EX-99.1

Published on December 9, 2025

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette December 10, 2025 2025 Goldman Sachs US Financial Services Conference Welcome. The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. are federally registered service marks of Huntington Bancshares Incorporated. ©2025 Huntington Bancshares Incorporated.

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Disclaimer 2 CAUTION REGARDING FORWARD-LOOKING STATEMENTS The information contained or incorporated by reference into this presentation may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the plans, objectives, expectations and intentions of Huntington Bancshares Incorporated (“Huntington”) and Cadence Bank (“Cadence”), the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, estimates, uncertainties and other important factors that change over time and could cause actual results to differ materially from any results, performance, or events expressed or implied by such forward- looking statements, including as a result of the factors referenced below. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward- looking statements. Forward-looking statements may be identified by words such as expect, anticipate, continue, believe, intend, estimate, plan, trend, objective, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. Huntington and Cadence caution that the forward-looking statements in this communication are not guarantees of future performance and involve a number of known and unknown risks, uncertainties and assumptions that are difficult to assess and are subject to change based on factors which are, in many instances, beyond Huntington’s and Cadence’s control. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements or historical performance: changes in general economic, political, or industry conditions; deterioration in business and economic conditions, including persistent inflation, supply chain issues or labor shortages, instability in global economic conditions and geopolitical matters, as well as volatility in financial markets; changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs; the impact of pandemics and other catastrophic events or disasters on the global economy and financial market conditions and our business, results of operations, and financial condition; the impacts related to or resulting from bank failures and other volatility, including potential increased regulatory requirements and costs, such as Federal Deposit Insurance Corporation (the “FDIC”) special assessments, long-term debt requirements and heightened capital requirements, and potential impacts to macroeconomic conditions, which could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital; unexpected outflows of uninsured deposits which may require us to sell investment securities at a loss; changing interest rates which could negatively impact the value of our portfolio of investment securities; the loss of value of our investment portfolio which could negatively impact market perceptions of us and could lead to deposit withdrawals; the effects of social media on market perceptions of us and banks generally; cybersecurity risks; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”); volatility and disruptions in global capital, foreign exchange and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; changes in policies and standards for regulatory review of bank mergers; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the Securities and Exchange Commission (the “SEC”), the Office of the Comptroller of the Currency, the Federal Reserve, the FDIC, the Consumer Financial Protection Bureau and state-level regulators; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement between Huntington and Cadence; the outcome of any legal proceedings that may be instituted against Huntington or Cadence; delays in completing the proposed transaction involving Huntington and Cadence; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); the failure to obtain Huntington shareholder approval or Cadence shareholder approval or to satisfy any of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington and Cadence do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the ability of Huntington and Cadence to meet expectations regarding the timing, completion and accounting and tax treatment of the transaction; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business, customer or employee relationships, including those resulting from the announcement or completion of the transaction; the ability to complete the transaction and integration of Huntington and Cadence successfully; the dilution caused by Huntington’s issuance of additional shares of its capital stock in connection with the transaction; and other factors that may affect the future results of Huntington and Cadence.

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Disclaimer 3 CAUTION REGARDING FORWARD-LOOKING STATEMENTS, Cont’d Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annu al Report on Form 10-K for the year ended December 31, 2024 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, each of which is on file with the SEC and available on the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Investor Relations” and in other documents Huntington files with the SEC, and in Cadence’s Annual Report on Form 10-K for the year ended December 31, 2024 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, each of which is on file with the Federal Reserve and available on Cadence’s investor relations website, ir.cadencebank.com, under the heading “Public Filings” and in other documents Cadence files with the Federal Reserve. All forward-looking statements are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Huntington nor Cadence assume any obligation to update forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in circumstances or other factors affecting forward-looking statements that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. If Huntington or Cadence updates one or more forward-looking statements, no inference should be drawn that Huntington or Cadence will make additional updates with respect to those or other forward-looking statements. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Reconciliations of non-GAAP financial measures included in this presentation to the most comparable GAAP measures are included on slide 20.

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Disclaimer 4 IMPORTANT ADDITIONAL INFORMATION In connection with the proposed transaction, Huntington filed with the SEC a Registration Statement on Form S-4 (File No. 333-291486) on November 13, 2025, as amended on December 1, 2025 (the “Amended Registration Statement”) (which Amended Registration Statement was declared effective on December 3, 2025), that inc ludes a Joint Proxy Statement of Huntington and Cadence and a Prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. Huntington filed a prospectus on December 3,2025, and each of Huntington and Cadence filed a definitive proxy statement on December 3, 2025. The proposed transaction involving Huntington and Cadence will be submitted to Huntington’s shareholders and Cadence’s shareholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifica tion under the securities laws of any such jurisdiction. INVESTORS, SHAREHOLDERS OF HUNTINGTON AND SHAREHOLDERS OF CADENCE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND THE FEDERAL RESERVE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Shareholders are able to obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and Cadence, without charge, at the SEC’s website (http://www.sec.gov) and Cadence’s website (https://ir.cadencebank.com/fdic -federal-reserve-filings), respectively. Copies of the joint proxy statement/prospectus, when available, and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007. Copies of the joint proxy statement/prospectus, when available, and filings containing information about Cadence may be obtained after their filing with the Federal Reserve at (https://ir.cadencebank.com/fdic-federal- reserve-filings), by directing a request to Will Fisackerly, Cadence Investor Relations, Cadence Bank, (800) 698-7878, IR@cadencebank.com. References to Cadence’s website do not constitute incorporation by reference of the information contained on the website and are not, and should not be, deemed part of this filing. PARTICIPANTS IN THE SOLICITATION Huntington, Cadence, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Huntington and shareholders of Cadence in connection with the proposed transaction. Information regarding the interests of the directors and executive officers of Huntington and Cadence and other persons who may be deemed to be participants in the solicitation of shareholders of Huntington and Cadence in connection with the transaction and a description of their direct and indirect interests, by security holdings or otherwise, are included in the definitive joint proxy statement/prospectus related to the transaction, which was filed by Huntington with the SEC. Information regarding Huntington’s directors and executive officers is available in its definitive joint proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on March 6, 2025, and other documents filed by Huntington with the SEC. Information regarding Cadence’s directors and executive officers is available in its definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the Federal Reserve on March 14, 2025, and other documents filed by Cadence with the Federal Reserve. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC and the Federal Reserve by Huntington and Cadence, respectively. Free copies of these documents may be obtained as described above under “Important Additional Information.”

