EX-99.1

Published on November 7, 2024

2024 BancAnalysts Association of Boston Conference Welcome.® 2024 BancAnalysts Association of Boston Conference November 7, 2024 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2024 Huntington Bancshares Incorporated.

2024 BancAnalysts Association of Boston Conference Disclaimer 2 CAUTION REGARDING FORWARD-LOOKING STATEMENTS The information contained or incorporated by reference in this presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; deterioration in business and economic conditions, including persistent inflation, supply chain issues or labor shortages, instability in global economic conditions and geopolitical matters, as well as volatility in financial markets; the impact of pandemics and other catastrophic events or disasters on the global economy and financial market conditions and our business, results of operations, and financial condition; the impacts related to or resulting from bank failures and other volatility, including potential increased regulatory requirements and costs, such as FDIC special assessments, long-term debt requirements and heightened capital requirements, and potential impacts to macroeconomic conditions, which could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital; unexpected outflows of uninsured deposits which may require us to sell investment securities at a loss; changing interest rates which could negatively impact the value of our portfolio of investment securities; the loss of value of our investment portfolio which could negatively impact market perceptions of us and could lead to deposit withdrawals; the effects of social media on market perceptions of us and banks generally; cybersecurity risks; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve; volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; changes in policies and standards for regulatory review of bank mergers; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd- Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, which are on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

2024 BancAnalysts Association of Boston Conference Delivering Accelerated Organic Growth 1 Expanding Net Interest Income 2 Driving Fee Revenues Higher 3 Maintaining Strong Credit Performance 4 Robust production in core and new initiatives Delivered 6.3% annualized loan growth (EOP) Average deposit growth of 5.6% YoY Managing dynamic interest rate environment Executing down beta playbook, expecting mid-40s down beta by 4Q26 Proactively reducing asset sensitivity Focused on payments, wealth management, and capital markets Launched in-house merchant acquiring capabilities Wealth Management AUM +22% YoY Capital Markets revenues +50% YoY Top quartile NCOs vs. peers(1) Top tier ACL Disciplined credit management leading to through the cycle outperformance Discussion Topics 3 Building Profit Growth Momentum 5 Expect record net interest income in FY25 Maintaining disciplined expense management Note: All stats as of 3Q24 unless otherwise noted See notes on slide 10

