EX-99.1

Published on November 2, 2023

Welcome.® The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2023 Huntington Bancshares Incorporated. 2023 BancAnalysts Association of Boston Conference November 2, 2023

2023 BAAB Conference Presentation2023 BAAB Conference Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS The information contained or incorporated by reference in this presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; deterioration in business and economic conditions, including persistent inflation, supply chain issues or labor shortages, instability in global economic conditions and geopolitical matters, as well as volatility in financial markets; the impact of pandemics, including the COVID-19 pandemic and related variants and mutations, and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; the impacts related to or resulting from recent bank failures and other volatility, including potential increased regulatory requirements and costs, such as FDIC special assessments, long-term debt requirements and heightened capital requirements, and potential impacts to macroeconomic conditions, which could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital; unexpected outflows of uninsured deposits which may require us to sell investment securities at a loss; rising interest rates which could negatively impact the value of our portfolio of investment securities; the loss of value of our investment portfolio which could negatively impact market perceptions of us and could lead to deposit withdrawals; the effects of social media on market perceptions of us and banks generally; cybersecurity risks; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve; volatility and disruptions in global capital and credit markets; movements in interest rates; transition away from LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, which are on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2

2023 BAAB Conference Presentation2023 BAAB Conference 3 Initiatives Support Vision To be the Leading People-First, Digitally Powered Bank Growing the Core Deposit Base through Primary Relationships 1 Driving Relationship Growth through Digital Innovation 2 Enhancing Our Regional Banking Model 3 Maximizing Customer Engagement Outcomes 4 ✓ New Customer Acquisition ✓ Growing Primary Relationships ✓ Effective Rate Management ✓ Differentiating Innovation ✓ Digital Deepening ✓ Feature Highlights • Marketplace • Activation Zone • Advisor Connect ✓ Regional Banking ✓ Wealth Management ✓ Select National Franchises (SBA, Practice Finance) ✓ Branch Optimization and Efficiency ✓ Leverages Strong Customer Engagement ✓ Focused on Deepening in Select Interaction Moments within Human Channels Discussion Topics

2023 BAAB Conference Presentation2023 BAAB Conference Huntington: A Purpose-Driven Company OUR PURPOSE We make people’s lives better, help businesses thrive, and strengthen the communities we serve OUR VISION To be the leading People-First, Digitally Powered Bank Purpose and Vision Linked to Business Strategies Guided by Through-the-Cycle Aggregate Moderate-to-Low Risk Appetite 4

2023 BAAB Conference Presentation2023 BAAB Conference Consumer & Regional Banking 5 $107B Deposits $66B Consumer & Business Loans $1.2B Fee Revenue1 Leading Midwest Consumer and National Specialty Franchises …With Established Scale and Scope $27B AUM Balances as of 3Q23 (EOP) (1) Total CRB Fee Revenue from 4Q22-3Q23 (2) Logged into online or mobile application at least once over the last 90-days (3) For J.D. Power 2023 award information, visit jdpower.com/awards 3.2M Consumer Checking Households #1 Branch Share in Ohio and Michigan 379K Business Checking Households 4.3M Consumer Deposit Customers 17% Growth in Wealth Advisory Relationships YoY 1,001 Branches in 11 States 74% Digital Adoption2 $2.1B National Practice Finance Committed Loans Recent Awards and Recognition JD Power Multi-Year Winner3 • Mobile App Satisfaction • Overall Customer Satisfaction History of Innovation Early Pay $50 Safety Zone™ Asterisk- Free Checking®