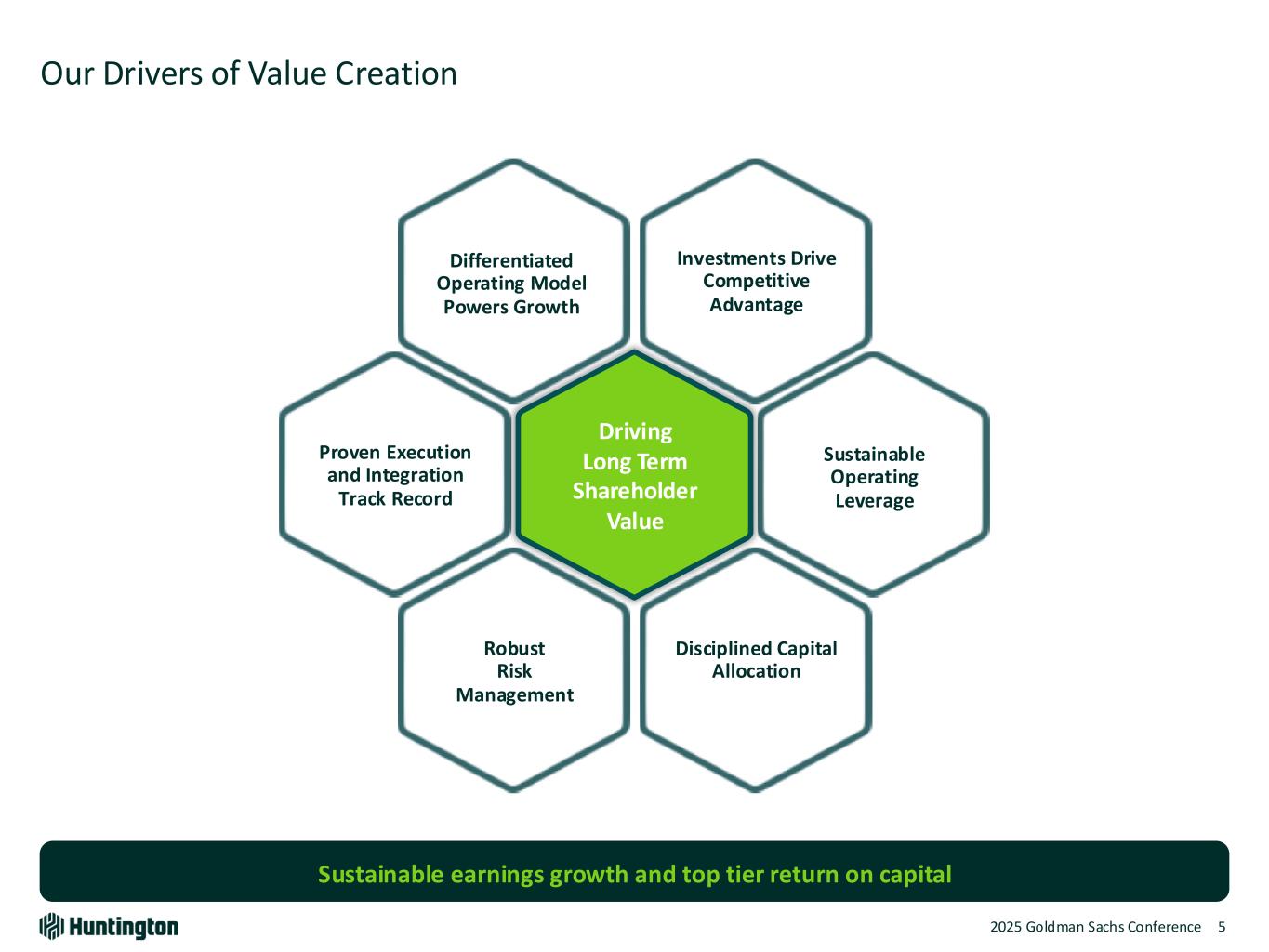

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Our Drivers of Value Creation 5 Differentiated Operating Model Powers Growth Sustainable Operating Leverage Disciplined Capital Allocation Proven Execution and Integration Track Record Robust Risk Management Investments Drive Competitive Advantage Driving Long Term Shareholder Value Sustainable earnings growth and top tier return on capital

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 62025 Goldman Sachs Conference Adhering to an aggregate moderate to low risk appetite We Have a Unique and Compelling Flywheel for Valuation Creation Organic Growth Remains Our Foundational Strategy1 We Have a Proven History of Successful Integration2 We View M&A as a Springboard for Organic Expansion3 Four Key Messages 4

