EXHIBIT 99.1

Published on December 5, 2017

Huntington Bancshares Incorporated

Goldman Sachs 2017 US

Financial Services Conference

December 6, 2017

Welcome

©2017 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Exhibit 99.1

Disclaimer

2

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals,

projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements

that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements.

Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar

expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking

statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause

actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political,

or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board;

volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and

services; success, impact, and timing of our business strategies, including market acceptance of any new products or services

implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews,

reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and

the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the

anticipated benefits of the merger with FirstMerit Corporation are not realized completely or when expected, including as a result of the

impact of, or problems arising from, the strength of the economy and competitive factors in the areas where we do business; and other

factors that may affect our future results. Additional factors that could cause results to differ materially from those described above can be

found in our Annual Report on Form 10-K for the year ended December 31, 2016, and Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2017, June 30, 2017, and September 30, 2017, which are on file with the Securities and Exchange Commission (the

“SEC”) and available in the “Investor Relations” section of our website, http://www.huntington.com, under the heading “Publications and

Filings” and in other documents we file with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not

assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-

looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such

statements.

Huntington’s Strategy

Delivering on our Commitments: FirstMerit Acquisition

Expectations: 4Q17 and 2018

Important Messages

Discussion Topics

3

Huntington’s Strategy

4

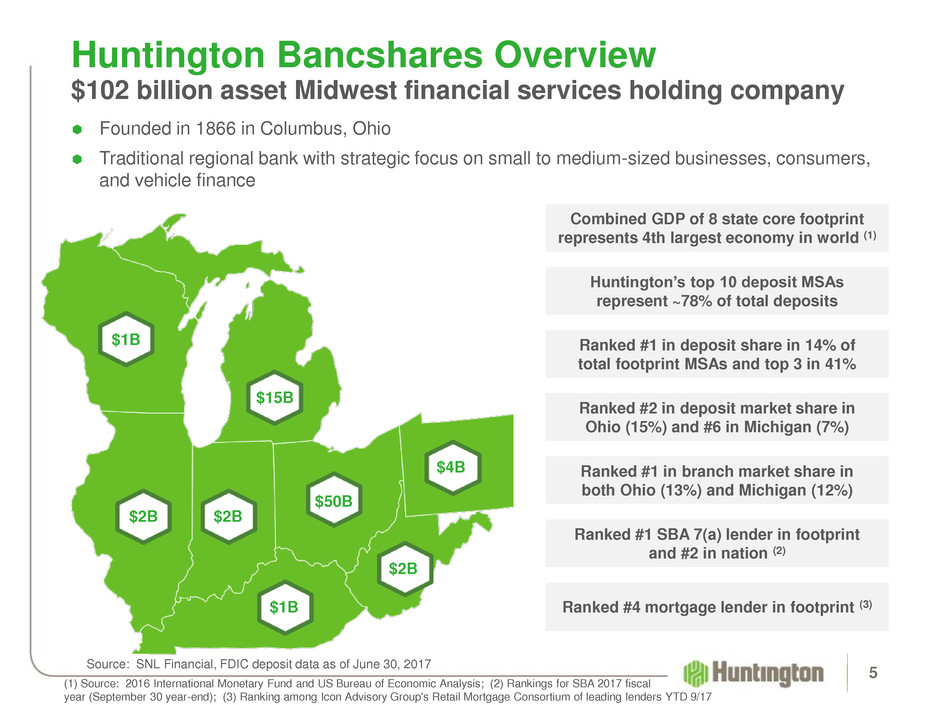

Ranked #2 in deposit market share in

Ohio (15%) and #6 in Michigan (7%)

Founded in 1866 in Columbus, Ohio

Traditional regional bank with strategic focus on small to medium-sized businesses, consumers,

and vehicle finance

Huntington Bancshares Overview

$102 billion asset Midwest financial services holding company

Huntington’s top 10 deposit MSAs

represent ~78% of total deposits

Combined GDP of 8 state core footprint

represents 4th largest economy in world (1)

Ranked #1 in deposit share in 14% of

total footprint MSAs and top 3 in 41%

Ranked #1 in branch market share in

both Ohio (13%) and Michigan (12%)

Ranked #1 SBA 7(a) lender in footprint

and #2 in nation (2)

5

Ranked #4 mortgage lender in footprint (3)

$15B

$1B

$2B $2B

$50B

$4B

$2B

$1B

Source: SNL Financial, FDIC deposit data as of June 30, 2017

(1) Source: 2016 International Monetary Fund and US Bureau of Economic Analysis; (2) Rankings for SBA 2017 fiscal

year (September 30 year-end); (3) Ranking among Icon Advisory Group's Retail Mortgage Consortium of leading lenders YTD 9/17

Small and

Medium

Businesses

Consumer

Vehicle

Finance

6

Well-Defined Strategy Builds Upon Our

Sustainable, Competitive Advantages

Delivering consistent, through-the-cycle shareowner returns

Drive continued growth in market share

and share of wallet through execution of

Optimal Customer Relationship strategy

Deliver exceptional customer experiences

via our customer-focused culture,

Welcome brand, and promise to “Do the

Right Thing”

Maintain our aggregate moderate-to-low

risk appetite through disciplined risk

management and strong corporate

governance

Core Areas of Strategic Focus:

