DEF 14A: Definitive proxy statements

Published on March 9, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

|

No fee required. | |

|

Fee paid previously with preliminary materials. | |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

A Letter from

Our Board’s Leadership

Stephen D. Steinour Chairman, President, and CEO |

|

David L. Porteous Independent Lead Director |

Dear Fellow Shareholders:

We are pleased to invite you to the 2023 Annual Meeting of Shareholders to be held virtually on Wednesday, April 19, 2023, at 2:00 p.m. Eastern Time via webcast. We hope you will join us online and participate in this year’s meeting. We will consider the matters described in the following Notice of Annual Meeting and Proxy Statement and review highlights of the past year.

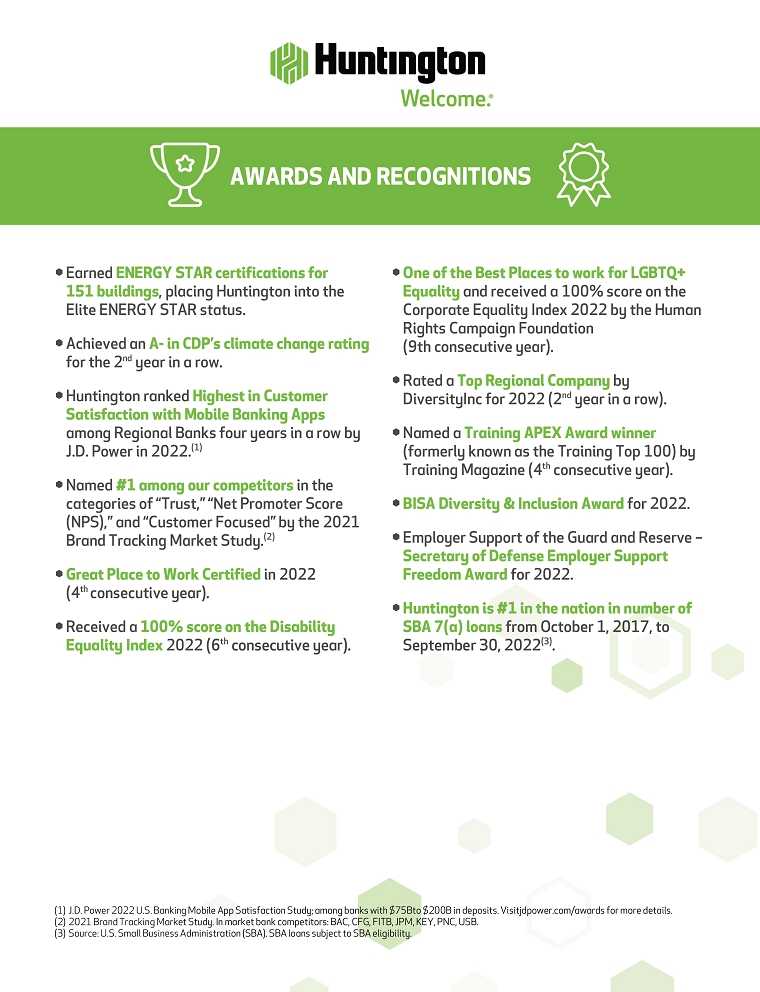

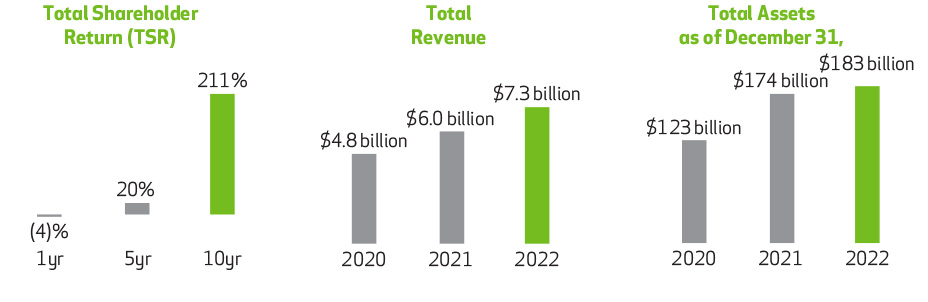

2022 was a tremendous year for Huntington. Despite economic headwinds, we achieved record financial performance, including full-year revenue growth, and finished the year with solid capital levels and top-tier loan reserves. We executed on strategic growth initiatives, acquiring Capstone Partners and Torana (now known as Huntington ChoicePaySM). We also fully delivered cost take-outs and are driving revenue growth synergies related to our TCF merger.

We continued to scale across our footprint through our Consumer and Business Bank, increasing deposits and loans while focusing on digital engagement with our customers. Our Commercial Bank has a national presence and saw record capital markets fees and continues to drive Specialty Banking and Asset Finance growth.

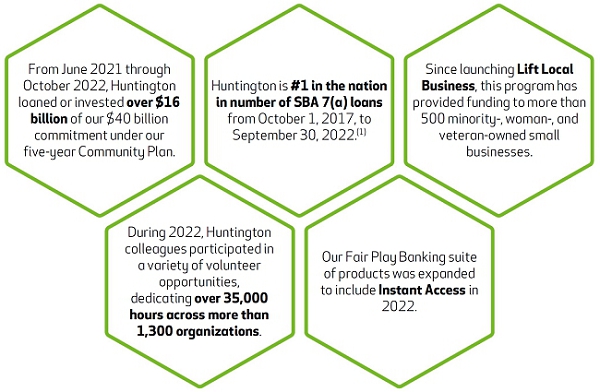

We invested in our communities in 2022 through our ESG initiatives, including lending and investing $16 billion of our $40 billion Community Plan. Our efforts and outreach were focused on affordable housing, small business, community development lending and investing, and racial and social equity. We remained the #1 SBA lender in the country by volume for the fifth year in a row and expanded nationwide in the beginning of the year.

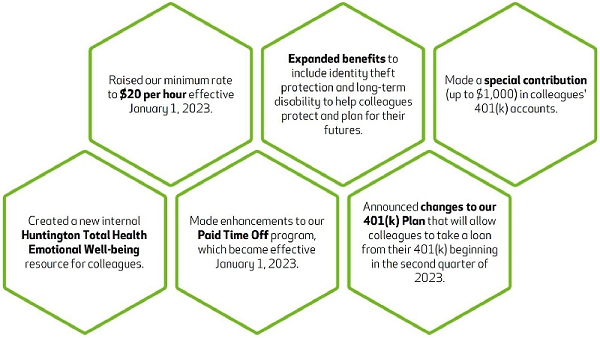

We also made investments in our colleagues in a number of ways, including by increasing colleague pay to a minimum of $20 per hour for all colleagues effective January 1, 2023. We also created greater workplace flexibility and health and financial wellness support.

We would like to thank Beth Ardisana and Bob Cubbin for their service on the Board of Directors, each of whom will be rolling off our Board at the 2023 Annual Meeting of Shareholders. Beth’s leadership and insights from her role as an accomplished chief executive officer and entrepreneur, and from her climate-related knowledge, have been invaluable to the Board. Bob's service, particularly in his role as Chair of our HR and Compensation Committee, has been outstanding. His guidance, leadership skills, and experience as a seasoned chief executive officer have added significantly to the Board's oversight of the Company. We speak on behalf of the entire Board in noting that Beth and Bob will be greatly missed.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 1 |

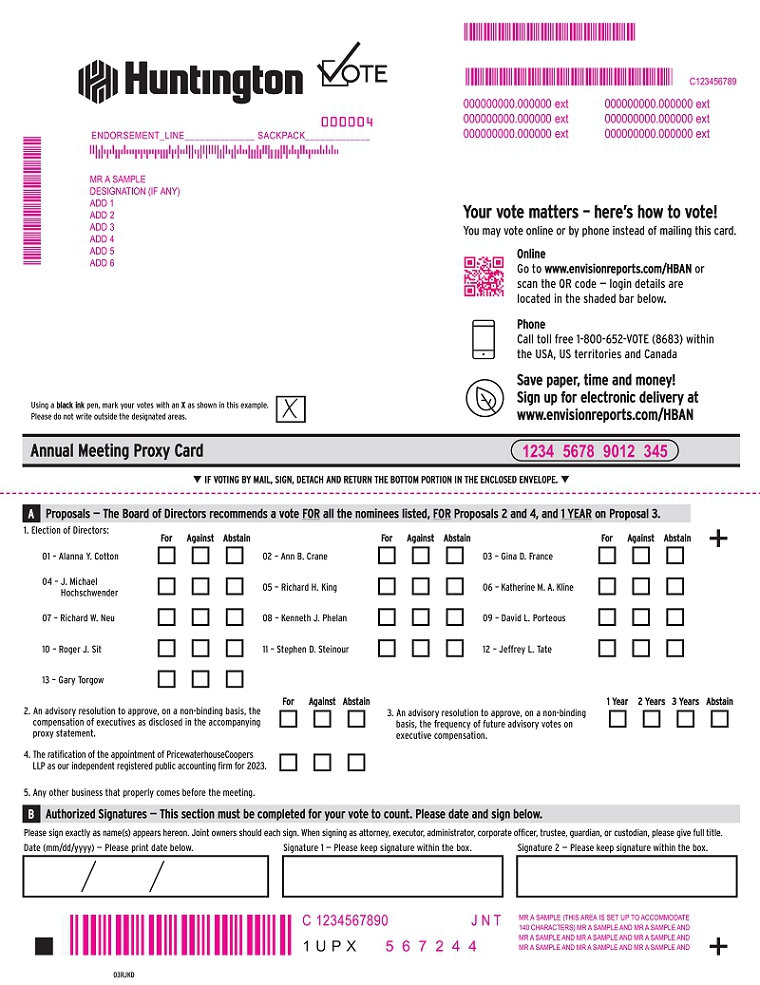

Details of the business to be conducted at the Annual Meeting and how to participate at the meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. Your vote is important to us. Whether or not you attend the virtual Annual Meeting, we encourage you to read the Proxy Statement carefully and vote via the internet, telephone, or mail to ensure that your shares are represented.

