EXHIBIT 99.1

Published on December 11, 2019

Goldman Sachs US Financial Services Conference December 11, 2019 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2019 Huntington Bancshares Incorporated.

Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect our future results. Additional factors that could cause results to differ materially from those described above can be found in our 2018 Annual Report on Form 10-K, as well as our subsequent Securities and Exchange Commission (“SEC”) filings, which are on file with the SEC and available in the “Investor Relations” section of our website, http://www.huntington.com, under the heading “Publications and Filings.” All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2019 Goldman Sachs US Financial Services Conference 2

Important Messages Building long-term shareholder value Consistent organic growth Maintain aggregate moderate-to-low risk appetite Minimize earnings volatility through the cycle Disciplined capital allocation Focus on top quartile financial performance relative to peers Strategic focus on Customer Experience and deepening relationships High level of colleague and shareholder alignment Board, management, and colleague ownership collectively represent Top 10 shareholder 2019 Goldman Sachs US Financial Services Conference 3

Purpose Drives Performance Huntington’s approach to shareholder value creation The best way to achieve our long-term financial goals and generate sustainable, through-the-cycle returns is to fulfill our purpose to make people’s lives better, help businesses thrive, and strengthen the communities we serve. Our success is deeply interconnected with the success of the people and communities we serve. 2019 Goldman Sachs US Financial Services Conference 4

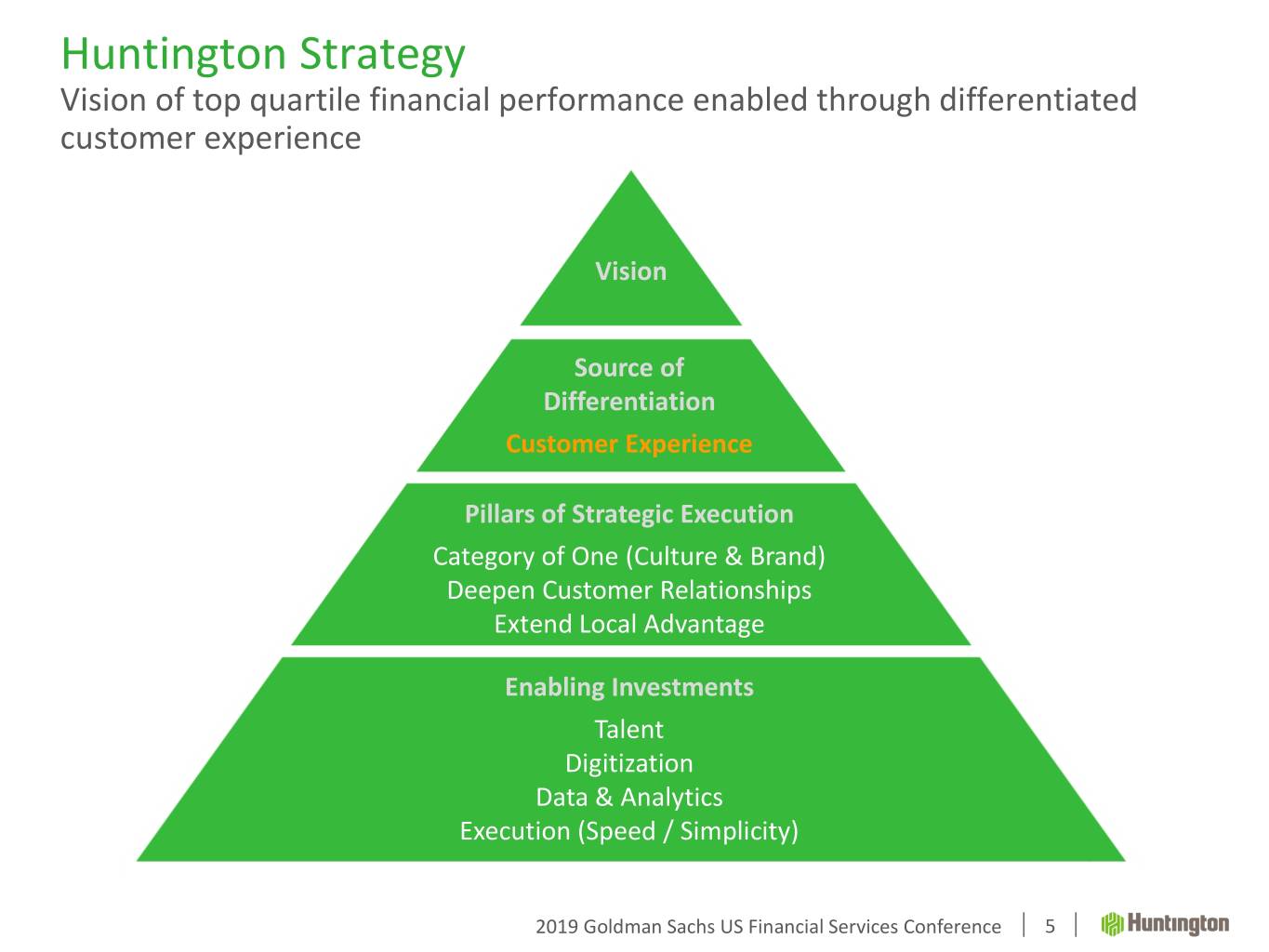

Huntington Strategy Vision of top quartile financial performance enabled through differentiated customer experience Vision Source of Differentiation Customer Experience Pillars of Strategic Execution Category of One (Culture & Brand) Deepen Customer Relationships Extend Local Advantage Enabling Investments Talent Digitization Data & Analytics Execution (Speed / Simplicity) 2019 Goldman Sachs US Financial Services Conference 5