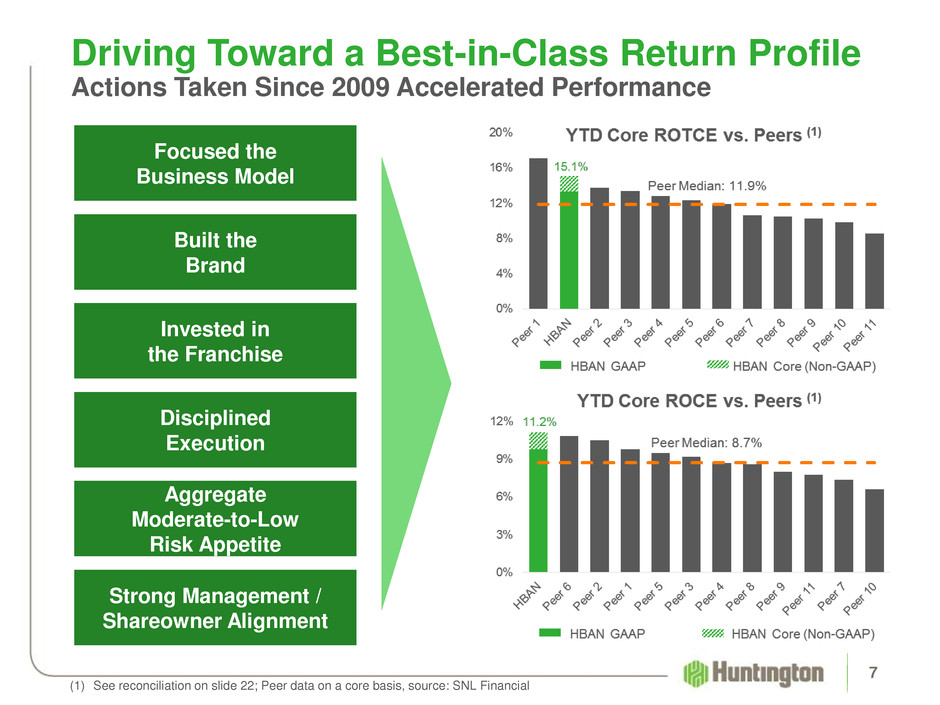

Driving Toward a Best-in-Class Return Profile

Actions Taken Since 2009 Accelerated Performance

7

Focused the

Business Model

Aggregate

Moderate-to-Low

Risk Appetite

Invested in

the Franchise

(1) See reconciliation on slide 22; Peer data on a core basis, source: SNL Financial

Built the

Brand

Disciplined

Execution

Strong Management /

Shareowner Alignment

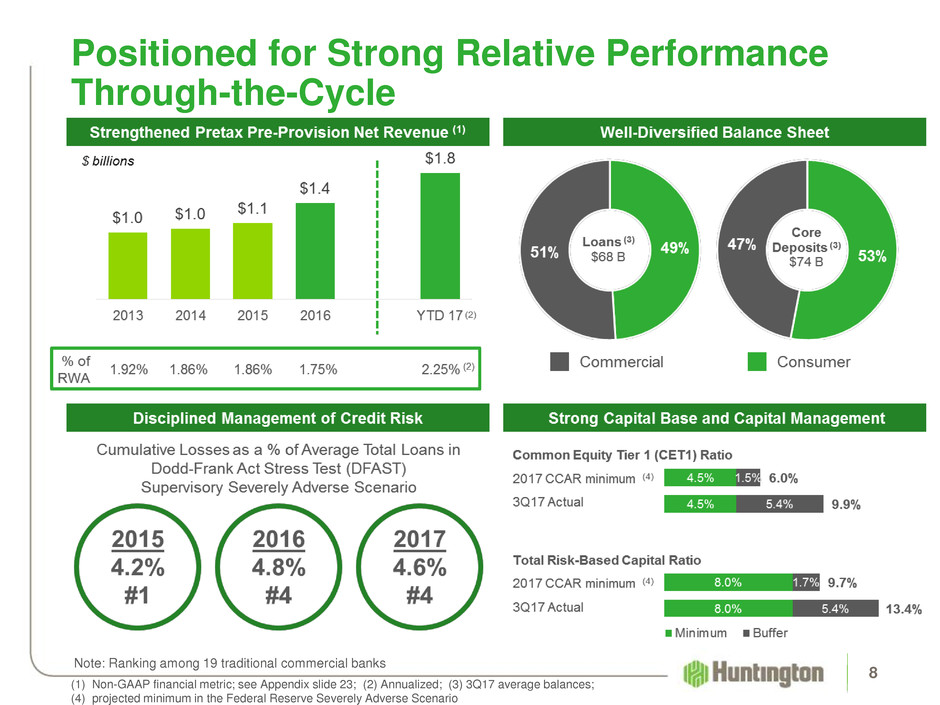

Positioned for Strong Relative Performance

Through-the-Cycle

8

(1) Non-GAAP financial metric; see Appendix slide 23; (2) Annualized; (3) 3Q17 average balances;

(4) projected minimum in the Federal Reserve Severely Adverse Scenario

Note: Ranking among 19 traditional commercial banks

Delivering on our

Commitments:

FirstMerit Acquisition

9

High Confidence in FirstMerit Deal Economics

On pace to meet or exceed originally announced cost savings and

revenue enhancements

10

$255+ MM

Cost Savings

✔ Implementation of all cost

savings complete

✔ Eliminated 42% of legacy

FirstMerit expense base

✔ Fully converted all operating

systems to Huntington systems

✔ Consolidated 24 operations

centers and corporate offices

✔ Consolidated 101 branches in

1Q17; 38 additional full-service

branches and 7 drive-through

only locations were

consolidated in 3Q17

$100+ MM

Revenue Synergies

✔ Introducing full Huntington

product suite to FirstMerit

customer base through Optimal

Customer Relationships (OCR)