Our culture is the bedrock of the Bank. Our colleagues are committed to customer service and the communities we serve. We believe we are well positioned to deliver substantial value creation in 2023 and beyond. We are grateful for the extraordinary commitment of our colleagues and our Directors for their steadfast dedication and guidance throughout the year.

Thank you for your continued support of Huntington.

Best wishes,

Stephen D. Steinour Chairman, President, and CEO |

David L. Porteous Independent Lead Director |

|

|

March 9, 2023 |

||

| Huntington Bancshares Incorporated 2023 Proxy Statement | 2 |

Notice of 2023 Annual Meeting of Shareholders

|

April 19, 2023 |

|||

|

Wednesday, 2:00 p.m. Eastern Time |

|||

|

Location Online at meetnow.global/M2GTLL2 |

|||

|

Matters to be Considered and Voted Upon: |

|||

|

Proposal 1 |

Election of Directors |

|

FOR  Page 19 |

|

Proposal 2 |

Advisory resolution to approve, on a non-binding basis, the compensation of executives as described in the proxy materials |

|

FOR  Page 67 |

|

Proposal 3 |

Advisory resolution to approve, on a non-binding basis, the frequency of future advisory votes on executive compensation |

|

1 YEAR  Page 111 |

|

Proposal 4 |

Ratification of the appointment of PwC as our independent registered public accounting firm for 2023 |

|

FOR  Page 112 |

|

Other business that properly comes before the meeting |

|||

Information for Shareholders Who Plan to Attend the 2023 Annual Meeting of Shareholders

Huntington’s Board is furnishing shareholders with this Proxy Statement to solicit proxies on its behalf to be exercised at the 2023 Annual Meeting of Shareholders, and any postponements or adjournments thereof, and we are first making this Proxy Statement available on or about March 9, 2023. Shareholders will be able to attend and participate in the Annual Meeting online, vote their shares electronically, and submit questions during the meeting by visiting meetnow.global/M2GTLL2 at the meeting date and time.

Record Date: Huntington shareholders as of the close of business on February 15, 2023, will be entitled to vote at our annual meeting and at any postponements or adjournments of the meeting.

Your vote is important. Please submit your proxy as soon as possible via the internet, mail, or telephone. If your shares are held by a Broker, it is important that you provide instructions to your Broker so that your vote is counted on all matters.

2023 Virtual Annual Shareholder Meeting

The Board has determined to again hold a virtual annual meeting in order to facilitate shareholder attendance and participation by enabling shareholders to participate from any location and at no cost. Shareholders as of the Record Date will be able to attend the meeting online, vote shares electronically, and submit questions during the meeting by visiting meetnow.global/M2GTLL2 at the meeting date and time. The meeting webcast will begin promptly at 2:00 p.m. Eastern Time. If you experience technical difficulties during the check-in process or during the meeting please contact (888) 724-2416 (U.S. toll-free) or +1-781-575-2748 (outside of U.S.) for assistance. See the General Information on Voting and the Annual Meeting section of the Proxy Statement for additional information on how to participate in this year’s meeting.

By Order of the Board of Directors,

Anne Kruger

Senior Associate General Counsel and Secretary

March 9, 2023

| HOW TO VOTE YOUR SHARES | |

|

Online |

| Registered holders | |

| www.envisionreports.com/HBAN | |

| Beneficial owners | |

| www.proxyvote.com | |

|

By Phone |

| Call the phone number at the top of your proxy card | |

|

By Mail |

| Complete, sign, date, and return your proxy card in the envelope provided | |

|

Online during the meeting |

| Attend and vote online during the virtual annual meeting | |

| Shareholders who hold their shares in street name should refer to the voting instructions provided by their Broker. | |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 19, 2023. The Proxy Statement and Annual Report to shareholders are available at www.edocumentview.com/HBAN.

|

Voluntary E-Delivery |

|

We encourage our shareholders to enroll in electronic delivery of proxy materials: If you are a registered shareholder, please sign up at www.computershare.com/hban. If you are a beneficial owner, please contact your Broker for instructions. Electronic delivery offers immediate and convenient access to proxy materials. It also helps us reduce paper usage and our printing and shipping costs. |

|

| Huntington Bancshares Incorporated 2023 Proxy Statement | 3 |

Table of Contents

Readers should refer to the Glossary at the end of this Proxy Statement for definitions of capitalized terms and acronyms used throughout.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 4 |

Information Highlights

The following chart provides highlights of many of Huntington’s ESG and compensation practices. Shareholders should note, however, that this chart does not contain all the information provided elsewhere in this Proxy Statement; therefore, you should carefully read the entire Proxy Statement before casting your vote.

|

ESG or Compensation Topic |

Huntington’s Practice |

|

|

Board Composition, Leadership, and Operations |

|

|

Number of Director nominees |

13 |

|

|

Substantially independent Board |

Yes, 85% of nominees are independent |

|

|

Independence of Audit Committee, HR and Compensation Committee, NESG Committee, and Risk Oversight Committee members |

100% |

|

|

Combined Chairman/CEO |

Yes |

|

|

Independent Lead Director with clearly defined authority and duties |

Yes |

|

|

Average Director nominee age |

62 years |

|

|

Mandatory retirement age |

72 unless an exception is made |

|

|

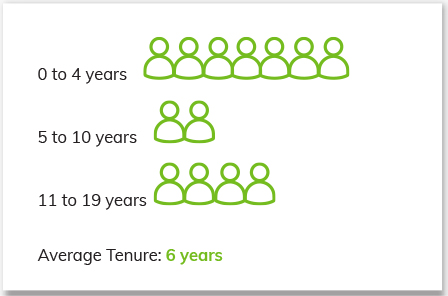

Average Director nominee tenure |

6 years |

|

|

Term limit |

None |

|

|

Gender diversity on the Board |

4 nominees (31%) |

|

|

Racial/ethnic diversity on the Board |

3 nominees (23%) |

|

|

Implemented a version of the Rooney Rule for Director candidate searches |

Yes |

|

|

Overboarded Directors |

No nominee serves on more than two other public company boards |

|

|

Board evaluations |

Annual rigorous process, including a Board-level evaluation, committee-level evaluations, and one-on-one discussions between the Lead Director and each other Director; periodic use of a third party |

|

|

Director onboarding and ongoing education |

Yes |

|

|

Director election voting standard |

Majority of the votes cast for and against each nominee, with plurality carveout for contested elections |

|

|

Director election frequency |

Annual |

|

|

Blank check preferred |

Yes, but Huntington’s capital plan is submitted to the Federal Reserve |

|

|

Number of Board meetings held in 2022 |

13 |

|

|

Number of Board and committee meetings held in 2022 |

56 |

|

|

Average Board and committee meeting attendance in 2022 |

97.5% |

|

|

Executive sessions with only independent Directors |

Yes, scheduled for all regular quarterly Board meetings |

|

|

Direct access to management and other colleagues |

Yes, the Board has direct access |

|

|

Risk mitigation practices |

Established an aggregate moderate-to-low, through-the-cycle risk appetite for the enterprise with key risks overseen by Board committees |