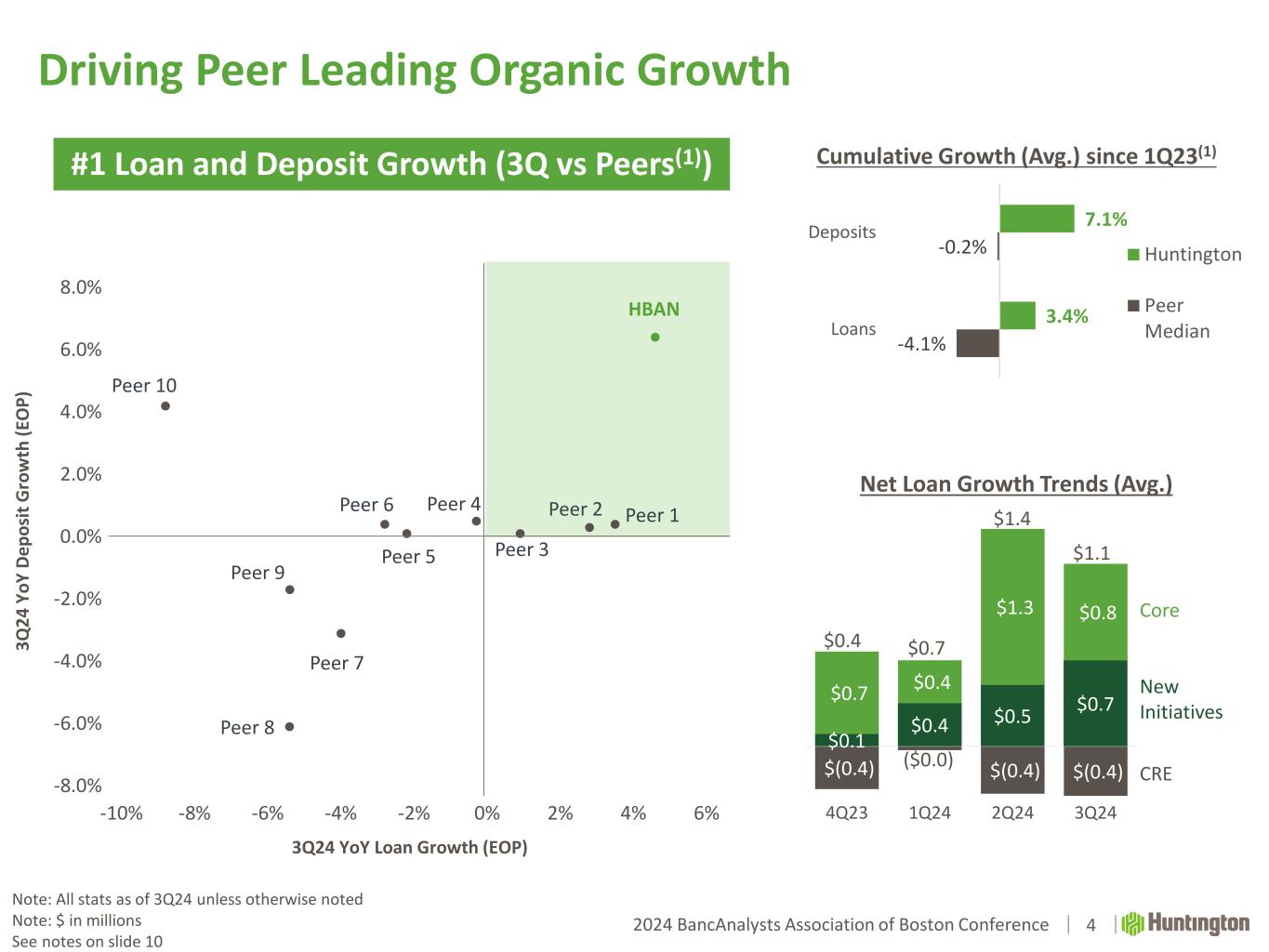

2024 BancAnalysts Association of Boston Conference HBAN Peer 1Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% -10% -8% -6% -4% -2% 0% 2% 4% 6% Driving Peer Leading Organic Growth 3Q 24 Y oY D ep os it G ro w th (E O P) 3Q24 YoY Loan Growth (EOP) Cumulative Growth (Avg.) since 1Q23(1) $(0.4) $(0.4) $(0.4) $0.1 $0.4 $0.5 $0.7$0.7 $0.4 $1.3 $0.8 4Q23 1Q24 2Q24 3Q24 Net Loan Growth Trends (Avg.) 4 #1 Loan and Deposit Growth (3Q vs Peers(1)) $0.4 $0.7 $1.4 $1.1 ($0.0) -4.1% -0.2% 3.4% 7.1% Loans Deposits Huntington Peer Median Core New Initiatives CRE Note: All stats as of 3Q24 unless otherwise noted Note: $ in millions See notes on slide 10