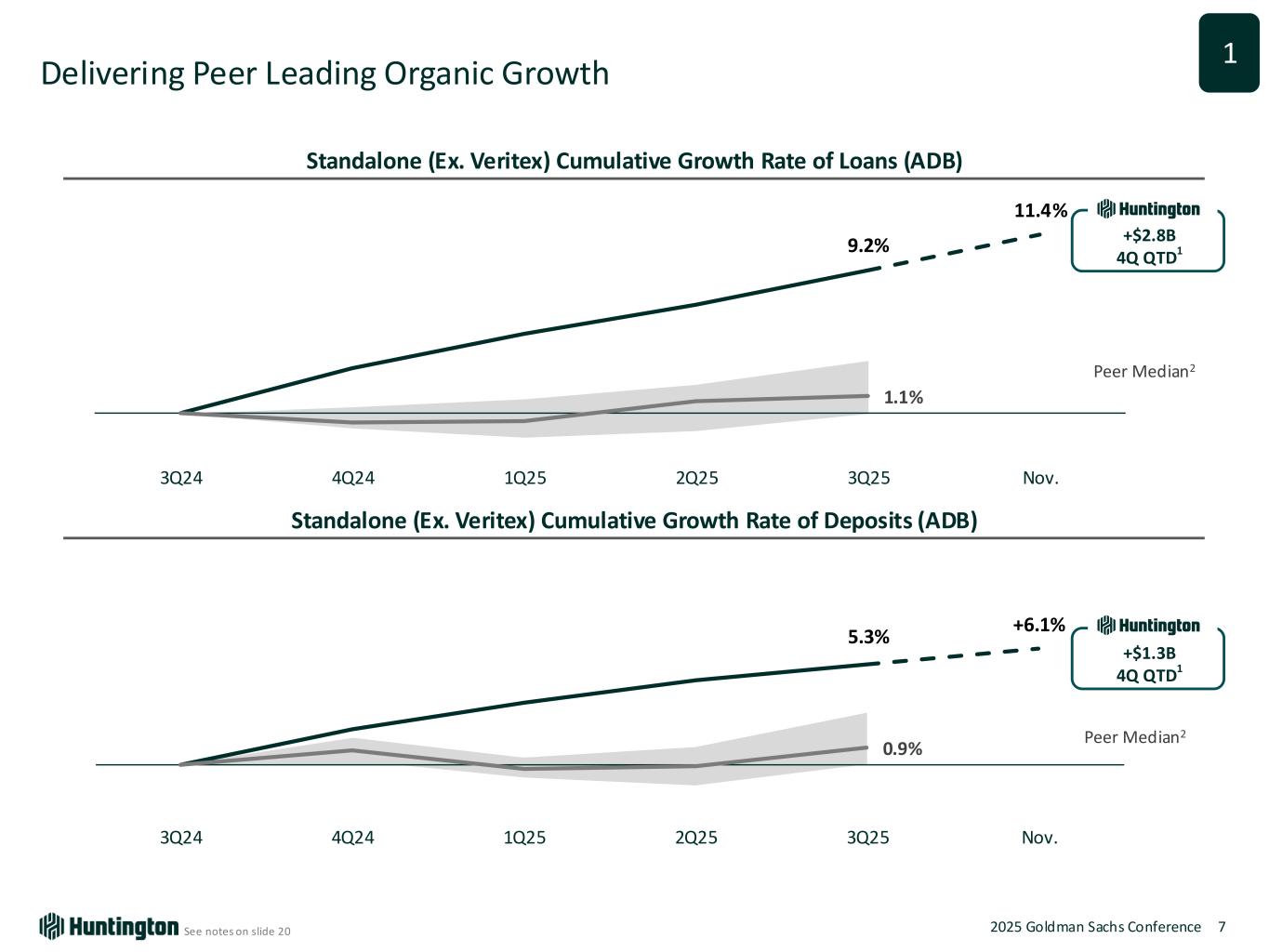

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Delivering Peer Leading Organic Growth See notes on slide 20 7 9.2% 11.4% 1.1% 3Q24 4Q24 1Q25 2Q25 3Q25 Nov. Standalone (Ex. Veritex) Cumulative Growth Rate of Loans (ADB) Standalone (Ex. Veritex) Cumulative Growth Rate of Deposits (ADB) Peer Median2 5.3% +6.1% 0.9% 3Q24 4Q24 1Q25 2Q25 3Q25 Nov. Peer Median2 1 +$2.8B 4Q QTD1 +$1.3B 4Q QTD1

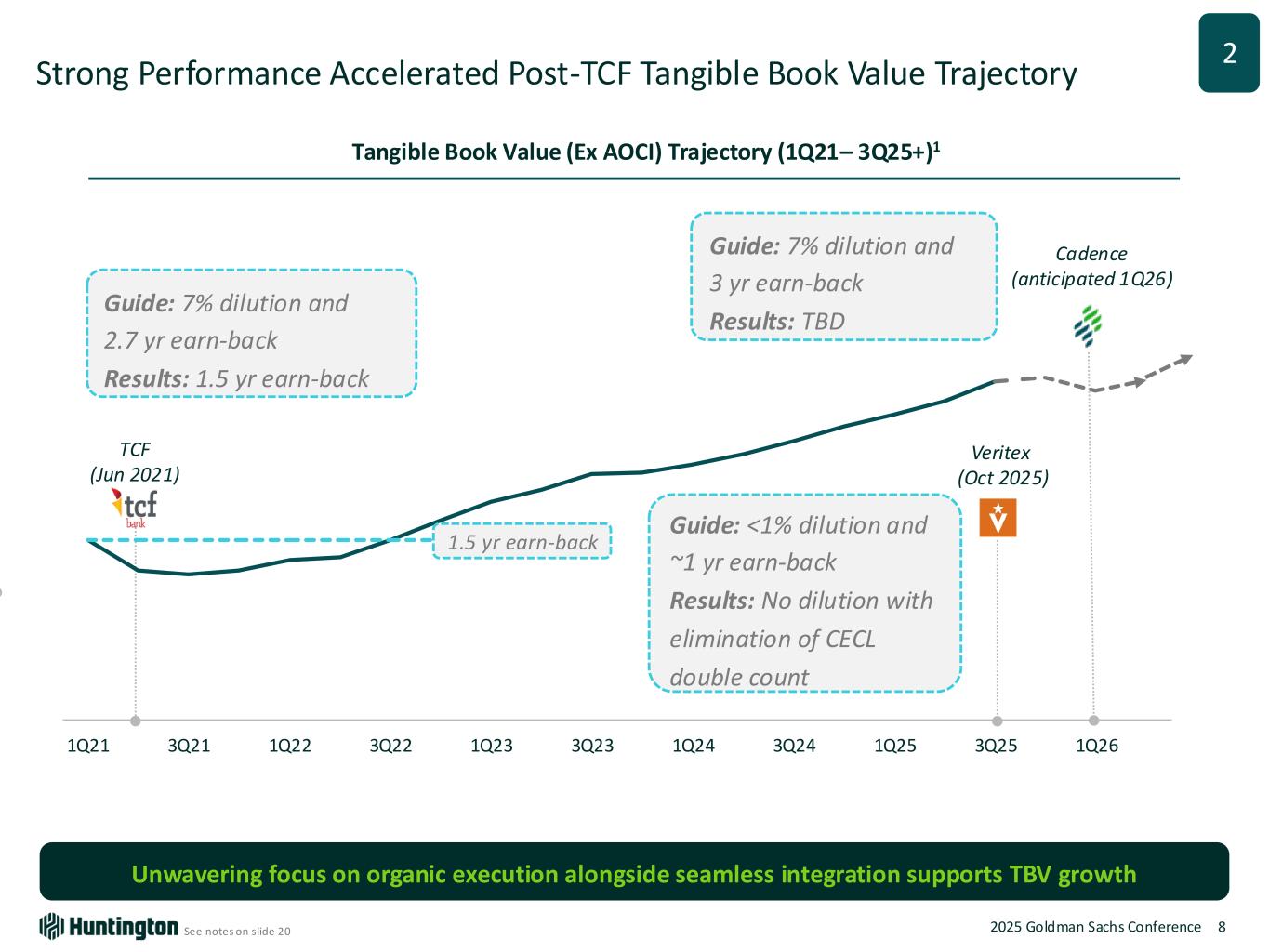

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Strong Performance Accelerated Post-TCF Tangible Book Value Trajectory See notes on slide 20 Unwavering focus on organic execution alongside seamless integration supports TBV growth 8 1Q21 3Q21 1Q22 3Q22 1Q23 3Q23 1Q24 3Q24 1Q25 3Q25 1Q26 Tangible Book Value (Ex AOCI) Trajectory (1Q21– 3Q25+)1 1.5 yr earn-back TCF (Jun 2021) Cadence (anticipated 1Q26) Veritex (Oct 2025) Guide: 7% dilution and 2.7 yr earn-back Results: 1.5 yr earn-back 2 Guide: 7% dilution and 3 yr earn-back Results: TBD Guide: <1% dilution and ~1 yr earn-back Results: No dilution with elimination of CECL double count

