to be officers, as defined in 17 C.F.R. 240.16a-1(f). The determination of an individual’s status as an Executive Officer is made by the Board or the Committee, and such determination is final, conclusive, and binding on such individuals and all other interested persons. Financial Reporting Measure: Refers to any of the following: • A measure determined and presented in accordance with the accounting principles used in preparing The Company’s financial statements • A stock price measure • A total shareholder return measure • Any measure derived wholly or in part from any of the measures listed above Any such measure does not need to be presented within The Company’s financial statements or included in a filing with the U.S. Securities and Exchange Commission to qualify as such. Financial Restatement: a restatement of The Company’s financial statements due to its material noncompliance with any financial reporting requirement under U.S. federal securities laws that is required to correct:

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 4 • An error in previously issued financial statements that is material to the previously issued financial statements; or • An error that would result in a material misstatement if: o The error is corrected in the current period or o Left uncorrected in the current period For the purposes of the Policy, a financial restatement does not include revisions to The Company’s financial statements in the following circumstances: • Out-of-period adjustments o When the error is immaterial to previously issued financial statements, and o The correction is also immaterial to the current period • Retrospective applications, including: o A change in accounting principles o A revision to reportable segment information due to changes in The Company’s internal organizational structure o A reclassification resulting from a discontinued operation o A change in the reporting entity, such as a reorganization of entities under common control o Revisions due to stock splits, review stock splits, stock dividends, or other changes in capital structure Recoupment Period: Refers to three fiscal years completed immediately prior to the applicable Recoupment Trigger Date. Additionally, the recoupment period includes any transition period resulting from a change in The Company’s fiscal year, if it falls within or immediately after those three fiscal years. A transition period between the last day of The Company’s previous fiscal year and the first day of its new fiscal year are considered a completed fiscal year if it spans nine to 12 months. Recoupment Trigger Date: The earlier of the following two dates: • The date on which the Board, the Human Resources Compensation Committee, or authorized Company officer(s) (if Board action is not required) – concludes or reasonably should have concluded that finance prepares a financial restatement. • The date on which a court, regulator, or other legally authorized body directs The Company to prepare a financial restatement. 4. Requirements 4.1. Recoupments of Erroneously Awarded Compensation In the event of a financial restatement, if a Covered Executive receives covered compensation that exceeds the amount they would have received had the compensation been calculated based on the restated financial results (i.e., the adjusted compensation), the CHRO reasonably and promptly recovers from such Covered Executive an amount equal to the excess of the awarded compensation over the adjusted compensation, each calculated on a pre-tax basis (such excess amount, the erroneously awarded compensation). 4.1.1. Determination of Erroneously Awarded Compensation This section outlines the obligations for calculating erroneously awarded compensation in cases where the applicable financial reporting measure, such as stock price or total shareholder return, is not directly recalculable from the financial restatement.

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 5 The CHRO with support from the Total Rewards Executive determines the amount of erroneously awarded compensation (on a pre-tax basis) based on a reasonable estimate of the effect of the financial restatement on the relevant measure if the following conditions apply: • The financial reporting measure applicable to the relevant covered compensation is stock price, total shareholder return, or any measure derived wholly or in part from either, and • The amount of erroneously awarded compensation cannot be directly recalculated from the financial restatement 4.1.2. Recovery Obligation This section outlines the requirements for recovery of erroneously awarded compensation, regardless of timing or fault. The Company’s obligation to recover erroneously awarded compensation is not dependent on: • Whether or when the restated financial statements are filed or • Any fault or misconduct, as determined by the CHRO, by the Covered Executive related to the accounting errors or actions leading to the financial restatement. 4.1.3. Impracticability Exception This section describes the limited circumstances under which the CHRO may forgo recovery of erroneously awarded compensation due to impracticability. The CHRO is not required to recover awarded compensation if either of the following conditions is met: • The direct expense of enforcing recovery (e.g., third-party costs) exceeds the amount to be recovered, provided that The Company: o Makes a reasonable attempt to recover the compensation, o Documents those attempts, and o Provides documentation to the National Association of Securities Dealers Automated Quotations (NASDAQ). • Recovery would likely cause a tax-qualified retirement plan (broadly available to employees) to fail to meet the requirements of Sections 401(a)(13) or 411(a) of the U.S. Internal Revenue Code. 4.1.4. No Indemnification This section confirms that the CHRO must not indemnify a Covered Executive for any losses resulting from the recovery of erroneously awarded compensation including: • Payment of insurance premiums or • Gross-up payments 4.1.5. Method of Recovery This section outlines the permissible methods and timing for recovering erroneously awarded compensation. The Committee must determine, in its sole discretion and in accordance with applicable law, the manner and timing of recovery, which may include: • Reimbursement of previously paid cash compensation • Recovery of gains from equity or equity-based awards (e.g., vesting, exercise, sale) • Offsetting against other compensation owed to the Covered Executive • Cancelling outstanding vested or unvested equity awards

