DEF 14A: Definitive proxy statements

Published on March 12, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Huntington Bancshares Incorporated

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

2021

Notice of Annual Meeting

and

Proxy Statement

|

March 11, 2021

Dear Fellow Shareholders:

We are pleased to invite you to the 2021 Annual Meeting of Shareholders to be held on Wednesday, April 21, 2021, at 2:00 pm Eastern Time virtually via webcast. Despite this year’s meeting being a virtual meeting, we hope that you will join and participate. We will consider the matters described in the following Notice of Annual Meeting and Proxy Statement and review highlights of the past year.

In 2020, we rose to the unprecedented challenges presented by living our purpose—to make people’s lives better, help businesses thrive, and strengthen the communities we serve. Guided by our purpose, we focused on the health and safety of our colleagues and customers, maintained our business resiliency, and continued to serve our customers and communities. We also focused on our strategic long-range plans to build the leading People-First, Digitally Powered bank with investments in customer experience, product differentiation, and key growth strategies. We continued to drive organic revenue growth, manage our expense growth to fund further investment, and delivered solid financial results and annual positive operating leverage on an adjusted basis for the eighth consecutive year.

On December 13 we announced a definitive agreement to acquire TCF Financial creating a top U.S. regional bank. The combined company positions Huntington for enhanced profitability and scale, revenue growth opportunities, significant cost synergies, and a strengthened market position driving increased long-term shareholder value. The merger is expected to close in the second quarter of 2021 subject to regulatory approvals, approval by the shareholders of each company, and customary closing conditions.

We remain grateful to our talented colleagues and our directors for their steadfast commitment, invaluable advice, and guidance throughout the year.

Details of the business to be conducted at the annual meeting and how to participate at the meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. Your vote is important to us. Whether or not you plan to attend the annual meeting, we encourage you to read the Proxy Statement carefully. Please vote via internet, telephone, or mail to ensure that your shares are represented.

Thank you for your support of Huntington.

Best wishes,

|

||||

|

|

||||

|

Stephen D. Steinour Chairman, President and CEO |

David L. Porteous Independent Lead Director |

||||

| 2021 Proxy Statement | 1 |

Notice of 2021 Annual Meeting of Shareholders

|

Date and Time Wednesday, April 21, 2021, at |

|

Location Online at http://www.meetingcenter. io/208317683 |

| Matters to be Voted Upon: | |||||

| Proposal 1 | Election of Directors |

|

FOR each director nominee | ||

|

Page 11 | ||||

| Proposal 2 | Advisory resolution to approve, on a non-binding basis, the compensation of executives as disclosed in the accompanying proxy statement |  |

FOR

|

Page 54 | |

| Proposal 3 | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021 |  |

FOR

|

Page 99 | |

| Proposal 4 | Approval of the Amended and Restated 2018 Long-Term Incentive Plan |  |

FOR

|

Page 104 | |

| Other business that properly comes before the meeting | |||||

Information for Shareholders Who Plan to Attend the 2021 Annual Meeting of Shareholders

Shareholders will be able to attend and participate in the Annual Meeting online, vote their shares electronically, and submit questions during the meeting by visiting: http://www.meetingcenter.io/208317683 at the meeting date and time. The password for the meeting is HBAN2021.

Record Date: Huntington shareholders as of the close of business on February 17, 2021, will be entitled to vote at our annual meeting and at any adjournments or postponements of the meeting.

Your vote is important. Please submit your proxy as soon as possible via the internet, mail, or telephone. If your shares are held by a broker, it is important that you provide instructions to your broker so that your vote is counted on all matters.

2021 Virtual Annual Shareholder Meeting

After careful consideration, the Board of Directors has determined to hold a virtual annual meeting in order to facilitate shareholder attendance and participation by enabling shareholders to participate from any location and at no cost. We believe this is the right choice given the current public health impacts of the COVID-19 pandemic and our desire to promote the health and safety of Huntington shareholders, as well as Huntington directors, officers, employees, and other constituents. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting http://www.meetingcenter.io/208317683 at the meeting date and time and using the password HBAN2021. The meeting webcast will begin promptly at 2:00 pm Eastern Time. If you experience technical difficulties during the check-in process or during the meeting please contact (888) 724-2416 (U.S. toll-free) or +1-781-575-2748 (outside of U.S.) for assistance.

By Order of the Board of Directors,

Lyndsey M. Sloan

Deputy General Counsel & Secretary March 11, 2021

How to Vote Your Shares

|

Online |

Registered holders – www.envisionreports.com/HBAN

Beneficial owners – www.proxyvote.com

|

By Phone |

Call the phone number at the top of your proxy card

|

By Mail |

Complete, sign, date and return your proxy card in the envelope provided

|

Online during the meeting |

Attend our annual meeting and vote during the online annual meeting

| Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 21, 2021. The proxy statement and annual report to shareholders are available at www.edocumentview.com/HBAN |

| 2 | Huntington Bancshares Incorporated |

| 2021 Proxy Statement | 3 |

Huntington Overview

We serve our customers through a banking network of over 800 retail branches as well as digital, telephone, and ATM banking capabilities.

