EXHIBIT 99.15

Published on December 1, 2025

Exhibit 99.15

BOARD OF GOVENORS OF THE

FEDERAL RESERVE SYSTEM

WASHINGTON, DC 20552

SCHEDULE 14 A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(3)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CADENCE BANK

(Exact Name of Registrant as Specified in Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the Appropriate Box):

| ☒ | No Fee Required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2025 Notice of

Annual Meeting

and Proxy Statement

March 14, 2025

Dear Fellow Shareholders:

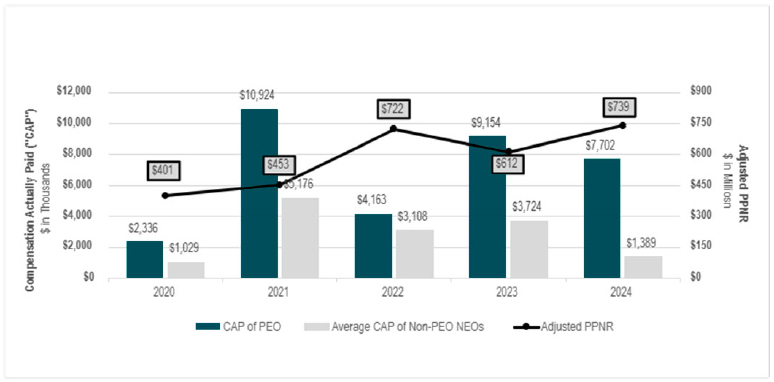

In 2024, our team achieved impressive results, driven by our vision to help people, companies and communities prosper. Our proven approach led to growth in core customer deposits of $2.2 billion, or 6.9%, for the year, and net organic loan growth of $1.2 billion, or 3.8%. Our disciplined approach to balance sheet management and operational efficiency drove a 20.7% increase in adjusted pre-tax pre-provision net revenue to $739.0 million, compared to 2023. Additionally, we expanded our net interest margin by 22 basis points to 3.30% and improved our adjusted efficiency ratio to 58.4%, reflecting meaningfully enhanced operating leverage.

Credit quality remained strong in 2024, with stable net charge-offs at 0.24% and a 5.9% reduction in criticized loans. We further added to shareholder returns through the repurchase of 1.2 million shares and an 11.5% increase in tangible book value per share, alongside a strengthened capital position. As we look ahead, we remain focused on sustaining our momentum, supporting our customers and driving long-term growth.

With increased merger and acquisition activity across the banking industry, we remain well positioned to participate opportunistically in support of our strategies. Backed by a robust organic growth engine, the strength of our geographic footprint and the diversity of our offerings, we are confident in our ability to drive long -term value for all our stakeholders while remaining disciplined and strategic in our approach. We kicked off 2025 with the signing of a definitive merger agreement with FCB Financial Corp., the bank holding company for First Chatham Bank, a Savannah, Georgia-based community bank. The merger will expand Cadence’s presence in the rapidly growing Savannah market and coastal Georgia communities.

Investing in our teammates continues to remain a top priority. We enhanced employee benefits by introducing a student debt retirement plan feature in our 401(k) plan, expanded our wellness initiatives and provided valuable retirement planning resources. We also continue to gather feedback from our teammates to drive meaningful organizational improvements. As a result of our continued commitment to fostering a workplace culture where our teammates can thrive, we were recognized as one of U.S. News & World Report’s Best Companies to Work For in 2024-2025. This recognition helps us attract top talent who share our focus on furthering a relationship-focused culture.

This year two directors, Alan W. Perry and Marc J. Shapiro, will retire from our Board of Directors effective April 23, 2025. Perry, a more than 30-year veteran, has served on the Board since 1991 and chaired the Risk Management Committee from 2016-2023. Shapiro, a founding member of the legacy Cadence Bancorporation Board, has served on the Board since 2021 and chaired the Executive Compensation and Stock Incentive Committee from 2021-2023. Over the years, each has generously dedicated their time and expertise to our Company, and we express our sincere gratitude for their invaluable service and contributions.

Earlier this year, we welcomed two new members, Fernando Araujo and Alice Rodriguez, to our Board of Directors. Araujo, chief executive officer of a publicly traded energy company, is an accomplished executive with more than 30 years of experience in all aspects of oil and gas upstream operations. Rodriguez spent over 35 years in the commercial banking industry at a large nationwide bank in various executive leadership roles before transitioning to take a more active role in a boutique home builder company she and her husband co-founded. Following the retirements of Perry and Shapiro, our Board will continue to be composed of 13 directors.

Notably, the Board of Directors amended the Company’s Articles of Incorporation and its Bylaws to begin declassification of the Board. As a result of this amendment, the Board will be declassified over the course of the annual meeting elections in 2025 and 2026, and beginning in 2027, all members of the Board will stand for election annually.

On behalf of the Board, we are pleased to invite you to the 2025 annual meeting of shareholders to be held on April 23, 2025, at 9 a.m. (Central Time). Our meeting will be held virtually via an audio-only format at https://meetnow.global/MNCNDYS to provide our shareholders with an easily accessible opportunity to attend, limiting the environmental impact of an in-person meeting.

All shareholders of record and beneficial owners as of February 28, 2025, can access our proxy materials free of charge at the website address outlined in the Notice of Internet Availability of Proxy Materials, mailed on or about March 14, 2025, and in the accompanying Proxy Statement. The decision to provide our proxy materials online reflects our continued commitment to improving shareholder access to information about Cadence Bank.

Your vote is important to us. Even if you plan to attend the virtual annual meeting, we encourage you to vote your shares as soon as possible by following the voting instructions provided in the proxy materials. Voting early helps us secure a quorum on the matters submitted for a shareholder vote and does not preclude you from voting at the meeting.

We remain committed to building long-term value in the Company, and we appreciate your continued support of Cadence Bank.

| Sincerely, | |

|

|

| James D. “Dan” Rollins III | |

| Chairman of the Board and | |

| Chief Executive Officer |

201 South Spring Street

Tupelo, Mississippi 38804

Notice of Annual Meeting of Shareholders

To Be Held April 23, 2025

To the Shareholders of Cadence Bank:

The annual meeting of shareholders of Cadence Bank will be conducted virtually over the internet using an audio-only format on Wednesday, April 23, 2025 at 9:00 a.m. (Central Time) (the “Annual Meeting”) for the following purposes:

| (1) | To elect five directors; |

| (2) | To conduct a non-binding, advisory vote on the compensation of our Named Executive Officers; |

| (3) | To ratify the appointment of Forvis Mazars, LLP as our independent registered public accounting firm for the year ending December 31, 2024; and |

| (4) | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors of Cadence Bank has fixed the close of business on February 28, 2025 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting.

Cadence Bank, on behalf of its Board of Directors, is soliciting your proxy to ensure a quorum is present and your shares are represented and voted at the Annual Meeting. Please see the Notice of Internet Availability of Proxy Materials for information about: (i) electronically accessing our proxy materials, including the accompanying Proxy Statement, a proxy card and our Annual Report to Shareholders for the year ended December 31, 2024, (ii) giving your proxy authorization via the internet or by telephone and (iii) requesting a paper copy of our proxy materials. If you subsequently decide to vote at the Annual Meeting, we also provide information about revoking your previously submitted proxy.

Please promptly give your proxy authorization by internet, QR code scan, telephone or if you request printed proxy materials, complete, sign and return a proxy card to ensure each of your shares are represented and voted.

| March 14, 2025 | By order of the Board of Directors, |

|

|

| James D. “Dan” Rollins III | |

| Chairman of the Board and | |

| Chief Executive Officer |

The accompanying Proxy Statement, a proxy card and Annual Report to Shareholders for the year ended December 31, 2024 are available by internet at www.envisionreports.com/CADE.

| Proxy Statement Summary |

This summary highlights information contained elsewhere in this Proxy Statement. Please read the entire Proxy Statement carefully before voting as this is only a summary.

Unless the context otherwise requires, references in this Proxy Statement to “Cadence Bank,” “Cadence,” “the Company,” “we,” “us” and “our” refer to Cadence Bank and its subsidiaries.

Annual Meeting

On Wednesday, April 23, 2025 at 9:00 a.m. (Central Time), the Annual Meeting of Cadence Bank will be conducted virtually over the internet using an audio-only format. After successfully holding our annual meetings virtually the last few years, we will continue to hold our annual meeting virtually, allowing more access for shareholders and reducing costs and environmental impact.