|

| Huntington Bancshares Incorporated 2023 Proxy Statement | 5 |

|

ESG or Compensation Topic |

Huntington’s Practice |

|

|

Shareholder Rights |

|

|

Right to call special meetings |

Yes, by a majority of outstanding shares |

|

|

Right to act by written consent |

Must be unanimous |

|

|

One share, one vote policy |

Yes |

|

|

Dual-class common stock |

None |

|

|

Cumulative voting permitted |

No |

|

|

Supermajority voting requirements |

66.67% for charter or bylaw amendments |

|

|

Poison pill |

No |

|

|

Proxy access bylaw |

No |

|

|

Exclusive forum bylaw |

No |

|

|

Fee shifting bylaw |

No (prohibited by state law) |

|

|

Other Governance Highlights |

|

|

Overall diversity among the executive officers |

6 individuals (46%) |

|

|

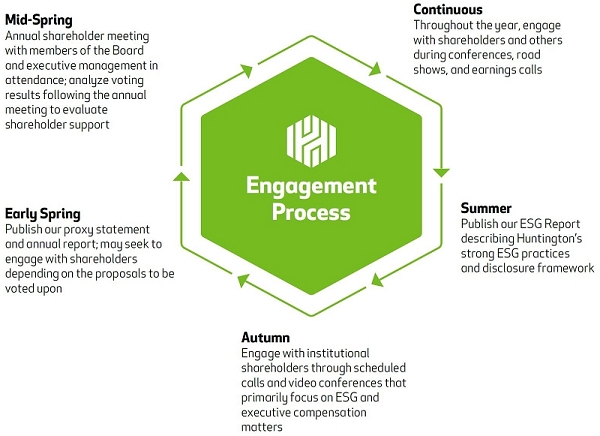

Shareholder engagement |

Ongoing throughout the year |

|

|

Council of Institutional Investors member |

Yes |

|

|

Independent auditor |

PwC (since 2015) |

|

|

ESG Practices and Disclosures |

|

|

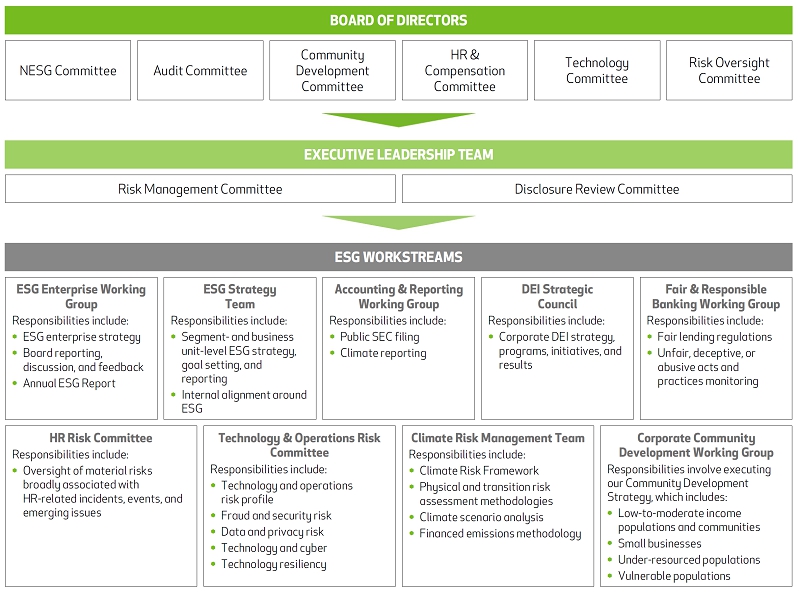

Board oversight of ESG |

Yes |

|

|

ESG stakeholder assessment conducted |

Yes, most recently completed in 2017 |

|

|

Annual ESG Report |

Yes, began publishing for 2016 |

|

|

Human Rights Statement |

Yes |

|

|

Service Provider Code of Conduct |

Yes |

|

|

SASB Index disclosed |

Yes, included within our ESG Report |

|

|

TCFD Index disclosed |

Yes, included within our ESG Report |

|

|

CDP Climate Change Questionnaire response |

A-score |

|

|

PCAF member |

Yes |

|

|

Established GHG and other climate-related goals |

Yes |

|

|

Environmental Policy Statement |

Yes |

|

|

Climate Risk Policy Statement |

Yes |

|

|

Political contributions disclosure |

Yes |

|

|

Individual Director-by-Director skills and diversity matrix |

Yes |

|

|

DEI Corporate Policy Statement |

Yes |

|

|

EEO-1 data disclosure |

Yes, available on our website |

|

|

Pay gap analysis disclosure |

Yes, included within our ESG Report |

|

| Huntington Bancshares Incorporated 2023 Proxy Statement | 6 |

|

ESG or Compensation Topic |

Huntington’s Practice |

|

|

Compensation and Human Resource Matters |

|

|

Succession planning for CEO and other executives |

Yes, at least annually |

|

|

CEO pay ratio |

155:1 |

|

|

Stock ownership guidelines |

10X salary for CEO and 3X for each NEO |

|

|

Dividend or dividend equivalents paid on equity grants prior to vesting |

No |

|

|

Prohibition on Director and executive officer hedging and pledging of Huntington stock |

Yes |

|

|

Performance-based compensation |

Yes, a majority of aggregate NEO LTI is based upon long-term performance; PSUs make up 55% of total annual LTI grant value for CEO and 50% for other NEOs |

|

|

Compensation tied to culture |

Yes, with performance reviews based 50% on what and 50% on how executives deliver |

|

|

Recoupment policy |

Yes |

|

|

Compensation metrics |

Balanced portfolio of metrics that drive annual and long-term goals in a risk appropriate manner |

|

|

Current frequency of say-on-pay vote |

Annual |

|

|

Double-trigger change-in-control provisions |

Yes |

|

|

Excise tax gross-ups |

No |

|

|

Repricing of previously-granted stock options without shareholder approval |

No |

|

|

Annual assessment of compensation programs |

Yes, against both peers and market best practices |

|

|

Incentive plans encourage excessive risk taking |

No |

|

|

Independent compensation consultant |

Pearl Meyer |

|

|

Corporate Information |

|

|

Common stock symbol |

HBAN |

|

|

Stock exchange |

Nasdaq |

|

|

Common stock outstanding as of the Record Date |

1,449,636,645 shares |

|

|

State of incorporation |

Maryland |

|

|

Year founded |

1866 |

|

|

Corporate headquarters |

Columbus, Ohio (Detroit, Michigan serves as the operational headquarters of Huntington Bank’s commercial banking operations) |

|

|

Registrar and transfer agent |

Computershare |

|

|

Corporate website |

huntington.com |

|

|

Investor Relations website |

ir.huntington.com |

|

| Huntington Bancshares Incorporated 2023 Proxy Statement | 7 |

Proxy Summary

This Proxy Summary provides shareholders with an overview of the contents within the Proxy Statement. It is not, however, intended to take the place of a complete and careful reading of the Proxy Statement. Therefore, shareholders are encouraged to read the Proxy Statement in its entirety before casting their vote.

2023 Annual Meeting Overview

|

|

|||

TIME & DATE 2:00 p.m. Eastern Time Wednesday, April 19, 2023 |

PLACE Online at meetnow.global/M2GTLL2 |

RECORD DATE Close of business on February 15, 2023 |

VOTING Common shareholders as of the Record Date are entitled to vote. Shareholders of record and most beneficial shareholders have several methods by which they can vote. Please refer to the Notice of 2023 Annual Meeting of Shareholders for voting methods. |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 8 |

Your Vote is Important to Us

Regardless of whether you are planning to attend this year’s annual meeting, please submit your vote over the internet; by phone; or complete, sign, and return your proxy card as soon as you can so that we can be assured of obtaining a quorum.

|

Proposal 1: Election of Directors |

The Board proposes the election of 13 individuals as Directors at this annual meeting. All our nominees are seasoned leaders. Collectively, they bring an effective variety of skills, knowledge, experience, perspectives, and diversity attributes to our Board. The independent Director nominees make up 85% of the Board. |

|

Our Board recommends a vote FOR the election of each of the nominees for Director. |

|

Proposal 2: Advisory resolution to approve, |

The Board and the HR and Compensation Committee believe that our compensation policies and procedures strongly align the interests of executives and shareholders and that our culture focuses executives on sound risk management and appropriately rewards executives for performance. |

|

Our Board recommends a vote FOR this proposal. |

|

Proposal 3: Advisory resolution to approve, on a non-binding basis, the frequency of future advisory votes on executive compensation |

The Board believes that the interests of our shareholders are best served by continuing to hold say-on-pay votes annually as this holds our executives accountable for the actions they take each year. |

|

Our Board recommends a vote for 1 YEAR. |

|

Proposal 4: Ratification of the appointment of the independent registered public accounting firm for 2023 |

The Board and the Audit Committee believe that the continued retention of PwC to serve as our independent registered public accounting firm is in the best interests of the Company and its investors. The Audit Committee will reconsider the appointment of PwC if its selection is not ratified by the shareholders. |

|

Our Board recommends a vote FOR this proposal. |

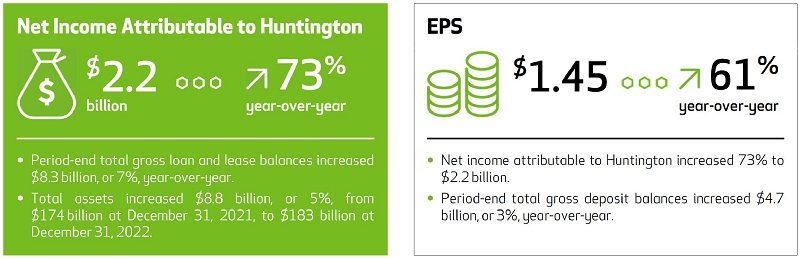

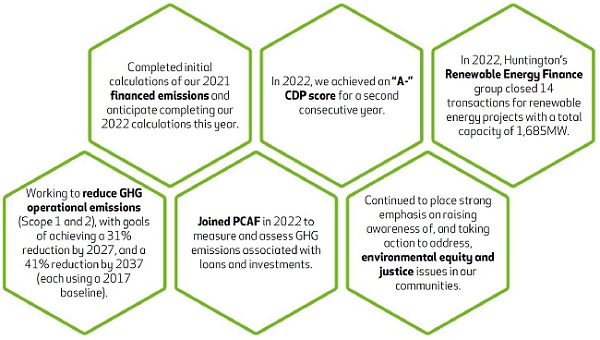

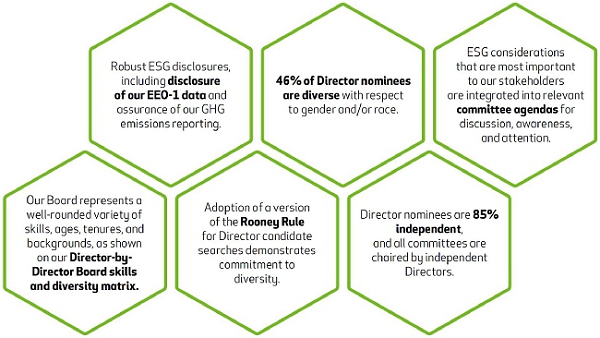

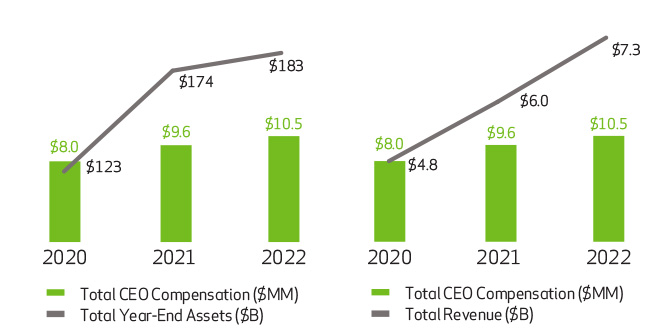

2022 Performance Highlights

The past year saw significant growth and long-term investment for Huntington. Over the past year, we continued to invest in our colleagues, communities, and customers. These investments are described throughout this Proxy Statement. The following provides a high-level overview of our 2022 performance:

| Huntington Bancshares Incorporated 2023 Proxy Statement | 9 |

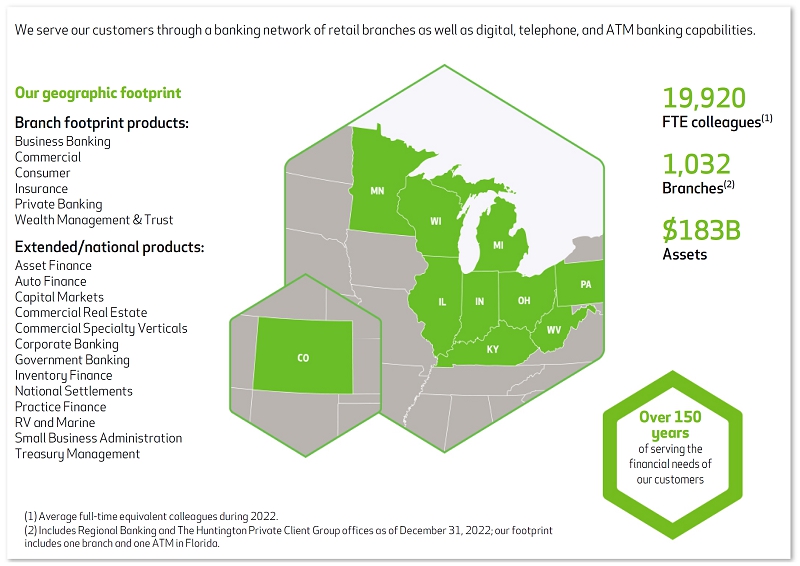

Huntington Overview

Our Strategic Focus

Investing, differentiating, and optimizing…

During November of 2022, Huntington hosted its first Investor Day in over a decade. As discussed during this event, we have established foundational strategic pillars supporting execution and value creation across the Company. These pillars focus on investing for sustainable, profitable growth; differentiating our culture, brand, and customer experience; and optimizing for top quartile performance and value creation.