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 6 • Any other remedial action permitted by law Notes: • The CHRO may not accept less than the full amount of erroneously awarded compensation. • To avoid adverse tax consequences under Section 409A of the Internal Revenue Code, any offsets involving nonqualified deferred compensation plans must comply with Section 409A. 4.2. Administration of the Policy This section outlines the required actions and procedures that the CHRO follows to recover erroneously awarded compensation. It specifies the approved recovery methods, prohibits indemnification, and ensures compliance with applicable laws and tax regulations. • The Committee must determine, in its sole discretion and in accordance with applicable law, the manner and timing of recovery of erroneously awarded compensation from a Covered Executive. • The Committee’s recovery methods include one or more of the following: o Requiring reimbursement of covered compensation previously paid in cash. o Seeking recovery of any gain realized on the vesting, exercise, settlement, sale, transfer, or other disposition of any equity or equity-based awards. o Offsetting the erroneously awarded compensation amount from any compensation otherwise owed by The Company or its affiliates to the Covered Executive. o Cancelling outstanding vested or unvested equity or equity-based awards. o Taking any other remedial and recovery action permitted by applicable law. • The CHRO must not accept an amount less than the full value of erroneously awarded compensation, except as provided in the impracticability exception. • The CHRO must ensure that any offsets involving nonqualified deferred compensation plans are made in compliance with Section 409A of the Internal Revenue Code to avoid adverse tax consequences to the Covered Executive. • The CHRO must not indemnify any Covered Executive, directly or indirectly, for any losses incurred in connection with the recovery of erroneously awarded compensation. This includes prohibiting the payment of insurance premiums or gross-up payments. 4.3. Amendment or Termination of the Policy This section outlines the conditions under which the Policy may be amended or terminated. It also clarifies the CHRO continuing obligations to comply with applicable laws and stock exchange rules, even if such requirements extend beyond the scope of the Policy. • The Committee may amend or terminate the Policy at any time, subject to Section 10D of the Exchange Act and Section 5608 of the NASDAQ Listing Rules.. • The CHRO must recover erroneously awarded compensation to the fullest extent required by any applicable law, stock market rule, or exchange regulation, even if such circumstances are not explicitly covered by the Policy. • The CHRO must not interpret the Policy as limiting its legal or regulatory obligations to recover compensation beyond what is explicitly stated. • The CHRO must consider the Policy no longer effective once it no longer has a class of securities publicly listed on a U.S. national securities exchange, unless otherwise required by applicable law.

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 7 4.4. Interpretation of the Policy This section establishes the CHRO obligation to ensure that the Policy is interpreted and applied in full compliance with applicable laws and stock exchange rules. • The CHRO must ensure that the Policy complies with the requirements of Section 10D of the Exchange Act and Section 5608 of the NASDAQ Listing Rules, including any related regulations, administrative interpretations, or stock exchange rules adopted in connection with those provisions. • The Committee and any responsible personnel must interpret and operate the Policy in a manner that satisfies all applicable legal and regulatory requirements. • The Committee must interpret and amend the provision as necessary to eliminate the conflict and maintain compliance if any provision of the Policy would otherwise conflict with or undermine compliance with these requirements. 4.5. Other Compensation Recoupment Rights The CHRO must treat the rights of recoupment under the Policy as additional to, and not a replacement for any other clawback or recoupment rights available under other pertinent policies. 4.6. Legal and Administrative Provisions This section outlines the legal and administrative framework supporting the Policy. It establishes how the Policy is incorporated into compensation agreements, confirms its binding nature on Covered Executives and their representatives, defines governing law and dispute resolution procedures, and addresses severability to ensure enforceability under applicable law. 4.6.1. Incorporation into Compensation Agreements • The Policy Owner must ensure that any applicable award agreement or other document setting forth the terms of Covered Compensation incorporates the Policy by reference. • In the event of any inconsistency between such documents and the Policy, the terms of the Policy must govern. • The Policy Owner must apply the Policy to all compensation received on or after the effective date, regardless of when the related agreement became effective, including compensation under the amended and restated 2018 Long-Term Incentive Plan and any successor plan. 4.6.2. Binding Effect The Policy is binding and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators, and other legal representatives. 4.6.3. Governing Law The Policy Owner must ensure that all matters related to the construction, validity, enforcement, and interpretation of the Policy and related documents are governed by the laws of the State of Ohio, without regard to conflict of law principles. 4.6.4. Dispute Resolution This section establishes that all disputes related to the Policy must first be addressed through good faith negotiations and, if unresolved, must be exclusively litigated in Ohio courts, with all parties waiving the right to a jury trial.