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Post-TCF Loan Growth1 2Q21 – 2Q25 CAGR % Disciplined M&A Strategy Accelerates Peer Leading Organic Growth See notes on slide 20 9 4.3% 2.7% 2.1% HBAN Peer Median Real GDP 4.8% 2.9% 2.6% HBAN Peer Median Real GDP Pre-TCF Loan Growth1 3Q16 – 1Q21 CAGR % Strengthened combined footprint: Michigan powerhouse and scale in Chicago Access to new geographies: Introduction to Minnesota and Colorado Scaled national verticals: Doubled Equipment Finance platform Growth Drivers from TCF Partnership 2 2 2

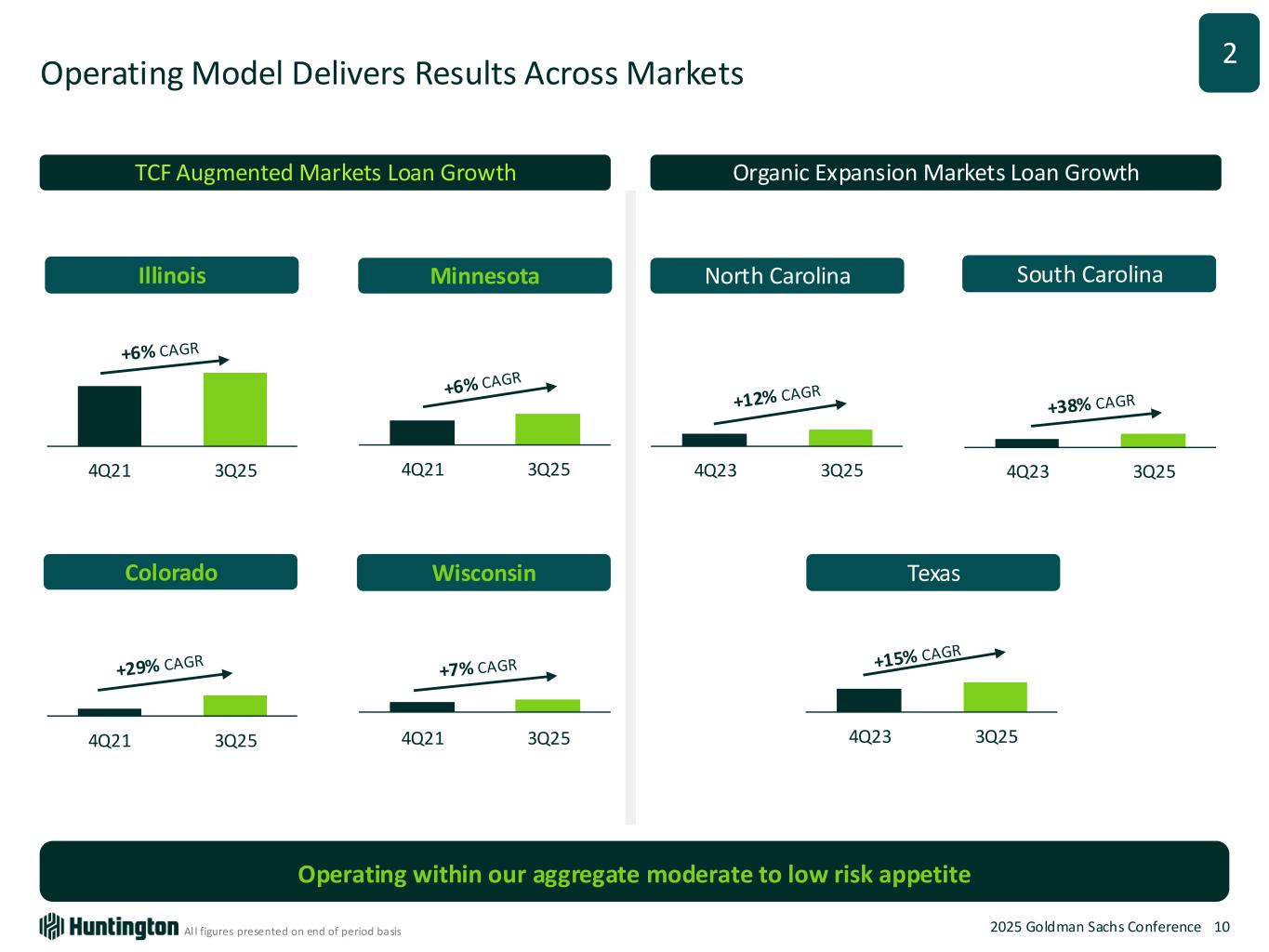

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Operating Model Delivers Results Across Markets Al l figures presented on end of period basis 10 TCF Augmented Markets Loan Growth Illinois 4Q21 3Q25 Minnesota 4Q21 3Q25 Colorado 4Q21 3Q25 Wisconsin 4Q21 3Q25 Organic Expansion Markets Loan Growth 4Q23 3Q25 4Q23 3Q254Q23 3Q25 Texas North Carolina South Carolina Operating within our aggregate moderate to low risk appetite 2

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Creating a New Multi-Region Powerhouse with Cadence Partnership Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Company Documents, S&P Global Market Intell igence; Note: Data as of September 30, 2025 or most recent ly available. Note: Pro forma balance sheet metrics as of September 30, 2025 and exclude purchase accounting adjustments; see notes on slide 20 11 branches spanning 21 states~1,450 of national population within state footprint ~56% expected population growth vs. national average1+30% top major MSAs by projected population growth212 of 25 ~$5.2T deposits in market small and mid-size businesses3~20M $276B Assets $220B Deposits $184B Loans & Leases National Customer Relationships 3