We are building the Leading People-First, Digitally Powered Bank

We are creating a sustainable, competitive advantage with focused investment in customer experience, product differentiation, and key growth initiatives.

|

||

|

We are a purpose-driven company

Our purpose is to make people’s lives better, help businesses thrive, and strengthen the communities we serve. |

||

|

||

|

Drive organic growth across all business segments

• Deliver a superior customer experience through highly engaged colleagues, differentiated products, digital capabilities, market segmentation, and tailored expertise

• Leverage the value of our brand, our deeply-rooted leadership in our communities, and our market-leading convenience to efficiently acquire, deepen, and retain client relationships

Deliver sustainable, top quartile financial performance

• Drive diversified revenue growth while maintaining rigorous expense management discipline and maximizing returns on organic growth investments

• Minimize earnings volatility through the cycle

• Deliver top quartile returns on capital |

||

|

||

|

Be a source of stability and resilience through enterprise risk management and balance sheet strength

• Maintain an aggregate moderate-to-low, through-the-cycle risk profile

• Disciplined capital allocation and priorities |

||

|

||

|

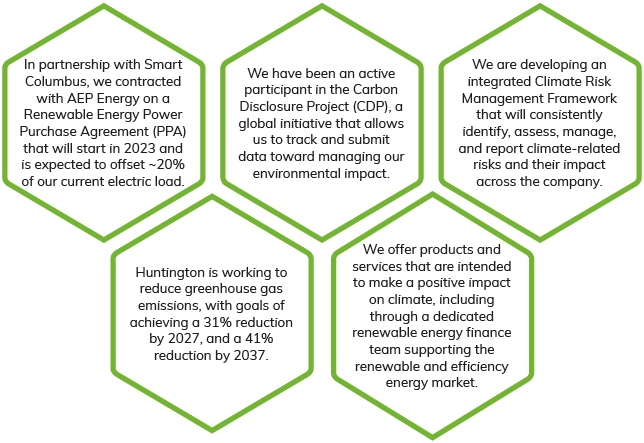

Our Commitment to ESG

We issued our 2019 Environmental, Social, and Governance (ESG) Report (our fourth ESG report) and our first report to address the Financial Stability Board’s Task Force on Climate-related Financial Disclosures’ (TCFD) recommendations, which should be reviewed as a companion piece to our 2019 ESG Report. (Neither report is part of or incorporated by reference into this proxy statement.) |

||

| 4 | Huntington Bancshares Incorporated |

Proxy Summary

Living our Purpose – 2020 Business Highlights

Make people’s lives better, help businesses thrive, and strengthen the communities we serve.

We have had an incredibly important role to play in 2020. Guided by our purpose, we actively worked to look out for our colleagues, customers, and community.

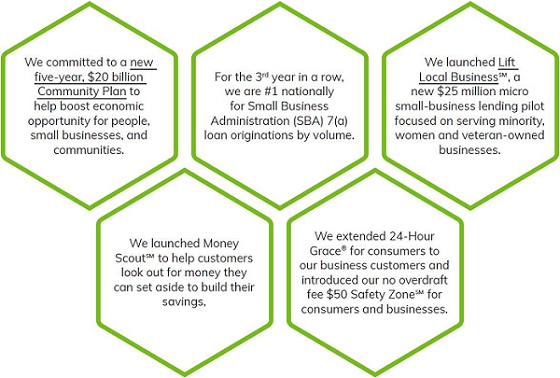

Looking out for Community

|

Committed to a new five-year, $20 billion Community Plan to help boost economic opportunity for people, small businesses, and communities throughout our seven-state footprint. |

|

Launched Lift Local Businesssm, a new $25 million micro small-business lending pilot focused on serving minority, women, and veteran-owned businesses. |

| • | Achieved 100% of goal in year 4 of 5-year $16.1 billion community development plan established in 2017. |

| • | # 1 nationally for Small Business Administration (SBA) 7(a) loan originations by volume (3rd year in a row)*. |

| • | # 1 originator, by volume, of SBA 7(a) loans within its footprint states for 12th year in a row.* |

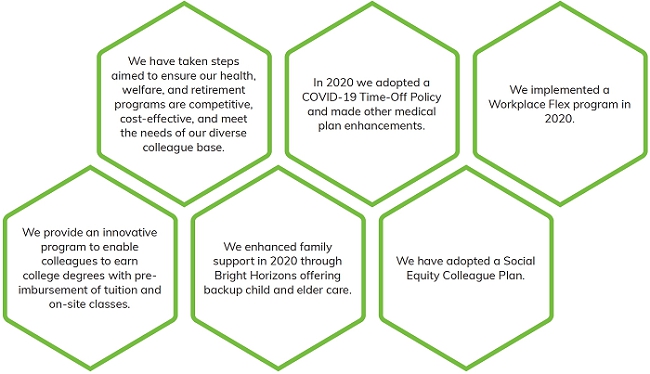

Looking out for Colleagues

|

Adopted COVID-19 Time Off policy and Medical plan enhancements |

|

Adopted Social Equity Colleague Plan to focus on culture and inclusion, development and career advancement, and talent experience. | |

|

Adopted Workplace Flex program |

|

Expanded our Diversity & Inclusion Policy Statement to Diversity, Equity & Inclusion | |