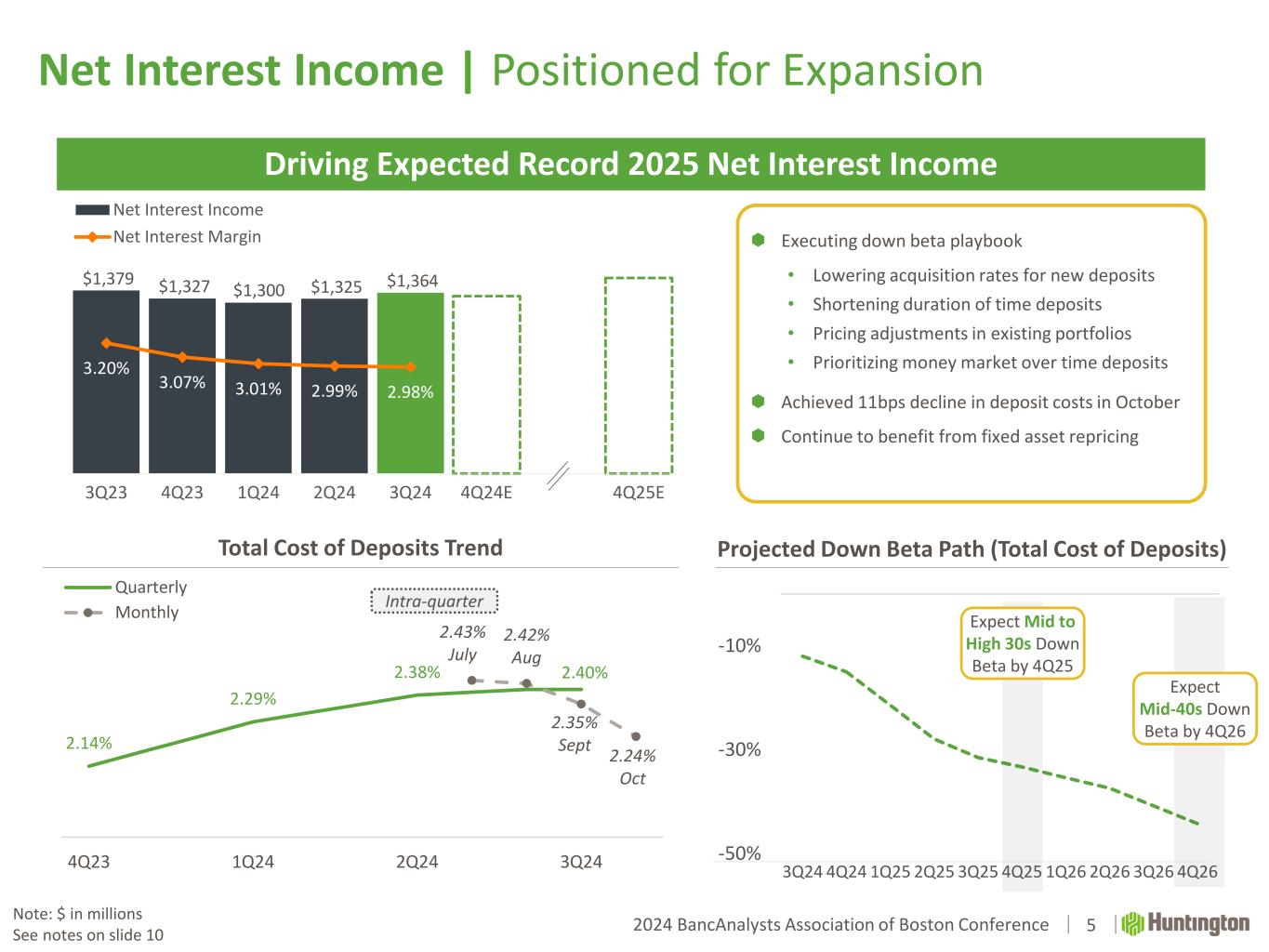

2024 BancAnalysts Association of Boston Conference Net Interest Income | Positioned for Expansion $1,379 $1,327 $1,300 $1,325 $1,364 3.20% 3.07% 3.01% 2.99% 2.98% 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24E 4Q25E Net Interest Income Net Interest Margin 2.14% 2.29% 2.38% 2.40% 2.43% July 2.42% Aug 2.35% Sept 2.24% Oct 4Q23 1Q24 2Q24 3Q24 24-Oct Quarterly Monthly Total Cost of Deposits Trend Intra-quarter -50% -30% -10% 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 3Q26 4Q26 Projected Down Beta Path (Total Cost of Deposits) Expect Mid to High 30s Down Beta by 4Q25 Expect Mid-40s Down Beta by 4Q26 5 Driving Expected Record 2025 Net Interest Income Executing down beta playbook • Lowering acquisition rates for new deposits • Shortening duration of time deposits • Pricing adjustments in existing portfolios • Prioritizing money market over time deposits Achieved 11bps decline in deposit costs in October Continue to benefit from fixed asset repricing Note: $ in millions See notes on slide 10