2023 BAAB Conference Presentation2023 BAAB Conference Loans Deposits Fee Income Colleagues $10.7 B $76.2 B $563 MM 7,233 ..$7.3 B $19.7 B $119 MM 1,146 $4.5 B $8.8 B $373 MM 1,044 $43.1 B ..$1.4 B $121 MM 1,608 --- --- $74 MM 345 ✓ 1,001 branches across 11 states ✓ 1,631 ATMs ✓ Digital (Online, Mobile) ✓ Payments (Debit, Credit) ✓ Product Management & Strategy ✓ Business Product Specialties: SBA & Practice Finance that operate nationally1 ✓ Serves Lower Middle Market Businesses ($2MM-$50MM Revenue) ✓ Treasury Management Services ✓ Private Banking ✓ Investment Management ✓ Brokerage, Annuities & Insurance ✓ Trust (Personal, Corporate) National Loan Products1: ✓ Mortgage ✓ Dealer Finance ✓ Auto ✓ RV & Marine ✓ Powersports ✓ Home Equity ✓ Consumer Lending ✓ Commercial P&C ✓ Employee Benefits ✓ Personal Lines ✓ Life Insurance Regional Banking Retail Banking Wealth Management Consumer Finance Insurance Purposefully Aligned and Well-Positioned for Growth Consumer & Regional Banking structure reflective of organizational re-alignment during 1H23 6 Diversified Lines of Business with Opportunities for Scale Balances represent 3Q23 ADB, Fee Income is last 4 quarters of actuals, Colleagues are as of 3Q23 1 Operate in extended geographies beyond Huntington’s 11 state branch footprint

2023 BAAB Conference Presentation2023 BAAB Conference 7 Differentiating Our Customers’ Experience Creating Innovative & Distinctive Products for all People The Business Bank of Choice Maximizing Customer Engagement & Satisfaction Local Model, Scalable to New Markets and Verticals Expanding and evolving history of product differentiation to drive continued household acquisition Providing Insights, Guidance, & Advice Building on leading position in business banking through expanding digital capabilities and scaling expertise Shifting colleague interactions from transactions to advice and evolving brand position Enhancing highly differentiated local model, creating closer connections between business, customers, and communities, and expanding select areas of expertise to new markets Building out industry best omni- channel experience through an easy-to-navigate digital storefront

2023 BAAB Conference Presentation2023 BAAB Conference #1 Overall Customer Satisfaction 2023 and 7 of last 11 years – JD Power #1 Mobile App 5 Years in a Row 2019, 2020, 2021, 2022 and 2023 – JD Power #1 Dealer Satisfaction Regional Banks, Prime Credit – 2022, JD Power Greenwich Excellence & Best Brand Awards 11 middle market awards including Excellence Award for Overall Satisfaction & Best Brand – Trust, 2022 8 3x Checking Households 3.2M Checking Households 1.1M Huntington “Fair Play Banking” and Past Innovations All Day Deposit The Hub 3.2M 2.2MM 1.1M Checking Households 1 2 3 Strong Acquisition Growth through Product Innovation Primary Relationships Earned through Customer Focus Growing Primary Relationships Supports Core Deposit Base Culture of product innovation with a proven track record and a leading brand that consumers trust 4 Note: For J.D. Power 2023 award information, visit jdpower.com/awards For Greenwich Awards, visit greenwich.com/document-type/greenwich-awards