|

Enhanced family support with backup child and elder care |

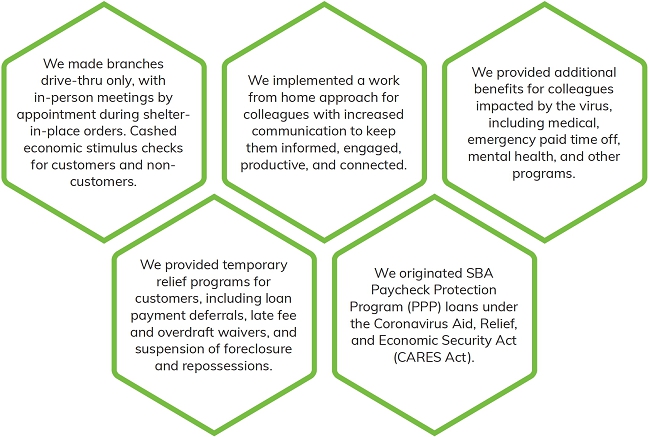

Looking out for Customers

| • | With a long history of Fair Play Banking- |

| • | Extended 24-Hour Grace® for consumers to our business customers | |

| • | Introduced our no overdraft fee $50 Safety Zonesm for consumers and businesses |

| • | Launched Money Scoutsm to help customers look out for money they can set aside to build their savings |

| • | More than 38,000 SBA Paycheck Protection Program (PPP) loans totaling more than $6.6Ibillion |

| • | Provided greater than $6.8 billion of forbearance to our borrowers during the 2020 second quarter |

| • | Upgraded our entire ATM network |

| * | Largest by number of 7(a) loans for SBA fiscal years 2018-2020; Source U.S. Small Business Administration. |

| 2021 Proxy Statement | 5 |

Proxy Summary

2020 Performance Highlights

The COVID-19 pandemic has caused and continues to cause significant, unprecedented disruption that affects daily living and negatively impacts the global economy. Huntington’s 2020 performance was most significantly impacted by COVID-19, the resulting recession and the impact of Current Expected Credit Losses (CECL), which impacted the provision for credit losses and in turn the earnings per share (EPS) results. Despite a challenging year, Huntington reported increases in revenue and Pretax Pre-Provision Earnings (PTPP), both at record levels.

Delivered positive operating leverage for the 8th consecutive year.(1)

|

|

|

||||

|

Revenue (FTE)(2) $4.8 billion

|

EPS $0.69

|

PTPP(3) $2.04 billion |

||||

|

|

|

|

||||

year-over-year |

year-over-year |

year-over-year |

||||

| • | Average loans increased $4.4 billion, or 6%, year-over-year |

| • | Average core deposits increased $8.7 billion, or 11%, year-over-year |

| • | Net interest margin of 2.99%, down 27 basis points from the prior year |

| • | Efficiency ratio(4) of 56.9%, up from 56.6% in the prior year |

| • | Net charge-off ratio of 57 basis points, up from 35 basis points in the prior year |

| • | Provision for credit losses of $1.0 billion, up from $287 million in the prior year |

| (1),(3),(4) | Non-GAAP, see Appendix A to this proxy statement for more information. |

| (2) | Non-GAAP, see page 50 of the company’s Form 10-K for the year ended December 31, 2020 for more information. |

| 6 | Huntington Bancshares Incorporated |

Proxy Summary

| Proposal 1 | |||

| Election of Directors |

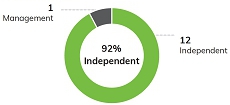

The board of directors proposes the election of thirteen directors at this annual meeting. All of our nominees are seasoned leaders. Collectively, they bring to our board an effective variety of skills, knowledge, experience, and perspectives. All of our non-employee directors are independent.

See page 11 for further information. |

||

|

|||

|

|

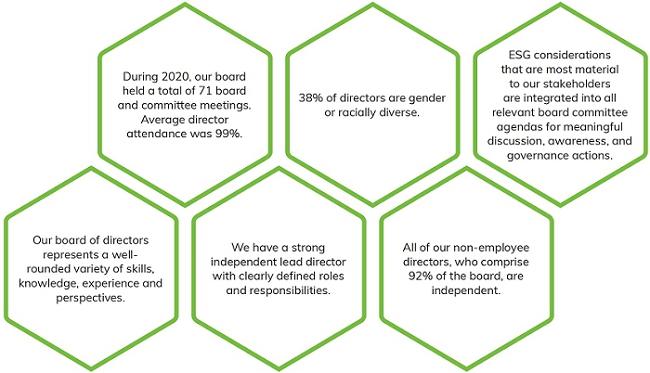

Board Key Facts

| 2021 Proxy Statement | 7 |

Proxy Summary

Board Nominees

A brief list of the nominees for the 2021 annual meeting is set forth below.

| Directors and Nominees | Age |

Director Since |

Committees | |

|

Lizabeth Ardisana CEO and principal owner, ASG Renaissance, LLC |

70 | 2016 |

• Community Development Committee • Risk Oversight Committee |

|

Alanna Y. Cotton President of Operations, Central & Eastern Europe, The Coca-Cola Company |

48 | 2019 |

• Community Development Committee • Technology Committee |

|

Ann B. (Tanny) Crane President and CEO, Crane Group Company |

64 | 2010 |

• Audit Committee • Community Development Committee (Chair) • Executive Committee |

|

Robert S. Cubbin Retired President and CEO, Meadowbrook Insurance Group |

63 | 2016 |

• Audit Committee • Compensation Committee (Chair) |

|

Steven G. Elliott Retired Senior Vice Chairman, BNY Mellon |

74 | 2011 |

• Compensation Committee • Executive Committee • Risk Oversight Committee (Chair) |

|

Gina D. France Chief Executive Officer and President, France Strategic Partners LLC |

62 | 2016 |

• Audit Committee • Compensation Committee |

|

J. Michael Hochschwender President and CEO, The Smithers Group |

60 | 2016 |

• Compensation Committee • Technology Committee |

|

John C. (Chris) Inglis Distinguished Visiting Professor of Cyber Studies at the U.S. Naval Academy |