You may attend and participate in the Annual Meeting virtually by visiting or clicking the following web address, https://meetnow.global/MNCNDYS, and entering the 15-digit control number found on the Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability” or “Notice”) you received. Please review the information provided in the Notice, on your proxy card, and in the accompanying instructions. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions in the Notice materials.

You are encouraged to log in to the Annual Meeting website 15 minutes before the start of the Annual Meeting. The virtual Annual Meeting has been designed to provide you the same information you would otherwise have access to at an in-person meeting. Accordingly, you will be able to vote online until the polls have closed at the Annual Meeting and will be able to submit questions in writing before or during the Annual Meeting by following the directions posted on the Annual Meeting website at https://meetnow.global/MNCNDYS.

Proxy Statement Summary

| Agenda and Voting Recommendations |

| Proposal | Description | Votes Required | Board Recommendation | Page |

| 1 | Election of five (5) director nominees to serve on the Board of Directors |

Plurality of votes cast | FOR each director nominee |

18 |

| 2 | Advisory approval of the compensation of our NEOs |

Plurality of votes cast | FOR | 86 |

| 3 | Ratification of appointment of our

Independent(1) Registered Public Accounting Firm |

Plurality of votes cast | FOR | 88 |

| (1) | See Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm Section describing the evaluation of independence. |

| Name | Age(1) | Director

Since |

Term

Expires |

Principal Occupation |

| Fernando G. Araujo | 57 | 2025 | 2026 | CEO and director of Berry Corporation; former COO of Berry Corporation |

| Shannon A. Brown | 68 | 2016 | 2026 | Former SVP of U.S. Operations Eastern Division, Chief Human Resources and Diversity Officer for FedEx Express |

| William G. Holliman | 60 | 2020 | 2026 | President and co-founder of HomeStretch Furniture |

| Alice L. Rodriguez | 60 | 2025 | 2026 | Retired senior executive from JP Morgan Chase & Co. |

| James D. Rollins III | 66 | 2012 | 2026 | Chief Executive Officer of Cadence Bank |

| (1) | Ages of all directors and executives and officers listed herein are as of the date of the annual meeting, April 23, 2025. |

You may cast your vote in any of the following ways:

|

|

|

|

|||

| Internet | QR Code | Phone | ||||

| Visit www.envisionreports.com/CADE and follow the steps outlined on the secure website. | You can scan your individualized QR code to vote with your mobile phone. | Call 1-800-652-VOTE (8683) and follow the instructions provided by the recorded message. | Send your completed and signed proxy card or voter instruction form to the address listed thereon. |

Proxy Statement Summary

We value the views of our investors and welcome feedback from them. Our standard shareholder engagement practice is to initiate conversations with our investors throughout the year. These engagement efforts supplement the many calls, conferences, and other shareholder outreach performed by the Company’s investor relations team throughout the year. In 2024, we again reached out to and met with shareholders in a variety of formats, who were invited to talk to us about corporate strategy, risk management, corporate governance, including environmental, social and governance issues, and executive compensation, in addition to other topics they wanted to discuss. We discuss our shareholder outreach during this last year in further detail on p. 46 in the section entitled “Shareholder Outreach and Say-on-Pay Results.” Our frequent engagement with our shareholders provides opportunities to exchange perspectives and information with our shareholders on our policies and practices (consistent with the disclosures made available in our public filings with the federal banking regulators) and provides us additional opportunities by which to seek input from shareholders to ensure we are addressing their questions and concerns.

The goals of our shareholder engagement include, but are not limited to: (i) obtaining shareholder insight into our corporate governance, executive compensation, risk management, and other policies and practices, including shareholder priorities and perspectives; (ii) communicating actions undertaken by the Board of Directors of the Company (the “Board of Directors” or the “Board”) and management in response to shareholder feedback; (iii) discussing current trends in corporate governance, executive compensation matters, risk management, and other pertinent matters; (iv) providing insight into our current business and operational practices and procedures; and (v) enhancing communication with our shareholders. It is our belief that our shareholder engagement allows key members of management and the Board of Directors to gather information about investor views and priorities for the Company and to make educated and deliberate decisions which are both balanced and appropriate for our diverse shareholder base and in the best interests of Cadence Bank.

| Performance and Corporate Governance Highlights |

| ✔ | Total assets were $47.0 billion at December 31, 2024, ranking the Company the 8th largest bank headquartered in its nine-state footprint, with total loans and leases of $33.7 billion, total deposits of $40.5 billion, and total shareholders’ equity of $5.6 billion as of December 31, 2024. |

| ✔ | Maintained a well-qualified Board of Directors with diverse experiences and backgrounds. |

| ✔ | Proposed declassifying the Board of Directors, which shareholders approved at the 2024 annual meeting. |

| ✔ | Repurchased 1,237,021 shares of Company common stock at a weighted average price of $26.74 during 2024. |

| ✔ | Approved an increase in the quarterly common stock dividend from $0.235 to $0.25 per share of common stock for the 2024 calendar year. The total cash dividend for 2024 was $1.00 per common share, or 36.1% of earnings. |

| ✔ | Maintained strong regulatory capital—Common Equity Tier 1 capital of 12.4% and Total Risk Based capital of 14.0% at December 31, 2024. |

| Financial Highlights |

| ✔ | Generated net organic loan growth of $1.2 billion, or 3.8%, while core customer deposits, which excluded brokered deposits and public funds, increased $2.2 billion, or 6.9%. |

| ✔ | Net interest margin for 2024 improved to 3.30% from 3.08% in 2023, as a result of balance sheet growth, improved earning asset mix, and continued upward repricing of earning asset yields. |

| ✔ | Total revenue of $1.8 billion for the year ended 2024, of which 19.9% of the total revenue was non-interest revenue. |

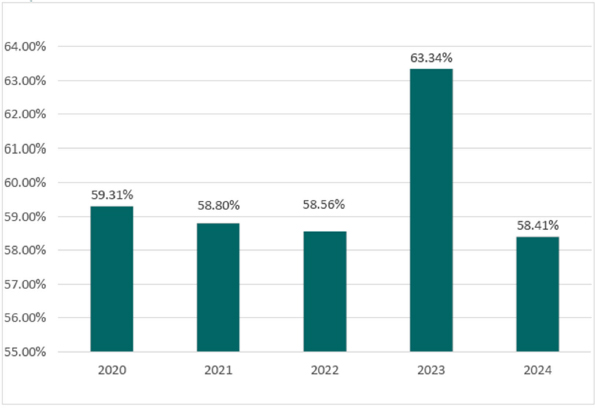

| ✔ | Continued progress toward improved operating efficiency reflected in approximately 500 basis points of improvement in the adjusted efficiency ratio from 63.3% in 2023 to 58.4% in 2024. |

| ✔ | Maintained stable credit quality reflected by relatively flat non-performing asset totals combined with improved criticized and classified totals compared to 2023. Net charge-offs totaled 0.24% of average loans and leases and the allowance for credit losses remained strong at 1.37% of net loans and leases at December 31, 2024. |

Proxy Statement Summary

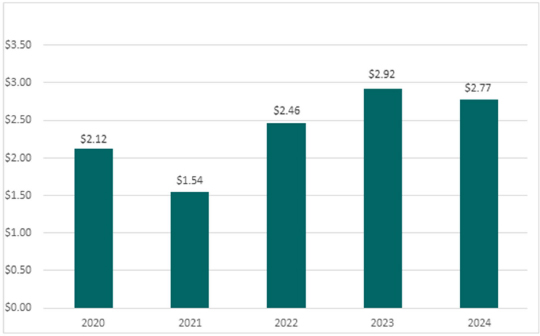

GAAP Earnings Per Diluted Common Share

The Company reported earnings per diluted common share of $2.77 for 2024 compared with $2.92 for 2023. The results for 2023 included an after-tax gain of approximately $520 million related to the sale of the insurance business, which was partially offset by after- tax securities portfolio restructuring losses totaling approximately $334 million. Aside from the impact of these items, the Company experienced improvement in several aspects of core operating performance. The Company reported meaningful improvement in both net interest margin and net interest income, stable credit quality, growth in noninterest revenue, and improved operating efficiency.