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 8 • The Covered Executives and the Company must first attempt to resolve any disputes related to the Policy through good faith negotiations. • If resolution is not achieved, disputes must be brought exclusively in the United States District Court for the District of Ohio or any Ohio state court. • All parties must waive any objections to jurisdiction, venue, or forum inconvenience, and must not initiate proceedings in any other court. • To the fullest extent permitted by law, all parties must waive the right to a jury trial in connection with any dispute arising from the Policy. 4.6.5. Severability If any provision of the Policy is found to be unenforceable or invalid under applicable law, the Policy Owner must apply the provision to the maximum extent permitted and must amend it as necessary to conform to legal requirements while preserving its intent. 5. Roles and Responsibilities 5.1. Committees 5.1.1. Human Resources and Compensation Committee (the “Committee”) The Committee is responsible for the following: • Deciding the manner and timing for recovering erroneously awarded compensation • Evaluating and documenting whether recovery is impracticable due to excessive enforcement costs or potential violations of tax-qualified retirement plan rules, and providing supporting documentation to NASDAQ when applicable • Ensuring that all provisions of the Policy are interpreted to comply with Section 10D of the Exchange Act and Nasdaq Listing Rules, and amending any conflicting provisions to maintain compliance • Approving any amendments or termination of the Policy • Ensuring the Policy is governed by Ohio law and that disputes are resolved in designated Ohio courts, with jury trial waivers enforced 5.2. First Line of Defense 5.2.1. The Chief Human Resources Officer (CHRO) The CHRO is responsible for the following: • Ensuring that review and approval of the Policy by the Human Resources and Compensation Committee occurs on at least a annual basis. • Ensuring that management’s responsibilities related to the Policy are achieved with the Human Resources and Compensation Committee. The Human Resources and Compensation Committee maintains the authority to review and amend the Policy as it deems appropriate. 5.2.2. Segment Risk Human Resources Segment Risk is responsible for establishing and monitoring any risk thresholds, limits or boundaries that may be deemed necessary by the CHRO to help The Company maintain the objectives of the Policy. Any risk measurements and limits that become necessary are documented in applicable risk assessments.

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 9 5.3. Business Support Units (BSU) Corporate Finance Corporate Finance assists in the determination of the occurrence of a financial restatement. 6. Governance of this Policy The Executive Compensation Director (the Policy Owner) must periodically review the Policy to ensure that the risks associated with the Policy have been appropriately identified and addressed. The Human Resources and Compensation Committee, as it deems necessary, may establish any additional reporting requirements or clarifications to the Policy. 6.1. Escalation The Policy Owner has primary responsibility for the interpretation of the requirements of the Policy. If the Policy Owner or another party determines that an escalation is necessary, the matter should be escalated by the Policy Owner to the governing committee for consideration and decisioning. See the Risk Governance Framework and the Risk Pillar Frameworks for additional information on escalation protocols. 6.2. Policy Exceptions A policy exception is an approved permission to not comply with a policy requirement. The request must be submitted by the impacted business segment/unit and must be approved by the Policy Owner before policy noncompliance occurs. Policy exceptions against requirements based in law or regulation are not allowed. See Section 4.5.5 of the ROC2405 Enterprise Policy on Governance and Policies for additional detail, including requirements regarding the duration, changes, and closures of exceptions. 6.3. Policy Violations A policy violation is an observation of policy noncompliance after it occurs. The identifying party must advise the Policy Owner of the violation. Policy violations do not have a duration; they are recorded as a one-time event. Violations of policies by individual colleagues may be subject to disciplinary action outlined in Huntington’s Huntington’s Code of Conduct and Ethics . Policy violations, including those that require remediation, must be reviewed against the criteria for a Finding in accordance with RMC-1201 Issues Management Policy. If a violation is determined not to meet the criteria for a Finding, the identifying party must document the rationale in the violation description. See Section 4.5.5 of the ROC2405 Enterprise Policy on Governance and Policies for additional detailed requirements regarding policy violations. 7. Contacts Table 1. Contacts Title Name Email Executive Compensation Director HR SRO