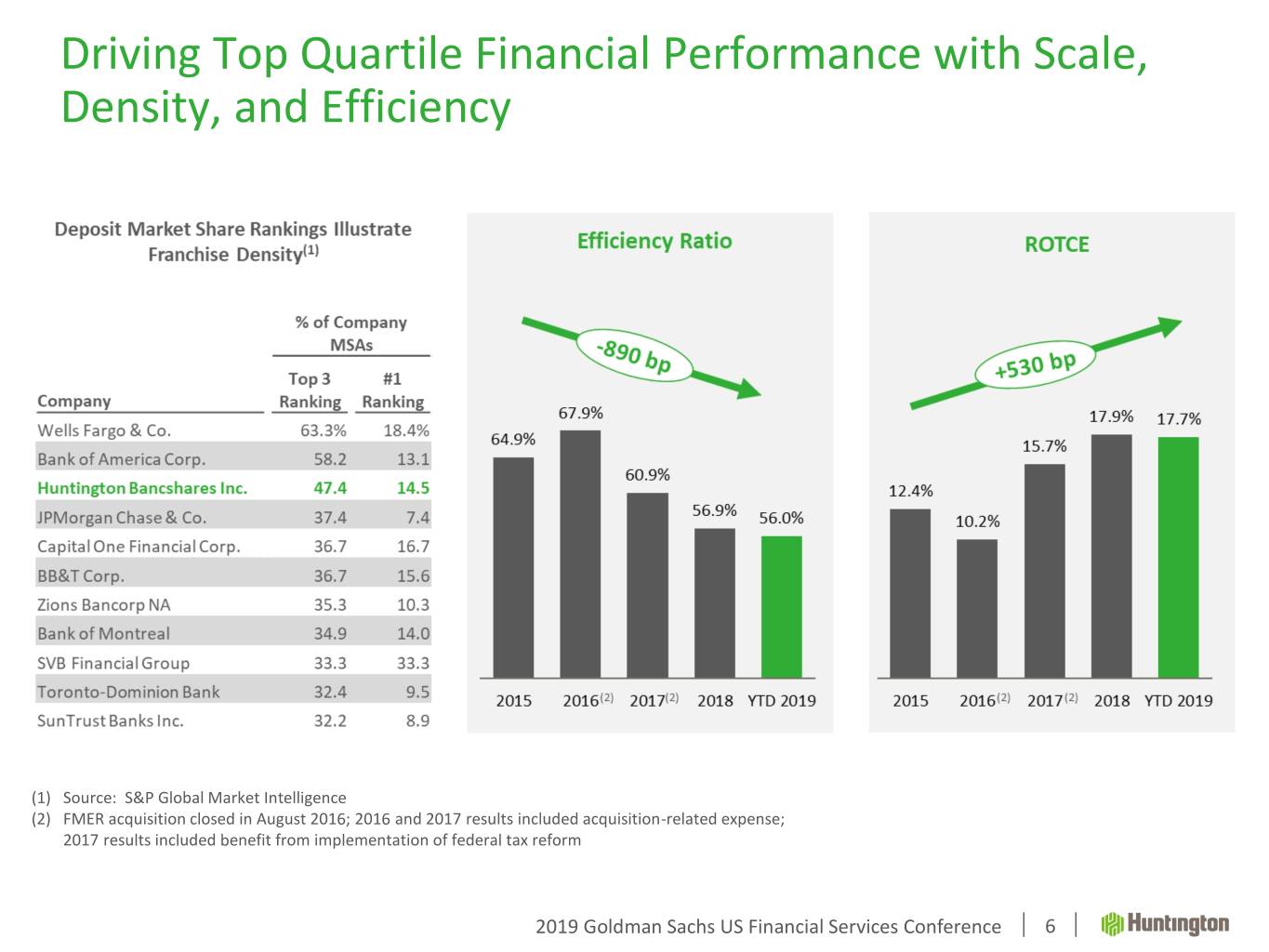

Driving Top Quartile Financial Performance with Scale, Density, and Efficiency (1) Source: S&P Global Market Intelligence (2) FMER acquisition closed in August 2016; 2016 and 2017 results included acquisition-related expense; 2017 results included benefit from implementation of federal tax reform 2019 Goldman Sachs US Financial Services Conference 6

Current Strategic Priorities Continuation of our strategic plan focused on delivering top tier performance and superior customer experience Drive organic revenue growth across all business segments Expand expertise-driven commercial and business lending Extend the reach of our corporate banking group both through geographic and vertical expansions Evolve customer segmentation and targeting to focus on differentiation in the consumer mass affluent market Deepen customer relationships utilizing our established OCR strategy across all businesses Manage expense growth to fund further investments Redeploy resources resulting from 4Q19 expense actions into continued strategic investments Continue to manage for positive operating leverage Advance digital and mobile technology strategy Utilize digital tools, customer insights, and modernized delivery model to drive further brand differentiation Leverage technology to enhance, simplify, drive consistency, and create efficiency across channels and segments to improve colleague and customer experience 2019 Goldman Sachs US Financial Services Conference 7

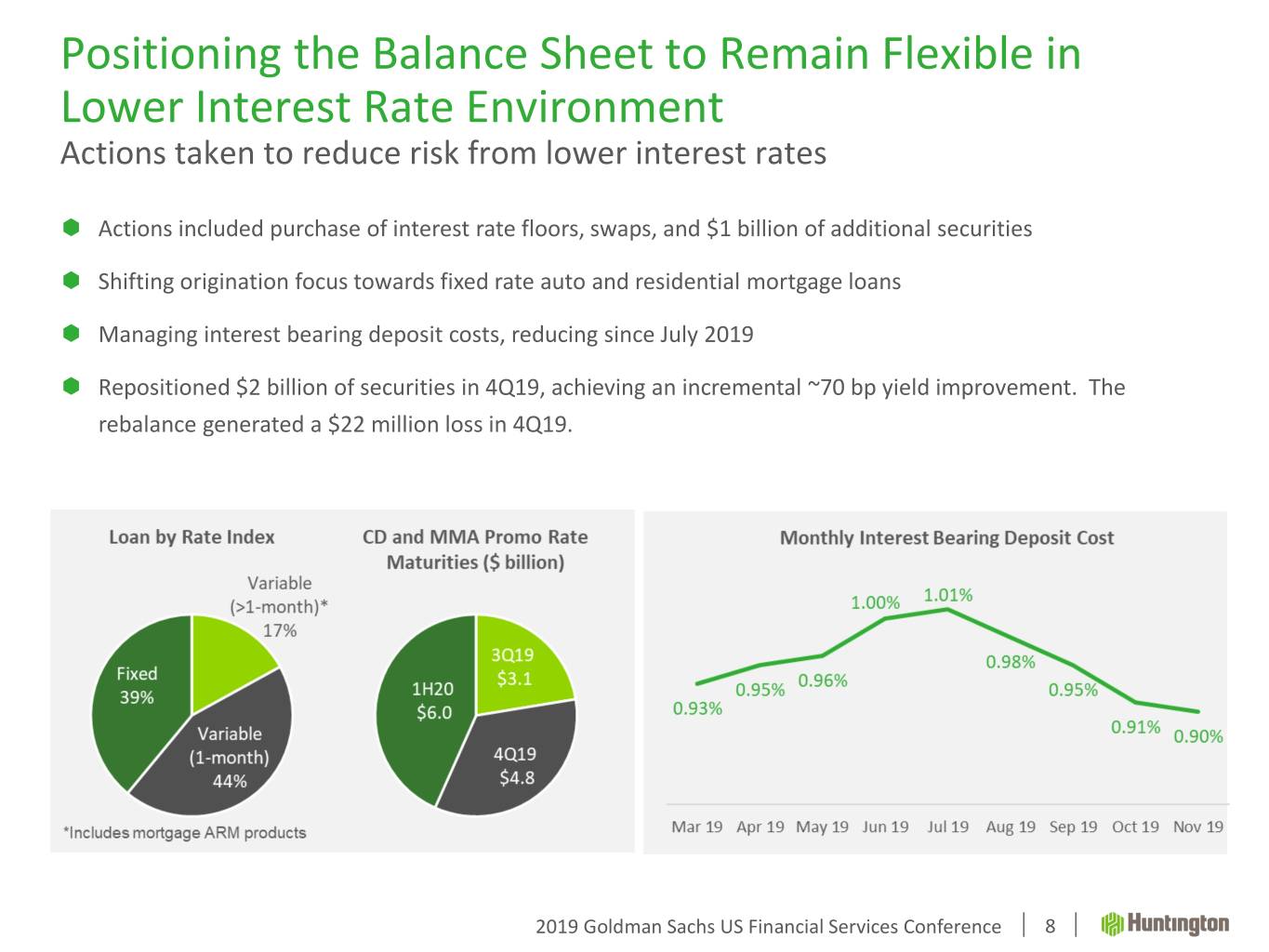

Positioning the Balance Sheet to Remain Flexible in Lower Interest Rate Environment Actions taken to reduce risk from lower interest rates Actions included purchase of interest rate floors, swaps, and $1 billion of additional securities Shifting origination focus towards fixed rate auto and residential mortgage loans Managing interest bearing deposit costs, reducing since July 2019 Repositioned $2 billion of securities in 4Q19, achieving an incremental ~70 bp yield improvement. The rebalance generated a $22 million loss in 4Q19. 2019 Goldman Sachs US Financial Services Conference 8