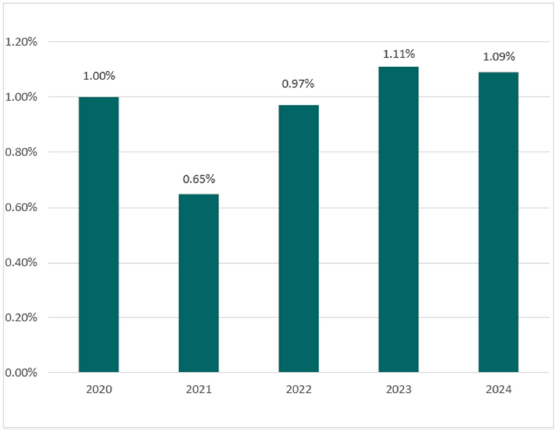

Return on Average Assets

The return on average assets (“ROAA”) was relatively flat at 1.09% for 2024 compared to 1.11% for 2023. The Company’s core operating performance was impacted by improvement in the items noted related to earnings per share.

Proxy Statement Summary

Adjusted Efficiency Ratio

The adjusted efficiency ratio again improved to 58.4% after the increase in 2023. This improvement was driven by a decline in total noninterest expense combined with growth in both net interest revenue and noninterest revenue. The Company implemented several strategic initiatives in 2023 that continued to yield benefits throughout 2024 including branch consolidation and headcount initiatives.

The efficiency ratio (tax equivalent) and the adjusted efficiency ratio (tax equivalent) are supplemental financial measures utilized in management’s internal evaluation of the Company’s use of resources and are not defined under GAAP. The efficiency ratio (tax equivalent) is calculated by dividing total noninterest expense by total revenue, which includes net interest income plus noninterest income plus the tax equivalent adjustment. The adjusted efficiency ratio (tax equivalent) excludes expense items otherwise disclosed as non-routine from total noninterest expense.1

1 Considered a non-GAAP financial measure. Information on reconciliation of non-GAAP measures to financial measures determined in accordance with GAAP may be found in Appendix A.

Proxy Statement Summary

Net Interest Margin – Fully Taxable Equivalent

Our net interest margin improved to 3.30% in 2024 as a result of balance sheet growth, improved earning asset mix, and continued upward repricing of earning asset yields.

At December 31, 2024, the loan to deposit ratio was 83.3% and securities were 15.5% of total assets. The Company’s net interest revenue was $1.44 billion for 2024, an increase from $1.35 billion for 2023. Average interest-earning assets were $43.6 billion in 2024 compared to $44.0 billion in 2023.

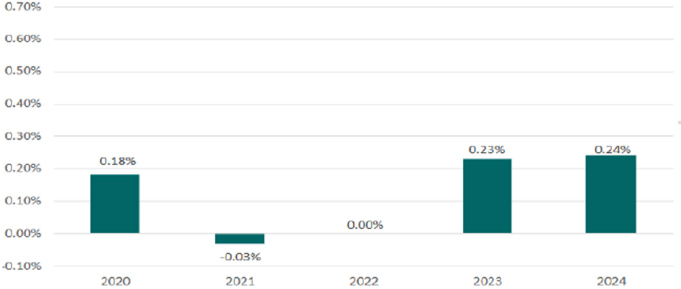

Credit Metrics – Net (Recoveries) Charge-offs to Average Loans and Leases

The Company reported net charge-offs of 0.24% of average loans and leases for 2024, which is relatively flat compared to 0.23% for 2023. Credit quality metrics were stable overall year over year including criticized and classified as well as non-performing asset levels. Importantly, the allowance for credit losses remained strong at 1.37% of net loans and leases at December 31, 2024.

Proxy Statement Summary

| Cadence’s

Corporate Engagement and Governance Framework |

Cadence built its integrated Corporate Engagement and Governance Framework around our mission statement to meet customers where they are in their financial journey, and provide expert advice and a broad array of products and services to help them reach their goals. While delivering value to our shareholders, we foster a workplace where teammates thrive and communities prosper.

In addition to the 2024 highlights below, our more detailed 2024 Corporate Engagement and Governance Report is available on the Investor Relations section of the Cadence Bank website at ir.cadencebank.com.

Recent Accolades

|

Recognitions by Forbes 2024 - Best-In-State Employers for Mississippi. |

|

Linscomb Wealth, a Cadence Bank subsidiary, recognized among Barron’s Top 100 RIA Firms for the third year in a row. |

|

U.S. News & World Report 2024-2025 - Best Companies to Work For - Banking and Best Companies to Work For - In the South. |

|

Recently named a Forbes 2025 America’s Best Large Employers |

|

2024 America Saves Designation of Saving Excellence for promoting savings for the tenth consecutive year. |

|

Voted #1 Regional Bank, #1 Business That Gives Back, #1 Company to Work For, and #1 Regional Investment Firm by Northeast Mississippi Daily Journal Readers 2024. |

|

Recognized by Brands Reimagined - 2024 REBRAND 100® Global Award Winner Silver Award of Distinction. |

Corporate Governance – Board Oversight and Leadership

|

Strong Independent Lead Director with clearly delineated duties. |

|

Director Independence Standards follow the Federal Reserve, U.S. Securities and Exchange Commission (“SEC”), and the New York Stock Exchange (“NYSE”) definition. |

|

All directors serving during 2024 attended more than 88% of the aggregate of all board meetings and 100% of all committee meetings. |

|

12 of 13 of our continuing directors are considered independent under the NYSE standards; the Chairman & CEO is the only non-independent director. |

|

Committed to regular board refreshment through our retirement policy. 54% of our continuing directors have served on the board six years or less. |

|

No director serves on an excess number of outside public boards. |

|

Annual peer-to-peer assessment of the board, its committees, and the Independent Lead Director. The Board conducts an annual evaluation of the CEO’s performance. |

|

Majority voting with director resignation policy. |

|

Significant stock ownership guidelines for our directors and executive officers, with a 12-month holding period post-vesting of equity shares. |

|

Prohibited transactions in our common stock include margin accounts, short selling, trading derivative securities, pledging, and hedging. |

|

No material related-party transactions involving our directors. |

|

Clawback policy for executive compensation for both short and long-term incentives. |

Proxy Statement Summary

Shareholder Rights

|

There are no classes of common stock with unequal voting rights or unequal ability to elect directors. |

|

Shareholders are allowed to call special meetings and may take action by written consent pursuant to the Mississippi Business Corporation Act. |

|

Shareholders may propose bylaw amendments pursuant to the Mississippi Business Corporation Act. |

|

No shareholder rights plan (poison pill). |

Corporate Governance – Operations and Risk Management

|

Risk management policies and procedures provide guidance for the appropriate risk management of technology resources, cybersecurity, legal and regulatory risk, and other such risks as may from time to time be material to our company. |

|

Business Continuity Program manages the threats and impacts associated with a disruption to key resources including people, equipment, facilities, technology and suppliers. |

|

Crisis Management Plan provides the management structure, key responsibilities, emergency assignments and general procedures to follow during and immediately after an emergency. |

Corporate Governance – Information Security Risk

|

We continuously evaluate additional technology measures to defend against potential attacks. |

|

We include Information Security in internal and third-party audits and assessments. |

|

We conduct compliance and training programs, including those for information security awareness. |

|

We collaborate with other financial institutions, regulators, law enforcement officials, other government agencies, internet service providers and internet security experts to analyze and deflect malicious online activity and deliver safe and consistent online services. |

Corporate Governance – Code of Business Conduct and Ethics

|

Equal Opportunity Employer. We strive to eliminate all forms of discrimination. Our policies prohibit all illegal harassment, retaliation and intimidation. |

|

Executive and board oversight of our anti-bribery and anti-corruption program. |

|

Maintain a strong anti-money laundering program to identify and report suspicious activity to the appropriate regulatory agencies. |

|

An independent third party administers our Sarbanes-Oxley Integrity Line, with all complaints reviewed by the Audit Committee of the board of directors. |

|

We regularly evaluate the effectiveness of our sales and incentive programs and the risk profile. We also evaluate new products and services under our risk governance framework with senior leadership oversight. |

Corporate Governance – Vendor Relationships

|

Ongoing monitoring of third-party relationships to verify vendors are performing consistently with the terms of the contracts. |

|

Management assesses, measures, and monitors the risks of each vendor. |

Proxy Statement Summary

Human Capital – Retention

|

Tracked teammate retention relative to industry experience; our turnover rate was in line with industry experience. |

|

Utilized multiple recruitment strategies across the United States to find talented, motivated, and qualified employees. |

|

We used an external compensation benchmarking service to determine market-level compensation for our job roles at similar-sized institutions; assess any necessary modifications to job grades annually. |

|

Maintained established workplace safety procedures and protocols, and provided annual security training to all teammates. |