Our business segments and other groups throughout the Company have identified key strategies, processes, and goals to accomplish and excel in each of these pillars. Examples from some of these groups are set forth in the following table:

| Huntington Bancshares Incorporated 2023 Proxy Statement | 10 |

|

|

Investing |

|

Differentiating |

|

Optimizing |

|

|

for sustainable, profitable growth |

|

our culture, brand, and customer experience |

|

for top quartile performance and value creation |

|

Consumer Banking |

Leverage leadership position to acquire and deepen primary bank relationships Capitalize on high digital engagement for incremental awareness and delivery of products, solutions, and support |

|

Leverage industry leading innovation position for continued competitive separation Build upon established brand in local and new markets, preserving local delivery mode |

|

Bring everyday banking solutions to more of our customers Drive efficiencies utilizing data, analytics, and technology Scale delivery of investment advice and planning |

|

Wealth Management |

Innovate and accelerate digital enablement focused on customer experience Expand our reach through new markets, including Colorado and Minnesota |

|

Deliver full-service model from mass affluent to high net worth Build upon established brand in local and new markets |

|

Harness Unified Advisory approach to deepen wealth management penetration across customer base Capture the power of the Huntington franchise and brand |

|

Business Banking |

Scale in select areas of expertise in-footprint and nationally Integrate digital solutions into small business owners’ daily management |

|

Harmonize customer relationship through digital and human expertise Offer differentiated products to solve customer needs |

|

Accelerate credit process modernization to reduce time to money and improve colleague/customer experience Expand digital capabilities to empower our customers |

|

Commercial Banking |

Target markets/clients with disciplined approach to grow operating accounts Accelerate digital capabilities to drive efficiency and improved experience Generate fee growth, including capital markets |

|

Execute on deepening opportunity to continue growth in primary bank relationships Leverage expertise and advice to scale middle market industry verticalizations and capital markets |

|

Build more efficient processes, broader product menu, and deliver innovative solutions Improve through data-driven insights/predictive analytics (EDGE) |

|

Enterprise Payments |

Deepen relationships with large established base Streamline to create simple, frictionless digital customer experiences |

|

Innovate solutions and advice based on customer needs to drive best-in-class user experience Expand B2C capabilities with ChoicePay |

|

Leverage partnerships and innovation to scale capabilities Enable scale with self-service options and automation |

|

Vehicle Finance |

Expand opportunistically with auto and RV/Marine platform Grow PowerSports with scaled infrastructure and expertise |

|

Leverage foundational 75 years of industry expertise and sector leading technology Ensure quality relationships through tenured colleagues with local knowledge |

|

Deliver superior credit performance through the cycle, utilizing technology and consistent with low-risk track record Optimize production and yield to enhance returns Leverage infrastructure for strategic growth and deepening |

|

Technology |

Leverage scalable infrastructure with modernized core and application programming interface (API) enablement Protect with clear information and cybersecurity roadmap |

|

Focus on customers’ financial journeys with insights and personalization, leveraging AI Invest proactively in talent development and training programs |

|

Execute on Operation Accelerate to transform customer and colleague experience and drive efficiency and revenue gains |

|

Culture and Colleagues |

Engage, develop, retain, and attract Cultivate a DEI Culture and empower colleagues with Future of Work leadership training |

|

Elevate colleague experience to transform customer experience and remain an Employer of Choice Build internal succession candidates through focused development |

|

Drive retention and attract talent with competitive compensation programs Incentivize through industry benchmarking and Pay Equity culture |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 11 |

Living our Purpose and Achieving our Vision

We succeed as an organization by looking out for people—specifically, our colleagues, customers, and communities.

Huntington understands the importance of looking out for those around us. We are keenly aware that our colleagues are our biggest assets and the keys to Huntington’s success. As such, we invest in their well-being and future. Our colleagues, along with our culture and Fair Play Banking Philosophy, have allowed us to create a customer experience that is recognized throughout the industry as being best in class. And, our giving back to those local communities that we serve further demonstrates our belief in investing in those around us.

|

Investing in Our Colleagues |

|

|

We engage, develop, retain, and attract top-tier talent from across our core and extended footprints and beyond. Huntington seeks to cultivate a DEI culture with a focus on care and increasing engagement with our colleagues. We upskill and reskill colleagues to prepare for the future and empower them with Future of Work training. Our colleagues are our brand. Therefore, we strive to create succession for executive and leadership roles through development. We also elevate the colleague experience to transform the customer experience and execute business strategies through our top talent. Our commitment to invest in our colleagues is evidenced by: |

|

|

A $20 per hour minimum rate (effective January 1, 2023) |

|

Expanded medical plans, which include long-term disability, autism therapy treatment, and fertility services |

|

A Workplace Flex program and child and family care resources |

|

Our Social Equity Colleague Plan, focusing on culture and inclusion, development and career advancement, and talent experience |

|

An Employee Assistance Program that includes counseling sessions at no charge to colleagues |

|

Building on Our Unique Customer Experience |

|

|

Our Fair Play Banking Philosophy, which we launched over a decade ago, demonstrates how we make Huntington a unique experience for our customers. We are continually looking to expand our suite of products that help differentiate us as a bank and allow us to better meet our customers’ needs and expectations. |

|

|

Instant Access gives consumer and business banking customers immediate access to up to $500 from check deposits (since 2022) |

|

Standby Cash® that gives qualifying customers immediate access to cash with a line of credit based primarily on their checking and deposit history rather than credit score (since 2021) |

|

Early Pay, which automatically gives customers with qualifying direct deposits access to their paychecks up to two days early, at no additional cost (since 2021) |

|

Our no overdraft fee $50 Safety ZoneSM for consumers and businesses (since 2020) |

|

24-Hour Grace® for consumers and business customers (since 2010 for consumers; extended to business customers in 2020) |

|

Money Scout® to help enrolled customers look out for money they can set aside to build their savings (since 2020) |

|

Savings Goal GetterSM helps customers achieve real savings through goal setting and tracking (since 2020) |

|

Asterisk Free Checking® with no minimum balance requirements (since 2011) |

|

Optimizing for Top Quartile Performance and Value Creation |

|

We are seeking to drive efficiency and optimization while innovating with scalable technology. Coupled with executing disciplined expense management to drive positive operating leverage and maintaining an aggregate moderate-to-low, through-the-cycle risk appetite, we believe we will be positioned to deliver top quartile performance across key financial and credit metrics. Our efforts to optimize our operations so that we are better positioned to achieve top performance and value creation can be seen through the many strategies and initiatives set forth on the previous page. We continue to refine and adjust these efforts throughout the year to keep pace with changes within our footprint and more broadly. |

|

Making a Difference in Our Local Communities |

|

|

Huntington is committed to creating thriving, economically inclusive communities across our geographic footprint. We leverage our strategic partnerships and invest in meaningful solutions to impact progress in critical areas. |

|

|

Committed to and began executing on our five-year, $40 billion Community Plan in 2021, which focuses on home and consumer lending, small business, community development lending and investing, and racial and social equity |

|

Provided funding to more than 500 minority-, women-, and veteran-owned businesses through our commitment to Lift Local Business® |

Our actions are further guided and directed by our Values:

Can-Do Attitude: We enthusiastically work and succeed together.

Service Heart: We work with an inclusive spirit, putting ourselves in each other’s shoes to better understand how we can help.

Forward Thinking: We are always looking ahead for ways to be the very best.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 12 |

Proposal 1Election of Directors |

|||

|

The Board proposes the election of 13 Director nominees at this annual meeting. All our nominees are seasoned leaders and bring to our Board an effective variety of skills, knowledge, experience, and perspectives. ► See page 19 for further information. |

|

Our Board recommends a vote FOR the election of each of the nominees for Director. |