66 | 2016 |

• Nominating and Corporate Governance Committee • Technology Committee (Chair) |

|

Katherine M. A. (Allie) Kline Former Chief Marketing and Communications Officer, Verizon Media |

49 | 2019 |

• Nominating and Corporate Governance Committee • Technology Committee |

|

Richard W. Neu Retired Chairman, MCG Capital Corporation |

65 | 2010 |

• Audit Committee (Chair) • Executive Committee • Nominating and Corporate Governance Committee |

|

Kenneth J. Phelan Senior Advisor, Oliver Wyman, Inc. |

61 | 2019 |

• Compensation Committee • Risk Oversight Committee |

|

David L. Porteous Attorney, McCurdy, Wotila & Porteous, P.C. and Independent Lead Director, Huntington |

68 | 2003 |

• Executive Committee (Chair) • Nominating and Corporate Governance Committee (Chair) • Risk Oversight Committee |

|

Stephen D. Steinour Chairman, President, and CEO, Huntington Bancshares Incorporated and The Huntington National Bank |

62 | 2009 | • Executive Committee |

| 8 | Huntington Bancshares Incorporated |

Proxy Summary

| Proposal 2 | |||

| Advisory resolution to approve, on a non-binding basis, the compensation of executives as disclosed in the accompanying proxy statement |

The Board of Directors and Compensation Committee believe that our compensation policies and procedures strongly align the interests of executives and shareholders. Further, our culture focuses executives on sound risk management and appropriately rewards executives for performance.

See page 54 for further information. |

||

|

|||

|

|

2020 Compensation Program

| Target Compensation Mix | ||||||

| CEO | Other NEOs | Description | ||||

| Base Salaries |

Fixed component representing 24% or less of targeted direct compensation for NEOs

|

|||||

|

|

|||||

| Annual Incentive Plan (Management Incentive Plan) |

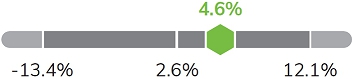

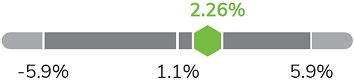

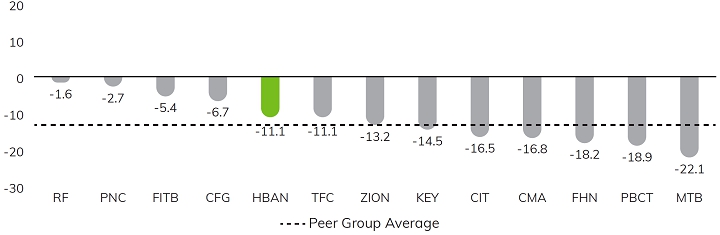

Annual incentive plan with overall adjusted performance at 95% of target on: • Earnings per share (EPS) - target of $1.349 • Operating leverage(1) - target of 1.10% • Pretax, Pre-Provision (PTPP)(2) growth - target of 2.6%

|

|||||

|

|

|

||||

| Long-Term Incentive Plan |

Awards of long-term incentive grants comprised of: • PSUs (55% for CEO, 50% for other NEOs) • Relative and Absolute ROTCE(3) for the cycle ending December 31, 2020 • Relative and Absolute ROTCE + “new revenue” adjustment for the cycle 2020 – 2022 • RSUs (20% for CEO, 25% for other NEOs) • Stock Options (25%) |

|||||

|

|

|||||

| (1),(2),(3) | Non-GAAP, see Appendix A to this proxy statement for more information. |

| 2021 Proxy Statement | 9 |

Proxy Summary

Executive Compensation Best Practices

|

|

|

| Proposal 3 | |||

| Ratification of the appointment of the independent registered public accounting firm for 2021 |

The Audit Committee and the board of directors believe that the continued retention of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm is in the best interests of the company and its investors. The Audit Committee will reconsider the appointment of PricewaterhouseCoopers LLP if its selection is not ratified by the shareholders.

See page 99 for further information. |

||

|

|||

|

|

| Proposal 4 | |||

| Approval of the Amended and Restated 2018 Long-Term Incentive Plan |

Huntington believes that its equity-based compensation plans have made a significant contribution to its success in attracting and retaining key employees and directors. The Amended 2018 Plan is being submitted to the shareholders for approval in order to comply with the applicable requirements of The Nasdaq Stock Market, Inc. Shareholder approval is also necessary under the federal income tax rules with respect to the qualification of incentive stock options.

See page 104 for further information. |

||

|

|||

|

|

| 10 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

The Board of Directors – Skills and Experience

The board of directors is committed to maintaining a well-rounded, skilled, and diverse board aligned with our company strategy to ensure overall board effectiveness and our long-term success. The Nominating and Corporate Governance Committee regularly assesses the composition of the board to assure that the appropriate knowledge, skills, and experience are represented. Candid and thorough self-assessment is also necessary to ensure that the board and board committees are productively and efficiently fulfilling their duties and to shape the board for Huntington’s continued success.

Nominees for Election

After consideration of the current composition of the board, the results of the annual self-assessment, and the company’s strategic objectives and goals, the board proposes the reelection of all 13 directors currently serving. The Nominating and Corporate Governance Committee recommended, and the board approved a waiver of the age limit for Steven G. Elliott and proposes the reelection of Mr. Elliott at the 2021 annual meeting. The decision

| 2021 Proxy Statement | 11 |

Corporate Governance and the Board

to waive the age limit for Mr. Elliott a third and final time was based on Mr. Elliott’s substantial financial services industry and risk management expertise as well as the institutional knowledge he has accumulated through oversight of the company’s risk management program as chair of the Risk Oversight Committee since 2011. As noted below under “Director Retirement Policy”, any waiver of the director age limit shall be based on special circumstances and may not be made with respect to any one person more than three times.