Human Capital – Professional Development Programs & Training

|

Teammates logged over 140,500 hours of training and professional development; each teammate logged an average of 20 hours of training through the company’s internal learning management system. |

|

Conducted Teammate Engagement Survey, achieving an outstanding 84% participation rate. Results revealed a strong trust and connection between teammates and their managers, as well as a high expectation of staff retention. |

|

Continued the Cadence Bank Management University to help supervisors and managers build important skills, including communication, problem-solving, teammate engagement, leadership development, soft skills and more. |

|

Continued cohort of our Emerging Leaders Mentorship Program in 2024, which focuses on coaching and developing teammates who have significant potential to broaden their role and responsibilities within the company. |

|

Identified potential successors for roles in the bank through multiple levels. |

|

Conducted virtual All Teammate Webinars, providing forums for our executives to connect with teammates across our footprint. |

|

Offered college reimbursement to teammates to help with furthering their education in banking-related areas. |

Human Capital – Employee Benefits & Support

|

Offered competitive compensation and benefits to attract and retain the best people, including paid parental leave to assist and support new parents with balancing work and family matters. |

|

Introduced a 401(k) student debt retirement savings feature in the 401(k) plan for teammates. |

|

Offered wellness initiative called It Pays to Know Your Numbers, encouraging teammates enrolled in the company’s health plan to complete a wellness check, including blood work and other preventive screenings. |

|

Maintained a dedicated healthcare clinic in Tupelo, Mississippi for our teammates and their families, where services are free of charge to employees enrolled in our health benefits programs. |

|

Offered a comprehensive diabetes program, accessible 24/7, 365 days a year for teammates living with Type 2 diabetes as part of our medical benefits plan. |

|

Offered free virtual visits to participants enrolled in select health plans. |

|

Offered a digital physical therapy benefit to teammates participating in our health plans. |

|

Offered free flu shot clinics in strategic office locations to support teammates’ health and welfare. |

|

Helped teammates dealing with issues negatively impacting their lives and the lives of their families through our Employee Assistance Program. |

|

Provided each teammate with one day’s (8 hours) pay to participate in a nonprofit organization or community event to encourage community involvement. |

|

Provided wellness rooms in select locations to support teammate health, with the goal to expand this feature as new locations are built. |

|

Offered Teammate Banking, a first-class, centralized unit of dedicated bankers who exclusively serve the banking and financial needs of new and existing teammates. |

|

Offered flexible work schedules and work-from-home accommodation where possible. |

Proxy Statement Summary

Human Capital – Values and Engagement

|

Encouraged all teammates to create a collaborative environment, which supports teammate engagement and establishes us as productive members of the communities we serve. |

|

Actively recruited prospective teammates from a wide range of institutions of learning, including public and private institutions throughout our footprint. |

|

Continued to support employee-led groups to provide relevant events, resources, networking, professional development, mentoring and leadership opportunities across the organization. |

Community Engagement and Investment

|

Partnered with the Federal Home Loan Bank to award over $3.6 million in grants under the Home Equity Leverage Partnership, Special Needs Assistance Program, Affordable Housing Grant, and Partnership Grant Program to support community-based organizations serving underserved communities in our footprint. |

|

Continued our partnership with Operation HOPE for financial literacy programs, which provide our customers with credit counseling, money management education, homeownership counseling and small business coaching. |

|

Managed approximately $1.2 billion in CRA-qualified investments, including current CRA exam period investments and prior exam period investments still on the books. |

|

Secured funding of approximately $5.1 million in eligible grants and contributions under the Community Reinvestment Act. |

|

Continued our commitment of $1.5 million to Atlanta, Georgia-based Westside Future Fund’s affordable housing initiative. |

|

Cadence Bank and Cadence Bank Foundation collectively contributed approximately $5.4 million to charitable organizations across our footprint. |

|

Donated more than $680,000 through the Cadence Bank Foundation and Cadence Bank in support of affordable housing across the footprint. |

|

Donated more than $70,000 to support numerous Habitat for Humanity chapters throughout the company’s footprint. |

|

Continued our partnership with organizations committed to supporting historically underrepresented communities. |

|

Contributed financial support in the amount of $347,000 for Innovation Depot, Inc., whose mission is to foster a thriving tech ecosystem. |

|

Cadence Cares Holiday Giving Program awarded $150,000 to nine select nonprofit organizations in the communities we serve. The organizations were selected with input from Cadence Bank’s teammates, customers and local communities. |

|

Contributed $100,000 to help expand the Houston, Texas-based Fifth Ward Community Redevelopment Corporation’s certified HUD counseling team. |

|

Contributed $100,000 to Avenue CDC in Houston, Texas to further our company’s commitment to support affordable housing. This partnership will allow for pre-purchase counseling, first-time homebuyer education and foreclosure prevention. |

|

Continued to support historically underserved and underrepresented communities through our Emerging Markets & Outreach program and other community development initiatives. |

Community Engagement and Investment – Lending

|

Originated loans for small businesses of $262 million through Small Business Administration (SBA) 7(a) loans; Cadence Bank ranked as the 17th highest producer of SBA 7(a) loans in the country. |

|

Provided a $1 million equity equivalent investment (EQ2) through 2025 to LiftFund. |

|

Closed nearly 2,000 mortgage loans totaling $524 million in majority-minority census tracts across our footprint. |

|

Provided $1.3 million in assistance to reduce customers’ up-front mortgage loan costs through the |

| Company’s mortgage fee reductions for low - to moderate-income borrowers and borrowers via our Community Heroes program, supporting borrowers employed in teaching, law enforcement, military, first responders and nursing. |

|

Invested over $400,000 to lower the up-front costs of obtaining a mortgage loan in the form of down payment and closing cost assistance for over 140 homeowners under the Bank’s MaxAccess program in majority Black, majority Hispanic, and majority Black and Hispanic census tracts in the Houston, Texas MSA. |

Proxy Statement Summary

|

Closed nearly 2,100 loans totaling $401 million in mortgages made to low- to moderate-income borrowers and in low- to moderate income neighborhoods across all mortgage loan products the bank offers through our Right@Home mortgage program. |

|

Maintained access to over 180 third-party programs offered by state housing authorities, local government agencies and non-profit organizations that provide down payment, closing cost and mortgage credit certificate assistance supporting affordable home mortgages and homeownership. Originated over 330 loans in excess of $62 million in home mortgages using many of these programs. |

|

Continued our relationship with Liberty Bank and Trust, a minority-owned depository institution and Community Development Financial Institution. |

|

Continued our support and partnership with the National Association of Hispanic Real Estate Professionals and the National Association of Real Estate Brokers to positively impact the housing needs of underserved communities and the development of a more diverse mortgage workforce. |

|

Continued our partnership with Community Land Trusts in Houston and Atlanta and with Habitat for Humanity to help stimulate the supply of affordable housing by facilitating mortgage lending for subsidized housing through these programs. |

|

Continued offering the Emerging Communities Credit Builder product, a loan secured by a certificate of deposit to help customers with blemished credit or limited credit history build or rebuild credit, improve credit habits, and save money. |

Customer-Focused Community Engagement and Investment

|

Continued investment in our online and mobile banking platforms for both business and consumer applications. |

|

At year-end 2024, we had over 300 Cadence LIVE Teller-enabled ATMs, which combine innovative technology with the service and expertise of an in-person bank visit, connecting customers with a live teller for personalized support and more flexible/extended hours. |

|

Our Voice of the Customer program includes ongoing measurement of customer satisfaction via proactive and easily accessible surveys. |

|

Continued to expand the role of remote bankers to support customer engagement with new products. |

|

Further developed our universal branches, composed of universal bankers, personal bankers and Cadence LIVE Tellers working in concert with one another. Instead of housing a vault or teller lines, this smaller footprint allows customers to easily conduct business with personal bankers and Cadence LIVE Teller specialists via LIVE Teller-enabled ATM assistance. |

|

Continued to support our customers with resources designed to help address the language needs and preferences of our customers through our Limited English Proficiency initiatives. |