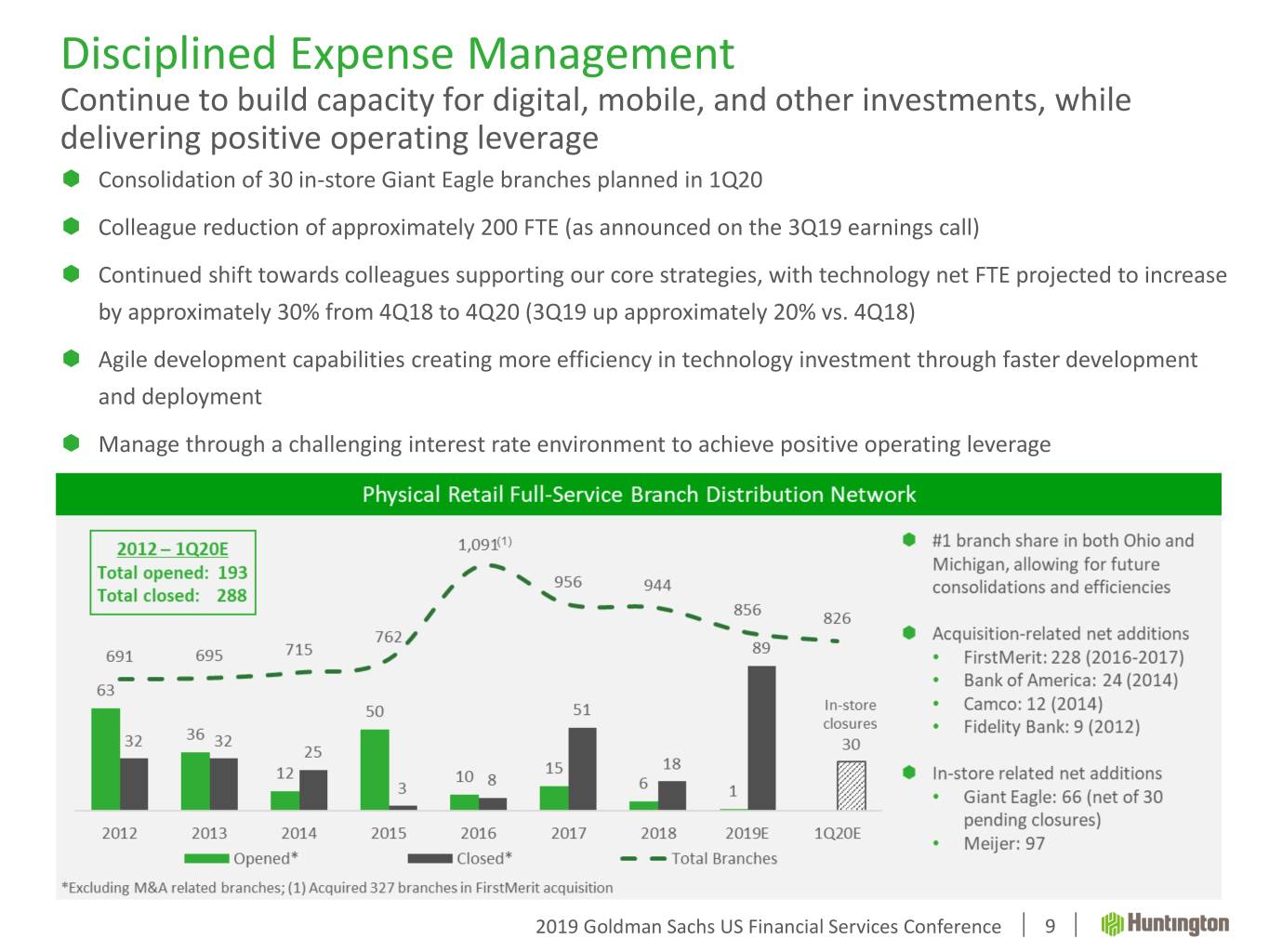

Disciplined Expense Management Continue to build capacity for digital, mobile, and other investments, while delivering positive operating leverage Consolidation of 30 in-store Giant Eagle branches planned in 1Q20 Colleague reduction of approximately 200 FTE (as announced on the 3Q19 earnings call) Continued shift towards colleagues supporting our core strategies, with technology net FTE projected to increase by approximately 30% from 4Q18 to 4Q20 (3Q19 up approximately 20% vs. 4Q18) Agile development capabilities creating more efficiency in technology investment through faster development and deployment Manage through a challenging interest rate environment to achieve positive operating leverage 2019 Goldman Sachs US Financial Services Conference 9