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 10 8. Revision History Table 2. Revision History Revision History: Date Approved Brief Revision Description October 17, 2023 New Policy Approved January 15, 2025 Policy Reviewed and Approved

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 11 Appendix 1 References AP 1.1 Authoritative Sources Table 3. Authoritative Sources Authoritative Sources: Section 10D of the Exchange Act Section 5608 of the NASDAQ Listing Rules AP 1.2 Guiding References Table 4. Guiding References Guiding References: Reference # Document Name COMP-1401 Recoupment Policy 2018 Amended and Restated Long-Term Incentive Plan (available on ir.huntington.com) 2024 Long-Term Incentive Plan (available on ir.huntington.com) AP 1.3 Supporting Documents Table 5. Supporting Documents Supporting Document References: Reference # Document Name Huntington’s Code of Conduct and Ethics

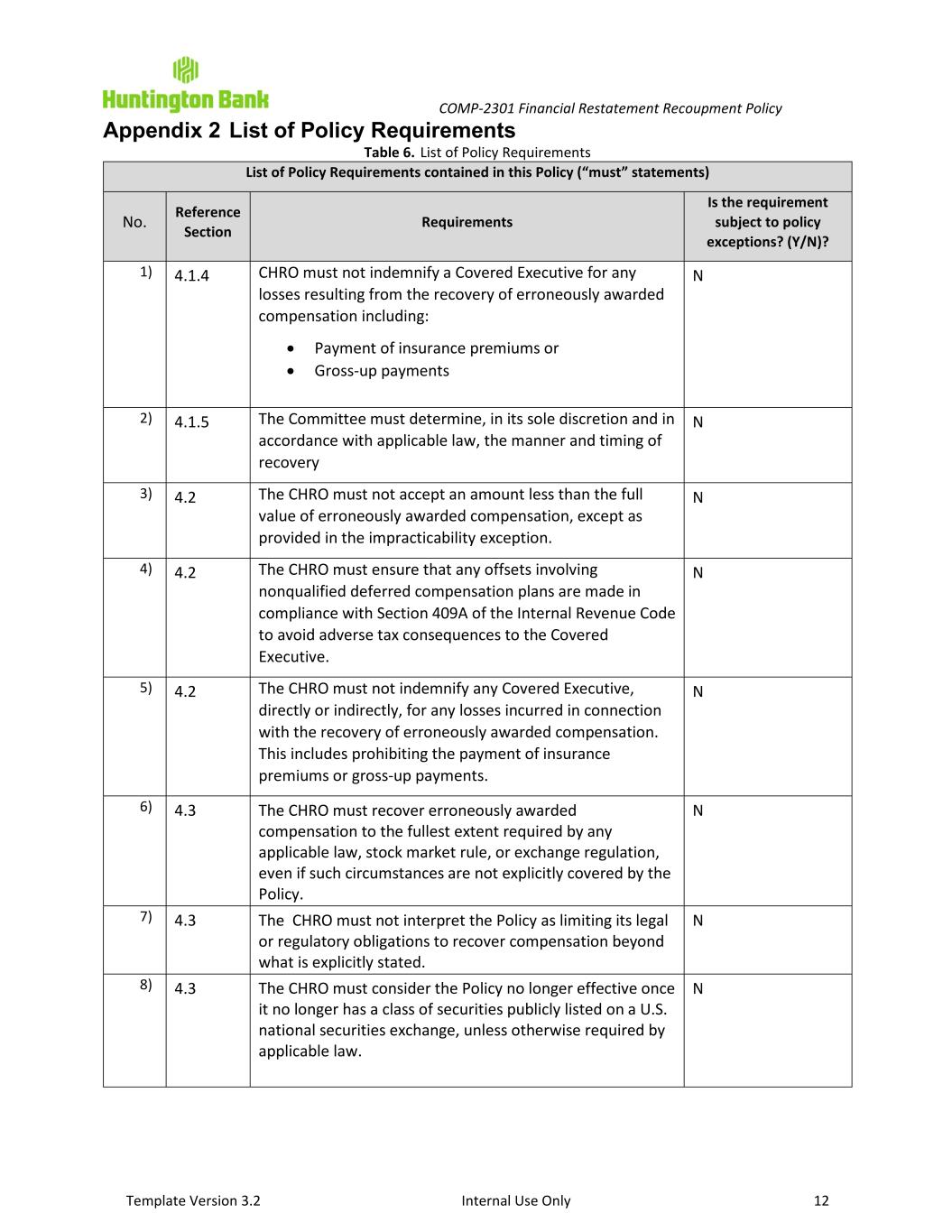

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 12 Appendix 2 List of Policy Requirements Table 6. List of Policy Requirements List of Policy Requirements contained in this Policy (“must” statements) No. Reference Section Requirements Is the requirement subject to policy exceptions? (Y/N)? 