Community Impact

|

Teammates volunteered over 4,000 hours conducting approximately 2,100 financial education programs that reached more than 46,000 adults and youth through financial literacy programs. |

|

Teammates participated in the United Way Employee Campaign, contributing more than $459,000 to support non-profit organizations that foster academic success, family stability, and health and wellness. |

|

Teammates volunteered over 11,500 service hours supporting more than 1,200 organizations in communities across our footprint. |

|

Through the IRS’ VITA program, teammates assisted in the preparation of 732 federal income tax returns and 399 state income tax returns, at no cost, for families and individuals in our communities. |

|

During Hurricanes Beryl, Milton, and Helene, which hit Houston, Georgia, and Florida in July, August, and September of 2024, respectively, we deployed generators and emergency supplies, including food, water and refrigerators to branches and individually impacted teammates. |

Community Engagement – Financial Wellness

|

Offered Budget Smart® Checking, an overdraft avoidance product, to provide our customers with safe, trusted and affordable banking. |

|

Provided spending tools through Online Banking to assist our customers with creating and managing a budget. |

Proxy Statement Summary

|

Educated teammates and customers about cybersecurity threats and fraud prevention and protection measures through a comprehensive fraud communications strategy. |

|

Delivered financial education, insights and resources through the Company’s website and an electronic newsletter published monthly for customers. |

Environment – Offices and Branches

|

Renovated our downtown Birmingham corporate office, reducing our footprint by over 18,000 square feet while modernizing the space for efficiency. We also relocated our Birmingham operations center to a new facility that reduced our square footage by almost 17,000 square feet. |

|

Continued focus on operational efficiency and the reduction of our physical impact with additional office downsizing. |

|

Reduced lighting, energy and water consumption by utilizing occupancy sensors and lighting timers, reduced-flow plumbing fixtures, and low-e glass where practical. We also attempted to minimize demands for landscape irrigation in new landscape design where possible. |

|

Strived for ways to lessen the impact on the environment by choosing “green” materials and building methods, where feasible, for new construction and renovations. |

Environment – Energy Upgrades of Facilities

|

Facilities equipped with interior or exterior LED lighting saved nearly 60 million kilowatt hours of energy and approximately $6 million in energy cost, as well as carbon emissions reduction of approximately 25,869 metric tons of CO2. |

|

Energy efficient mechanical systems with programmable controls provided additional savings on energy cost. |

Environment – Digital Banking

|

Continued to deliver digital banking (online and mobile app) solutions to meet customers’ preferences for self-service transactions utilizing online, mobile and ATM/Cadence LIVE Teller-enabled ATM channels. |

|

Offered a full slate of digital banking solutions, including online banking and mobile apps which help to reduce paper usage. |

Renewable Energy Lending

|

The number of borrower relationships continued to grow, and total funded loans increased to $468.9 million as of December 31, 2024. Additionally, 2024 was Cadence Bank’s inaugural year using our balance sheet and tax capacity to participate in the renewable energy tax credit transfer market. |

|

Our Renewable Energy Group has an extensive background in supporting energy transition by financing solar, wind, battery storage and biogas projects in a responsible, thoughtful manner. The portfolio growth is well-balanced and maintains strong credit quality underwriting. |

Managing Exposure to Investments Subject to Environmental Risk

|

Environmentally conscious in lending arrangements; we consider loans involving property where environmental hazards or contamination exist undesirable except where parties can undertake proper assessments and monitoring. |

|

For credit extended to develop land in a floodplain, or where there are other indications there may be wetlands present, we may require a letter or report from the United States Army Corps of Engineers. |

Proxy Statement Summary

Paper Consumption and Recycling

|

Over 80% of mortgage loan applications were initiated and processed through online and digital processes. |

|

The Mortgage Loan department’s hybrid eClosing solution enhances a customer’s closing experience and reduces the number of paper documents in a closing package. In 2024, 5,560 closings utilized this method, and on average, eClosing reduces paper documents per closing by an average of 63 pages, eliminating more than 350,280 pages in 2024. |

|

Recycling efforts resulted in nearly two million pounds, or 917 tons, of paper being shredded, saving an estimated 15,675 trees, four million kilowatts of energy, 6.4 million gallons of water, 348,520 gallons of oil and 2,751 cubic yards of saved landfill space. |

|

Focused on significantly reducing our consumption of bottled water through a program called “Skip the Bottles, Save the Earth. |

Corporate Governance, Compensation and Board Matters

The Nominating and Corporate Governance Committee, the Executive Compensation and Stock Incentive Committee, and the Board carefully considered our corporate governance and compensation practices in 2024:

Corporate Governance Highlights

| What We Do |

| ✔ | Shareholder Engagement. Annual shareholder engagement program. |

| ✔ | Board recommended governance proposals. The Board recommended three governance proposals, which were approved by shareholders at the 2024 annual meeting. |

|

To declassify the Board by 2027. |

|

To reduce the threshold for shareholder actions by written consent. |

|

To eliminate the supermajority threshold for shareholder approval of a merger or takeover where the Board does not recommend approval of the proposed transaction. |

| ✔ | Independent Directors. Our Board is composed of 13 continuing directors who are independent under the NYSE standards for independence as well as our Director Independence Standards. The only non-independent director is our CEO. |

| ✔ | Independent Committees. Our Audit, Executive Compensation and Stock Incentive, Nominating and Corporate Governance, and Risk Management Committees are composed entirely of independent directors. |

| ✔ | Independent Lead Director. Strong Independent Lead Director with clearly delineated duties. The Board conducts an annual assessment of the Independent Lead Director. |

| ✔ | Executive Sessions. Independent directors meet in executive sessions at least semi- annually, and met eight times in 2024. |

| ✔ | Outside Advisors. Board and Committees may retain outside advisors independently of management. |

| ✔ | Board Diversity. Diverse Board in terms of qualifications, specific skills, and experiences, as well as gender and ethnicity, with 69% of our continuing directors from under-represented groups (women and minorities). |

| ✔ | Directors Public Company Service. None of the Company’s directors serve on an excess number of public boards. |

| ✔ | Board Involvement and Attendance. All directors serving during 2024 attended approximately 88% of all Board and 100% of all committee meetings in 2024. |

| ✔ | Board and Committee Peer-to-Peer Assessments. Conduct Board and Committee peer-to-peer assessments annually. |

| ✔ | Board Refreshment. Demonstrated commitment to regular board refreshment through retirement policy, with 54% of continuing directors having served 6 years or less. |

| ✔ | Director Resignation Policy. Majority voting with director resignation policy. |

| ✔ | Related-Party Transactions. No material related-party transactions involving our directors. |

| ✔ | Orientation Program. Orientation program for new directors and continuing education for all directors. |

| ✔ | CEO Performance. The Board conducts an annual evaluation of the CEO’s performance. |

Proxy Statement Summary

| ✔ | CEO Public Company Service. CEO does not serve on any outside public company boards. |

| ✔ | Succession Planning. Maintain a formal management succession plan that includes an annual review of management succession planning and requires executives and other managers to regularly identify potential leaders for succession planning. |

| ✔ | Clawback Policy. Maintain a clawback policy which applies to both short-term and long-term incentive plans, and which complies with NYSE rules. |

| ✔ | Stock Ownership Guidelines. Directors and executive officers are subject to significant common stock ownership guidelines, with a 12-month holding period after the vesting of equity awards. |

| ✔ | Special Meetings. Shareholders have the right to call special meetings. |

| ✔ | Shareholder Action by Written Consent. The Company allows shareholders the ability to take action by written consent. |

| What We Don’t Do |

| X | Special Meeting Rights. There are no material restrictions on shareholders’ rights to call special meetings. |

| X | Supermajority Vote. We do not require a supermajority vote to approve amendments to our Articles of Incorporation or Bylaws. Shareholders may amend the Bylaws at any regular or special meeting where a quorum is present. |

| X | No Poison Pill. We do not have a shareholder rights plan. |

| X | No Share Recycling. Shares withheld from awards for taxes or other purposes are not available for re-issuance under our long-term equity incentive plans. |

| X | Short Selling or Use of Derivatives. In addition to the types of short selling prohibited by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our insider trading policy prohibits our directors and executive officers from any short selling, hedging, or from trading derivative instruments related to our securities. |

| X | Margin Accounts Holding and Pledging of Our Common Stock. Our directors and executive officers are prohibited from holding shares in margin accounts and are not permitted to pledge shares of our common stock as collateral. |