Strategic Goals and the Board’s Skill Set

Additions to the board within the last five years demonstrate our commitment to refreshment in correlation with strategy and emerging risks. In 2016, we appointed John C. (Chris) Inglis, a Distinguished Visiting Professor of Cyber Studies at the U.S. Naval Academy, to the board and Technology Committee. Mr. Inglis is a renowned expert and a frequent speaker on cybersecurity, a key risk for the banking industry. Three new board members, Alanna Cotton, Allie Kline, and Ken Phelan, were added in 2019 to align with our strategic focus on and in recognition of the rapid changes in technology. Ms. Cotton brings to the board an extensive background in brand development, product marketing, and innovation, and Ms. Kline brings significant expertise in consumer marketing, branding, and communication. These additions will help our board to position Huntington for further advancement of the company’s digital and mobile technology strategy, a key area of investment. Additionally, we further strengthened our risk oversight with the addition of banking and risk management expert Ken Phelan who recently served as the Chief Risk Officer for the U.S. Department of the Treasury. Mr. Phelan is a highly regarded risk leader with unique, broad-based experience across a spectrum of risks.

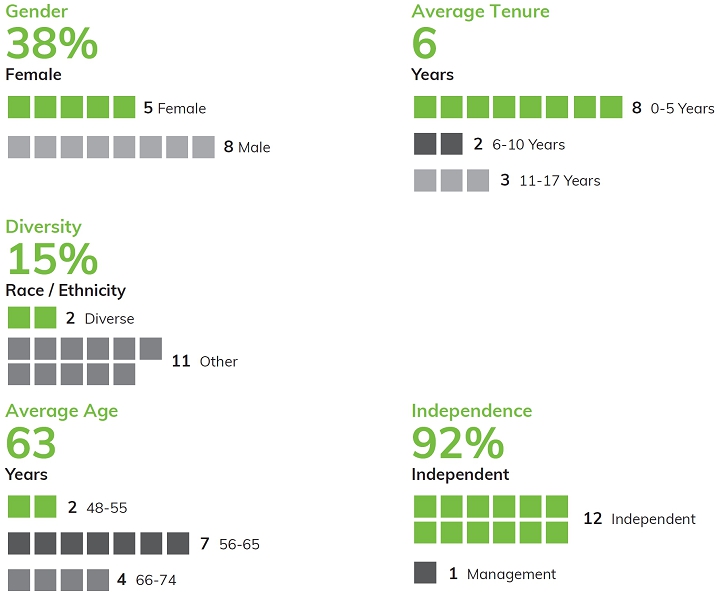

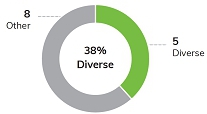

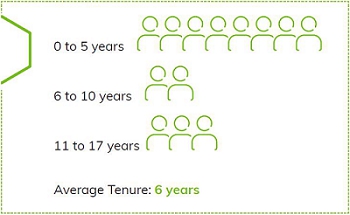

Diversity & Inclusion

Our nominees for director represent a well-rounded diversity of skills, knowledge, experience, and perspectives. All of our nominees are seasoned leaders. We also have a mix of newer and longer-term directors among the nominees. The average tenure of our director nominees is 6 years (as of the 2021 annual meeting). The director nominees range in age from 48 to 74 years.

| Gender & Ethnic Diversity | Average Tenure | |

|

|

|

| Average Age | Independence | |

|

|

| 12 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

Board Skills, Experience and Diversity

A graphic summary of the qualifications and attributes of our director nominees is presented below.

| Ardisana | Cotton | Crane | Cubbin | Elliott | France | Hochschwender | Inglis | Kline | Neu | Phelan | Porteous | Steinour | |

| Skills & Experience | |||||||||||||

| Audit / Financial Reporting |  |

|

|

|

|

|

|

|

|

||||

|

Client

/ Consumer Marketing, Branding & Communication |

|

|

|

|

|

||||||||

|

Compensation &

Human Capital Management |

|

|

|

|

|

|

|

|

|

|

|

||

| ESG |  |

|

|

|

|

|

|

||||||

| Financial Services |  |

|

|

|

|

|

|

|

|

||||

|

Government,

Public Policy & Regulatory |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legal |  |

|

|

||||||||||

| Payments |  |

|

|||||||||||

| Public Company Executive |  |

|

|

|

|

|

|||||||

| Risk Management |  |

|

|

|

|

|

|

|

|

||||

| Strategic Planning / M&A |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Technology / Cybersecurity |  |

|

|

|

|

|

|||||||

| Demographic Background | |||||||||||||

| Tenure (Years) | 4 | 1 | 10 | 4 | 10 | 4 | 4 | 4 | 2 | 11 | 1 | 17 | 12 |

| Age (Years) | 70 | 48 | 64 | 63 | 74 | 62 | 60 | 66 | 49 | 65 | 61 | 68 | 62 |

| Gender (Male/Female) | F | F | F | M | M | F | M | M | F | M | M | M | M |

| Race/Ethnicity | |||||||||||||

| African American/Black |  |

||||||||||||

| Hispanic |  |

||||||||||||

| Caucasian/White |  |

|

|

|

|

|

|

|

|

|

|

| 2021 Proxy Statement | 13 |

Corporate Governance and the Board

|

Audit / Financial Reporting | Prior experience working in finance, accounting, and / or audit, internally or externally. |  |