✔ Expanded SBA expertise to

Chicago / WI

✔ Expanded RV / Marine lending

to 17 new states

✔ Expanded Home Lending

business to Chicago / WI

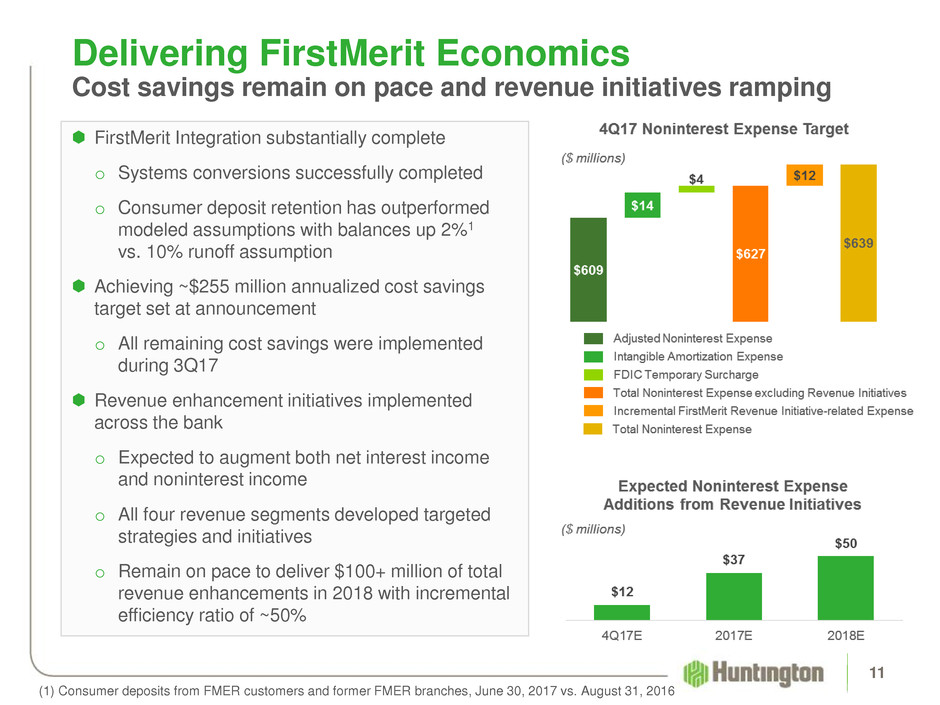

Delivering FirstMerit Economics

Cost savings remain on pace and revenue initiatives ramping

11

FirstMerit Integration substantially complete

o Systems conversions successfully completed

o Consumer deposit retention has outperformed

modeled assumptions with balances up 2%1

vs. 10% runoff assumption

Achieving ~$255 million annualized cost savings

target set at announcement

o All remaining cost savings were implemented

during 3Q17

Revenue enhancement initiatives implemented

across the bank

o Expected to augment both net interest income

and noninterest income

o All four revenue segments developed targeted

strategies and initiatives

o Remain on pace to deliver $100+ million of total

revenue enhancements in 2018 with incremental

efficiency ratio of ~50%

(1) Consumer deposits from FMER customers and former FMER branches, June 30, 2017 vs. August 31, 2016

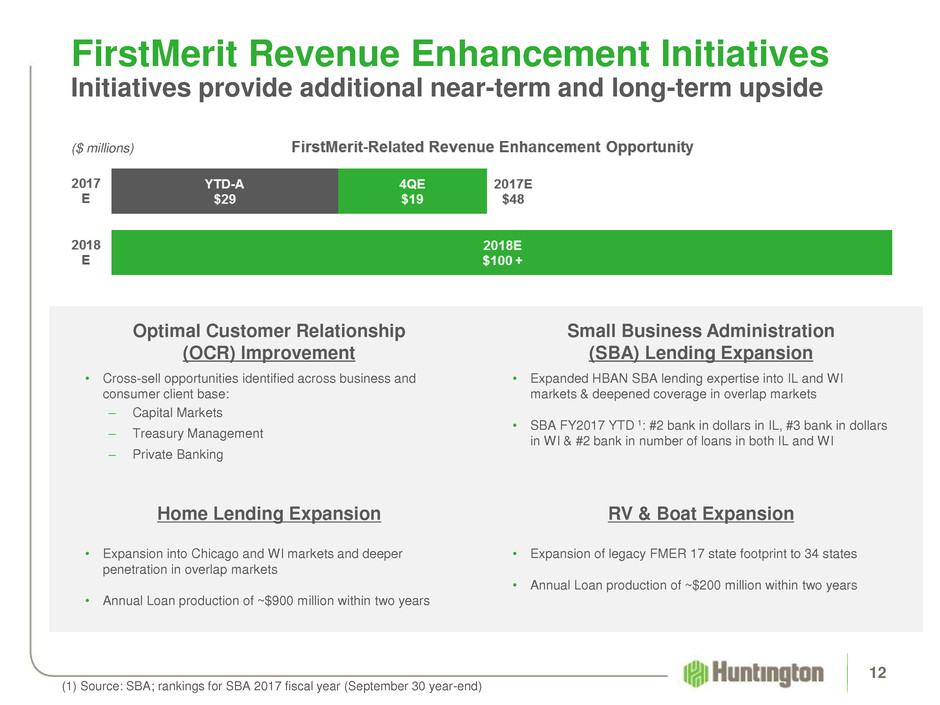

FirstMerit Revenue Enhancement Initiatives

Initiatives provide additional near-term and long-term upside

12

Home Lending Expansion

Small Business Administration

(SBA) Lending Expansion

RV & Boat Expansion

Optimal Customer Relationship

(OCR) Improvement

(1) Source: SBA; rankings for SBA 2017 fiscal year (September 30 year-end)