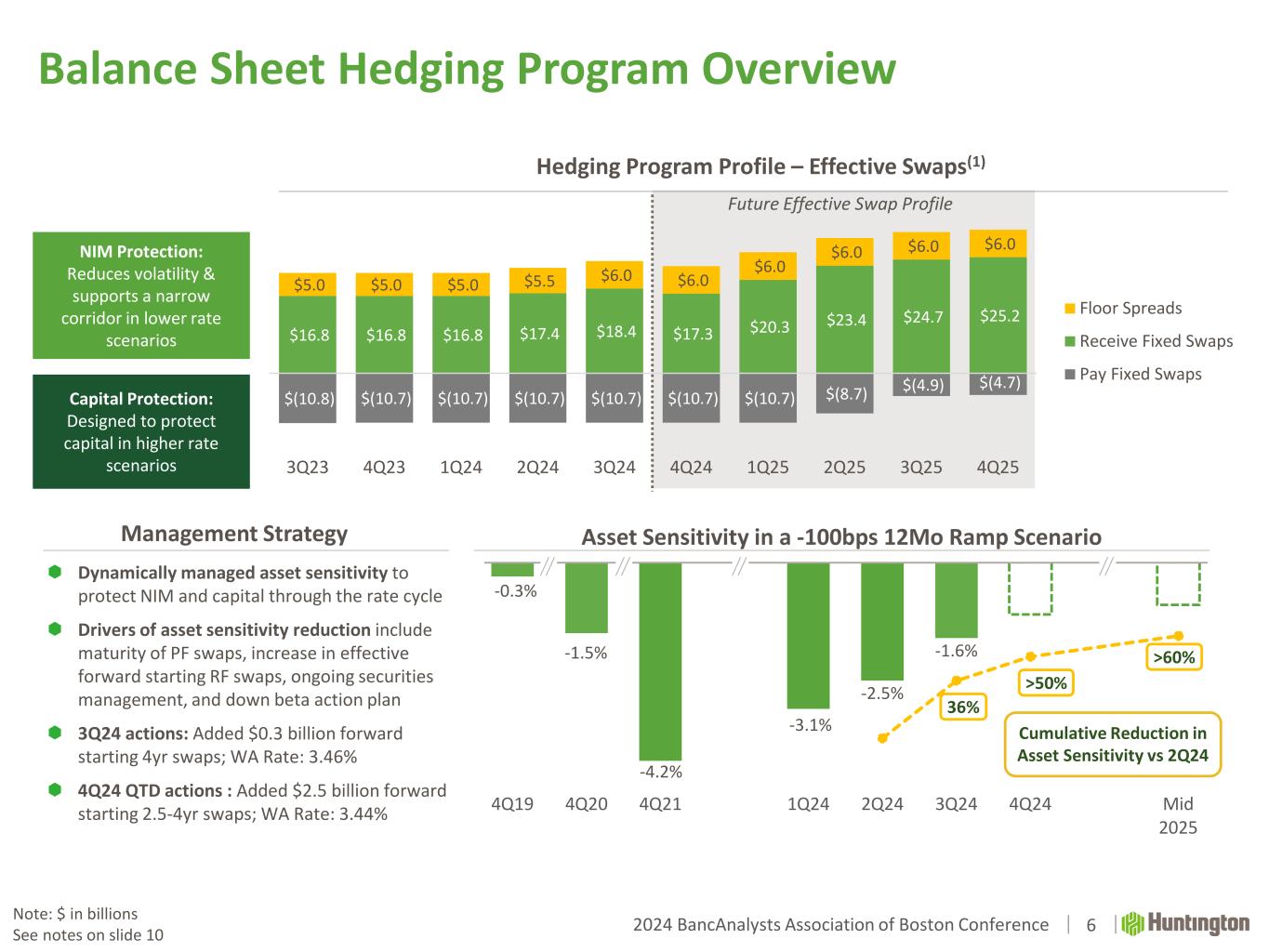

2024 BancAnalysts Association of Boston Conference Balance Sheet Hedging Program Overview Capital Protection: Designed to protect capital in higher rate scenarios NIM Protection: Reduces volatility & supports a narrow corridor in lower rate scenarios Dynamically managed asset sensitivity to protect NIM and capital through the rate cycle Drivers of asset sensitivity reduction include maturity of PF swaps, increase in effective forward starting RF swaps, ongoing securities management, and down beta action plan 3Q24 actions: Added $0.3 billion forward starting 4yr swaps; WA Rate: 3.46% 4Q24 QTD actions : Added $2.5 billion forward starting 2.5-4yr swaps; WA Rate: 3.44% Hedging Program Profile – Effective Swaps(1) Future Effective Swap Profile -0.3% -1.5% -4.2% -3.1% -2.5% -1.6% 36% >50% >60% 4Q19 4Q20 4Q21 1Q24 2Q24 3Q24 4Q24 Mid 2025 Asset Sensitivity in a -100bps 12Mo Ramp ScenarioManagement Strategy Cumulative Reduction in Asset Sensitivity vs 2Q24 $(10.8) $(10.7) $(10.7) $(10.7) $(10.7) $(10.7) $(10.7) $(8.7) $(4.9) $(4.7) $16.8 $16.8 $16.8 $17.4 $18.4 $17.3 $20.3 $23.4 $24.7 $25.2 $5.0 $5.0 $5.0 $5.5 $6.0 $6.0 $6.0 $6.0 $6.0 $6.0 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Floor Spreads Receive Fixed Swaps Pay Fixed Swaps 6Note: $ in billions See notes on slide 10