Proxy Statement Summary

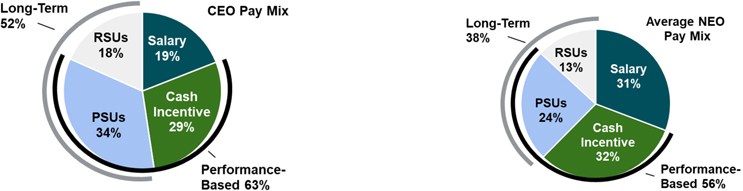

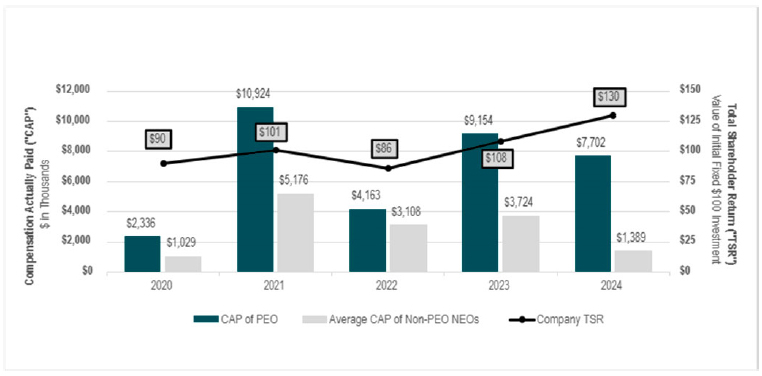

Executive Compensation Highlights

| What We Do |

| ✔ | Executive Compensation Policy. We maintain an Executive Compensation Policy, which outlines the principal criteria used to measure the success of our executive officers in achieving our business objectives. |

| ✔ | Review Compensation Program. We review our compensation program against market practices to confirm it is competitive and does not encourage excessive risk-taking. |

| ✔ | Pay for Performance. We provide short-term and long-term incentive awards based on performance targets aligned with identified business performance metrics. |

| ✔ | Balance of Performance Metrics. We use multiple performance metrics and multi-year vesting timeframes to prevent over-emphasis on any single metric and minimize short-term risk-taking. |

| ✔ | Long Vesting Periods. Awards of our restricted stock units prior to 2023 vested on a cliff basis of four years. Beginning in 2023, restricted stock units vest ratably over years 2, 3, and 4. Performance awards have cliff vesting following a three-year performance period. |

| ✔ | Stock Ownership Guidelines. We maintain rigorous stock ownership guidelines for our directors and executive officers, in order to more closely align the financial interests of the directors and executive officers with those of our shareholders. |

| ✔ | “Clawback Policy.” We maintain a clawback policy which sets forth the conditions under which we may recover excess incentive-based compensation (as defined in our policy) paid or awarded to or received by any of our current or former executive officers. |

| ✔ | “Double Triggers.” Our change in control agreements include a “double trigger” requiring both a change in control, and termination of the executive’s employment without cause, or by the executive for good reason, within a set period of time for the executive to receive payment. |

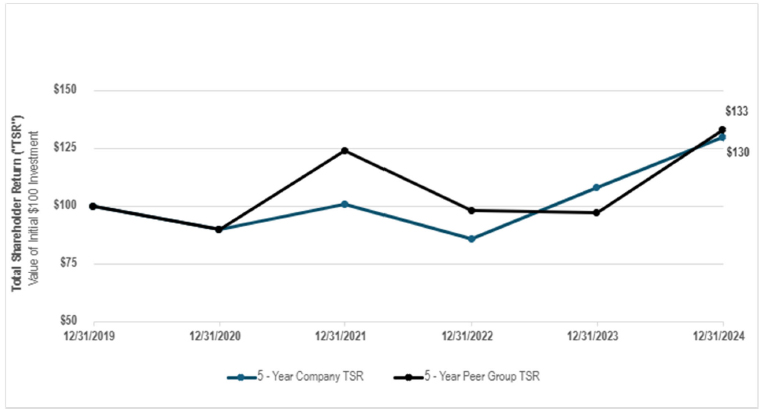

| ✔ | Shareholder Engagement. In late 2024 and January 2025, we conducted a shareholder engagement program, during which we reached out to holders representing 67.53% of our outstanding shares, and holders of 13.65% of our shares met with us. Additionally, we are available year-round for shareholder questions and comments both in person and virtually, and we have ongoing shareholder interactions through direct contact, as well as meetings with advisors, shareholders, and other stakeholders. |

| ✔ | Annual Say-on-Pay Vote. We conduct an annual say-on-pay vote for shareholders to approve executive compensation of our NEOs. |

| What We Don’t Do |

| X | Dividends on Unearned Performance-Based and Restricted Stock Unit Equity Awards. Performance-based equity awards and restricted stock units accrue dividend equivalents during the respective performance and retention period, which are not paid to the executive until vesting. |

| X | Short Selling or Use of Derivatives. Our insider trading policy prohibits our directors and executive officers from any short selling or hedging activities, and from trading derivative instruments related to our securities. |

| X | “Gross Ups.” We do not provide tax “gross up” payments. |

| X | Option Repricing. Our long-term equity incentive plans prohibit option repricing without the approval of our shareholders. |

| X | Option Backdating or “Spring-Loading.” We do not backdate options or grant options retroactively. |

| X | Multi-year Guaranteed Bonuses. We do not award multi-year guaranteed bonuses. |

Voting Process

In an effort to lower the cost of the Annual Meeting and conserve natural resources, we are furnishing our proxy materials to our shareholders via the internet in accordance with the “notice and access” e-proxy rules rather than mailing printed copies of those materials to each shareholder. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of our proxy materials. If, however, you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting these materials included in the Notice of Internet Availability. If you chose to receive a printed copy of our proxy materials, you will continue to receive these materials by mail unless you affirmatively change to electronic delivery.

The Notice of Internet Availability contains instructions regarding how to access the proxy materials, how to give your proxy authorization to vote your shares by internet, QR code scan, or telephone. This process is designed to expedite shareholders’ receipt of our proxy materials.

| February 28, 2025 | The Record Date. Shareholders on this Date are entitled to notice of, and to vote at, the Annual Meeting. |

| March 14, 2025 | Mailing date of the Notice of Internet Availability of Proxy Materials, including this Proxy Statement, a proxy card, and our Annual Report for the year ending December 31, 2024 to shareholders. |

Record Date, Shares Outstanding, Votes Per Share and Quorum

The close of business on February 28, 2025 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. As of such date, we had 500,000,000 authorized shares of common stock, $2.50 par value per share, of which 183,525,441 shares were outstanding, and 6,900,000 authorized shares of 5.5% Series A Non- Cumulative Perpetual Preferred Stock, $0.01 par value per share, of which 6,900,000 shares were outstanding. Only holders of shares of our common stock are entitled to vote at the Annual Meeting, and each share of our common stock is entitled to one vote. Holders of a majority of the outstanding shares of our common stock must be present, virtually or by proxy, to constitute a quorum for the transaction of business at the Annual Meeting.

If a proxy is properly given by a shareholder of record and not revoked, it will be voted in accordance with the instructions provided, if any, and if no instructions are provided, it will be voted as shown below.

| Proposal 1 | “FOR” the election of each of the five director nominees to serve on the Board of Directors. |

| Proposal 2 | “FOR” the advisory approval of the compensation of our Named Executive Officers. |

| Proposal 3 | “FOR” the ratification of appointment of Forvis Mazars LLP as our independent registered public accounting firm for the year ending December 31, 2025. |

| Any other proposal properly before the annual meeting |

As recommended by our Board of Directors. |

We encourage shareholders to vote their proxies by internet, QR code scan, or telephone, or, if you request a paper copy of the proxy materials, by mailing a proxy card enclosed with those materials.

| Voting Methods – Each should take only a few minutes to complete | |

| Internet | Follow the instructions in the Notice of Internet Availability. |

| QR code scan | Follow the instructions in the Notice of Internet Availability. |

| Telephone | Follow the instructions in the Notice of Internet Availability. |

| Mailing your proxy card | Follow the instructions in the Notice of Internet Availability to request a paper copy of our proxy materials. Once received, complete, sign, date and return the proxy card by mail using the postage prepaid return envelope included with the paper copy of your proxy materials. |

Voting Process

Frequently Asked Questions:

|

Q: Is a vote submitted via the internet, using a QR code scan, or by telephone as valid as one submitted by mail? |

A: Yes. All methods of voting have equal weight. |

| Q: When is the last day and time I can vote? |

A: If you are voting via the internet, using a QR code scan, or by telephone, you may vote at any time until the voting closes during the Annual Meeting on April 23, 2025.