($ millions)

• Expanded HBAN SBA lending expertise into IL and WI

markets & deepened coverage in overlap markets

• SBA FY2017 YTD 1: #2 bank in dollars in IL, #3 bank in dollars

in WI & #2 bank in number of loans in both IL and WI

• Expansion of legacy FMER 17 state footprint to 34 states

• Annual Loan production of ~$200 million within two years

• Expansion into Chicago and WI markets and deeper

penetration in overlap markets

• Annual Loan production of ~$900 million within two years

• Cross-sell opportunities identified across business and

consumer client base:

– Capital Markets

– Treasury Management

– Private Banking

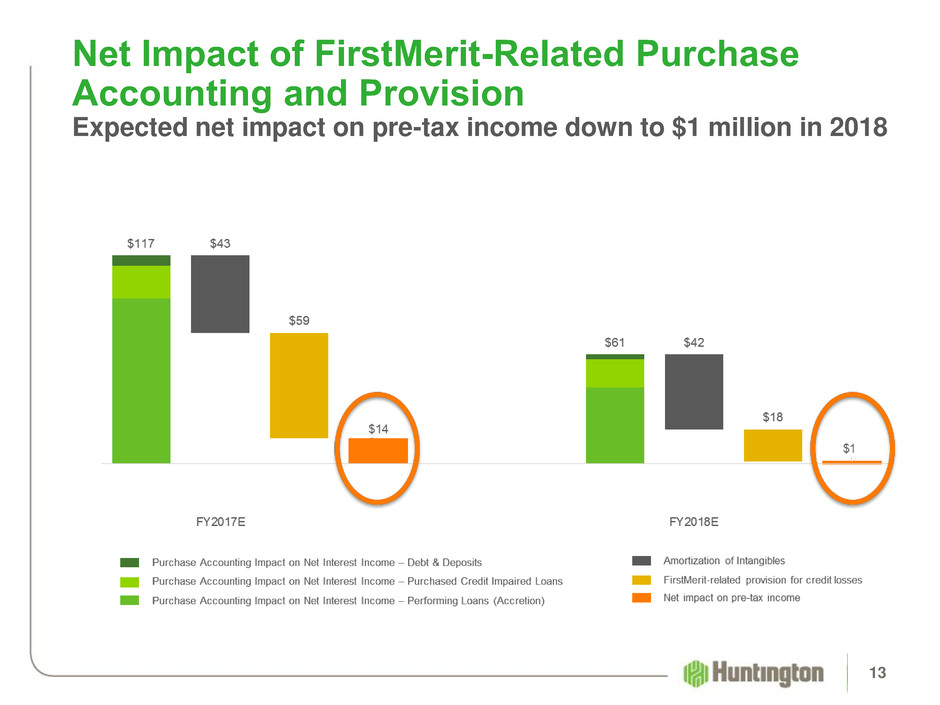

13

Net Impact of FirstMerit-Related Purchase

Accounting and Provision

Expected net impact on pre-tax income down to $1 million in 2018

Expectations:

4Q17 and 2018

14

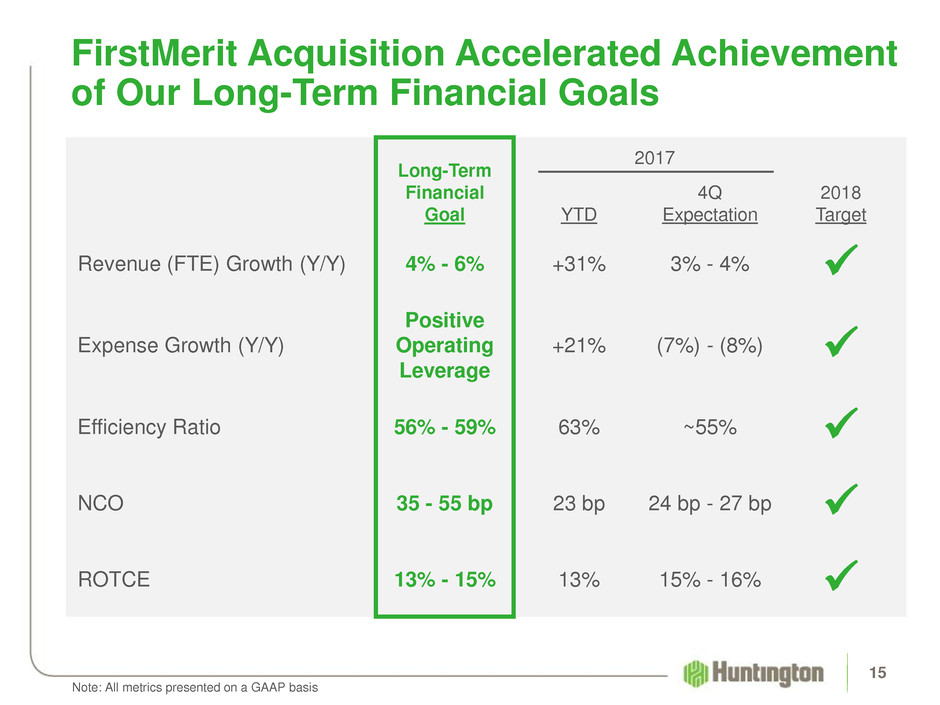

FirstMerit Acquisition Accelerated Achievement

of Our Long-Term Financial Goals

15

Long-Term

Financial

Goal YTD

4Q

Expectation

2018

Target

Revenue (FTE) Growth (Y/Y) 4% - 6% +31% 3% - 4%

Expense Growth (Y/Y)