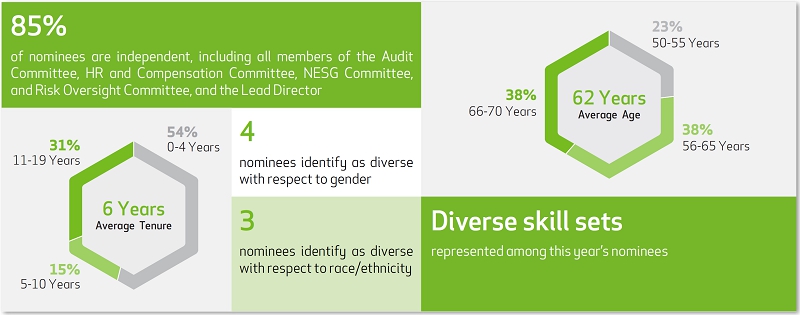

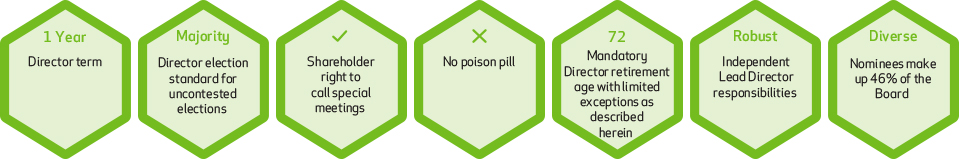

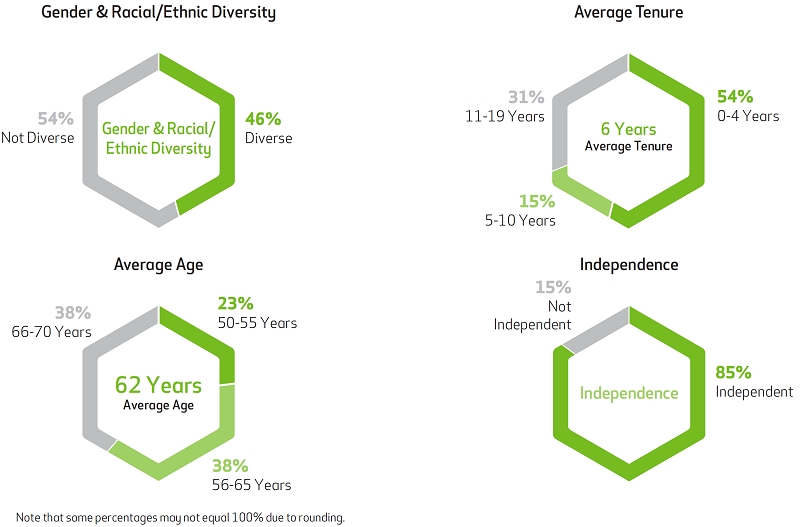

Board Key Facts

This year’s slate of nominees comprises a variety and balanced combination of backgrounds, experience, diversity attributes, age, and tenure. We believe that Huntington’s Directors, both individually and as a group, possess the mixture of skills needed to oversee the Company and its operations both now and for the foreseeable future.

Board Diversity and Skills

As part of the 2022 year-end Director questionnaire process, the Director nominees self-identified their demographic attributes, which are represented in the following.

Note that some percentages may not equal 100% due to rounding.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 13 |

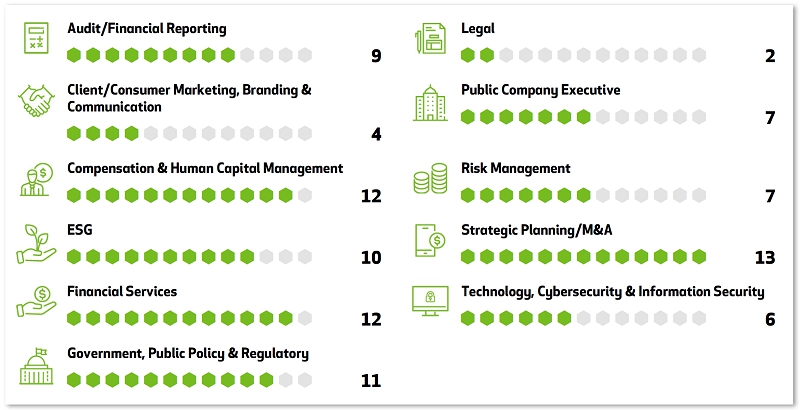

In addition to diversity attributes, Director nominees self-identified their skills and expertise gained through their varied backgrounds and industries. The overall skills represented on the Board, as identified by the Directors, are demonstrated through the following charts.

More detailed information about each nominee and the Board as a whole can be found within the Proposal 1 — Election of Directors section of this year’s Proxy Statement.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 14 |

Board Nominees

A brief description of the nominees for the 2023 Annual Meeting is set forth below:

|

|

Directors and Nominees |

Age |

Director Since |

Huntington Board Committees |

Other Current Public Company Directorships |

|

Alanna Y. Cotton President and Chief Business Officer, |

50 |

2019 |

Community Development Committee  Technology Committee |

|

|

Ann B. (Tanny) Crane President and CEO, Crane Group Company |

66 |

2010 |

Audit Committee (Audit Committee Financial Expert)  Community Development Committee (Chair)  Executive Committee |

|

|

Gina D. France CEO and President, France Strategic Partners LLC |

64 |

2016 |

Audit Committee (Audit Committee Financial Expert)  HR and Compensation Committee |

CBIZ, Inc.  Cedar Fair, L.P. |

|

J. Michael Hochschwender CEO, The Smithers Group, Inc. |

62 |

2016 |

HR and Compensation Committee  Technology Committee (Chair) |

|

|

Richard H. King Chairman, Metropolitan Airports Commission, Minneapolis/St. Paul |

67 |

2021 |

Technology Committee |

|

|

Katherine M. A. (Allie) Kline Founding Principal, LEO DIX |

51 |

2019 |

NESG Committee  Technology Committee |

BILL Holdings, Inc. (formerly Bill.com Holdings, Inc.) |

|

Richard W. Neu Retired Chairman, MCG Capital Corporation |

67 |

2010 |

Audit Committee (Chair) (Audit Committee Financial Expert)  Executive Committee  NESG Committee |

Tempur Sealy International, Inc. |

|

Kenneth J. Phelan Senior Advisor, Oliver Wyman, Inc. |

63 |

2019 |

Executive Committee  HR and Compensation Committee  Risk Oversight Committee (Chair) |

Adtalem Global Education Inc. |

|

David L. Porteous Attorney, McCurdy, Wotila & Porteous, P.C. and Independent Lead Director, Huntington |

70 |

2003 |

Executive Committee (Chair)  NESG Committee (Chair)  Risk Oversight Committee |

|

|

Roger J. Sit CEO, Global Chief Investment Officer, and Director, Sit Investment Associates, Inc. |

61 |

2021 |

NESG Committee  Risk Oversight Committee |

|

|

Stephen D. Steinour Chairman, President, and CEO, Huntington and President and CEO, Huntington Bank |

64 |

2009 |

Executive Committee |

Bath & Body Works, Inc. |

|

Jeffrey L. Tate CFO and Executive Vice President, Leggett & Platt |

53 |

2021 |

Audit Committee (Audit Committee Financial Expert) |

|

|

Gary Torgow Chairman, Huntington Bank |

66 |

2021 |

Community Development Committee |

DTE Energy Company |

|

|

|||||

| Huntington Bancshares Incorporated 2023 Proxy Statement | 15 |

Corporate Governance

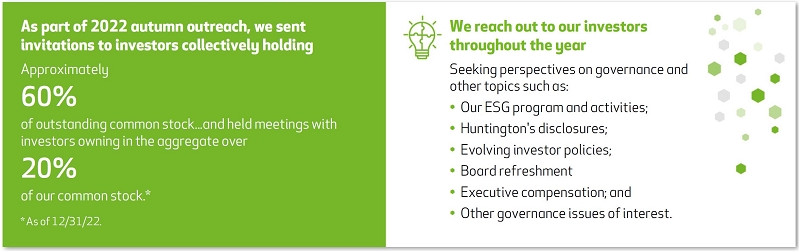

Huntington’s Board and executive management endeavor to keep pace with and exceed the constantly evolving corporate governance standards. As such, we have adopted many robust corporate governance practices that govern the Company and Board.

See page 36 for further information.

More detailed information about Huntington’s corporate governance framework and practices can be found in the Corporate Governance section of this year’s Proxy Statement. Within this section, shareholders can find information on matters such as our shareholder engagement efforts, Director independence, and Board leadership.

ESG

At Huntington, we believe that the evolving nature of ESG creates both risks that must be mitigated and opportunities to be seized. Therefore, we continue to seek ways to enhance and expand our ESG practices to benefit our stakeholders while transparently providing them with information discussing our progress.

See page 58 for further information.

The Company’s robust governance framework is complemented by our environmental and social practices, all of which make up our ESG program. At Huntington, we believe that it is not just about succeeding as an organization—how we succeed is equally important. This means being good stewards of the environmental resources we touch and impact; it also means planning for the future, particularly with respect to mitigating climate change and how we are impacting the communities in which we operate. This also includes our giving of time and resources and understanding how we can further DEI, both within our communities and the Company. The ESG section of the Proxy Statement contains a high-level overview of our various ESG practices. Shareholders are encouraged to review Huntington’s annual ESG Reports that further describe environmental, social, and governance matters at the Company.

Proposal 2Advisory Resolution to Approve, on a Non-Binding Basis, the Compensation of Executives as Described in the Proxy Materials |

|||

|

The Board and the HR and Compensation Committee believe that our compensation policies and procedures strongly align the interests of executives and shareholders. Further, our culture focuses executives on sound risk management and appropriately rewards executives for performance. ► See page 67 for further information. |

|

Our Board recommends a vote FOR this proposal. |

|

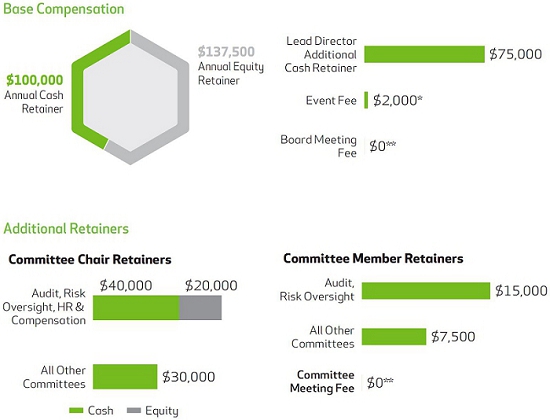

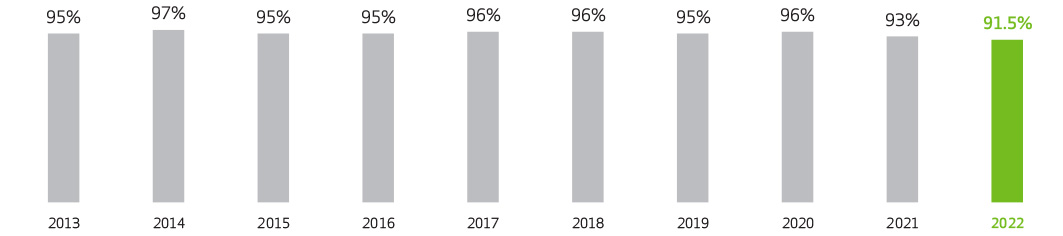

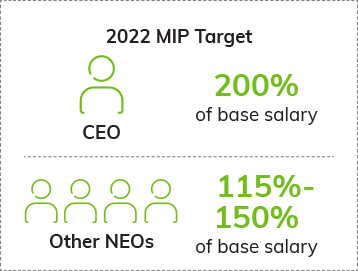

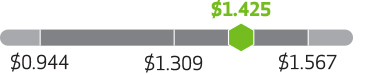

The following highlights Huntington’s executive compensation practices, which are designed to incentivize not only success, but succeeding the right way. Plans are intended to encourage prudent risk taking while balancing both short- and longer-term wins. Shareholders should look to the Compensation of Executive Officers, including the CD&A, for detailed information on our pay-for-performance executive compensation structure.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 16 |