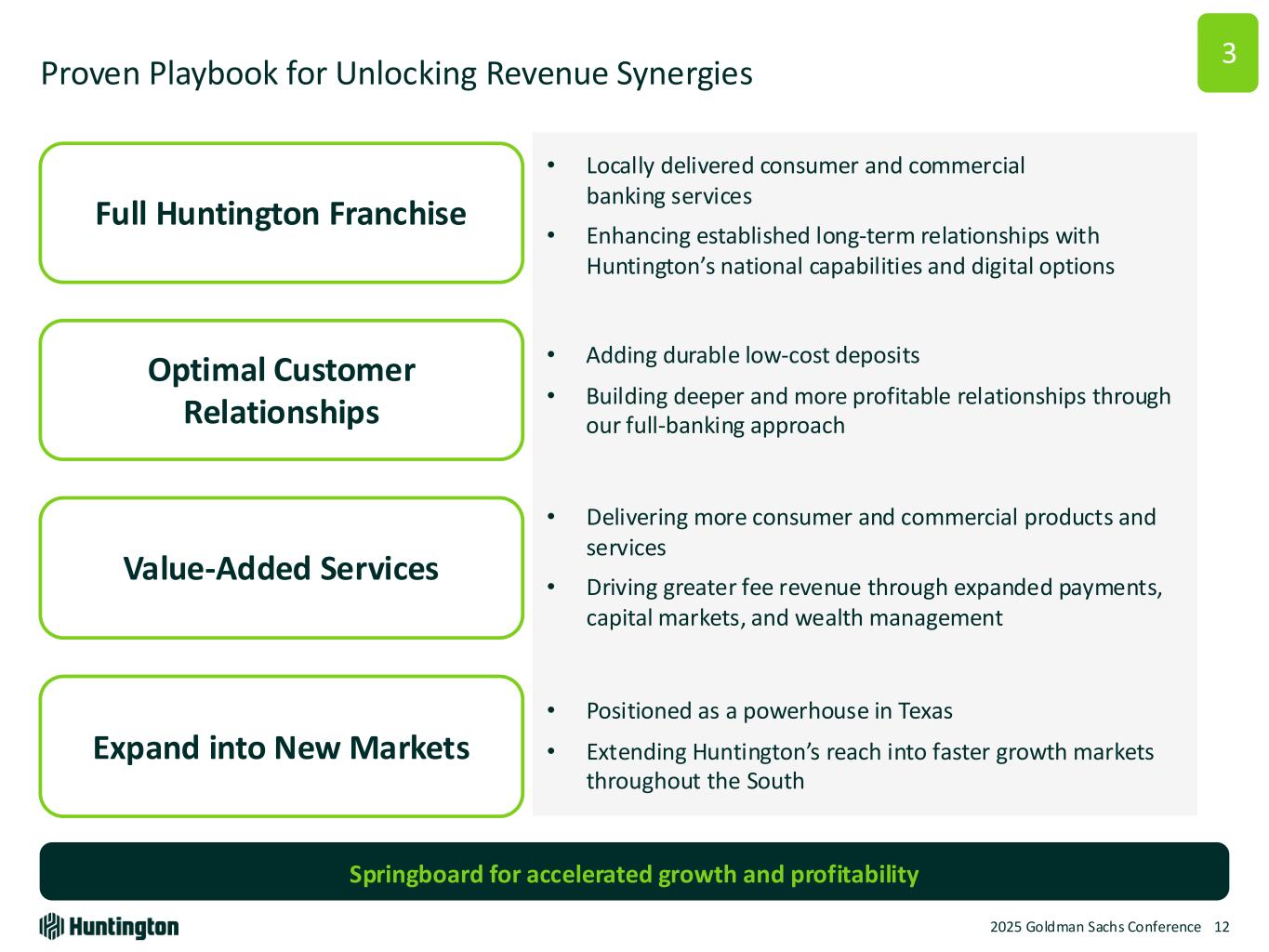

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Proven Playbook for Unlocking Revenue Synergies Springboard for accelerated growth and profitability 12 Full Huntington Franchise Optimal Customer Relationships Value-Added Services Expand into New Markets 3 • Positioned as a powerhouse in Texas • Extending Huntington’s reach into faster growth markets throughout the South • Delivering more consumer and commercial products and services • Driving greater fee revenue through expanded payments, capital markets, and wealth management • Adding durable low-cost deposits • Building deeper and more profitable relationships through our full-banking approach • Locally delivered consumer and commercial banking services • Enhancing established long-term relationships with Huntington’s national capabilities and digital options

