Published on September 17, 2009

| Exhibit 99.1 |

|

FOR IMMEDIATE RELEASE September 17, 2009 |

| Contacts: | |||

| Analysts | Media | ||

| Jay Gould | (614) 480-4060 | Maureen Brown | (614) 480-5512 |

| Jim Graham | (614) 480-3878 |

HUNTINGTON BANCSHARES ANNOUNCES

A $350 MILLION PUBLIC OFFERING OF COMMON STOCK AND

COMPLETION OF CURRENT DISCRETIONARY EQUITY ISSUANCE PROGRAM

COLUMBUS, Ohio Huntington Bancshares Incorporated (NASDAQ: HBAN; www.huntington.com) announced today that it has commenced a public offering of $350 million of its common shares. It also announced that its discretionary equity issuance program launched September 9, 2009, which resulted in the issuance of 35.7 million shares worth $150 million at an average price of $4.20 per share, is now complete. This brings our total shares of common stock outstanding as of September 16, 2009, to 604.8 million shares.

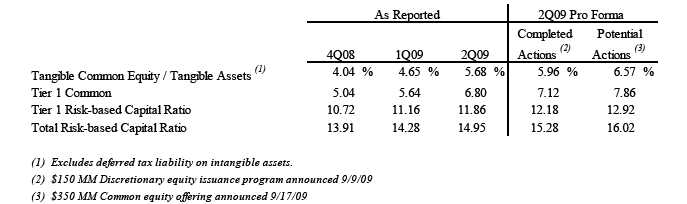

The table below highlights the estimated pro forma impact of the new public offering, as well as the completed discretionary equity issuance program, on June 30, 2009 capital ratios:

Over the last several months we have been very encouraged by the depth and breadth of investor participation in our capital building actions that allowed us to successfully complete our capital objective announced May 20, 2009, of raising $675 million in regulatory common equity, said Stephen D. Steinour, chairman, president, and chief executive officer. As such, we believe

- 1 -

we have an opportunity to continue to build common equity efficiently to the long-term benefit of all our shareholders. We have consistently had strong regulatory capital ratios. Recently, there has been a focus on capital ratios that give greater weight to the common equity component. While the $675 million we raised in regulatory common equity has already significantly improved our Tier 1 common equity and tangible common equity ratios, this action would improve our June 30, 2009, pro forma Tier 1 common equity ratio to 7.86% and our pro forma tangible common equity ratio to 6.57%. This capital also increases our flexibility to repurchase debt and thus improve our overall funding. Further, it gives us the additional capacity to pursue growth of our core businesses, which includes supporting organic asset and deposit growth. This capital also allows us to take advantage of initiatives identified through our strategic planning effort currently underway and would significantly enhance our ability to eventually repay our $1.4 billion of TARP capital.

Other Information

Huntington has an existing shelf registration statement (including a base prospectus) on file with the Securities and Exchange Commission and will file a prospectus supplement related to the common equity issuance described above. Prospective investors should read the registration statement (including the base prospectus), the prospectus supplement and other documents Huntington has filed with the SEC for more complete information about Huntington and the offering before investing. Investors may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Huntington, any underwriter or any dealer participating in the offering will arrange to send investors the prospectus if requested by contacting Goldman, Sachs & Co., Attention: Prospectus Department, 85 Broad Street, New York, NY 10004, telephone: 866-471-2526, fax: 212-902-9316, email: Prospectus-ny@ny.email.gs.com; .

This news release does not constitute an offer to sell or the solicitation of an offer to buy any Huntington common stock, and nor shall there be any sale or purchase of securities Huntington common stock in any state or jurisdiction in which such an offer, solicitation, sale or purchase would be unlawful. Unless an exemption from the securities laws is available, any offering of Huntington common stock may be made only by means of an effective registration statement (including related base prospectus) and prospectus supplement.

Forward-looking Statement

This press release contains certain forward-looking statements, including certain plans, expectations, goals, projections, and statements, which are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: (1) deterioration in the loan portfolio could be worse than expected due to a number of factors such as the underlying value of the collateral could prove less valuable than otherwise assumed and assumed cash flows may be worse than expected; (2) changes in economic conditions; (3) movements in interest rates; (4) competitive pressures on product pricing and services; (5) success and timing of other business strategies; (6) the nature, extent, and timing of governmental actions and reforms, including existing and potential future restrictions and limitations imposed in connection with the Troubled Asset Relief Programs voluntary Capital Purchase Plan or otherwise under the Emergency Economic Stabilization Act of 2008; (7) extended disruption of vital infrastructure; and (8) the pricing and total shares sold under the common stock offering. Additional factors that could cause results to differ materially from those described above can be found in Huntingtons 2008 Annual Report on Form 10-K, and documents subsequently filed by Huntington with the Securities and Exchange Commission. All forward-looking statements included in this release are based on information available at the time of the release. Huntington assumes no obligation to update any forward-looking statement.

About Huntington

Huntington Bancshares Incorporated is a $51 billion regional bank holding company headquartered in Columbus,

- 2 -

Ohio. Huntington has more than 143 years of serving the financial needs of its customers. Through our subsidiaries, including our banking subsidiary, The Huntington National Bank, we provide full-service commercial and consumer banking services, mortgage banking services, equipment leasing, investment management, trust services, brokerage services, customized insurance service program, and other financial products and services. Our over 600 banking offices are located in Indiana, Kentucky, Michigan, Ohio, Pennsylvania, and West Virginia. Huntington also offers retail and commercial financial services online at huntington.com; through its technologically advanced, 24-hour telephone bank; and through its network of almost 1,400 ATMs. The Auto Finance and Dealer Services group offers automobile loans to consumers and commercial loans to automobile dealers within our six-state banking franchise area. Selected financial service activities are also conducted in other states including: Private Financial Group offices in Florida and Mortgage Banking offices in Maryland and New Jersey. International banking services are available through the headquarters office in Columbus and a limited purpose office located in both the Cayman Islands and Hong Kong.

###

- 3 -