2022 Compensation Program

|

|

Target Compensation Mix(1) |

|

Description |

|

|

|

CEO |

Other NEOs (Average) |

||

|

|

Base Salaries |

|||

|

|

|

|

|

Fixed component representing 12.5% of aggregate total target compensation for our CEO and 24.8% for our other NEOs |

|

Annual Incentive Plan (Management Incentive Plan) |

||||

|

|

|

Annual incentive plan with overall performance at 184.0% of target. As further described in the CD&A, the HR and Compensation Committee exercised negative discretion when certifying funding to reduce funding to 155.0% of target. Annual performance-based compensation based on:  EPS(2)  Operating Leverage(2)  PTPP Earnings Growth(2) |

|

|

Long-Term Incentive Plan |

||||

|

|

|

Awards of long-term incentive grants comprised of:  PSUs (55% for CEO, 50% for other NEOs; based on Relative and Absolute ROTCE(2) + new revenue adjuster for the three-year 2022 – 2024 cycle)  RSUs (45% for CEO, 50% for other NEOs) |

|

|

(1)

Based on annualized base salaries. Excludes Mr. Standridge, who only received a partial-year salary beginning with his employment on April 11, 2022. Mr. Standridge did not receive a Huntington 2022 LTIP award, but he did receive a one-time grant of RSUs in order to compensate Mr. Standridge for certain equity payments he forfeited as a result of accepting the opportunity with Huntington. For additional detail, see 2022 Compensation Decisions for Each Named Executive Officer in the CD&A. Including Mr. Standridge with his target MIP and target LTIP as a percentage of his base annualized salary, the non-CEO NEO compensation percentages would be: Base Salary (23.4%), Annual Incentive Plan (28.3%) and LTIP (48.3%). Note that some percentages may not add up to 100% due to rounding. (2)

Non-GAAP, see Appendix A to this proxy statement for more information. |

||||

Executive Compensation Best Practices

|

What We Do |

|

What We Do Not Do |

||

|

Significant stock ownership (10X salary for CEO) |

|

|

No repricing of previously-granted stock options without shareholder approval |

|

Significant emphasis on performance-based compensation, with the majority dependent upon long-term performance |

|

|

No perquisite or excise tax gross-ups upon change in control |

|

Annual assessment of compensation programs to compare them to those of our peers and market best practices |

|

|

No single-trigger vesting of equity awards upon change in control |

|

Balanced portfolio of metrics that drive annual and long-term goals in a risk appropriate manner |

|

|

No hedging or pledging of Huntington securities by executives or Directors |

|

PSUs make up 55% of total annual LTI grant value for CEO and 50% for other NEOs |

|

|

No dividend or dividend equivalents paid on equity grants prior to vesting |

|

All incentive compensation, including vested and paid compensation, is subject to a robust Recoupment Policy |

|

|

No incentive plans encourage excessive risk taking |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 17 |

Proposal 3Advisory Resolution to Approve, on a Non-Binding Basis, the Frequency of Future Advisory Votes on Executive Compensation |

|||

|

The Board believes that the interests of our shareholders are best served by continuing to hold say-on-pay votes annually as this holds our executives accountable for the actions they take each year. ► See page 111 for further information. |

|

Our Board recommends a vote for 1 YEAR. |

|

Shareholders are being requested to express their preference on how frequently we present the say-on-pay proposal to shareholders for a vote. Shareholders have the option to vote for every one, two, or three years. More information can be found under Proposal 3 — Advisory resolution to approve, on a non-binding basis, the frequency of future advisory votes on executive compensation.

Proposal 4Ratification of the Appointment of the Independent Registered Public Accounting Firm for 2023 |

|||

|

The Board and the Audit Committee believe that the continued retention of PwC to serve as our independent registered public accounting firm is in the best interests of the Company and its investors. The Audit Committee will reconsider the appointment of PwC if its selection is not ratified by the shareholders. ► See page 112 for further information. |

|

Our Board recommends a vote FOR this proposal. |

|

Shareholders are being requested to ratify PwC as the Company’s independent auditors for 2023. Information about PwC, our engagement arrangement, and the fees paid can be found under Proposal 4 — Ratification of the Appointment of the Independent Registered Public Accounting Firm for 2023.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 18 |

Election of Directors

Proposal 1Election of Directors |

|||

|

The Board proposes the election of 13 individuals as Directors at this annual meeting. Directors elected at the meeting will each serve a one-year term until the 2024 Annual Meeting and until their successors are duly elected and qualify or their earlier resignation or removal. We have no reason to believe that any nominee will be unable or unwilling to serve as a Director if elected. If, however, any of these nominees should become unavailable, the Board may decrease the number of Directors pursuant to our Bylaws or may designate a substitute nominee, for whom shares represented by a properly submitted proxy would be voted. |

|

The Board recommends a vote FOR the election of each of the nominees for Director. |

Shareholders are being requested to vote on a proposal to elect 13 nominees as Directors of Huntington. The Board recommends that you vote FOR each nominee because they bring to our Board an effective variety of skills, knowledge, experience, and perspectives. Each nominee is a proven leader within their respective fields and industries.

After consideration of the current composition of the Board, the results of the annual Board evaluation, and the Company’s strategic objectives and goals, the Board, upon consultation with the NESG Committee, has nominated the following individuals, each of whom is currently serving, for election at the 2023 Annual Meeting of Shareholders:

|

Alanna Y. Cotton |

Katherine M. A. (Allie) Kline |

Stephen D. Steinour |

|

Ann B. (Tanny) Crane |

Richard W. Neu |

Jeffrey L. Tate |

|

Gina D. France |

Kenneth J. Phelan |

Gary Torgow |

|

J. Michael Hochschwender |

David L. Porteous |

|

|

Richard H. King |

Roger J. Sit |

|

Pursuant to Huntington’s Bylaws, all Directors shall serve a one-year term until the 2024 Annual Meeting and until their successors are duly elected and qualify or their earlier resignation or removal. Pursuant to the Board’s mandatory retirement age, Beth Ardisana was not eligible for renomination this year, and accordingly, she has not been nominated. Additionally, Bob Cubbin was not renominated this year.

The General Information on Voting and the Annual Meeting section of the Proxy Statement contains information on how to nominate and recommend individuals for directorship.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 19 |

Diversity & Inclusion on the Board

The Board understands the importance of and is committed to maintaining a diverse group of Directors who can bring their unique and individual experiences, talents, and points of view to the boardroom. By ensuring its membership is diverse, the Board is setting the tone at the top with respect to DEI.

Our nominees for directorship represent a well-rounded diversity of backgrounds, skills, knowledge, experience, perspectives, and characteristics. All our nominees are seasoned leaders. We also have a mix of newer and longer-term Directors among the nominees. As of the 2023 Annual Meeting, the average tenure of our Director nominees will be approximately 6 years, and the nominees will range in age from 50 to 70 years.

The Board believes that its membership should be diverse with respect to gender, race, and ethnicity. By maintaining diversity within the boardroom, the Board is setting the tone at the top and supporting the Company's DEI efforts.

To further demonstrate its commitment to diversity and to memorialize the practices already taking place, at the beginning of 2022, the Board amended the Corporate Governance Guidelines to adopt a version of the Rooney Rule, which states that the NESG Committee will include highly qualified candidates who reflect diverse backgrounds (including diversity of gender, race, and ethnicity) in the pool from which nominees are chosen. Any third-party firms or consultants used to compile a pool of candidates will be required to include a diverse slate.

The Board measures the success and efficacy of these refreshment practices by the levels of diversity the Board is able to maintain on an ongoing basis.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 20 |

Board Skills, Experience and Diversity

A summary of the qualifications and attributes as self-identified by our Director nominees is presented below.

|

Board Diversity Matrix (As of April 19, 2023)* |

||

|

Total Number of Continuing Directors |

13** |

|

|

|

Female |

Male |

|

Gender: |

|

|

|

Number of Directors based on gender identity |

4 |

9 |

|

Number of Directors who identify in any of the categories below: |

|

|

|

African American or Black |

1 |

1 |

|

Asian |

0 |

1 |

|

White |

3 |

7 |

|

Individual Director Characteristics |

||||||||||||||

|

|

|

Cotton |

Crane |

France |

Hochs- |

King |

Kline |

Neu |

Phelan |

Porteous |

Sit |

Steinour |

Tate |

Torgow |

|

Skills & Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit/Financial Reporting |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Client/Consumer Marketing, Branding & Communication |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation & Human Capital Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government, Public Policy & Regulatory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Company Executive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Planning/M&A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology, Cybersecurity & Information Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenure (Years) |

|

3 |

12 |

6 |

6 |

1 |

4 |

13 |

3 |

19 |

1 |

14 |

1 |

1 |

|

Total Number of Public Company Boards |

|

1 |

1 |

3 |

1 |

1 |

2 |

2 |

2 |

1 |

1 |

2 |

1 |

2 |

|

Age (Years) |

|

50 |

66 |

64 |

62 |

67 |

51 |

67 |

63 |

70 |

61 |

64 |

53 |

66 |

|

Gender (Male (M)/Female (F)/Non-Binary (NB)) |

|

F |

F |

F |

M |

M |

F |

M |

M |

M |

M |

M |

M |

M |

|

LGBTQ+ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Race/Ethnicity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

African American or Black |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

White |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The “as of” date reflects the date of the 2023 Annual Meeting. The Director questionnaires were due back to Huntington on January 13, 2023.