|

Client / Consumer Marketing, Branding and Communication | Experience leveraging technology to improve the customer experience online and in-store and drive omni-channel experiential initiatives. Customer marketing and branding experience with digital mindset. |  |

|

Compensation & Human Capital Management | Experience aligning compensation with strategy and performance, tying compensation to behaviors, and ensuring compensation plans do not encourage excessive risk taking. Experience developing a strong corporate culture and focusing on employee engagement. Experience in human capital management. |  |

|

ESG | Experience with ESG practices, from a sustainability and / or reporting perspective, with a focus on leadership in modern board practices and corporate governance. |  |

|

Financial Services | Experience with financial market products and services. |  |

|

Government, Public Policy & Regulatory | Experience working closely with government officials at a local, state or federal level, developing or leading public policy, or working in the government. Experience with regulators and regulatory issues. |  |

|

Legal | Significant experience as a lawyer at a firm, with the government, or as in-house counsel with a track record of assessing risk, implementing appropriate mitigation measures, and advising business clients. |  |

|

Payments | Strong understanding of payment platforms, models, systems, and technology. |  |

|

Public Company Executive | CEO or other senior executive (direct report to CEO) of a publicly traded company. |  |

|

Risk Management | Deep experience with enterprise risk management principles and concepts as well as experience managing risk at a large, complex organization. |  |

|

Strategic Planning / M&A | Experience leading complex mergers, acquisitions, or divestitures and direct involvement in the integration of people, systems, data, and operations. |  |

|

Technology, Cybersecurity & Information Security | Expertise in cybersecurity and information technology systems and developments, either through academia or industry experience. Experience leading technology strategy for a large organization or experience managing security risks at a large organization. |  |

| 14 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

Director Nominees

The following provides biographical information regarding each of the nominees, including the specific business experience, qualifications, attributes and skills that the directors considered, in addition to prior service on the board, when the board determined to nominate them.

|

Lizabeth Ardisana

Director since: 2016 Age: 70

Committees: Community Development Committee

Other Current Public Clean Energy Fuels Corp.

|

• Chief Executive Officer and the principal owner of the firm ASG Renaissance, LLC which Ms. Ardisana founded in 1987. ASG Renaissance is a technical and communication services firm. ASG Renaissance has more than 23 years of experience providing services to a wide range of clients in the automotive, environmental, defense, construction, healthcare, banking, and education sectors. • Chief Executive Officer of Performance Driven Workforce, LLC, a scheduling and staffing firm which was founded in 2015 and has since expanded into five states. • Hispanic and female business owner; an active business and civic leader in Michigan. • Held numerous leadership positions in a variety of non-profit organizations, Skillman Foundation, CS Mott Foundation, Kettering University, Metropolitan Affairs Coalition and Focus: Hope • Appointed by the governor of Michigan to the executive board of the Michigan Economic Development Corporation and chairs its finance committee. • Vice chair of the Wayne State University Physicians Group where she serves on the audit committee. • Holds a bachelor’s degree in mathematics and computer science from the University of Texas, a master’s degree in mechanical engineering from the University of Michigan and a master’s degree in business administration from the University of Detroit. • Serves on the board of directors of Clean Energy Fuels Corp. Member of the board of directors of Citizens Republic Bancorp, Inc. from 2004 to 2013, and a member of the board of directors of FirstMerit Corporation from 2013 to 2016. • Brings significant leadership experience to the board.

Key Experience and Skills:

|

||

|

|

||||

|

|

|

Alanna Y. Cotton

Director since: 2019 Age: 48

Committees: Community Development Committee Technology Committee

|

• President of Operations, Central & Eastern Europe, The Coca-Cola Company. Ms. Cotton joined The Coca-Cola Company in 2020 and became President of Operations for Central and Eastern Europe in January 2021. • Previously Ms. Cotton was Senior Vice President and general manager, product marketing, with Samsung Electronics America, Inc. where she oversaw product commercialization and digital platform engagement from 2018 to 2020. She served as Samsung’s vice president and general manager, mobile computing and wearables from 2017 – 2018 and previously as vice president, marketing (demand generation), tablets, wearables and PCs. • Served in various roles with PepsiCo, Inc. from 2004 to 2014, including vice president, brands from 2013 to 2014. Began her career with Proctor & Gamble Company in 1996. • Holds a master’s degree in business administration from Stanford University. • Has significant consumer product and technology experience and related marketing expertise with a consumer-centric focus. • Brings an extensive understanding of consumers (particularly millennials), their preferences, behaviors and usage patterns, in support of advancing Huntington’s digital and mobile technology strategy.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 2021 Proxy Statement | 15 |

Corporate Governance and the Board

|

Ann B. (Tanny) Crane

Director since: 2010 Age: 64

Committees: Audit Committee

|

• President and Chief Executive Officer, Crane Group Company. Since 2003, she has led Crane Group Company, a privately-held, diversified portfolio company comprised of businesses primarily serving the manufacturing and services markets, as well as managing investments in private equity firms and real estate and bond portfolios. She joined the manufacturer, Crane Plastics Company, in 1987 as director of human resources, and became vice president of sales and marketing in 1993. She was named president in 1996. • Previously served as Product Manager for Quaker Oats from 1982 to 1987 where she managed all aspects of multiple product lines. • Appointed as a director for the Federal Reserve Bank of Cleveland in 2003. After serving as a director for five years, she was named chair of the board and served in that capacity for two years. • Served on the board of directors for Wendy’s International from 2003 to 2007. Also served on the board of directors for State Savings Bank from 1993 to 1998. • Holds a bachelor’s degree in marketing and finance from The Ohio State University and a Masters of Management in marketing and finance from the J.L. Kellogg Graduate School of Management at Northwestern University. • Widely recognized for her and her company’s philanthropy throughout Central Ohio. • An accomplished executive who is knowledgeable of the financial services industry and is deeply involved in community support and investment. • Because of her knowledge and experience, she has been selected to serve on the Audit Committee, the Community Development Committee, and the Executive Committee.