Positive

Operating

Leverage

+21% (7%) - (8%)

Efficiency Ratio 56% - 59% 63% ~55%

NCO 35 - 55 bp 23 bp 24 bp - 27 bp

ROTCE 13% - 15% 13% 15% - 16%

Note: All metrics presented on a GAAP basis

2017

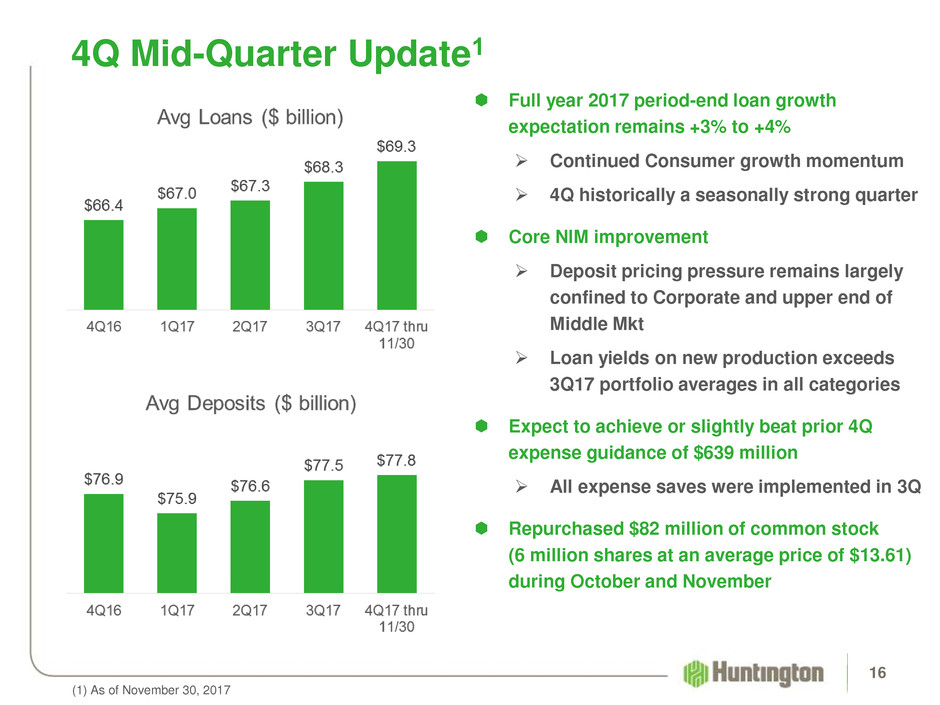

4Q Mid-Quarter Update1

16

Full year 2017 period-end loan growth

expectation remains +3% to +4%

Continued Consumer growth momentum

4Q historically a seasonally strong quarter

Core NIM improvement

Deposit pricing pressure remains largely

confined to Corporate and upper end of

Middle Mkt

Loan yields on new production exceeds

3Q17 portfolio averages in all categories

Expect to achieve or slightly beat prior 4Q

expense guidance of $639 million

All expense saves were implemented in 3Q

Repurchased $82 million of common stock

(6 million shares at an average price of $13.61)