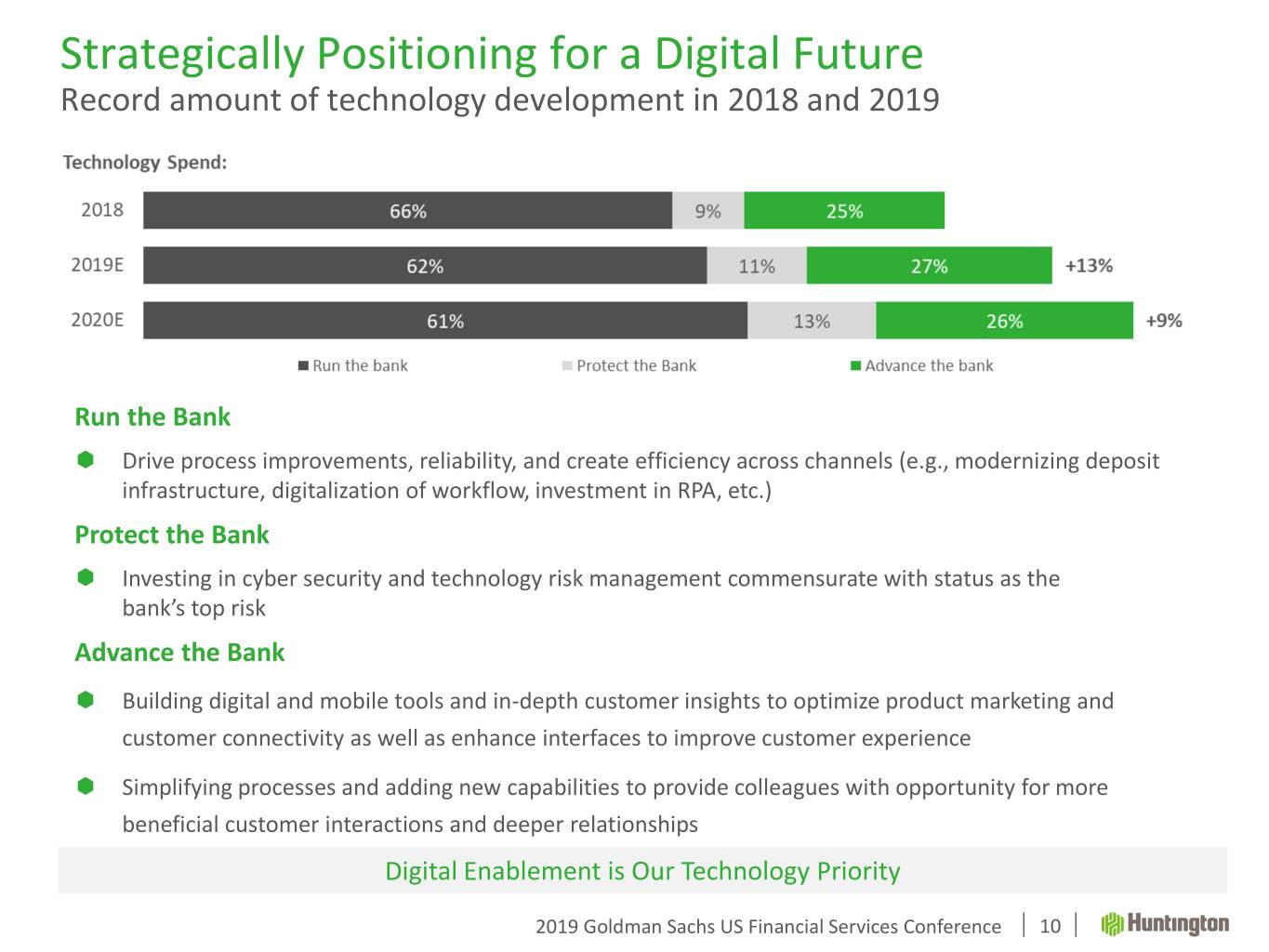

Strategically Positioning for a Digital Future Record amount of technology development in 2018 and 2019 Run the Bank Drive process improvements, reliability, and create efficiency across channels (e.g., modernizing deposit infrastructure, digitalization of workflow, investment in RPA, etc.) Protect the Bank Investing in cyber security and technology risk management commensurate with status as the bank’s top risk Advance the Bank Building digital and mobile tools and in-depth customer insights to optimize product marketing and customer connectivity as well as enhance interfaces to improve customer experience Simplifying processes and adding new capabilities to provide colleagues with opportunity for more beneficial customer interactions and deeper relationships Digital Enablement is Our Technology Priority 2019 Goldman Sachs US Financial Services Conference 10

Strategically Positioning For a Digital Future Continue tech enhancements driving modernized delivery model and recognition Improving and Simplifying Sales and Service Transforming Branch Efficiency Next Gen Acquisition ✓ Reduced time to open and Deepening We Listen to Customers & an account by 30% - 50% ✓ Data-driven targeted offers Colleagues. ✓ Paperless origination ✓ Improved, real-time sales leads ✓ Active migration of branch ✓ Digitally-enabled acquisition We Add Value to Our deposits to self service including mobile capabilities Customers. ✓ New ATM vendor and capabilities ✓ New sales process Customer Segmentation Robotic Processing / AI We Make Banking ✓ Personalized communication Chatbots Easier. ✓ Bundled products ✓ Full scale deployment in 1Q20 Mobile and Digital Initiatives to Enhance Customer Experience Highest in Customer Satisfaction with Online Banking and Mobile Banking Apps ✓ Introduced “the Hub” portal (digital and mobile tools, alerts, and insights) For J.D. Power 2019 award information, visit jdpower.com/awards ✓ Introduced digital card lock for credit and debit cards ✓ Partnered with third-party fintech on spend categorization ✓ Partnered with third-party firm on updated leads generation capability ✓ Launching AI on Huntington Heads Up (push notification service) ✓ Robotic Process Automation – Center of Excellence established across the bank 2019 Goldman Sachs US Financial Services Conference 11

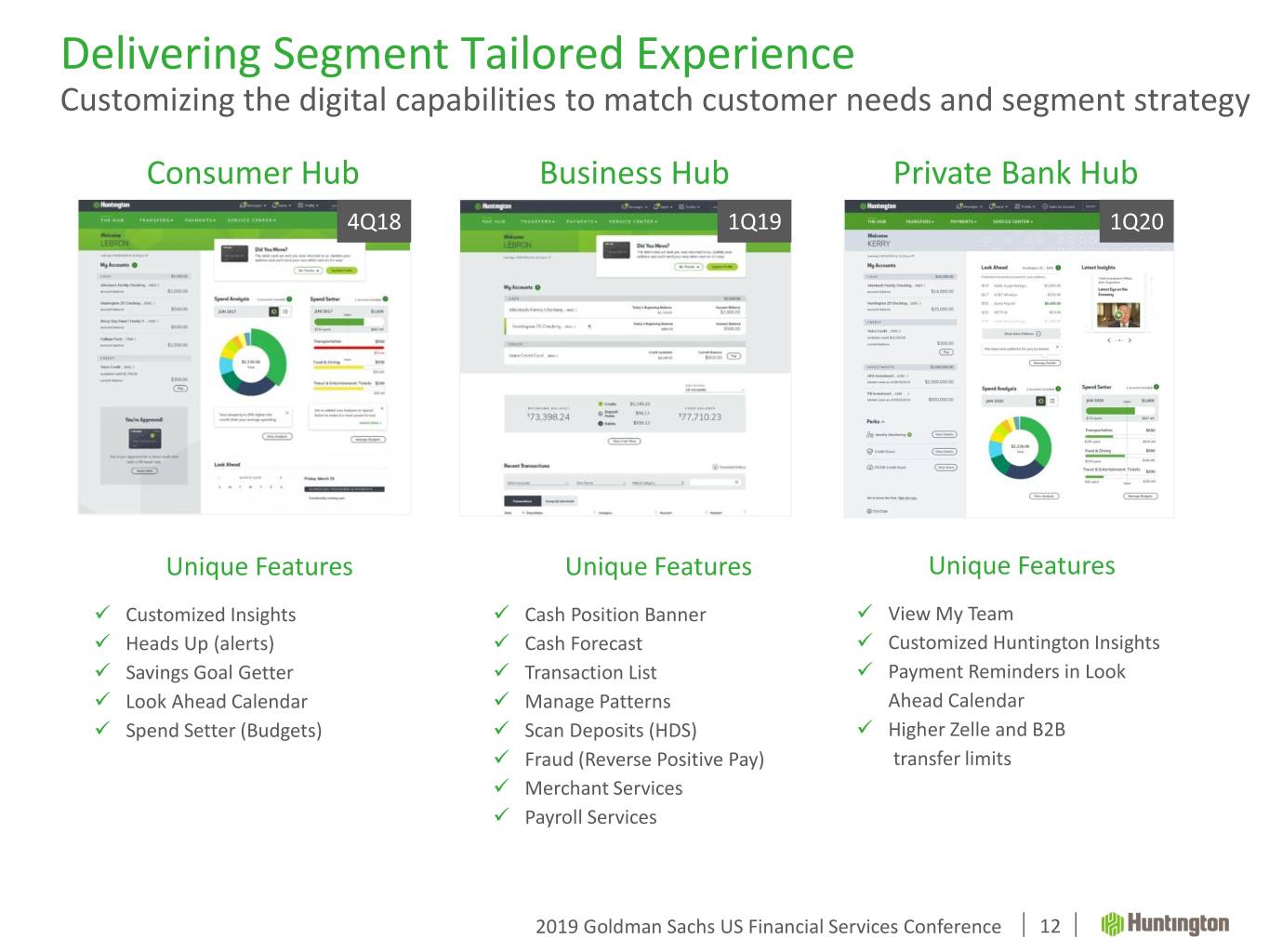

Delivering Segment Tailored Experience Customizing the digital capabilities to match customer needs and segment strategy Consumer Hub Business Hub Private Bank Hub 4Q18 1Q19 1Q20 Unique Features Unique Features Unique Features ✓ Customized Insights ✓ Cash Position Banner ✓ View My Team ✓ Heads Up (alerts) ✓ Cash Forecast ✓ Customized Huntington Insights ✓ Savings Goal Getter ✓ Transaction List ✓ Payment Reminders in Look ✓ Look Ahead Calendar ✓ Manage Patterns Ahead Calendar ✓ Spend Setter (Budgets) ✓ Scan Deposits (HDS) ✓ Higher Zelle and B2B ✓ Fraud (Reverse Positive Pay) transfer limits ✓ Merchant Services ✓ Payroll Services 2019 Goldman Sachs US Financial Services Conference 12