Key Experience and Skills:

|

||

|

|

||||

|

|

Robert S. Cubbin

Director since: 2016 Age: 63

Committees: Audit Committee

Other Current Public Kelly Services, Inc.

|

• Retired President and Chief Executive Officer of Meadowbrook Insurance Group. He retired in 2016 following a 30-year career with Meadowbrook Insurance Group during which he held various management positions. He joined the company as vice president and general counsel, primarily responsible for all legal and regulatory affairs. He was promoted to executive vice president in 1996 and then to president and chief operating officer in 1999, primarily responsible for all operational functions within the company. He became chief executive officer in 2001. While with Meadowbrook, he led the formation of the firm’s insurance company subsidiaries, their initial capital raising efforts and ultimately led the company’s initial public offering and registration of its stock on the NYSE. He managed all negotiations, due diligence, integration and regulatory matters relative to dozens of acquisitions over his career. He served as a director of Meadowbrook Insurance Group, Inc., including the time-period during which Meadowbrook was a public company. • Served on the board of directors of Citizens Republic Bancorp, Inc. from 2008 to 2013 and on the board of directors of FirstMerit Corporation from 2013 to 2016. • Served as the chair of the audit committee at Citizens Republic Bancorp, Inc. • Serves on the board of Kelly Services, Inc. since 2014, where he is a member of the audit committee and chair of the compensation and talent committee. • Served as a board member, executive committee member, and chair of the finance and investment committee of Business Leaders for Michigan, a non-profit organization, comprised of the state’s senior executives of the state’s largest job providers, which is focused on driving business development and economic change in the State of Michigan. • Holds a Bachelor of Arts in psychology from Wayne State University, and a Juris Doctor degree from Detroit College of Law. • A licensed attorney and member of the State Bar of Michigan. • A broadly experienced executive who brings many years of expertise and leadership to our board and the committees on which he serves.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 16 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

|

Steven G. Elliott

Director since: 2011 Age: 74

Committees: Compensation

Other Current Public PPL Corporation

|

• Retired Senior Vice Chairman, BNY Mellon. He began a 23-year career with BNY Mellon in 1987 as head of finance for Mellon Financial Corporation. He was named chief financial officer in 1990, vice chairman in 1992, and senior vice chairman in 1998. He also served as a director of Mellon Financial Corporation from 2001 until the merger with The Bank of New York in July 2007. He was then a director of BNY Mellon through July 2008. While at Mellon, he led a number of the company’s servicing businesses and was co-leader of the integration of The Bank of New York and Mellon Financial Corporation when they merged in 2007. He led strategic acquisitions, divestitures, and restructurings, and he also held various business leadership roles in asset servicing, securities lending, foreign exchange, capital markets, global cash management, technology and institutional banking. • Served as chief financial officer of First Commerce Corporation, corporate controller of Crocker National Bank, senior vice president of Continental Illinois National Bank, and corporate controller of United California Bank. • A certified public accountant (inactive). • Has substantial public company director experience with Fortune 500 companies, currently serving on the board of PPL Corporation where he chairs the audit committee and serves on the executive and finance committees. • Served on the board of Alliance Bernstein, from 2011 to 2017, where he was lead director and chair of the audit committee and served on its executive and compensation committees. • Holds a bachelor’s degree in finance from the University of Houston and a masters of management in finance with the highest distinction from the J.L. Kellogg Graduate School of Management at Northwestern University. • As a seasoned financial services executive with many years of experience as chief financial officer for large financial services organizations, he brings valuable insight and advice to our board and to his role as chairman of the board’s Risk Oversight Committee, where his experience contributes to building strong and effective risk management.

Key Experience and Skills:

|

||

|

|

||||

|

|

|

Gina D. France

Director since: 2016 Age: 62

Committees: Audit Committee

Other Current Public Cedar Fair LP;

|

• Chief Executive Officer and President of France Strategic Partners LLC, a strategy and transaction advisory firm serving corporate clients across the country. • Before founding France Strategic Partners LLC in 2003, served as a managing director of Ernst & Young LLP, where she led a national client-facing strategy group that worked exclusively with CEOs and their senior executive teams on corporate strategy, mergers and acquisitions, financial transactions, and value-creation strategies. • A strategic advisor to over 250 companies throughout the course of her career. • Has more than 35 years of strategy, investment banking, and corporate finance experience. • Served as an investment banker with Lehman Brothers in New York and San Francisco. • Served as the international cash manager of Marathon Oil Company. • Currently serves on corporate boards: Cedar Fair LP (audit committee chair) and CBIZ, Inc. Previously served on the boards of FirstMerit Corporation, Dawn Food Products, Inc., and Mack Industries. • Appointed a director of the BNY Mellon Family of Funds in 2019. • A trustee of Baldwin Wallace University and the Cleveland Modern Dance Association and was a founding board member and treasurer of In Counsel with Women. • Holds a bachelor’s degree in finance magna cum laude from Indiana University and a master of management in finance with the highest distinction from the J.L. Kellogg Graduate School of Management at Northwestern University. • A seasoned corporate director and executive who brings many years of finance, investment banking, financial reporting, risk oversight and corporate strategy experience to our board and the committees on which she serves.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 2021 Proxy Statement | 17 |