during October and November

(1) As of November 30, 2017

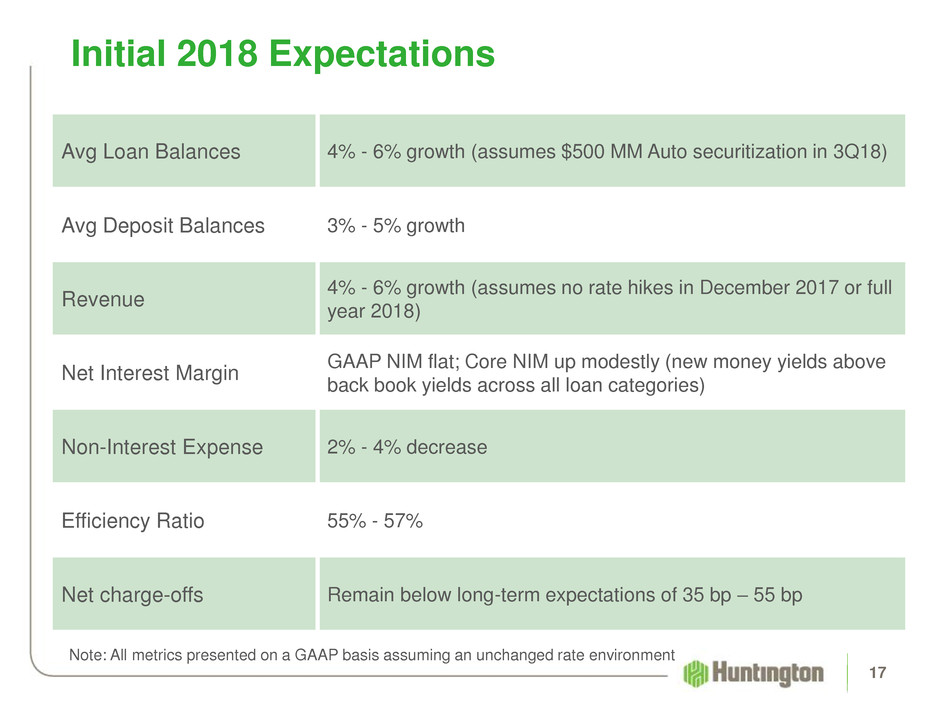

Initial 2018 Expectations

17

Avg Loan Balances 4% - 6% growth (assumes $500 MM Auto securitization in 3Q18)

Avg Deposit Balances 3% - 5% growth

Revenue

4% - 6% growth (assumes no rate hikes in December 2017 or full

year 2018)

Net Interest Margin

GAAP NIM flat; Core NIM up modestly (new money yields above

back book yields across all loan categories)

Non-Interest Expense 2% - 4% decrease

Efficiency Ratio 55% - 57%

Net charge-offs Remain below long-term expectations of 35 bp – 55 bp

Note: All metrics presented on a GAAP basis assuming an unchanged rate environment

Important Messages

18

Strong economic outlook for Midwest footprint

FirstMerit integration substantially complete; Fully implemented all cost saves

and executing on revenue synergies

Focused on three areas with sustainable competitive advantages

o Consumer

o Small to Medium Enterprises (including Commercial Real Estate)

o Vehicle Finance

Consistent core strategy since 2009

o Delivering on growth strategies with sustained investment

o Meaningful investment in people, technology, and brand – continuously improving

o Disciplined risk management – aggregate moderate-to-low risk profile

Driving core deposit and loan growth through disciplined execution and a

differentiated customer experience

Focused on delivery of consistent through-the-cycle shareholder returns

High level of colleague and shareholder alignment

Important Messages

19

Appendix

20

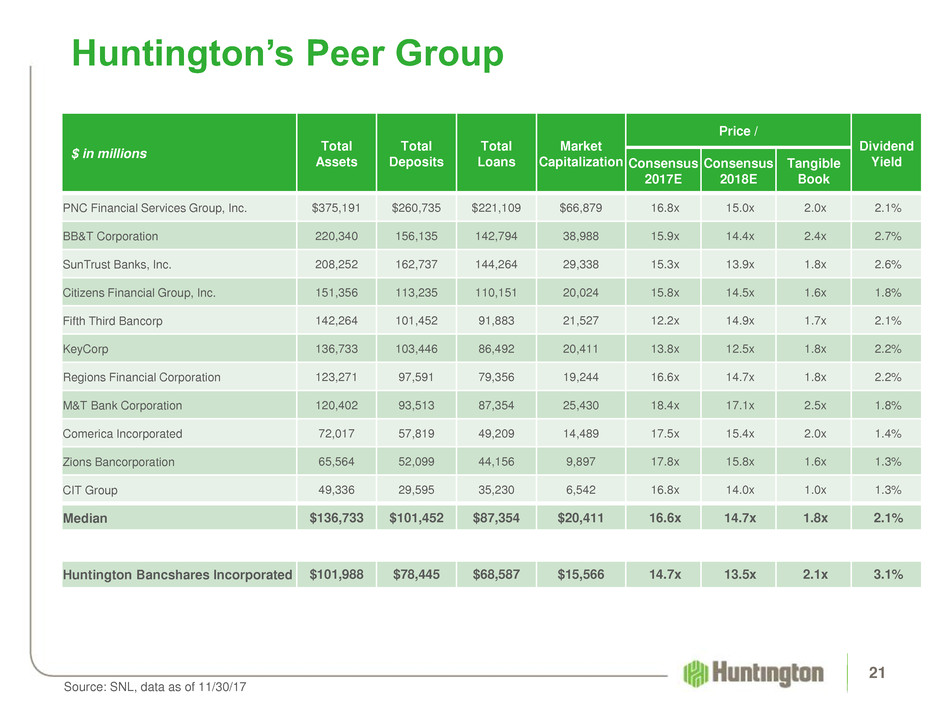

Huntington’s Peer Group

21

$ in millions

Total

Assets

Total

Deposits

Total

Loans

Market

Capitalization

Price /

Dividend

Yield Consensus

2017E

Consensus

2018E

Tangible

Book

PNC Financial Services Group, Inc. $375,191 $260,735 $221,109 $66,879 16.8x 15.0x 2.0x 2.1%

BB&T Corporation 220,340 156,135 142,794 38,988 15.9x 14.4x 2.4x 2.7%

SunTrust Banks, Inc. 208,252 162,737 144,264 29,338 15.3x 13.9x 1.8x 2.6%

Citizens Financial Group, Inc. 151,356 113,235 110,151 20,024 15.8x 14.5x 1.6x 1.8%