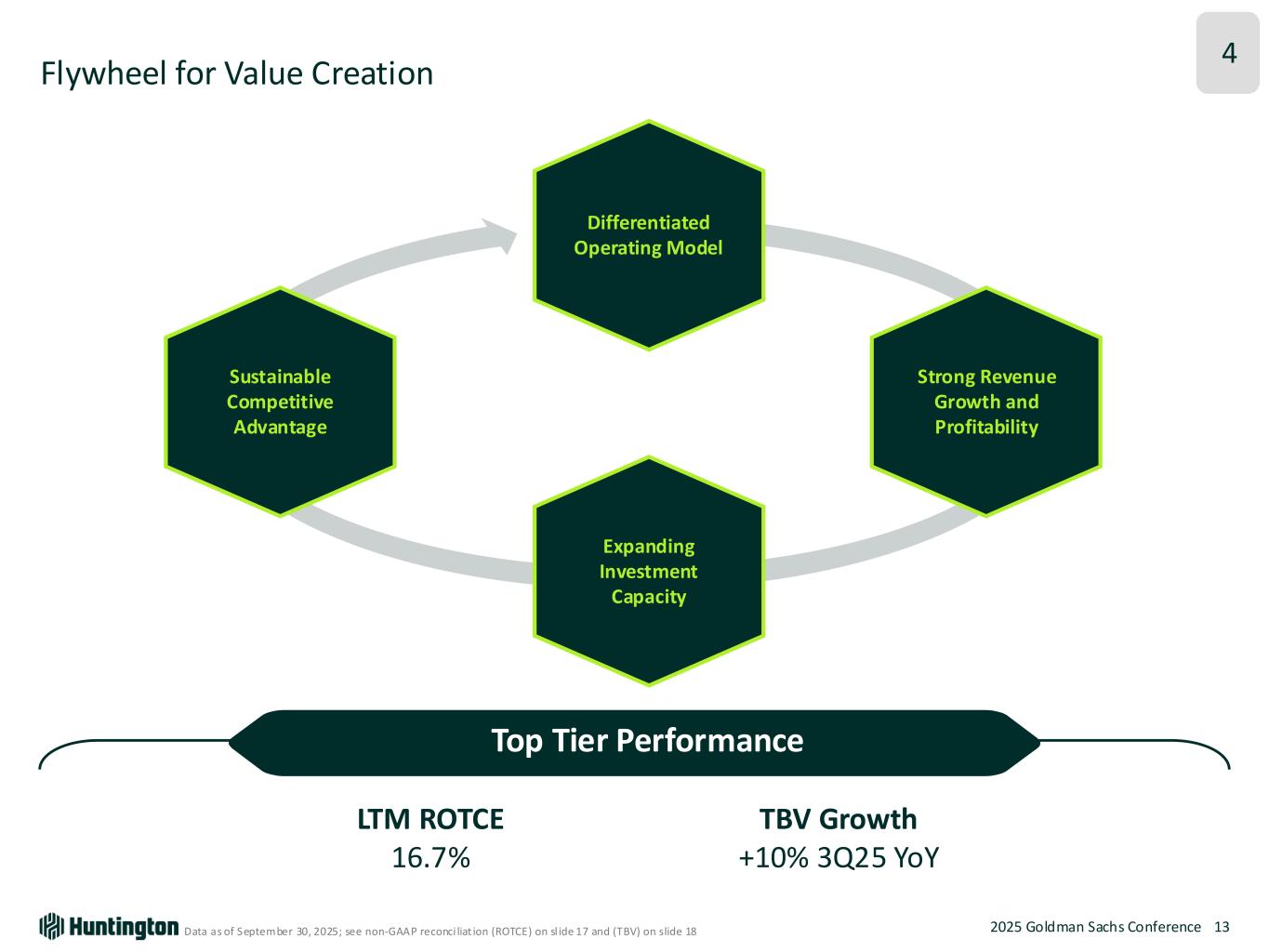

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Flywheel for Value Creation Data as of September 30, 2025; see non-GAAP reconci liat ion (ROTCE) on sl ide 17 and (TBV) on slide 18 13 Top Tier Performance LTM ROTCE 16.7% TBV Growth +10% 3Q25 YoY Sustainable Competitive Advantage Strong Revenue Growth and Profitability Differentiated Operating Model Expanding Investment Capacity 4

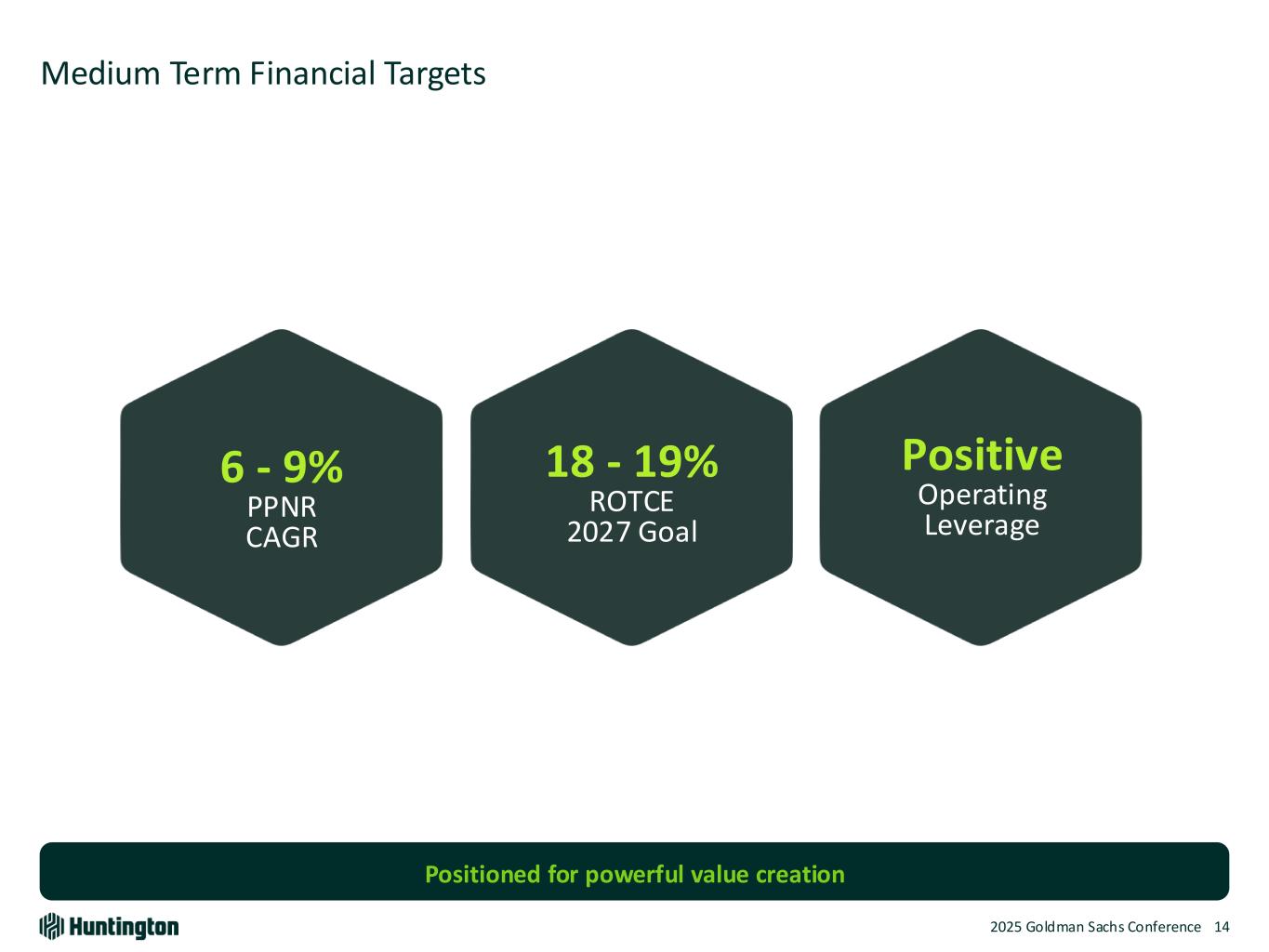

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Medium Term Financial Targets 14 6 - 9% PPNR CAGR Positive Operating Leverage 18 - 19% ROTCE 2027 Goal Positioned for powerful value creation