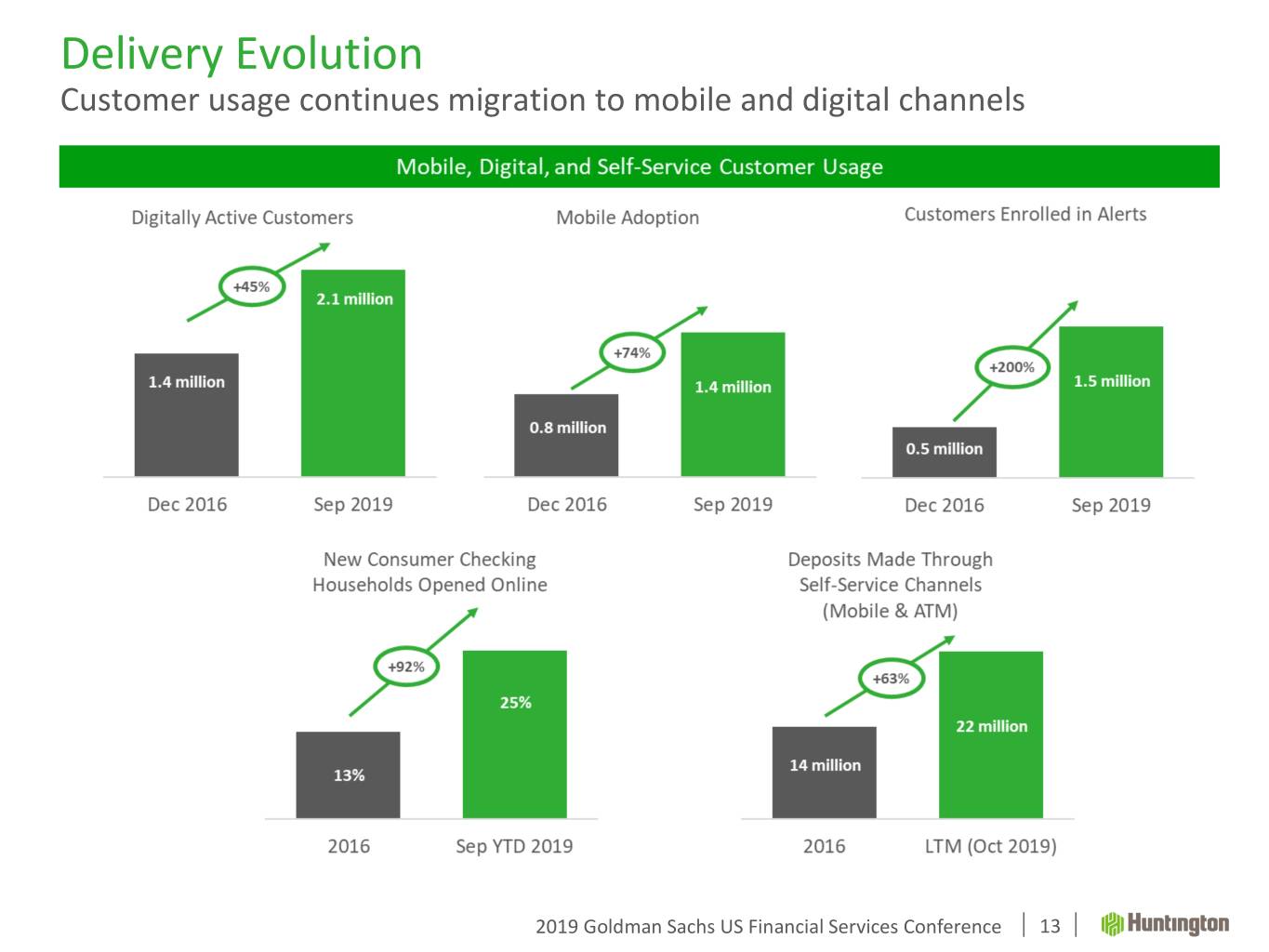

Delivery Evolution Customer usage continues migration to mobile and digital channels 2019 Goldman Sachs US Financial Services Conference 13