This matrix only includes those Directors who were nominated for election at the 2023 Annual Meeting by the NESG Committee and Board. Because Director Ardisana and Director Cubbin were not nominated this year, they are not included in the matrix.

| Huntington Bancshares Incorporated 2023 Proxy Statement | 21 |

The following are descriptions of the skills that the Board believes are critical to the effective oversight of the Company. We also describe how each impacts our strategy, Purpose, Vision, or Board oversight.

|

|

|

|

|

|

|

|

|

|

Audit/Financial Reporting |

|

Prior experience working in finance, accounting, and/or audit, internally or externally, or otherwise qualifying as an Audit Committee Financial Expert. As a bank holding company with multiple subsidiaries and business lines, it is important to have Directors who understand auditing and financial reporting requirements. |

|

|

|

|

Client/Consumer Marketing, Branding & Communication |

|

Experience leveraging technology to improve the customer experience online and in-store and driving omnichannel experiential initiatives. Customer marketing and branding experience with digital mindset. We look out for people, and it is important to have Directors who understand the channels and strategies we use to connect to our customers. |

|

|

|

|

Compensation & Human Capital Management |

|

Experience aligning compensation with strategy and performance, tying compensation to behaviors, and ensuring compensation plans do not encourage excessive risk taking. Experience developing a strong corporate culture and focusing on colleague engagement. Experience in human capital management. Looking out for people includes our colleagues, and having Directors with these skills helps ensure the Board is better able to oversee this area. |

|

|

|

|

ESG |

|

Experience with ESG practices, from a sustainability and/or reporting perspective, with a focus on leadership in modern board practices and corporate governance. We are continually striving to further integrate and advance ESG throughout the Company. Having Directors who understand the different facets of ESG is important to the Board’s ability to oversee this rapidly changing field. |

|

|

|

|

Financial Services |

|

Experience with capital markets or financial market products and services and an understanding of payment platforms, models, systems, and technology. Financial services remain at the heart of our Vision to become the country’s leading people-first, digitally powered bank. It is important to have Directors who can oversee how we realize our Vision. |

|

|

|

|

Government, Public Policy & Regulatory |

|

Experience working closely with government officials at a local, state, or federal level; developing or leading public policy; or working in the government. Experience with regulators and regulatory issues. Banking and financial services are heavily regulated and are becoming more political in nature. Having Directors with this skill is important to the Board’s oversight. |

|

|

|

|

Legal |

|

Significant experience as a lawyer at a firm, with the government, or as in-house counsel with a track record of assessing risk, implementing appropriate mitigation measures, and advising business clients. We have established an aggregate moderate-to-low, through-the-cycle risk appetite, and having Directors with a legal background helps us avoid and mitigate certain risks. |

|

|

|

|

Public Company Executive |

|

CEO or other senior executive (direct report to CEO) of a publicly traded company. It is important to have proven leaders on the Board who can oversee the Company’s management team as they execute on our strategies and goals. |

|

|

|

|

Risk Management |

|

Deep experience with enterprise risk management principles and concepts as well as experience managing risk at a large, complex organization. Risk and risk management plays a significant role in our industry. As such, we have established an aggregate moderate-to-low, through-the-cycle risk appetite, and we need Directors with experience in avoiding and mitigating risks. |

|

|

|

|

Strategic Planning/M&A |

|

Experience leading complex mergers, acquisitions, or divestitures and direct involvement in the integration of people, systems, data, and operations. Strategic planning is important for any company, including Huntington, and we must be able to seize opportunities as they come. It is important that we have Directors who are able to oversee our business development planning activities and evaluation of opportunities. |

|

|

|

|

Technology, Cybersecurity & Information Security |

|

Knowledge in cybersecurity and information technology systems and developments, either through academia or industry experience. Experience leading technology strategy for a large organization or experience managing security risks at a large organization. A significant piece of our Vision is to be digitally powered. To help us achieve this portion of our Vision, the Board needs Directors with experience in these areas. |

|

|

| Huntington Bancshares Incorporated 2023 Proxy Statement | 22 |

Director Nominees

The following provides biographical information regarding each of the nominees, including the specific business experience, qualifications, attributes, and skills that were considered, in addition to prior service on the Board, when the Board determined to nominate them. As described in the following biographical information, each nominee brings significant experience to the Board and the committees on which they serve, leading to the Board's determination that each of the nominees is well qualified to serve as a Director on Huntington’s Board.

|

Alanna Y. Cotton |

|

Director since: 2019 Age: 50  Community Development Committee  Technology Committee |

Career Highlights  President and Chief Business Officer, Ferrero North America. Since September 2022, Ms. Cotton has been responsible for driving continued growth for Ferrero’s business in the U.S., Canada, and Caribbean, building upon its growing footprint and capabilities for iconic brands like Kinder, Butterfinger, Nutella, Tic Tac, Keebler, Famous Amos, and Mother's. Under her guidance, the company is expanding its capabilities in North America.  Former President of Operations, Central & Eastern Europe for The Coca-Cola Company. She joined The Coca-Cola Company in 2020 and became President of Operations for Central and Eastern Europe in January 2021.  Previously Ms. Cotton was Senior Vice President and General Manager, Product Marketing, with Samsung Electronics America, Inc. where she oversaw product commercialization and digital platform engagement from 2018 to 2020. She served as Samsung’s Vice President and General Manager, Mobile Computing, and Wearables from 2017 to 2018 and previously as Vice President, Marketing (Demand Generation), Tablets, Wearables, and PCs.  Served in various roles with PepsiCo, Inc. from 2004 to 2014, including Vice President, Brands from 2013 to 2014.

Began her career with Proctor & Gamble Company in 1996.  Has significant consumer product and technology experience and related marketing expertise with a consumer-centric focus.

Brings an extensive understanding of consumers (particularly millennials), their preferences, behaviors, and usage patterns, in support of advancing Huntington’s digital and mobile technology strategy, making her a valued member of the Board.

Education  Holds a bachelor’s degree in environmental engineering from Northwestern University and a master’s degree in business administration from Stanford University.

Key Experience and Skills:  Client/Consumer Marketing, Branding & Communication  Compensation & Human Capital Management  Financial Services  Government, Public Policy & Regulatory  Strategic Planning/M&A  Technology, Cybersecurity & Information Security |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 23 |

|

Ann B. (Tanny) Crane |

|

Director since: 2010 Age: 66  Audit Committee  Community Development Committee (Chair)  Executive Committee |

Career Highlights  President and CEO, Crane Group Company. Since 2003, she has led Crane Group Company, a privately-held, diversified portfolio company comprised of businesses primarily serving the manufacturing and services markets, as well as managing investments in private equity firms and real estate and bond portfolios. She joined the manufacturer Crane Plastics Company in 1987 as Director of Human Resources, and became Vice President of Sales and Marketing in 1993. She was named President in 1996.  Previously served as Product Manager for Quaker Oats from 1982 to 1987 where she managed all aspects of multiple product lines.  Appointed as a director for the Federal Reserve Bank of Cleveland in 2003. After serving as a director for five years, she was named chair of the board and served in that capacity for two years.  Served on the board for Wendy’s International from 2003 to 2007. Also served on the board for State Savings Bank from 1993 to 1998.  Widely recognized for her and her company’s philanthropy throughout Central Ohio.  An accomplished executive who brings a wealth of knowledge of the financial services industry, community support and investment, and leadership to our Board, all of which make her qualified to serve as a Director.

Education  Holds a bachelor’s degree in marketing and finance from The Ohio State University and a master of management in marketing and finance from the J.L. Kellogg Graduate School of Management at Northwestern University.

Key Experience and Skills:  Audit/Financial Reporting  Client/Consumer Marketing, Branding & Communication  ESG  Financial Services  Government, Public Policy & Regulatory  Strategic Planning/M&A |

|

Gina D. France |

|

Director since: 2016 Age: 64  Audit Committee  HR and Compensation Committee Other Current Public Company Directorships:  CBIZ, Inc.;  Cedar Fair, L.P. |

Career Highlights  CEO and President of France Strategic Partners LLC, a strategy and transaction advisory firm serving corporate clients across the country.  Before founding France Strategic Partners in 2003, served as a Managing Director of Ernst & Young LLP, where she led a national client-facing strategy group that worked exclusively with CEOs and their senior executive teams on corporate strategy, mergers and acquisitions, financial transactions, and value-creation strategies.  A strategic advisor to over 250 companies throughout the course of her career.  Has more than 40 years of strategy, investment banking, and corporate finance experience.  Served as an investment banker with Lehman Brothers in New York and San Francisco.  Served as the international cash manager of Marathon Oil Company.  Appointed a director of the BNY Mellon Family of Funds in 2019.  Previously served on the boards of FirstMerit Corporation, Dawn Food Products, Inc., and Mack Industries.  Serves as a director of the Cleveland Modern Dance Association and was a founding board member and treasurer of In Counsel with Women.  A seasoned corporate director and executive who brings many years of finance, investment banking, financial reporting, risk oversight, and corporate strategy experience to our Board and the committees on which she serves.

Education  Holds a bachelor’s degree in finance magna cum laude from Indiana University and a master of management in finance with the highest distinction from the J.L. Kellogg Graduate School of Management at Northwestern University.

Key Experience and Skills:  Audit/Financial Reporting  Compensation & Human Capital Management  ESG  Financial Services  Government, Public Policy & Regulatory  Risk Management  Strategic Planning/M&A |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 24 |

|

J. Michael Hochschwender |

|

Director since: 2016 Age: 62  HR and Compensation Committee  Technology Committee (Chair) |

Career Highlights  CEO of The Smithers Group, Inc., Akron, Ohio, a private group of companies that provides technology-based services to global clientele in a broad range of industries. He also served as its President until May 2021. Under his leadership since 1996, Smithers has experienced rapid growth, technological diversification, and geographic expansion through an aggressive series of acquisitions as well as organic growth.  Served as a director of FirstMerit Corporation for ten years and as a member of the audit committee and compensation committee.  Has three decades of corporate management and consulting experience.  Served five years in the U.S. Navy SEAL Teams, deploying to Southeast Asia and the Middle East and attaining the rank of Commander.  Active in local health, civic, and educational organizations, currently serving on the boards of Burton D. Morgan Foundation and the Tulane School of Science and Engineering.  Served on the boards of the Akron General Medical Center, the Greater Akron Chamber of Commerce, Ohio Foundation of Independent Colleges, Old Trail School, The American Council of Independent Laboratories, and The University of Akron Foundation.  Brings substantial leadership and executive experience, as well as business experience in the northeast Ohio market, making him qualified to serve on the Board.