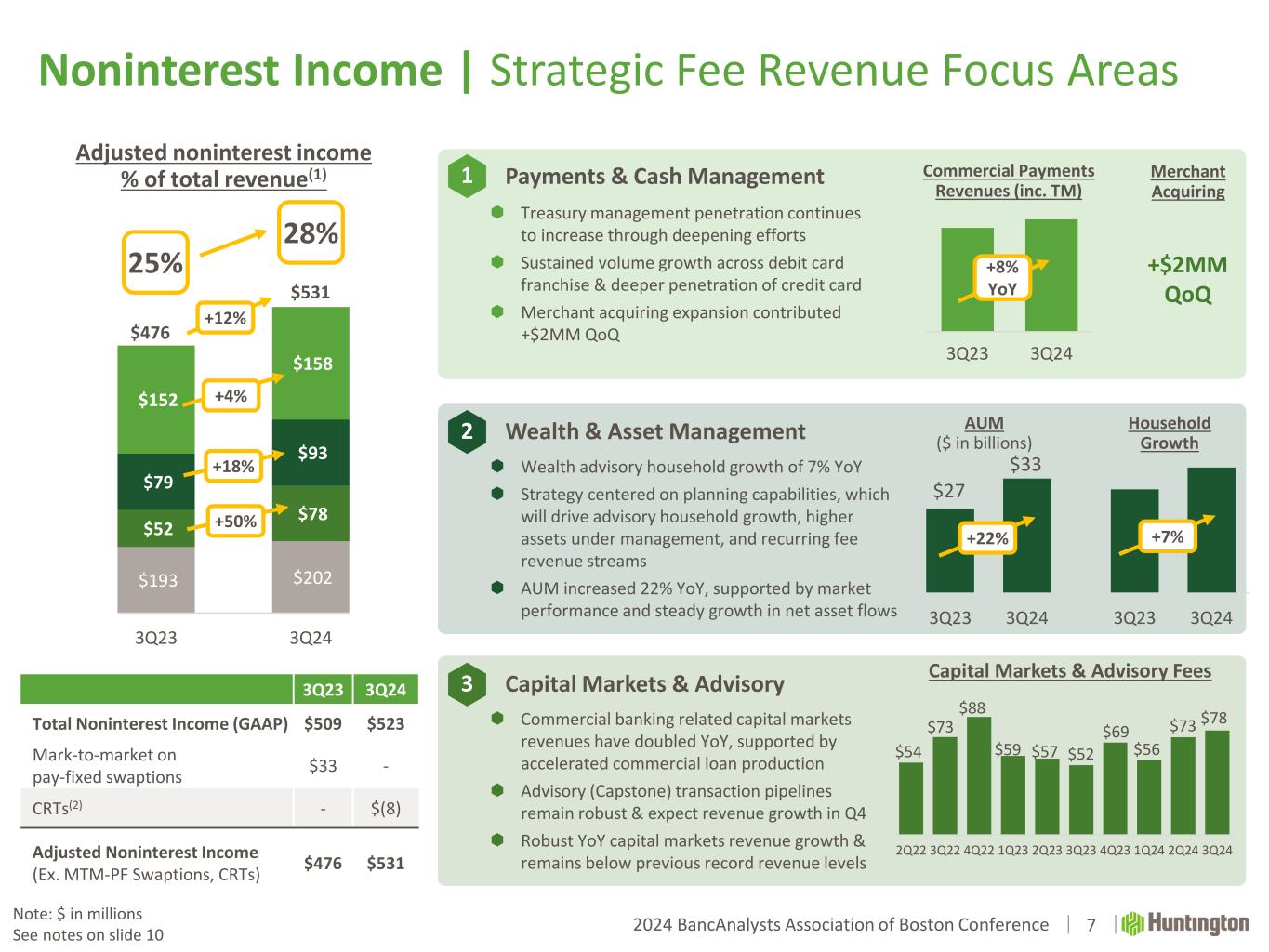

2024 BancAnalysts Association of Boston Conference 3Q23 3Q24 3Q23 3Q24 $193 $202 $52 $78 $79 $93 $152 $158 3Q23 3Q24 Noninterest Income | Strategic Fee Revenue Focus Areas Capital Markets & Advisory Payments & Cash Management Wealth & Asset Management 1 3 +18% +4% +50% 2 $27 $33 3Q23 3Q24 $54 $73 $88 $59 $57 $52 $69 $56 $73 $78 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Commercial banking related capital markets revenues have doubled YoY, supported by accelerated commercial loan production Advisory (Capstone) transaction pipelines remain robust & expect revenue growth in Q4 Robust YoY capital markets revenue growth & remains below previous record revenue levels Wealth advisory household growth of 7% YoY Strategy centered on planning capabilities, which will drive advisory household growth, higher assets under management, and recurring fee revenue streams AUM increased 22% YoY, supported by market performance and steady growth in net asset flows Treasury management penetration continues to increase through deepening efforts Sustained volume growth across debit card franchise & deeper penetration of credit card Merchant acquiring expansion contributed +$2MM QoQ$476 $531 +12% AUM ($ in billions) Capital Markets & Advisory Fees Household Growth +22% +7% +8% YoY 28% 25% Commercial Payments Revenues (inc. TM) Merchant Acquiring +$2MM QoQ 7 3Q23 3Q24 Total Noninterest Income (GAAP) $509 $523 Mark-to-market on pay-fixed swaptions $33 - CRTs(2) - $(8) Adjusted Noninterest Income (Ex. MTM-PF Swaptions, CRTs) $476 $531 Adjusted noninterest income % of total revenue(1) Note: $ in millions See notes on slide 10