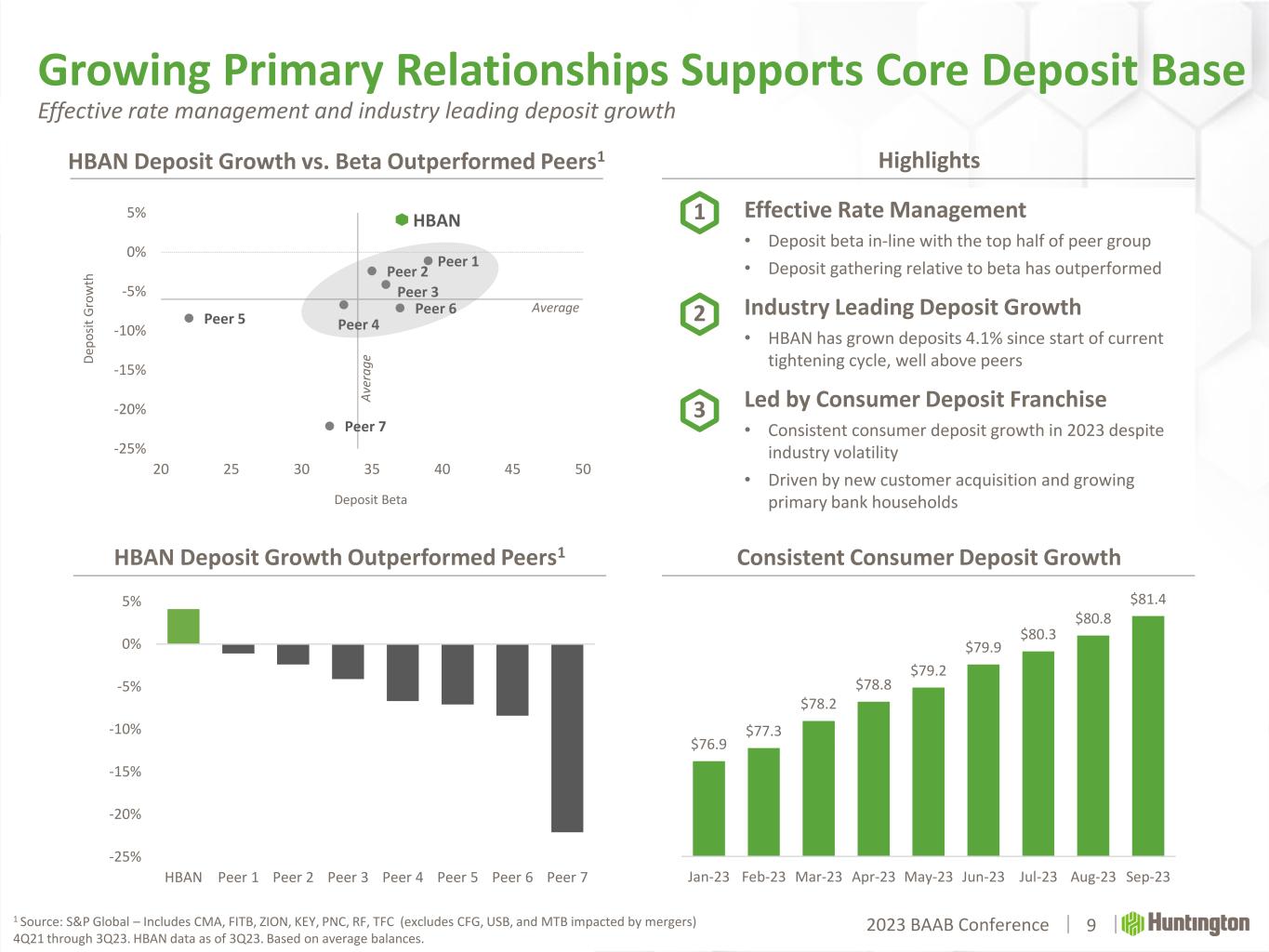

2023 BAAB Conference Presentation2023 BAAB Conference Effective Rate Management • Deposit beta in-line with the top half of peer group • Deposit gathering relative to beta has outperformed Industry Leading Deposit Growth • HBAN has grown deposits 4.1% since start of current tightening cycle, well above peers Led by Consumer Deposit Franchise • Consistent consumer deposit growth in 2023 despite industry volatility • Driven by new customer acquisition and growing primary bank households Growing Primary Relationships Supports Core Deposit Base Effective rate management and industry leading deposit growth 9 HBAN Deposit Growth vs. Beta Outperformed Peers1 HBAN Deposit Growth Outperformed Peers1 HBAN Peer 1 Peer 2 Peer 3 Peer 4Peer 5 Peer 6 Peer 7 -25% -20% -15% -10% -5% 0% 5% 20 25 30 35 40 45 50 D ep o si t G ro w th Deposit Beta -25% -20% -15% -10% -5% 0% 5% HBAN Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Consistent Consumer Deposit Growth Highlights 1 2 3 $76.9 $77.3 $78.2 $78.8 $79.2 $79.9 $80.3 $80.8 $81.4 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Average A ve ra g e 1 Source: S&P Global – Includes CMA, FITB, ZION, KEY, PNC, RF, TFC (excludes CFG, USB, and MTB impacted by mergers) 4Q21 through 3Q23. HBAN data as of 3Q23. Based on average balances.