1) 4.1.4 CHRO must not indemnify a Covered Executive for any losses resulting from the recovery of erroneously awarded compensation including: • Payment of insurance premiums or • Gross-up payments N 2) 4.1.5 The Committee must determine, in its sole discretion and in accordance with applicable law, the manner and timing of recovery N 3) 4.2 The CHRO must not accept an amount less than the full value of erroneously awarded compensation, except as provided in the impracticability exception. N 4) 4.2 The CHRO must ensure that any offsets involving nonqualified deferred compensation plans are made in compliance with Section 409A of the Internal Revenue Code to avoid adverse tax consequences to the Covered Executive. N 5) 4.2 The CHRO must not indemnify any Covered Executive, directly or indirectly, for any losses incurred in connection with the recovery of erroneously awarded compensation. This includes prohibiting the payment of insurance premiums or gross-up payments. N 6) 4.3 The CHRO must recover erroneously awarded compensation to the fullest extent required by any applicable law, stock market rule, or exchange regulation, even if such circumstances are not explicitly covered by the Policy. N 7) 4.3 The CHRO must not interpret the Policy as limiting its legal or regulatory obligations to recover compensation beyond what is explicitly stated. N 8) 4.3 The CHRO must consider the Policy no longer effective once it no longer has a class of securities publicly listed on a U.S. national securities exchange, unless otherwise required by applicable law. N