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference 15 Appendix

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Guidance Update 16 Standalone +Veritex Average Loans FY24 Baseline = $124.5 billion ~8% ~9 - 9.5% High end or slightly above the range Average Deposits FY24 Baseline = $155.1 billion ~5.5% ~ 6.5 - 7% High end of the range Net Interest Income FY24 Baseline = $5.398 billion 10 - 11% + $20M PPNR + $0.01 EPS ~$125 - $150M 1x items ~12% reflecting HBAN standalone high end of range plus Veritex with updated PAA (see Appendix slide: Purchase Accounting Update) Noninterest Income (ex CRTs and Loss on sale of securities) Non-GAAP FY24 Baseline = $2.080 billion ~7% ~7% including Veritex 4Q25: ~$585M Noninterest Expense (ex –Notable Items) Non-GAAP FY24 Baseline = $4.514 billion ~6.5% ~6.5% HBAN standalone + ~$60M Veritex partial quarter ~250bps operating leverage for the combined enterprise Note: 4Q25 one-time costs align to prior range Net Charge-offs Full Year 2025: 20 - 30bps Midpoint of the range Effective Tax Rate 17.5%-18% FY25 No change Avg. Diluted Shares ~1.570B Shares 4Q25 ~1.505B Shares FY25 Preferred Dividends $43M 4Q25 $124M FY25 FY25 vs. FY24 Guidance Commentary As of: 10/17/25

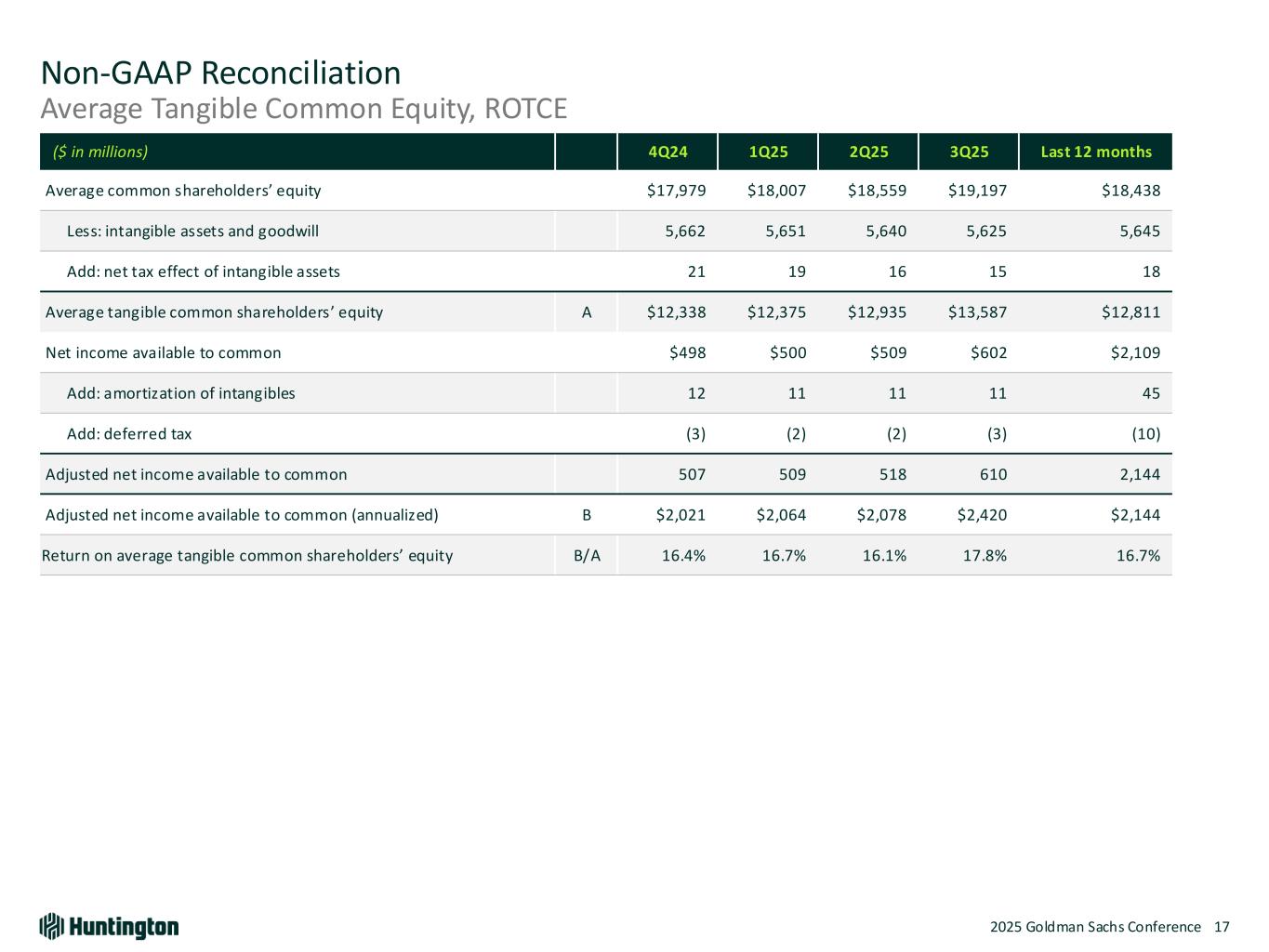

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference 17 Non-GAAP Reconciliation Average Tangible Common Equity, ROTCE ($ in millions) 4Q24 1Q25 2Q25 3Q25 Last 12 months Average common shareholders’ equity $17,979 $18,007 $18,559 $19,197 $18,438 Less: intangible assets and goodwill 5,662 5,651 5,640 5,625 5,645 Add: net tax effect of intangible assets 21 19 16 15 18 Average tangible common shareholders’ equity A $12,338 $12,375 $12,935 $13,587 $12,811 Net income available to common $498 $500 $509 $602 $2,109 Add: amortization of intangibles 12 11 11 11 45 Add: deferred tax (3) (2) (2) (3) (10) Adjusted net income available to common 507 509 518 610 2,144 Adjusted net income available to common (annualized) B $2,021 $2,064 $2,078 $2,420 $2,144 Return on average tangible common shareholders’ equity B/A 16.4% 16.7% 16.1% 17.8% 16.7%

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference 18 TBV per Share (in millions, except per share amounts) 3Q24 4Q24 1Q25 2Q25 3Q25 % Change 3Q25 vs. 3Q24 Huntington shareholders’ equity $20,606 $19,740 $20,434 $20,928 $22,248 Less: preferred stock 2,394 1,989 1,989 1,989 2,731 Common shareholders’ equity $18,212 $17,751 $18,445 $18,939 $19,517 Less: goodwill 5,561 5,561 5,561 5,561 5,547 Less: other intangible assets, net of tax 85 76 67 58 51 Tangible common equity A $12,566 $12,114 $12,817 $13,320 $13,919 Number of common shares outstanding B 1,453 1,454 1,457 1,459 1,459 Tangible book value per share A/B $8.65 $8.33 $8.80 $9.13 $9.54 10.3% Non-GAAP Reconciliation Tangible book value per share