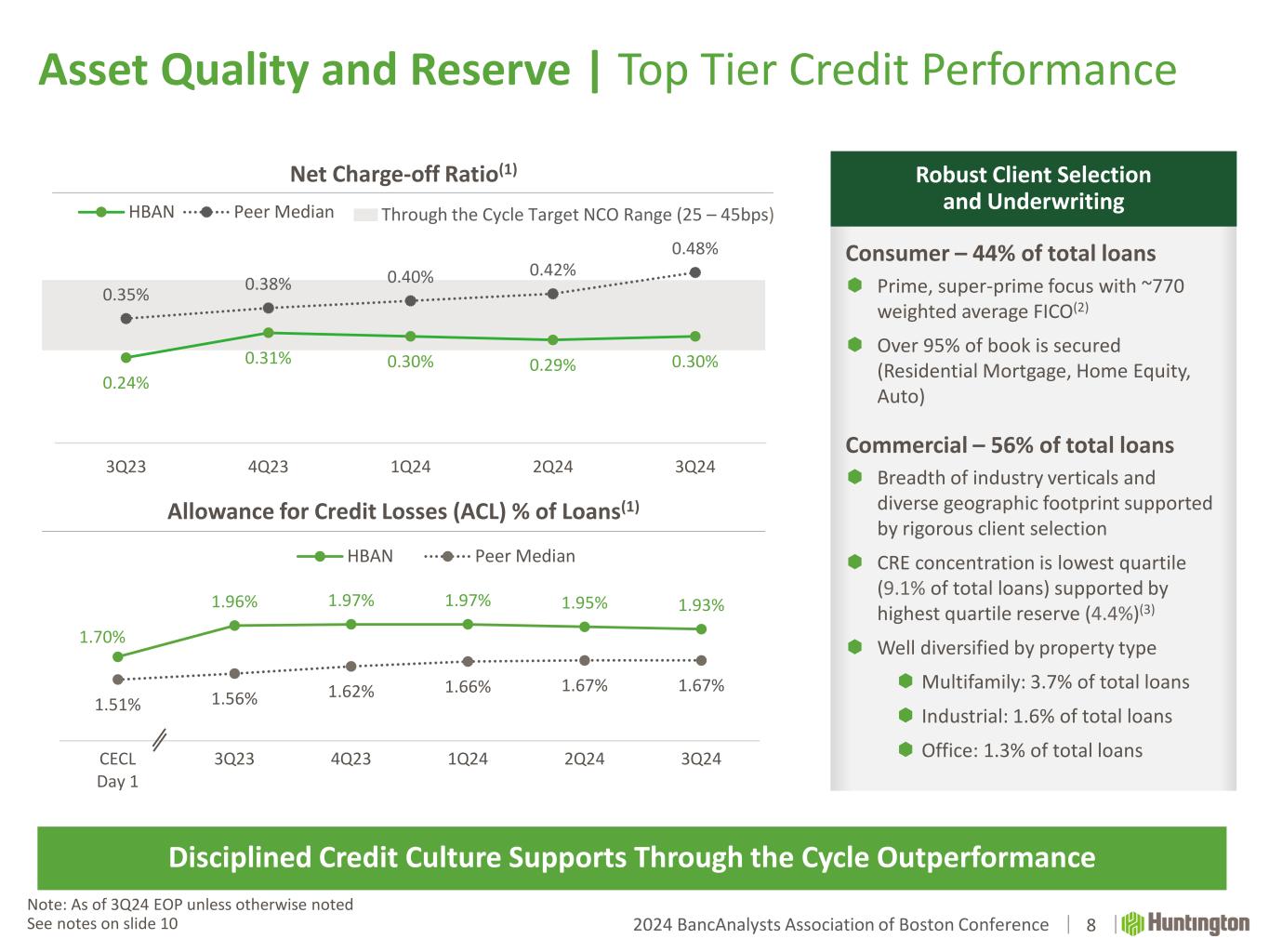

2024 BancAnalysts Association of Boston Conference 1.70% 1.96% 1.97% 1.97% 1.95% 1.93% 1.51% 1.56% 1.62% 1.66% 1.67% 1.67% CECL Day 1 3Q23 4Q23 1Q24 2Q24 3Q24 HBAN Peer Median Through the Cycle Target NCO Range (25 – 45bps) 8 Asset Quality and Reserve | Top Tier Credit Performance Net Charge-off Ratio(1) Allowance for Credit Losses (ACL) % of Loans(1) Robust Client Selection and Underwriting Consumer – 44% of total loans Prime, super-prime focus with ~770 weighted average FICO(2) Over 95% of book is secured (Residential Mortgage, Home Equity, Auto) Commercial – 56% of total loans Breadth of industry verticals and diverse geographic footprint supported by rigorous client selection CRE concentration is lowest quartile (9.1% of total loans) supported by highest quartile reserve (4.4%)(3) Well diversified by property type Multifamily: 3.7% of total loans Industrial: 1.6% of total loans Office: 1.3% of total loans Disciplined Credit Culture Supports Through the Cycle Outperformance Note: As of 3Q24 EOP unless otherwise noted See notes on slide 10 0.24% 0.31% 0.30% 0.29% 0.30% 0.35% 0.38% 0.40% 0.42% 0.48% 3Q23 4Q23 1Q24 2Q24 3Q24 HBAN Peer Median

2024 BancAnalysts Association of Boston Conference 9 Disciplined Management Approach Executing organic growth initiatives inclusive of new geographies and commercial verticals Delivering high-quality loan growth and expanding deposit balances Implementing down-beta action plan Managing asset sensitivity and maintaining NIM within a tight corridor Powering fee revenue growth across payments, wealth management, and capital markets Managing expense growth in line with prior guidance with a focus on creating ongoing efficiencies to self-fund investments Maintaining disciplined focus on strong capital through the cycle aligned with our aggregate moderate-to-low risk appetite