Education  Holds a bachelor’s degree in biology and environmental studies from Tulane University and a master’s degree in business administration from the Wharton School of Business at the University of Pennsylvania.

Key Experience and Skills:  Audit/Financial Reporting  Compensation & Human Capital Management  ESG  Strategic Planning/M&A  Technology, Cybersecurity & Information Security |

|

Richard H. King |

|

Director since: 2021 Age: 67  Technology Committee |

Career Highlights  Began serving as Chairman of the Metropolitan Airports Commission in Minneapolis, Minnesota in July 2019.  Served in a variety of senior roles at Thomson Reuters, a global provider of intelligent information, from 2000 until his retirement in 2021, most recently serving as Managing Director of Operations from January 2020 until his retirement. Prior to that, he served as Executive Vice President and Chief Information Officer during 2019 and from 2015 to 2017; Executive Vice President, Operations from 2017 to 2019; Executive Vice President & Chief Operating Officer for Technology from 2012 to 2015; and Chief Technology Officer of Thomson Reuters Professional Division and Executive Vice President and Chief Operating Officer of Thomson West from 2008 to 2012.  Completed the National Association of Corporate Directors’ Cyber-Risk Oversight Program and received the CERT Certificate in Cybersecurity Oversight issued by the Software Engineering Institute at Carnegie Mellon University.  Serves as chair of the Technology Advisory Council for the State of Minnesota.  Brings significant cybersecurity and technological expertise, making him a valued Director on our Board.

Education  Holds bachelor's and master's degrees in education from the University of Vermont.

Other Prior Public Company Boards Within Five Years  Prior to the TCF Merger in June 2021, he served on the board of TCF (formerly Chemical Financial Corporation) since its 2019 merger with legacy TCF, the board of which he had served on since 2014.

Key Experience and Skills:  Compensation & Human Capital Management  Financial Services  Government, Public Policy & Regulatory  Public Company Executive  Strategic Planning/M&A  Technology, Cybersecurity & Information Security |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 25 |

|

Katherine M. A. (Allie) Kline |

|

Director since: 2019 Age: 51  NESG Committee  Technology Committee Other Current Public Company Directorships:  BILL Holdings, Inc. (formerly Bill.com Holdings, Inc.) |

Career Highlights  Founding Principal of LEO DIX, a boutique management consultancy.  Served as EVP and Chief Marketing and Communications Officer for Verizon Media, the Verizon Communications, Inc. subsidiary consisting of 20+ distinctive digital brands reaching one billion consumers, including AOL, HuffPost, MAKERS, TechCrunch, Tumblr, Yahoo, Yahoo Finance, and Yahoo Sports. She served in this role from 2015 to 2018 following Verizon’s acquisitions of AOL and Yahoo, where she was responsible for all consumer and B2B marketing, digital, communications, brand, and corporate citizenship. She simultaneously served as CEO of MAKERS.  Held the position of Chief Marketing and Communications officer for AOL from 2013 to 2015 prior to Verizon’s acquisition of AOL in 2015. From January 2013 until June 2015, she was the Chief Marketing Officer of AOL Platforms (a division of AOL).  Held the position of Chief Marketing Officer for 33 Across, a leading data and analytics company in the digital advertising space from 2011 to 2012. Held the position of Vice President, Marketing for Brand Affinity Technologies, a digital sports and celebrity endorsement marketing platform from 2008 to 2011.  A board member of the National Forest Foundation, serving on the executive committee.  Founded and chaired the board of trustees of Verizon Media’s Charitable Foundation and previously chaired the AOL Foundation. She also served on the executive committee for the Internet Advertising Bureau board of directors, and served on the board of The Female Quotient.  Held digital media and marketing leadership positions with Unicast (acquired by Sizmek), InterVU (acquired by Akamai Technologies), and the Washington Wizards.  Renowned for her business, marketing, and communications expertise with fast-growth companies, as well as cyber, M&A, transformations, and ESG/DEI/values leadership, all of which make her qualified to serve on our Board.

Education  Holds a bachelor’s degree in corporate communications from Ithaca College.

Other Prior Public Company Boards Within Five Years  Served on the board of Waddell & Reed Financial, Inc. from February 2020 to April 2021.  Served on the board of Pier 1 Imports, Inc. from September 2018 to October 2020.

Key Experience and Skills:  Client/Consumer Marketing, Branding & Communication  Compensation & Human Capital Management  ESG  Financial Services  Government, Public Policy & Regulatory  Public Company Executive  Strategic Planning/M&A  Technology, Cybersecurity & Information Security |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 26 |

|

Richard W. Neu |

|

Director since: 2010 Age: 67  Audit Committee (Chair)  Executive Committee  NESG Committee Other Current Public Company Directorships:  Tempur Sealy International, Inc. |

Career Highlights  Retired Chairman of MCG Capital Corporation. He served as chairman of the board from 2009 to 2015, until its sale to PennantPark Floating Rate Capital Ltd. He also served as CEO from October 2011 to November 2012. MCG was a Washington, D.C.-based publicly traded business development corporation providing financing to middle market companies throughout the United States. He first joined the MCG board in 2007 and served as a member of the audit, nominating and corporate governance, and valuation and investment committees.  Served as Executive Vice President, CFO, Treasurer, and director for both Charter One Financial, Inc. and Charter One Bank from 1995 to 2004. He assumed this role following the merger of First Federal of Michigan and Charter One Financial, Inc. He joined First Federal of Michigan in 1985 as CFO and was elected to the board in 1992.  Serves as the lead director, chair of the compensation committee, and as a member of the audit committee and nominating and governance committee on the board of Tempur Sealy.  Served on the board of the Dollar Thrifty Automotive Group from 2006 to 2012 until its sale to Hertz Corporation. He served as the lead director from December 2011 to November 2012 and served as chairman of the board from November 2010 to December 2011. He previously served as chairman of the audit committee and as a member of the corporate governance committee.  His professional experience includes seven years at a Big 4 public accounting firm, 20 years as a CFO of a major regional bank holding company, and 15 years in a variety of public company board roles.  Possesses a comprehensive knowledge of our bank markets, as well as extensive knowledge of the banking industry. He has led numerous bank acquisitions and integrations.  His knowledge and diverse business experience, as well as financial acumen, make him a valued member of the Board and as Chair of its Audit Committee.

Education  Holds a bachelor’s degree in business administration from Eastern Michigan University.

Other Prior Public Company Boards Within Five Years  Served on the board of Oxford Square Capital Corporation from 2016 to 2021.

Key Experience and Skills:  Audit/Financial Reporting  Compensation & Human Capital Management  ESG  Financial Services  Government, Public Policy & Regulatory  Public Company Executive  Risk Management  Strategic Planning/M&A |

| Huntington Bancshares Incorporated 2023 Proxy Statement | 27 |

|

Kenneth J. Phelan |

|

Director since: 2019 Age: 63

Executive Committee  HR and Compensation Committee  Risk Oversight Committee (Chair) Other Current Public Company Directorships:  Adtalem Global Education Inc. |

Career Highlights  Senior Advisor, Oliver Wyman, Inc., global management consulting firm, since 2019.  Served as CRO for the U.S. Department of the Treasury from 2014 to 2019. In this role he established the department’s Office of Risk Management to provide senior Treasury and other Administration officials with analysis of key risks, including credit, market, liquidity, operational, governance, and reputational risks across the department. He also served as Acting Director for the Office of Financial Research, an independent bureau within the Treasury Department charged with supporting the Financial Stability Oversight Council and conducting research about systemic risk.  Served as CRO for RBS Americas from 2011 to 2014.  Possesses broad risk oversight expertise as well as extensive knowledge of the banking industry.  His knowledge and experience strengthen the Board’s governance and risk oversight and make him a key member of the Risk Oversight Committee and the Board. He was determined by the Board to be a “risk management expert” under the Federal Reserve’s Regulation YY.

Education  Holds a master’s degree in economics from Trinity College in Dublin, Ireland and a juris doctor degree from Villanova University.

Key Experience and Skills:  Compensation & Human Capital Management  Financial Services  Government, Public Policy & Regulatory  Legal  Public Company Executive  Risk Management  Strategic Planning/M&A  Technology, Cybersecurity & Information Security |

|

David L. Porteous |

|

Director since: 2003 Age: 70 Lead Director

Committees:  Executive Committee (Chair)  NESG Committee (Chair)  Risk Oversight Committee |

Career Highlights  Attorney at McCurdy, Wotila & Porteous, P.C.  Practiced law for more than 40 years with a focus on business, corporate, and municipal law and government relations.  Prior to joining McCurdy, Wotila & Porteous in 2008, he managed his own law practice for more than 20 years.  A recognized authority on economic development and has served on the boards of the Michigan Economic Development Corporation; the Michigan Economic Growth Authority, where he was chairman of the executive committee; the Michigan Strategic Fund, where he was chairman; and the Michigan Chamber of Commerce.  Former director of the Federal Home Loan Bank of Indianapolis, where he chaired the audit committee.  Served on the board of trustees of Michigan State University, where he was chairman of the board from 2003 to 2006 and was a member of its finance and audit committees.  Served as a director of Jackson National Life Insurance of New York from 2002 to 2016, where he served as a member of the audit, risk, and compensation committees.  Brings significant legal, economic, and leadership experience to the Board and committees on which he serves.

Education  Holds a bachelor’s degree in criminal justice from Michigan State University and a juris doctor degree from Western Michigan University, Cooley Law School.