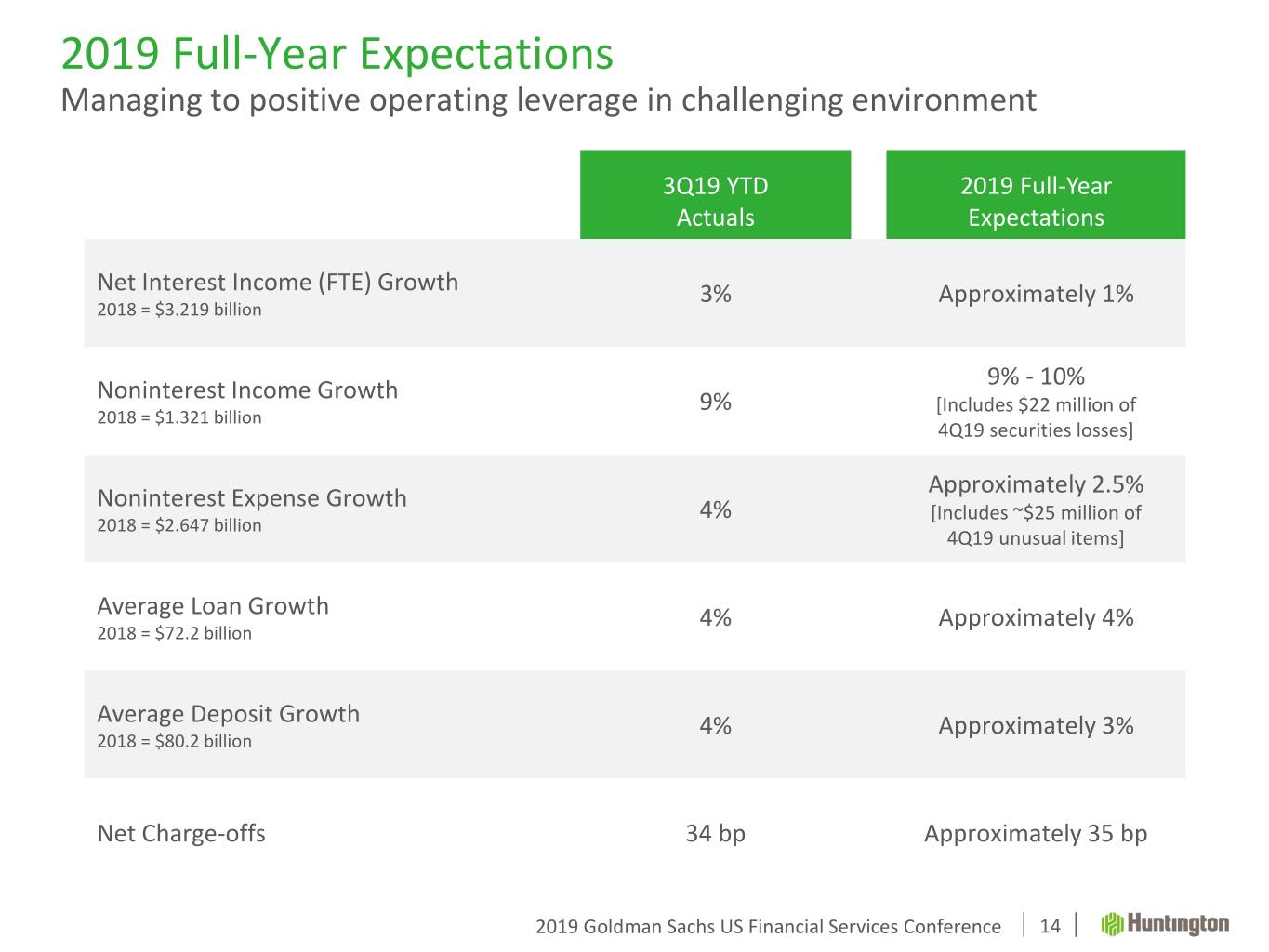

2019 Full-Year Expectations Managing to positive operating leverage in challenging environment 3Q19 YTD 2019 Full-Year Actuals Expectations Net Interest Income (FTE) Growth 3% Approximately 1% 2018 = $3.219 billion 9% - 10% Noninterest Income Growth 9% [Includes $22 million of 2018 = $1.321 billion 4Q19 securities losses] Approximately 2.5% Noninterest Expense Growth 4% [Includes ~$25 million of 2018 = $2.647 billion 4Q19 unusual items] Average Loan Growth 4% Approximately 4% 2018 = $72.2 billion Average Deposit Growth 4% Approximately 3% 2018 = $80.2 billion Net Charge-offs 34 bp Approximately 35 bp 2019 Goldman Sachs US Financial Services Conference 14

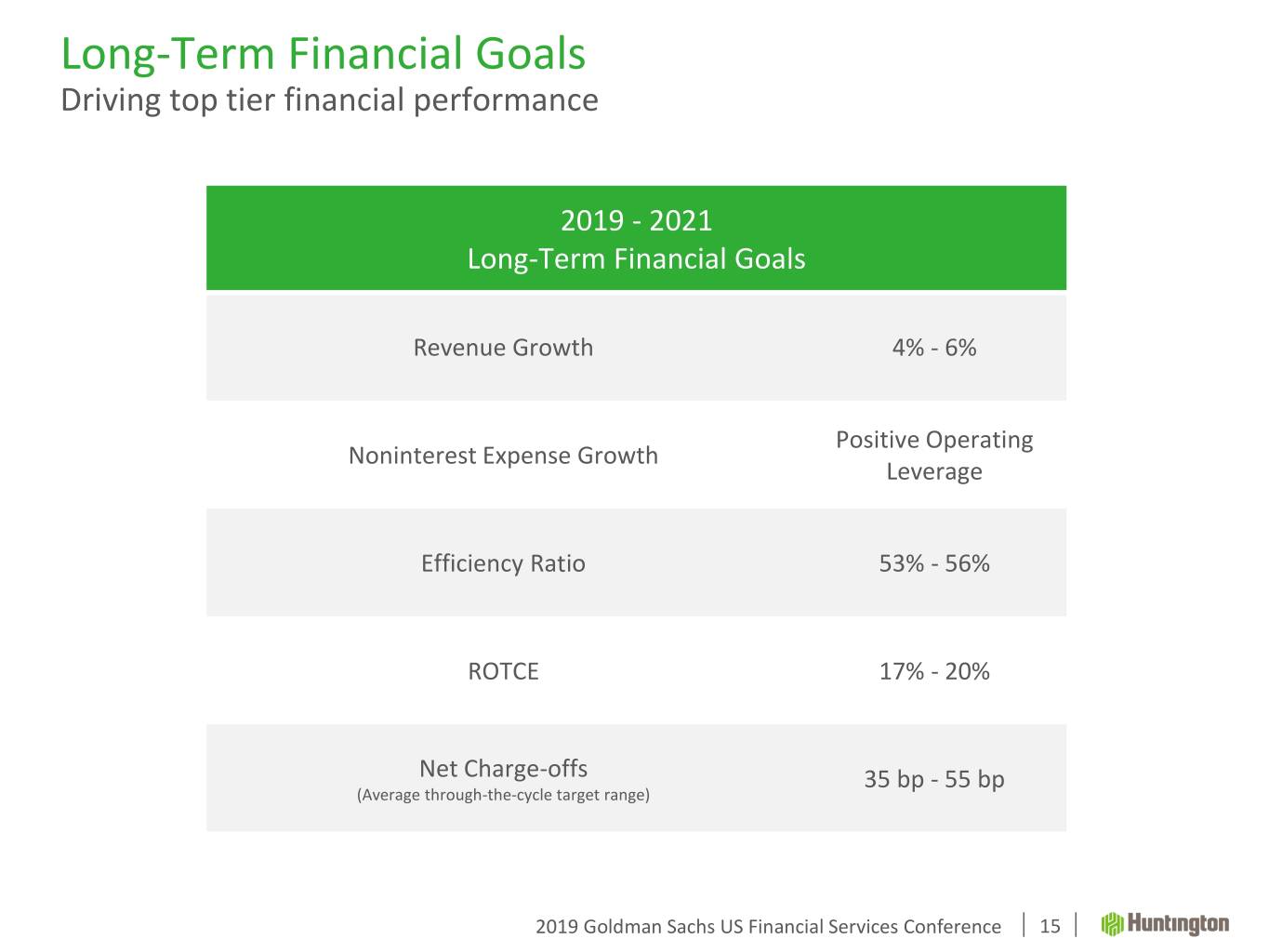

Long-Term Financial Goals Driving top tier financial performance 2019 - 2021 Long-Term Financial Goals Revenue Growth 4% - 6% Positive Operating Noninterest Expense Growth Leverage Efficiency Ratio 53% - 56% ROTCE 17% - 20% Net Charge-offs 35 bp - 55 bp (Average through-the-cycle target range) 2019 Goldman Sachs US Financial Services Conference 15