Fifth Third Bancorp 142,264 101,452 91,883 21,527 12.2x 14.9x 1.7x 2.1%

KeyCorp 136,733 103,446 86,492 20,411 13.8x 12.5x 1.8x 2.2%

Regions Financial Corporation 123,271 97,591 79,356 19,244 16.6x 14.7x 1.8x 2.2%

M&T Bank Corporation 120,402 93,513 87,354 25,430 18.4x 17.1x 2.5x 1.8%

Comerica Incorporated 72,017 57,819 49,209 14,489 17.5x 15.4x 2.0x 1.4%

Zions Bancorporation 65,564 52,099 44,156 9,897 17.8x 15.8x 1.6x 1.3%

CIT Group 49,336 29,595 35,230 6,542 16.8x 14.0x 1.0x 1.3%

Median $136,733 $101,452 $87,354 $20,411 16.6x 14.7x 1.8x 2.1%

Huntington Bancshares Incorporated $101,988 $78,445 $68,587 $15,566 14.7x 13.5x 2.1x 3.1%

Source: SNL, data as of 11/30/17

22

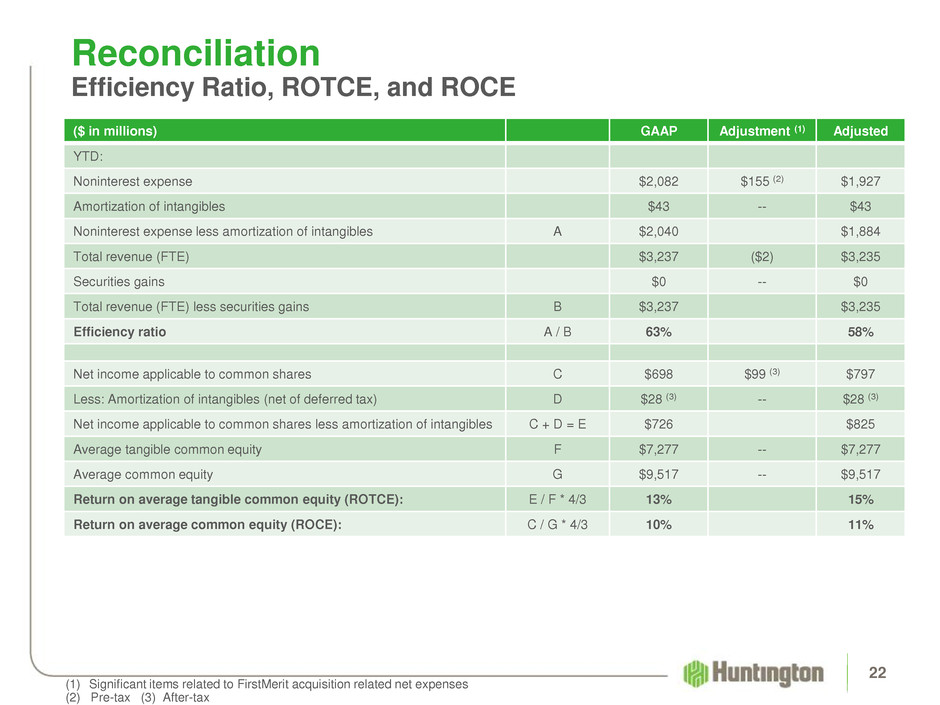

Reconciliation

Efficiency Ratio, ROTCE, and ROCE

($ in millions) GAAP Adjustment (1) Adjusted

YTD:

Noninterest expense $2,082 $155 (2) $1,927

Amortization of intangibles $43 -- $43

Noninterest expense less amortization of intangibles A $2,040 $1,884

Total revenue (FTE) $3,237 ($2) $3,235

Securities gains $0 -- $0

Total revenue (FTE) less securities gains B $3,237 $3,235

Efficiency ratio A / B 63% 58%

Net income applicable to common shares C $698 $99 (3) $797

Less: Amortization of intangibles (net of deferred tax) D $28 (3) -- $28 (3)

Net income applicable to common shares less amortization of intangibles C + D = E $726 $825