2024 BancAnalysts Association of Boston Conference Notes 10 Slide 3: (1) Source: Company Financials. Includes all peers: CMA, FITB, ZION, KEY, MTB, PNC, RF, TFC, CFG, and USB. Slide 4: (1) Source: S&P Global Market Intelligence and filings - Includes all peers: CMA, FITB, ZION, KEY, MTB, PNC, RF, TFC, CFG, and USB. Slide 6: (1) Shown current position as of 11/05/24 with projection of effective swaps through 4Q25 Slide 7: (1) Noninterest income, adjusted as a percentage of Total Revenue (FTE); adjusted noninterest income (non-GAAP) excludes effect of MTM on PF Swaptions and CRTs (“Credit Risk Transfers”) (2) CRTs (“Credit Risk Transfers”) include both a 4Q23 transaction related to a ~$3 billion portfolio of on-balance sheet prime indirect auto loans, which reduced risk-weighted assets by ~$2.4 billion; and a 2Q24 transaction related to a ~$4 billion portfolio of on-balance sheet prime indirect auto loans, which reduced risk-weighted assets by ~$3 billion Slide 8: (1) Source: Company Financials. Includes all peers: CMA, FITB, ZION, KEY, MTB, PNC, RF, TFC, CFG, and USB. (2) As of 2Q24 (3) Source: Company Second Quarter 2024 Form 10Q's. Includes publicly listed US-based banks with >$50 billion in assets as of 2Q24 if data was available for both the CRE concentration and CRE reserve ratio. Excludes BHC's primarily classified as card issuers or adjacent to a depository institution. CRE Concentration and CRE Reserves based on SEC financials where available.