If you are voting by mail, we must receive your ballot before the voting closes at the Annual Meeting on April 23, 2025. |

| Q: What if I vote by one method, and then I vote using another method? | A: Only the last vote submitted by a shareholder is counted, and we will disregard previous vote(s) if we receive a subsequently voted proxy for your shares. |

| Q: Do I have to vote to attend the Annual Meeting? | A: No. Shareholders are not required to vote in order to attend the annual meeting. |

| Q: If I vote via proxy, can I still attend the Annual Meeting and vote there? | A: Yes, you can still attend the Annual Meeting, no matter if or when you vote your proxy. And if you have previously voted, you may revoke your proxy and vote at the Annual Meeting. We will only count the last vote. |

For a general description of how votes will be counted, please refer to the section below entitled “GENERAL INFORMATION - Counting of Votes.”

If shares entitled to vote are held in “street name” through a broker, bank or other holder of record, the beneficial holder will receive instructions from the registered holder that must be followed in order for the shares to be voted on behalf of the beneficial holder. Please vote as instructed by your broker, bank or other holder of record. If a beneficial holder provides specific voting instructions, the shares will be voted as instructed and as the proxy holders may determine how to vote within their discretion with respect to any other matters that may properly come before the Annual Meeting.

The final voting results of the Annual Meeting will be announced no later than four business days after the Annual Meeting on a Form 8-K which will be filed with the federal banking authorities and which will be available on the Investor Relations section of our website at ir.cadencebank.com.

Our proxy materials have been made available to you by internet access in connection with the solicitation of proxies by our Board of Directors for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting of Shareholders. Proxies will be voted at the Annual Meeting and at any adjournments or postponements thereof. We pay the entire cost of soliciting your proxy, including the cost of preparing, assembling, printing, mailing, and otherwise distributing the Notice of Internet Availability of Proxy Materials and these proxy materials, as well as soliciting your vote. If shareholders request paper copies of our proxy materials, we will bear the cost of printing, mailing and other expenses in connection with this solicitation of proxies and will also reimburse brokers and other persons holding shares of common stock in their names or in the names of nominees for their expenses in forwarding paper copies of our proxy materials to the beneficial owners of such shares. Certain of our directors, officers and employees may, without any additional compensation, solicit proxies in person or by telephone.

| Proposal 1: Election of Directors |

Size, Tenure, and Demographics of Board of Directors

Our Second Amended and Restated Articles of Incorporation (the “Articles”) provide that the Board of Directors shall consist of at least nine (9) and no more than twenty (20) members, with the exact number to be determined from time to time by the entire Board of Directors. Currently, the Board of Directors has 15 members. Current directors Alan Perry and Marc Shapiro are not standing for re-election; both reached retirement age per our retirement policy. The Board of Directors has taken action to decrease the size of the Board, effective as of the Annual Meeting, to 13 members.

The Articles provide that the Board of Directors shall be declassified over the course of the annual meeting elections in 2025, 2026, and beginning in 2027, all members of the Board shall stand for election annually. Over 54% of the continuing directors on our Board of Directors have a tenure of six years or less. Additionally, 69% of our continuing directors are from historically under-represented groups, including women and minorities.

Board Skills and Qualifications

All of our directors bring a wealth of executive leadership experience to our Board, particularly at public companies and in roles in the banking and financial services industry. The Board determined that the below skills, presented alphabetically, are linked to prudent Board oversight of the Company as described below:

| Experience and Attributes | Short Description |

| Accounting/Audit Committee of a Public Company/Finance | A director who understands general accounting principles and is able to analyze financial data. |

| Audit Committee Financial Expert | A director who has all of the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to apply such principles with the accounting of estimates, accruals and reserves; (iii) experience in preparing, auditing, analyzing or evaluating financial statements as presented in the Company’s financial reporting, or experience in actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions. |

| Audit Committee of a Public Company | A director with experience serving on an Audit Committee of a publicly-traded company. |

| Financial Services Industry | A director who understands the types of financial products and services offered, as well as those the Company chooses not to offer, are critical to the success of the Company. |

| Public Company CEO | A director with experience as a current or former chief executive officer of a publicly-traded company. |

| Corporate Governance | A director who understands the constantly changing corporate governance trends and practices that affect the fundamental operation of a company and how it can have a significant impact on corporate operations and shareholder value. |

| Cybersecurity Technology | A director who has experience in the practice of securing networks, resources, and systems from digital/cyberattacks and taking measures to protect a system or network from cyberattacks. |

Proposal 1: Election of Directors

| Experience and Attributes | Short Description |

| Executive Leadership | A director who has experience leading an organization by providing practical insights on governance, accountability and integrity. |

| Human Resources (compensation, management succession, ethics, diversity) | A director who understands and has experience in various types of executive compensation, benefit options, talent recruitment and retention, succession planning, corporate culture, code of conduct and ethics, and diversity in the workforce. |

| Information Security & Technology | A director who has experience in implementing, establishing, or overseeing technology to include information security systems and protocols. |

| Investment Banking and Trust Services | A director who is knowledgeable in the benefits and risks associated with serving as a fiduciary. |

| Operations Management Technology | A director who possesses the knowledge and experience in providing the best customer experience in business operations and technology by improving processes, services, and products, as well as reducing operational risks. |

| Public Company Board Service | A director with publicly-traded company board service who understands the board’s function, reporting requirements, strategic planning, prudent governance practices and problem-solving. |

| Real Estate Uses and Transactions | A director who has experience in real estate appraisals, values, and transactions over complex real estate matters. |

| Regulatory or Compliance | A director who has experience in understanding the federal and state regulations that impact the Company’s products and services. |

| Risk Management | A director who is familiar with risk management by identifying risks and establishing a risk appetite framework and controls. |

| Strategic Planning – M&A Strategy and Development | A director who understands how to strategically plan for the future of the Company, both in the short-and long-term, and is able to oversee and advise management with respect to the formulation and execution of the Company’s strategic planning, which includes not only organic growth, but growth through mergers and acquisitions. |

| Sustainability Practices | A director who has experience in recognizing risks and opportunities associated with the environmental related issues resulting from the operations of a company; the creation and development of a diverse workforce reflective of the communities served; and transparent governance practices which make the Company’s current operations more resilient and sustainable. |

Proposal 1: Election of Directors

The following chart summarizes each continuing director’s key experience, qualifications and attributes.

| Experience and Attributes | Rol l ins | Araujo | Brown | Cannon | Corley | Evans | Hepner | Holliman | Hood | Jackson | Owodunni | Rodriguez | Stanton |

| Accounting/Audit Committee of a Public Company/Finance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Audit Committee Financial Expert | - | - | - | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | ✓ |

| Audit Committee of a Public Company | - | - | - | ✓ | ✓ | - | ✓ | - | ✓ | ✓ | ✓ | - | - |

| Corporate Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Cybersecurity Technology | ✓ | - | - | - | - | - | - | ✓ | ✓ | - | - | - | ✓ |

| Executive Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Financial Services Industry | ✓ | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Human Resources (compensation, management succession, ethics, diversity) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Information Security & Technology | ✓ | ✓ | - | - | ✓ | ✓ | - | ✓ | ✓ | - | - | - | ✓ |

| Investment Banking and Trust Services | ✓ | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - |

| Operations Management and Technology | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | - | ✓ | ✓ | ✓ |

| Public Company Board Service | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | ✓ |

| Public Company CEO | ✓ | ✓ | - | - | - | ✓ | - | - | - | - | - | - | ✓ |

| Real Estate Uses and Transactions | ✓ | ✓ | ✓ | - | - | ✓ | ✓ | ✓ | - | ✓ | - | - | - |

| Regulatory or Compliance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Risk Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Strategic Planning – M&A Strategy and Development | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Proposal 1: Election of Directors

Our retirement policy serves as a mechanism to encourage director refreshment on our Board by providing that directors retire at age 75. Any director who reaches the age of 75 during his or her term of office may continue to serve until the expiration of the then-current term.