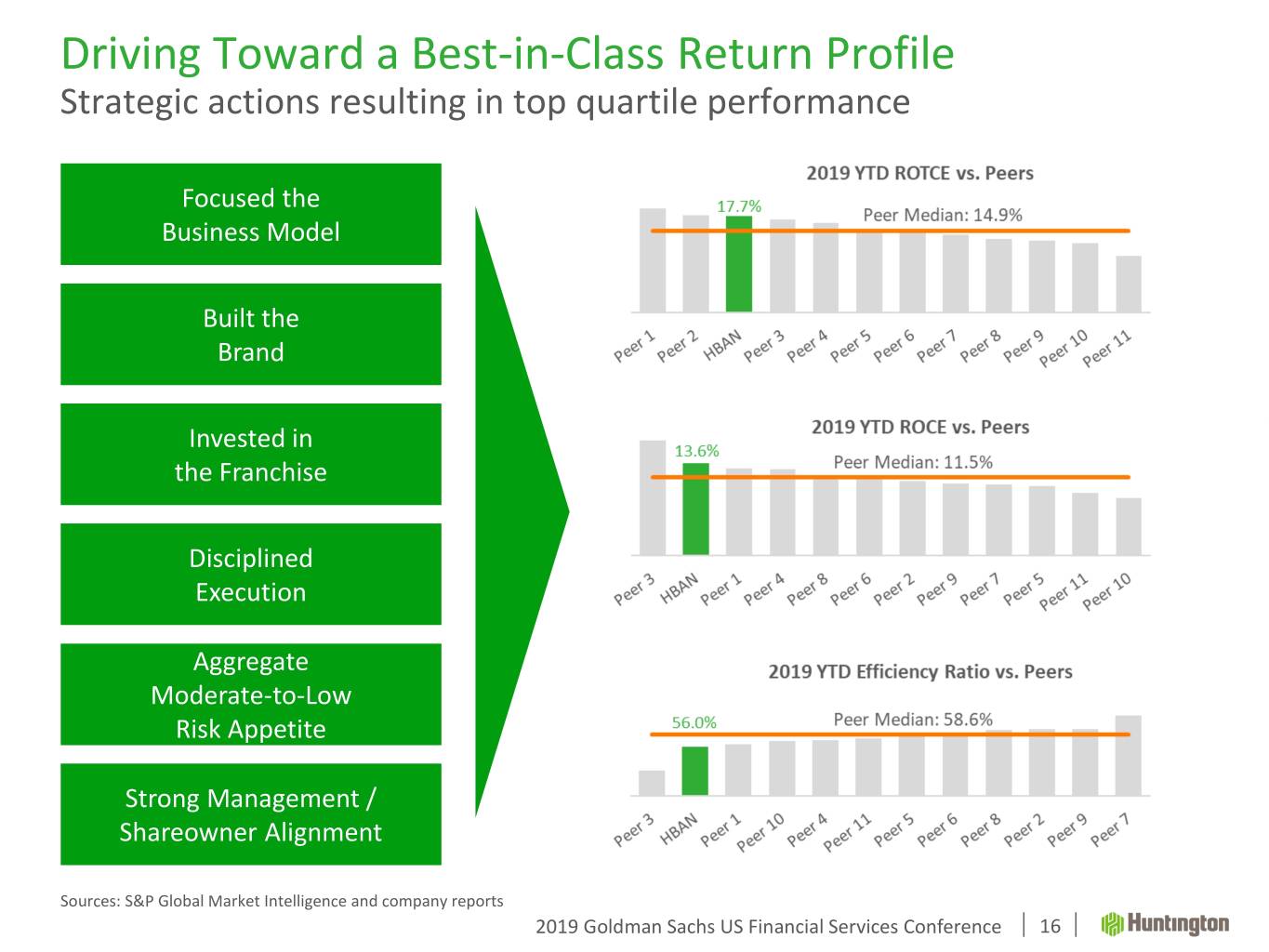

Driving Toward a Best-in-Class Return Profile Strategic actions resulting in top quartile performance Focused the Business Model Built the Brand Invested in the Franchise Disciplined Execution Aggregate Moderate-to-Low Risk Appetite Strong Management / Shareowner Alignment Sources: S&P Global Market Intelligence and company reports 2019 Goldman Sachs US Financial Services Conference 16

Important Messages Building long-term shareholder value Consistent organic growth Maintain aggregate moderate-to-low risk appetite Minimize earnings volatility through the cycle Disciplined capital allocation Focus on top quartile financial performance relative to peers Strategic focus on Customer Experience and deepening relationships High level of colleague and shareholder alignment Board, management, and colleague ownership collectively represent Top 10 shareholder 2019 Goldman Sachs US Financial Services Conference 17

Appendix

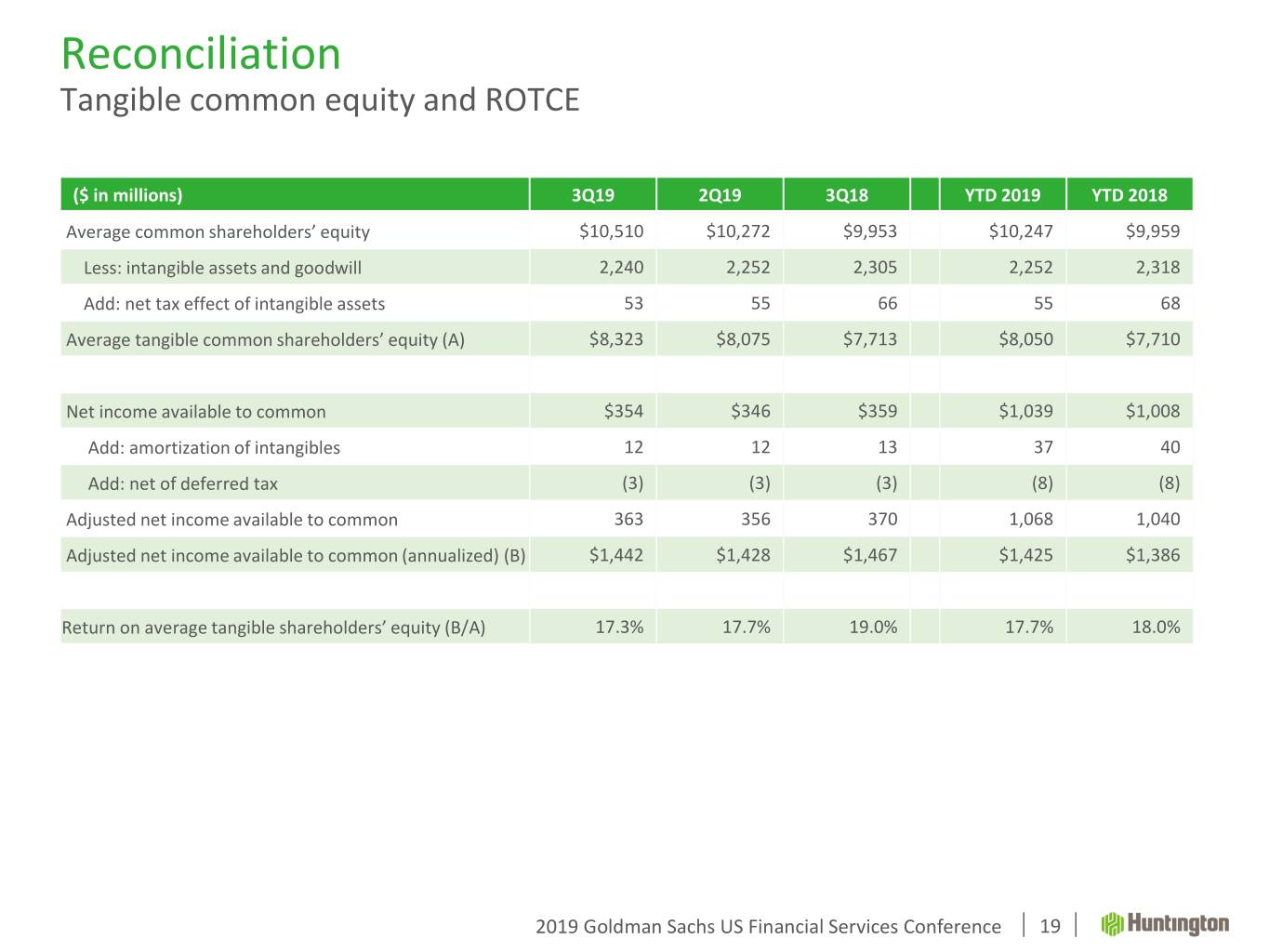

Reconciliation Tangible common equity and ROTCE ($ in millions) 3Q19 2Q19 3Q18 YTD 2019 YTD 2018 Average common shareholders’ equity $10,510 $10,272 $9,953 $10,247 $9,959 Less: intangible assets and goodwill 2,240 2,252 2,305 2,252 2,318 Add: net tax effect of intangible assets 53 55 66 55 68 Average tangible common shareholders’ equity (A) $8,323 $8,075 $7,713 $8,050 $7,710 Net income available to common $354 $346 $359 $1,039 $1,008 Add: amortization of intangibles 12 12 13 37 40 Add: net of deferred tax (3) (3) (3) (8) (8) Adjusted net income available to common 363 356 370 1,068 1,040 Adjusted net income available to common (annualized) (B) $1,442 $1,428 $1,467 $1,425 $1,386 Return on average tangible shareholders’ equity (B/A) 17.3% 17.7% 19.0% 17.7% 18.0% 2019 Goldman Sachs US Financial Services Conference 19