2023 BAAB Conference Presentation2023 BAAB Conference 10 5% 15%Branch Significant Near-Term Opportunity to Deepen into High Digital Traffic Huntington has organically acquired 1.2M checking households over the past five years Tremendous share of wallet opportunity exists among our 4.3M digitally enabled customers Leverage reputation for service excellence to increase trust in advice and guidance 1 2 High Digital Engagement Deposit Wallet Share by Origination Channel Wallet Share Opportunity through Achieving Top Decile Performance 80M 74% 43% Monthly Digital Logins Households Digitally Active Digitally Acquired YTD ~20% increase in core deposits1 ~30% increase in loan balances Illustrative Example 2 – 3x Opportunity Driving Relationship Growth through Digital Innovation 4.3M digitally enabled customers on pace for 960M annual digital logins (90% mobile) Digital Note: Households Digitally Active – Logged into online or mobile application at least once over the last 90-days (1) Defined as primary bank relationship deposits or low-cost deposits

2023 BAAB Conference Presentation2023 BAAB Conference • Product deepening within mobile interactions Marketplace 11 Activation Zone AdvisorConnect • Digital shopping experience including personalized offers leading to streamlined account opening and loan origination flows • Reimagined onboarding experience for new checking customers gives customers more options and controls over products • Makes it easy to connect with a colleague for advice while augmenting branch referrals through digitally requested appointments • New area to drive Primary Bank Customers during checking acquisition • Digital leads connect customers to colleagues in categories that customers prefer to work with a person Driving Relationship Growth through Digital Innovation We’re making it easier to switch to Huntington and engage with our products and colleagues ✓ ~20% digital customers visiting monthly ✓ 11% of 2023 deposit account originations ✓ Utilized by 87% of new checking customers ✓ New digitally acquired checking customers ✓ 10k-20k wealth management leads annually Outcome Outcome Outcome Strategic Unlock Strategic Unlock Strategic Unlock

2023 BAAB Conference Presentation2023 BAAB Conference 12 Growing Our Local Advantage through an Enhanced Regional Banking Model Regional President Regional P&L accountability Regional Banking Model brings localized delivery and service differentiation, building on Strong Local Advantage in existing geographies Reorganization is more cost efficient and better aligns customer facing colleagues to revenue synergies from existing interactions Regional model has been recently applied to acquired growth markets that present short term upside Leverages National Franchise Businesses (SBA, Practice Finance, Consumer Finance) and enables optionality to redeploy model in expanded geographies Gives us the right organization to drive scale in business banking, wealth, and insurance to support continued strong fee income growth Aligned goals & incentives for key referral partnerships Raised segmentation to $2MM-$50MM (lower middle market) 2023 Regional Banking Enhancements Eliminated dotted lines, bankers report to their region Aligned leadership across all lines of business Strong alignment with Commercial middle market Controlled regional credit & pricing authorities Regional Banking National Accounts Local BDOs Limited Coverage National Specialty Coverage Note: BDO – Business Development Office

2023 BAAB Conference Presentation2023 BAAB Conference 13 Maximizing Customer Engagement Outcomes Focused on unlocking human channel deepening opportunities within key businesses Examples of substantial untapped revenue synergies inside everyday customer interactions • 3% of small business within Retail have a merchant relationship • 5% of small business within Retail have treasury management • 39% of small business within Retail have personal banking Retail Growing and Diversifying Fee Income Focused investments are driving strong fee income growth in key businesses Growing fee based Advisory Relationships & positive net AUM flows in volatile markets • Improved advisory penetration from 1.7% (2021) to 2.2% (3Q23) with upside opportunity versus industry benchmark of 3-5% • 8 consecutive quarters of positive net flows • Important category of future investment Wealth Sustained spend growth and deepening • Levering strength and scale of top tier debit franchise • Opportunity to expand treasury management penetration of 22% versus industry benchmark of 46% for small business (up to $20MM revenue) within Regional Banking Payments 3Q22 3Q23 Primary Bank Customers 3Q22 3Q23 Advisory Relationships 3Q22 3Q23 AUM 3Q22 3Q23 Treasury Management Fees 3Q22 3Q23 Card Spend Growing Primary Bank Customers 3-4% Note: Treasury Management Fees, gross excluding earnings credit rate

2023 BAAB Conference Presentation2023 BAAB Conference Key Messages Leading Consumer & Business Banking franchise with #1 rankings for service, trust, and digital 1 Driving enterprise success, providing deposits & funding, optimization of NIM & ROTCE, and fee income growth in Payments & Wealth 2 Leveraging regional structure to extend local advantage – activating full HBAN power to communities, powering household acquisition and deepening 3 Capitalizing on distinctive national businesses and compelling opportunities to drive organic growth 4 Supporting and extending differentiation through sustained investment in product innovation, digital leadership, and best in class service 5 14