Average tangible common equity F $7,277 -- $7,277

Average common equity G $9,517 -- $9,517

Return on average tangible common equity (ROTCE): E / F * 4/3 13% 15%

Return on average common equity (ROCE): C / G * 4/3 10% 11%

(2) Pre-tax (3) After-tax

(1) Significant items related to FirstMerit acquisition related net expenses

23

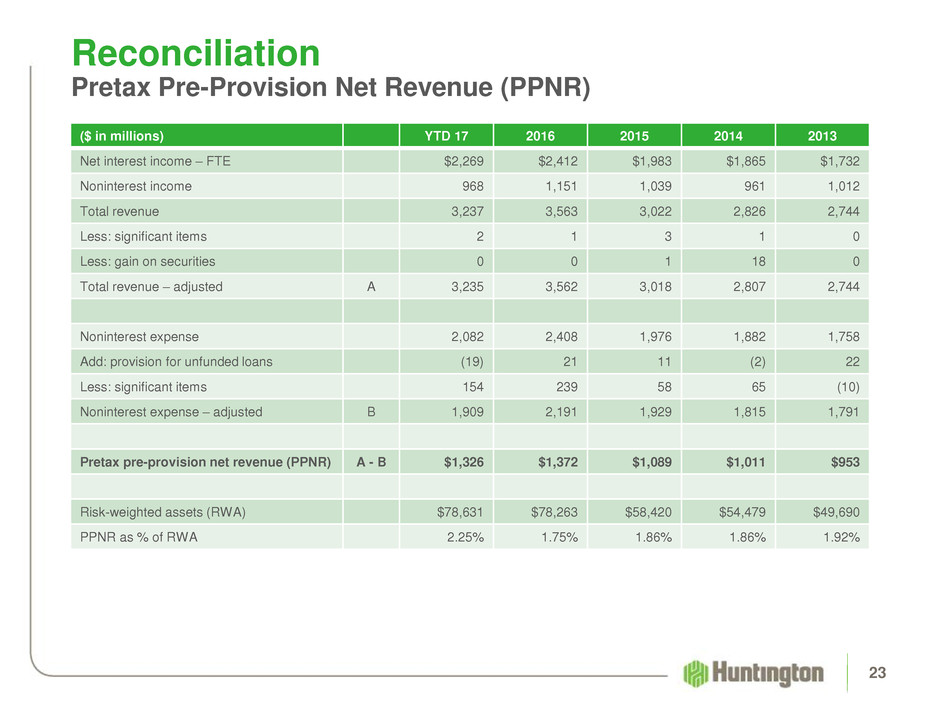

Reconciliation

Pretax Pre-Provision Net Revenue (PPNR)

($ in millions) YTD 17 2016 2015 2014 2013

Net interest income – FTE $2,269 $2,412 $1,983 $1,865 $1,732

Noninterest income 968 1,151 1,039 961 1,012

Total revenue 3,237 3,563 3,022 2,826 2,744

Less: significant items 2 1 3 1 0

Less: gain on securities 0 0 1 18 0

Total revenue – adjusted A 3,235 3,562 3,018 2,807 2,744

Noninterest expense 2,082 2,408 1,976 1,882 1,758

Add: provision for unfunded loans (19) 21 11 (2) 22

Less: significant items 154 239 58 65 (10)

Noninterest expense – adjusted B 1,909 2,191 1,929 1,815 1,791

Pretax pre-provision net revenue (PPNR) A - B $1,326 $1,372 $1,089 $1,011 $953

Risk-weighted assets (RWA) $78,631 $78,263 $58,420 $54,479 $49,690

PPNR as % of RWA 2.25% 1.75% 1.86% 1.86% 1.92%

Use of Non-GAAP Financial Measures

This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be

helpful in understanding Huntington’s results of operations or financial position. Where non-GAAP financial measures are

used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can

be found in this document, the earnings press release, or the Form 8-K related to this document, all of which can be found

on Huntington’s website at www.huntington-ir.com.

Annualized Data

Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for

analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or

year-over-year amounts. For example, loan and deposit growth rates, as well as net charge-off percentages, are most often

expressed in terms of an annual rate like 8%. As such, a 2% growth rate for a quarter would represent an annualized 8%

growth rate.

Fully-Taxable Equivalent Interest Income and Net Interest Margin

Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this

income had been taxable at statutory rates. This adjustment puts all earning assets, most notably tax-exempt municipal

securities and certain lease assets, on a common basis that facilitates comparison of results to results of competitors.

Earnings per Share Equivalent Data

Significant income or expense items may be expressed on a per common share basis. This is done for analytical and

decision-making purposes to better discern underlying trends in total corporate earnings per share performance excluding

the impact of such items. Investors may also find this information helpful in their evaluation of the company’s financial

performance against published earnings per share mean estimate amounts, which typically exclude the impact of Significant

Items. Earnings per share equivalents are usually calculated by applying an effective tax rate to a pre-tax amount to derive

an after-tax amount, which is divided by the average shares outstanding during the respective reporting period. Occasionally,

when the item involves special tax treatment, the after-tax amount is disclosed separately, with this then being the amount

used to calculate the earnings per share equivalent.

Rounding

Please note that columns of data in this document may not add due to rounding.

Basis of Presentation

24

Do we

consolidate

this and

next slide?

Significant Items

From time to time, revenue, expenses, or taxes are impacted by items judged by Management to be outside of ordinary

banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually

large that their outsized impact is believed by Management at that time to be infrequent or short term in nature. We refer

to such items as “Significant Items”. Most often, these Significant Items result from factors originating outside the

company – e.g., regulatory actions/assessments, windfall gains, changes in accounting principles, one-time tax

assessments/refunds, litigation actions, etc. In other cases they may result from Management decisions associated with

significant corporate actions out of the ordinary course of business – e.g., merger/restructuring charges, recapitalization

actions, goodwill impairment, etc.

Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in

market and economic environment conditions, as a general rule volatility alone does not define a Significant Item. For

example, changes in the provision for credit losses, gains/losses from investment activities, asset valuation write-downs,

etc., reflect ordinary banking activities and are, therefore, typically excluded from consideration as a Significant Item.

Management believes the disclosure of “Significant Items”, when appropriate, aids analysts/investors in better

understanding corporate performance and trends so that they can ascertain which of such items, if any, they may wish

to include/exclude from their analysis of the company’s performance - i.e., within the context of determining how that

performance differed from their expectations, as well as how, if at all, to adjust their estimates of future performance

accordingly. To this end, Management has adopted a practice of listing “Significant Items” in its external disclosure

documents (e.g., earnings press releases, quarterly performance discussions, investor presentations, Forms 10-Q and

10-K).

“Significant Items” for any particular period are not intended to be a complete list of items that may materially impact

current or future period performance. A number of items could materially impact these periods, including those

described in Huntington’s 2016 Annual Report on Form 10-K and other factors described from time to time in

Huntington’s other filings with the Securities and Exchange Commission.

Basis of Presentation

25

Welcome

©2017 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Mark A. Muth

Director of Investor Relations

Office: 614.480.4720

E-mail: mark.muth@huntington.com

For additional information,

please visit:

http://www.huntington.com