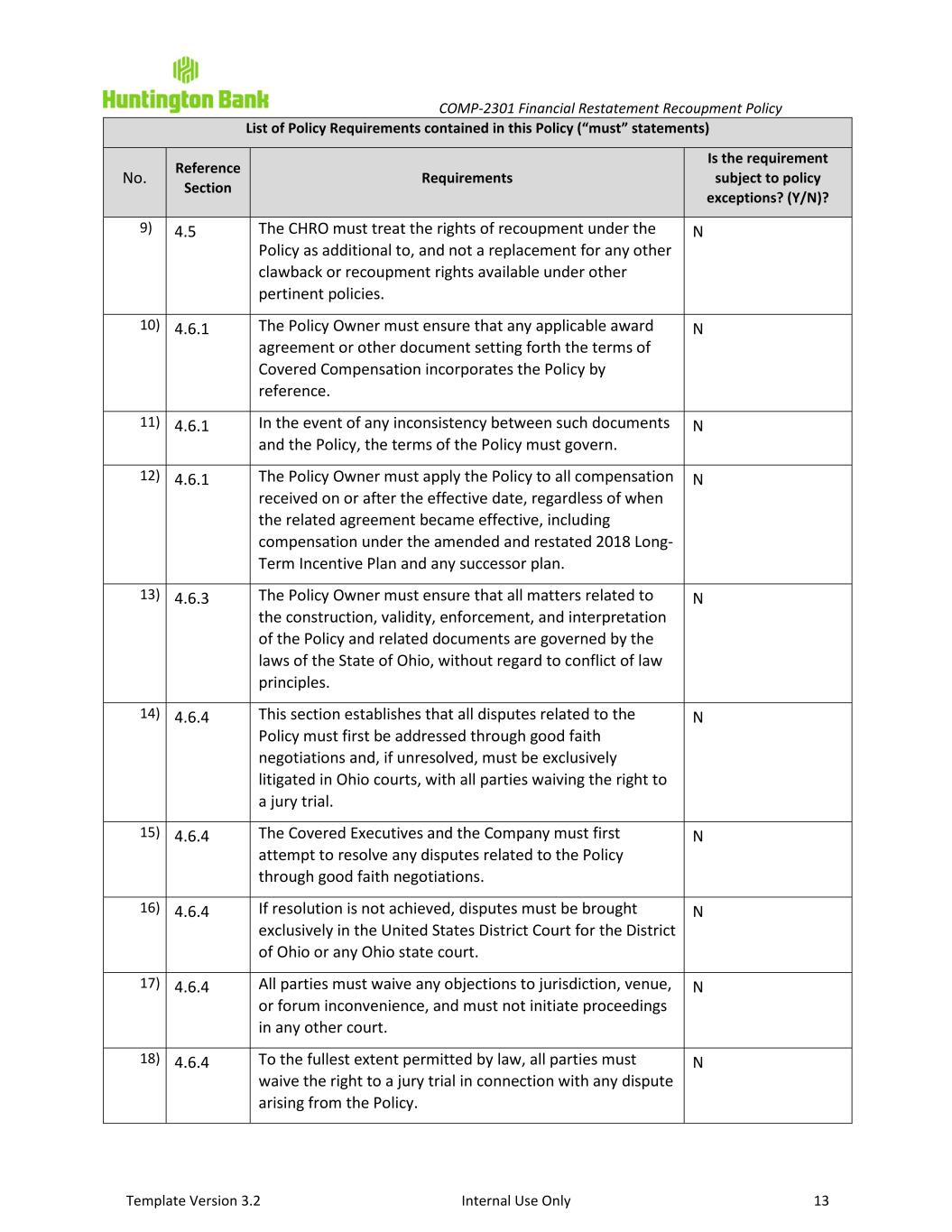

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 13 List of Policy Requirements contained in this Policy (“must” statements) No. Reference Section Requirements Is the requirement subject to policy exceptions? (Y/N)? 9) 4.5 The CHRO must treat the rights of recoupment under the Policy as additional to, and not a replacement for any other clawback or recoupment rights available under other pertinent policies. N 10) 4.6.1 The Policy Owner must ensure that any applicable award agreement or other document setting forth the terms of Covered Compensation incorporates the Policy by reference. N 11) 4.6.1 In the event of any inconsistency between such documents and the Policy, the terms of the Policy must govern. N 12) 4.6.1 The Policy Owner must apply the Policy to all compensation received on or after the effective date, regardless of when the related agreement became effective, including compensation under the amended and restated 2018 Long- Term Incentive Plan and any successor plan. N 13) 4.6.3 The Policy Owner must ensure that all matters related to the construction, validity, enforcement, and interpretation of the Policy and related documents are governed by the laws of the State of Ohio, without regard to conflict of law principles. N 14) 4.6.4 This section establishes that all disputes related to the Policy must first be addressed through good faith negotiations and, if unresolved, must be exclusively litigated in Ohio courts, with all parties waiving the right to a jury trial. N 15) 4.6.4 The Covered Executives and the Company must first attempt to resolve any disputes related to the Policy through good faith negotiations. N 16) 4.6.4 If resolution is not achieved, disputes must be brought exclusively in the United States District Court for the District of Ohio or any Ohio state court. N 17) 4.6.4 All parties must waive any objections to jurisdiction, venue, or forum inconvenience, and must not initiate proceedings in any other court. N 18) 4.6.4 To the fullest extent permitted by law, all parties must waive the right to a jury trial in connection with any dispute arising from the Policy. N