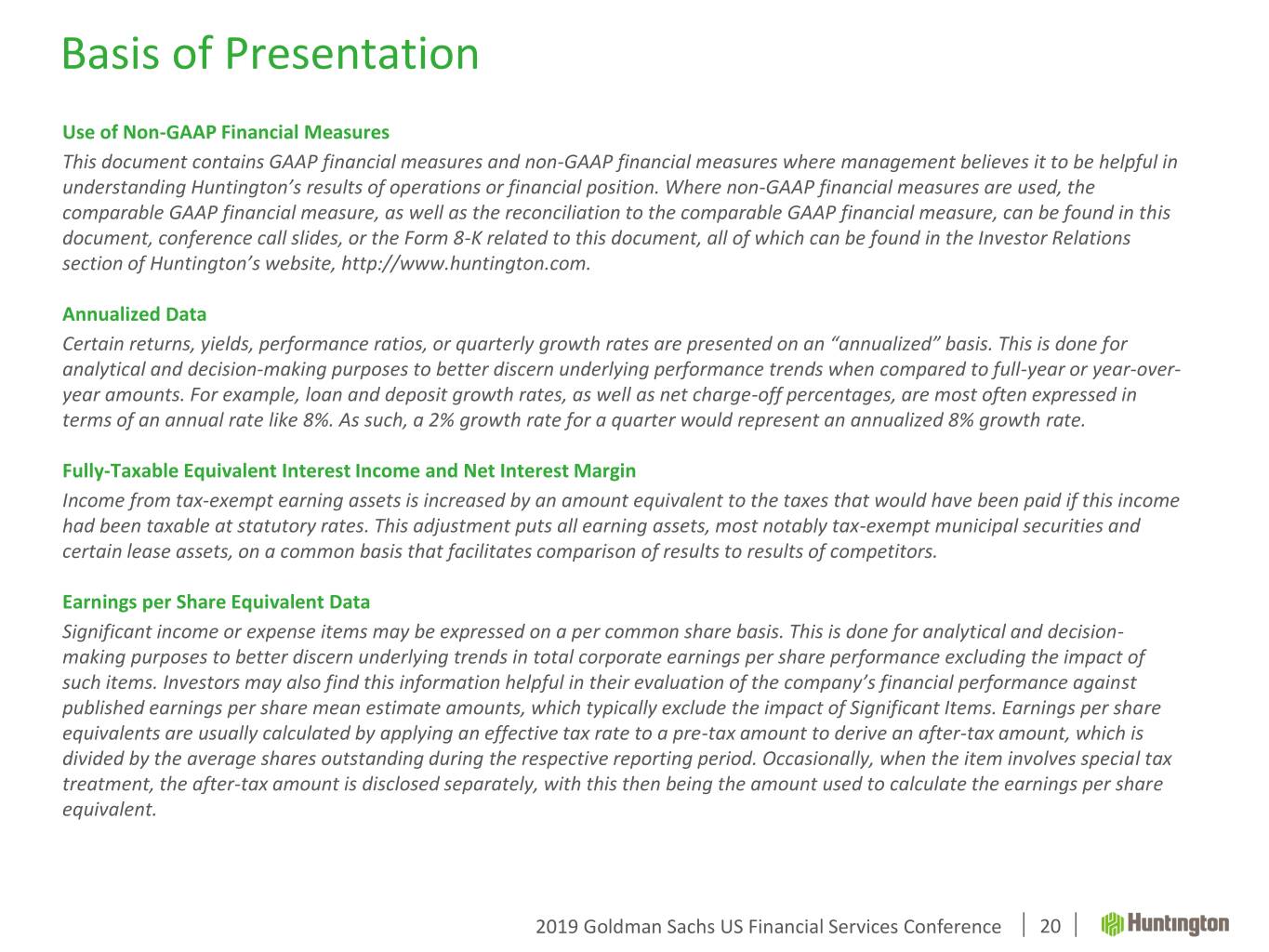

Do we consolidate Basis of Presentation this and next slide? Use of Non-GAAP Financial Measures This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Huntington’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this document, conference call slides, or the Form 8-K related to this document, all of which can be found in the Investor Relations section of Huntington’s website, http://www.huntington.com. Annualized Data Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over- year amounts. For example, loan and deposit growth rates, as well as net charge-off percentages, are most often expressed in terms of an annual rate like 8%. As such, a 2% growth rate for a quarter would represent an annualized 8% growth rate. Fully-Taxable Equivalent Interest Income and Net Interest Margin Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at statutory rates. This adjustment puts all earning assets, most notably tax-exempt municipal securities and certain lease assets, on a common basis that facilitates comparison of results to results of competitors. Earnings per Share Equivalent Data Significant income or expense items may be expressed on a per common share basis. This is done for analytical and decision- making purposes to better discern underlying trends in total corporate earnings per share performance excluding the impact of such items. Investors may also find this information helpful in their evaluation of the company’s financial performance against published earnings per share mean estimate amounts, which typically exclude the impact of Significant Items. Earnings per share equivalents are usually calculated by applying an effective tax rate to a pre-tax amount to derive an after-tax amount, which is divided by the average shares outstanding during the respective reporting period. Occasionally, when the item involves special tax treatment, the after-tax amount is disclosed separately, with this then being the amount used to calculate the earnings per share equivalent. 2019 Goldman Sachs US Financial Services Conference 20

Basis of Presentation Rounding Please note that columns of data in this document may not add due to rounding. Significant Items From time to time, revenue, expenses, or taxes are impacted by items judged by management to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that their outsized impact is believed by management at that time to be infrequent or short term in nature. We refer to such items as “Significant Items”. Most often, these Significant Items result from factors originating outside the company – e.g., regulatory actions/assessments, windfall gains, changes in accounting principles, one-time tax assessments/refunds, and litigation actions. In other cases they may result from management decisions associated with significant corporate actions out of the ordinary course of business – e.g., merger/restructuring charges, recapitalization actions, and goodwill impairment. Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in market and economic environment conditions, as a general rule volatility alone does not define a Significant Item. For example, changes in the provision for credit losses, gains/losses from investment activities, and asset valuation write-downs reflect ordinary banking activities and are, therefore, typically excluded from consideration as a Significant Item. Management believes the disclosure of “Significant Items”, when appropriate, aids analysts/investors in better understanding corporate performance and trends so that they can ascertain which of such items, if any, they may wish to include/exclude from their analysis of the company’s performance - i.e., within the context of determining how that performance differed from their expectations, as well as how, if at all, to adjust their estimates of future performance accordingly. To this end, Management has adopted a practice of listing “Significant Items” in its external disclosure documents (e.g., earnings press releases, quarterly performance discussions, investor presentations, Forms 10-Q and 10-K). “Significant Items” for any particular period are not intended to be a complete list of items that may materially impact current or future period performance. A number of items could materially impact these periods, including those which may be described from time to time in Huntington’s filings with the Securities and Exchange Commission. 2019 Goldman Sachs US Financial Services Conference 21

Mark A. Muth Director of Investor Relations Office: 614.480.4720 E-mail: mark.muth@huntington.com Brian M. Vereb Asst. Dir. of Investor Relations Office: 614.480.5098 E-mail: brian.m.vereb@huntington.com For additional information, please visit: http://www.huntington.com The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2019 Huntington Bancshares Incorporated. (Nasdaq: HBAN)