Required Vote and Voting Process

Directors are elected by a plurality of the votes cast by the holders of shares of our common stock represented at a meeting at which a quorum is present. The holders of our common stock do not have cumulative voting rights with respect to the election of directors. Consequently, each shareholder may cast only one vote per share for each nominee. Unless a proxy specifies otherwise, the persons named in the proxy card shall vote the shares covered by the proxy for the nominees listed below. Should any nominee become unavailable for election, shares covered by a proxy will be voted for a substitute nominee selected by the current Board of Directors.

Our Second Amended and Restated Bylaws, as amended (“Bylaws”), provide that, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from than votes “for” his or her election must promptly tender his or her resignation following certification of the shareholder vote. The Nominating and Corporate Governance Committee will consider any such resignation offer and recommend to the Board of Directors whether to accept it. The Board of Directors will act on any such recommendation of the Nominating and Corporate Governance Committee within 90 days following certification of the shareholder vote.

Last year our shareholders approved an amendment to our Articles to declassify our Board. This year is the first year in which shareholders will vote for directors for a one-year term. The directors up for election this year include the two directors appointed to the Board in January of 2025, Fernando G. Araujo and Alice L. Rodriguez, and are joined by three continuing Board members, Shannon A. Brown, William G. Holliman and the CEO and Chairman of the Board, James D. Rollins III. These five (5) individuals, if elected, will serve until the annual meeting of shareholders in 2026, or until their earlier removal, resignation or retirement.

Each nominee has consented to be a candidate and to serve as a director if elected. The Board has no reason to believe any nominee will be unavailable to serve as a director. Assuming the election of the five (5) director nominees at the Annual Meeting, the Board of Directors will consist of 13 members.

The biographies in the table below show the name, age, principal occupation, and directorships with other public, private, and non-profit companies, and if applicable, information regarding involvement in certain legal or administrative proceedings held by each of the nominees designated by the Board of Directors for election as a director. In addition, each of the nominees has held their principal occupation for more than five (5) years unless otherwise indicated below. We have also provided a brief discussion of the specific experience, qualifications, attributes, or skills that led to the Nominating and Corporate Governance Committee’s conclusion that each nominee should serve as one of our directors.

Proposal 1: Election of Directors

Director Nominees’ Background and Qualifications

| Directors Standing for Election – 1-year Term |

|

Fernando G. Araujo, 57

|

Background and Qualifications: Mr. Araujo, the CEO of Berry Corporation, brings more than 30 years experience in the oil & gas industry to the Board. His extensive career has included domestic, international, and cross-border assignments, among them, several where he oversaw operations in various countries. In addition to Mr. Araujo’s extensive executive experience, he has decades of experience operating a business in a highly-regulated environment with significant compliance obligations. Mr. Araujo’s background also includes a great deal of strategic planning, experience with mergers and acquisitions, sustainability practices, and both operational and risk management skills. He is well-versed in the establishment and maintenance of information security protocols. The experience Mr. Araujo brings to the Board deepens that of the collective group in a number of areas, while expanding it beyond the financial services sector.

Directorships, public:

● Cadence Bank (NYSE: CADE) (Since 2025) ● Berry Corporation (NASDAQ: BRY) (non-independent director)

Directorships, Non-profit:

● Western States Petroleum Association

|

Proposal 1: Election of Directors

|

Shannon A. Brown, 68 |

Background and Qualifications: Mr. Brown is deeply familiar with issues related to the financial services industry and the customers and employees it serves. Mr. Brown previously held a number of senior executive level positions at FedEx Express prior to his retirement in November 2022. At the time of his retirement, Mr. Brown was the Senior Vice President of U.S. Operations, Eastern Division and the Chief Diversity Officer. During his more than three-decade career at FedEx Express, Mr. Brown also served as Senior Vice President, Human Resources and Senior Vice President of Air, Ground, and Freight Services. Through this professional background Mr. Brown possesses expertise in matters relating to recruitment, development, and retention of a diverse workforce, as well as employee benefits and compensation. Mr. Brown also has extensive non-profit experience, through which he has additional expertise related to serving constituencies with a variety of economic, racial, and geographic backgrounds and needs.

Directorships, public:

● Cadence Bank (NYSE: CADE) (Since 2016) ● Universal Insurance Holdings, Inc. (NYSE: UVE)

Directorships, non-profit:

● United Way of the Mid-South ● Central Board of the Boys & Girls Club of Greater Memphis ● Western Governors University Advisory Board ● University of Denver School of Transportation & Supply Chain ● Orpheum Theatre Group ● Atlanta Business League ● Atlanta Convention and Visitors Bureau ● Metal Museum

Former Directorships:

● Buckeye Technologies, Inc. ● Memphis Area Chamber of Commerce ● Teach for America – Memphis ● Memphis International Festival |

Proposal 1: Election of Directors

|

William G. Holliman, 60

|

Background and Qualifications: Mr. Holliman is an experienced executive and entrepreneur whose hands-on business and management experience contributes to the diversity of types of management experience on the Board. He currently serves as President of HomeStretch Furniture, a private company he co-founded, which specializes in furniture manufacturing. Mr. Holliman is a lifelong native Mississippian, whose ties and understanding of one of the primary markets in which the Company has operations, augments the Board’s understanding of the kinds of compensation, diversity, sustainability, strategic planning, and risk management matters the Board oversees.

Directorships, public:

● Cadence Bank (NYSE: CADE) (Since 2020)

Directorships, non-profit:

● North Mississippi Medical Center ● North Mississippi Health Services, Inc. ● Faith Family Ministries |

Proposal 1: Election of Directors

|

Alice L. Rodriguez, 60 |

Background and Qualifications: Ms. Rodriguez brings her experience of over 35 years working for JP Morgan Chase & Co. (and its predecessors). Over the decades, Ms. Rodriguez served the company in a variety of roles, including as the head of the community impact organization and Managing Director, and before that as Managing Director and head of the community and business development organization. Earlier in her career, Ms. Rodriguez served as a wealth management executive in the Texas markets, and as a business banking executive for the California region. She has extensive experience managing large teams of people, and with the related human resources matters, in addition to managing risks more broadly. Ms. Rodriguez also has deep experience with corporate governance, strategic planning, operations management, and regulatory compliance.

Directorships, public:

● Cadence Bank (NYSE: CADE) (Since 2025)

Directorships, private:

● Oncor Holdings

Directorships, non-profit:

● DreamSpring (Chair) ● Latino Business Action Network ● United States Hispanic Chamber of Commerce Education Fund ● Avance Inc ● Perot Museum of Natural Science ● Dallas Arboretum

Former Directorships:

● United States Hispanic Chamber of Commerce (Chair) ● DreamSpring (Chair)

|

Proposal 1: Election of Directors

|

James D. Rollins III, 66

|

Background and Qualifications: Mr. Rollins has served as Chairman of the Board of Cadence Bank since April 2014 and CEO since November 2012. Prior to that, he served as President and Chief Operating Officer of Prosperity Bancshares, Inc., from 2006 to 2012. From 1994-2006, Mr. Rollins held other senior executive positions at Prosperity Bancshares and Prosperity Bank. Before joining Prosperity Bank, Mr. Rollins worked for First State Bank and Trust Company. Mr. Rollins brings his decades of executive, operational, and leadership experience to his role as Chairman of the Board. Reflective of his broad experience in the banking industry, Mr. Rollins is an audit committee financial expert who also has expertise with strategic and risk management, operations management, information and technology security, as well as human resources issues, including compensation, diversity, ethics, and sustainability matters.

Directorships, public:

● Cadence Bank (NYSE: CADE) (Since 2012 and Chair since 2014)

Directorships, non-profit:

● North Mississippi Health Services, Inc. (Past Chair) ● Mississippi Economic Council (Past Chair)

Former Directorships:

● Prosperity Bancshares, Inc. (NYSE: PB) ● Healthcare Foundation of North Mississippi |

The Board of Directors Recommends Shareholders

vote “FOR” each of the five Nominees for Director named above.

Proposal 1: Election of Directors

Continuing Directors’ Background and Qualifications

The biographies in the table below show the name, age, principal occupation and directorships with other public, private, and non-profit companies, held by each of the continuing directors. In addition, each of the continuing directors has held their principal occupation for more than five years unless otherwise indicated. We have also provided a brief discussion of the specific experience, qualifications, attributes or skills that led to the Nominating and Corporate Governance Committee’s conclusion that each continuing director should serve as one of our directors.

| Continuing Directors – Class II – Term Expires 2026 |

|

Deborah M. Cannon, 73 |