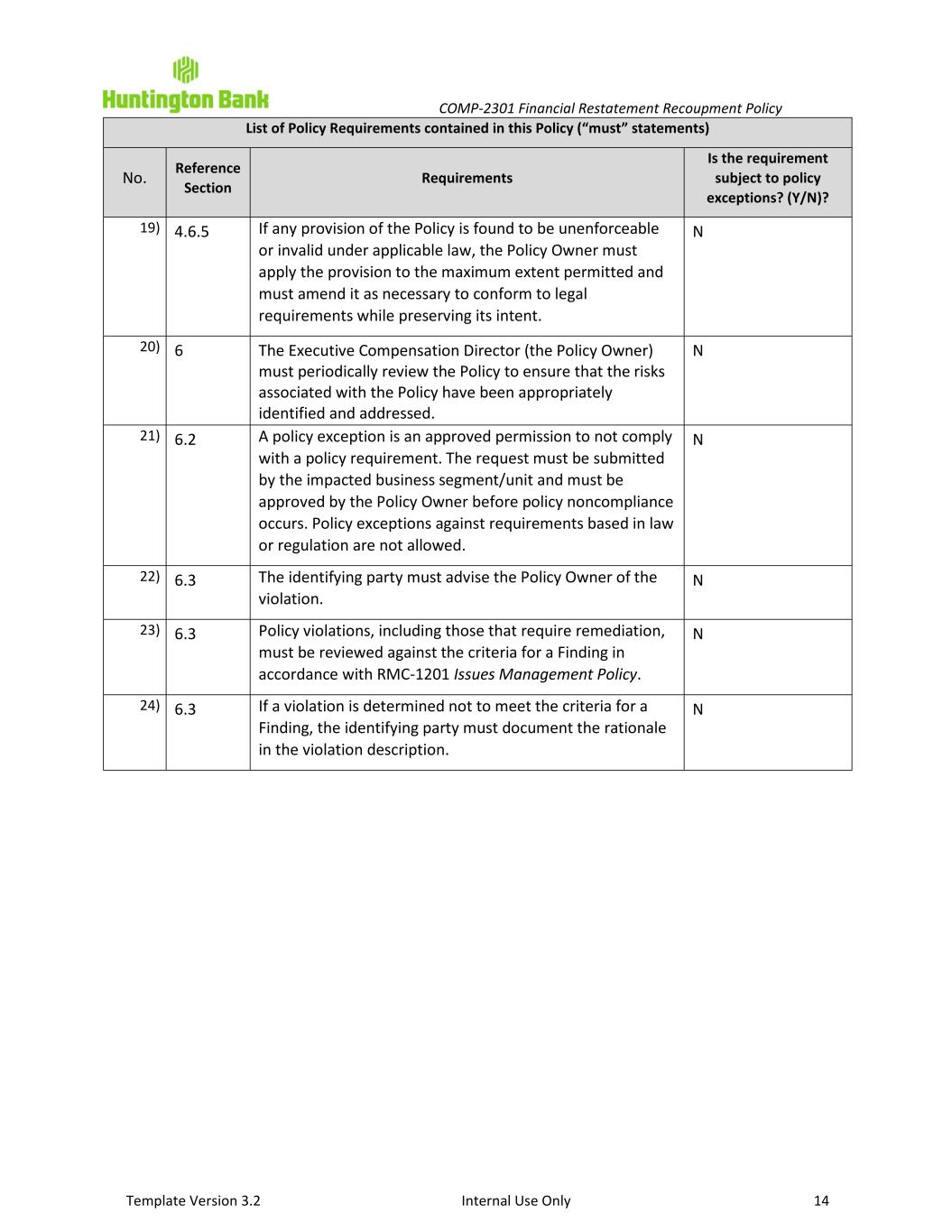

COMP-2301 Financial Restatement Recoupment Policy Template Version 3.2 Internal Use Only 14 List of Policy Requirements contained in this Policy (“must” statements) No. Reference Section Requirements Is the requirement subject to policy exceptions? (Y/N)? 19) 4.6.5 If any provision of the Policy is found to be unenforceable or invalid under applicable law, the Policy Owner must apply the provision to the maximum extent permitted and must amend it as necessary to conform to legal requirements while preserving its intent. N 20) 6 The Executive Compensation Director (the Policy Owner) must periodically review the Policy to ensure that the risks associated with the Policy have been appropriately identified and addressed. N 21) 6.2 A policy exception is an approved permission to not comply with a policy requirement. The request must be submitted by the impacted business segment/unit and must be approved by the Policy Owner before policy noncompliance occurs. Policy exceptions against requirements based in law or regulation are not allowed. N 22) 6.3 The identifying party must advise the Policy Owner of the violation. N 23) 6.3 Policy violations, including those that require remediation, must be reviewed against the criteria for a Finding in accordance with RMC-1201 Issues Management Policy. N 24) 6.3 If a violation is determined not to meet the criteria for a Finding, the identifying party must document the rationale in the violation description. N