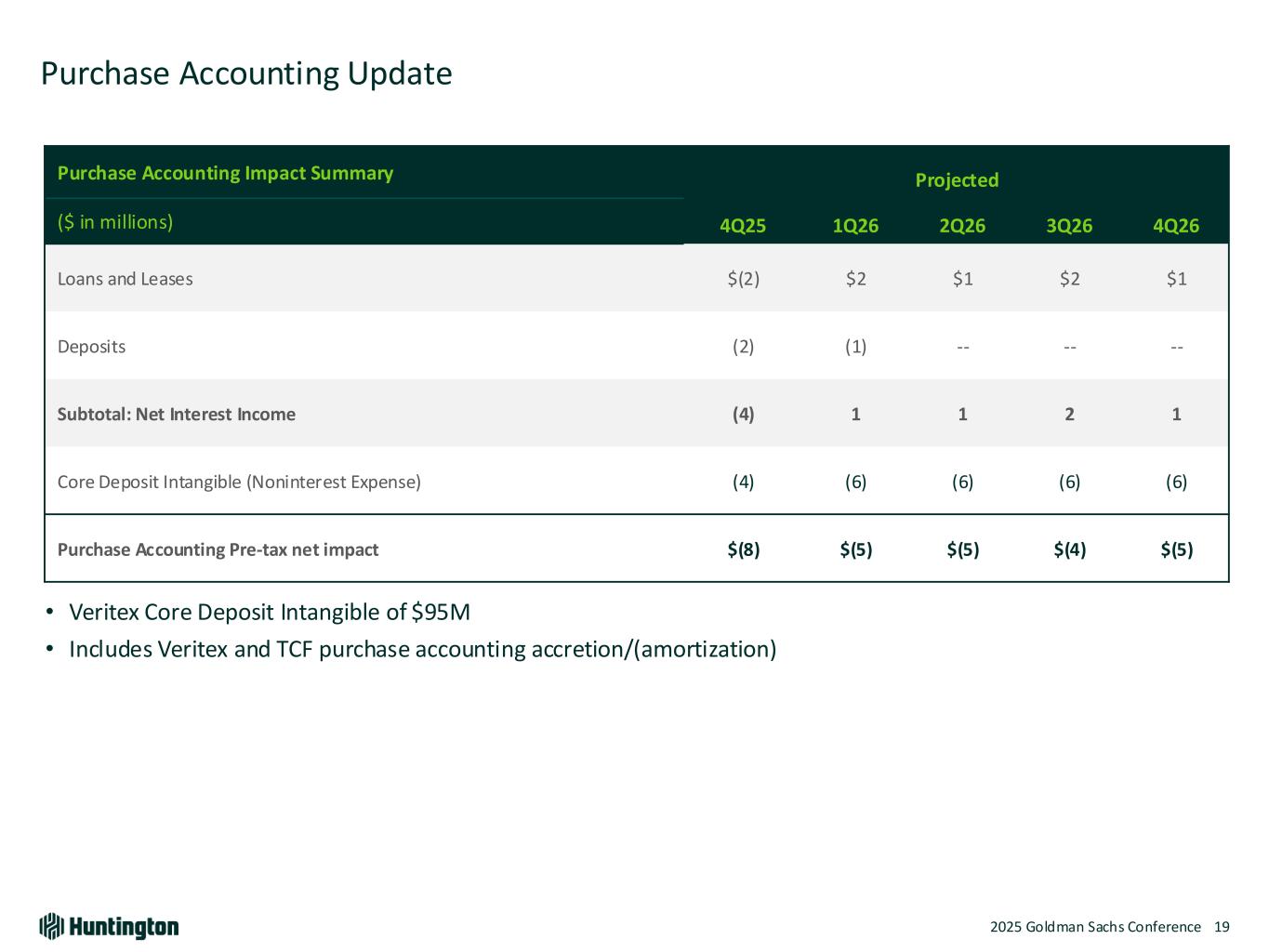

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Purchase Accounting Update 19 Purchase Accounting Impact Summary Projected ($ in millions) 4Q25 1Q26 2Q26 3Q26 4Q26 Loans and Leases $(2) $2 $1 $2 $1 Deposits (2) (1) -- -- -- Subtotal: Net Interest Income (4) 1 1 2 1 Core Deposit Intangible (Noninterest Expense) (4) (6) (6) (6) (6) Purchase Accounting Pre-tax net impact $(8) $(5) $(5) $(4) $(5) • Veritex Core Deposit Intangible of $95M • Includes Veritex and TCF purchase accounting accretion/(amortization)

Abundant Green R: 126 G: 207 B: 28 Dark Teal R: 3 G: 79 B: 84 Pastel Teal R: 184 G: 239 B: 228 Pastel Magenta R: 248 G: 224 B: 229 White R: 255 G: 255 B: 255 Prosperous Sage R: 0 G: 45 B: 42 Primary Palette Off-White R: 245 G: 245 B: 245 Highlight Green R: 177 G: 238 B: 44 Legacy Green R: 45 G: 130 B: 42 Light Teal R: 121 G: 222 B: 226 Deep Sage R: 33 G: 72 B: 70 Highlight Teal R: 58 G: 204 B: 223 Charts/Graphs Palette Pastel Magenta R: 248 G: 224 B: 229 Dark Magenta R: 80 G: 16 B: 89 Highlight Magenta R: 193 G: 22 B: 216 Capstone Blue R: 4 G: 30 B: 66 Deep Magenta R: 144 G: 5 B: 163 Second Palette 2025 Goldman Sachs Conference Notes 20 Slide 7: (1) Average fourth quarter to date balances as of 11/30/2025 (2) Source: S&P Global Market Intelligence - Peers include CFG, CMA, FITB, KEY, MTB, PNC, RF, TFC, USB, ZION Slide 8: (1) Source: S&P Global Market Intelligence; Tangible Book Value, excl AOCI defined as Tangible equity per share, before the effect of accumulated other comprehensive income Slide 9: (1) Source: S&P Global Market Intelligence - Peers include CFG, CMA, FITB, KEY, MTB, PNC, RF, TFC, USB, ZION (2) U.S. Bureau of Economic Analysis, “Real Gross Domestic Product, Chained Dollars,” www.bea.gov (accessed December 8, 2025) Slide 11: (1) Projected population growth of states within Cadence footprint vs national average, 2026E - 2031E (2) Major MSAs defined as those with a current population of 1M+; Projected population growth for the period of 2026E - 2031E (3) Small and medium sized businesses defined as those with employees < 500 and sole proprietorships