Corporate Governance and the Board

|

J. Michael Hochschwender

Director since: 2016 Age: 60

Committees: Compensation |

• President and Chief Executive Officer of The Smithers Group, Inc., Akron, Ohio, a private group of companies that provides technology-based services to global clientele in a broad range of industries. Under his leadership since 1996, Smithers has experienced rapid growth, technological diversification, and geographic expansion through an aggressive series of acquisitions as well as organic growth. • Served as a director of FirstMerit Corporation for ten years and as a member of the audit committee and compensation committee. • Has more than 20 years of corporate management and consulting experience. • Holds a master’s degree from the Wharton School of Business at the University of Pennsylvania and a bachelor’s degree from Tulane University. • Served five years in the U.S. Navy SEAL Teams, deploying to Southeast Asia and the Middle East. • Active in local health, civic, and educational organizations, currently serving on the boards of Burton D. Morgan Foundation and The University of Akron Foundation. • Served on the boards of the Akron General Medical Center, the Greater Akron Chamber of Commerce, Ohio Foundation of Independent Colleges, Old Trail School, and The American Council of Independent Laboratories. • Brings substantial leadership and executive experience to the board of directors as well as business experience in the northeast Ohio market.

Key Experience and Skills:

|

||

|

|

||||

|

|

John C. (Chris) Inglis

Director since: 2016 Age: 66

Committees: Nominating and

Other Current Public FedEx Inc.

|

• Currently a Distinguished Visiting Professor of Cyber Studies at the U.S. Naval Academy. • Served for 28 years at the National Security Agency (NSA) as a computer scientist and operational manager, retiring in 2014 as the Agency’s deputy director and senior civilian leader. In this role, he acted as the NSA’s chief operating officer responsible for guiding and directing strategies, operations and policy. • Served for 30 years in the U.S. Air Force (9 years active, followed by 21 years in the reserve component), from which he retired as Brigadier General in 2006. • His military service included command at the squadron, group, and joint force headquarters and he holds a Command Pilot rating. • Currently serving on the U.S. Cyber Solarium Commission, charged by the U.S. Congress with making recommendations for U.S. national cyber strategy. • Managing director at Paladin Capital. • Serves as a director of FedEx Inc. and previously served as a director of KEYW Corp. • Served on, or co-chaired, three U.S. Department of Defense Science Board studies on cyber threat and strategy. • Holds advanced degrees in engineering and computer science from Columbia University, Johns Hopkins University, and the George Washington University. He is also a graduate of the J.L. Kellogg Graduate School of Management at Northwestern University executive development program, the USAF Air War College, Air Command and Staff College, and Squadron Officers’ School. • His leadership and his expertise in cybersecurity strengthen the governance of the board and the Technology Committee.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 18 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

|

Katherine M. A. (Allie) Kline

Director since: 2019 Age: 49

Committees: Nominating and

Other Current Public Bill.com Holdings, Inc.

|

• Founding principal of LEO DIX, a boutique services firm that helps CEOs, boards and c-suite executives drive growth during times of disruption, transition, transformation, and turnarounds. • Served as Chief Marketing and Communications Officer for Verizon Media, the Verizon Communications, Inc. subsidiary consisting of 20+ distinctive digital brands reaching one billion consumers including AOL, HuffPost, MAKERS, TechCrunch, Tumblr, and the Yahoo family of brands. She served in this role following Verizon’s acquisition of Yahoo from 2017 to July 2018, where she was responsible for all consumer and B2B marketing, external and internal communications, brand strategy and creative, and corporate citizenship and cause marketing. She also served as CEO of MAKERS, Verizon’s prominent women’s media brand. • Held the position of chief marketing and communications officer for AOL from 2013 to 2017 prior to and following Verizon’s acquisition of AOL in 2015. From January 2013 until June 2015, she was the chief marketing officer of AOL Platforms (a division of AOL). • Held the position of chief marketing officer for 33 Across, a leading data and analytics company in the digital advertising space from 2011 to 2012. Held the position of vice president, marketing for Brand Affinity Technologies, a digital sports and celebrity endorsement marketing platform from 2008 to 2011. • She currently serves on the board of directors of Waddell & Reed Financial Inc. where she is a member of the nominating & governance committee, and on the board of directors of Bill.com Holdings, Inc. where she is a member of the audit committee. Served on the board of directors of Pier 1 Imports, Inc. from September 2018 to October 2020 where she was a member of the compensation committee. • A board member of the National Forest Foundation, serving on the strategic planning, development and marketing, and grants committee since September 2018. • Founded and chaired the board of trustees of Verizon Media’s Charitable Foundation, which is focused on improving the lives of women, girls, and underserved youth. Previously chaired the AOL Foundation, was a member of the executive committee for the Internet Advertising Bureau Board of Directors and served on the board of The Female Quotient. • Held digital media and marketing leadership positions with Launch Ideas, Unicast (acquired by Sizmek), InterVU (acquired by Akamai Technologies), and the Washington Wizards. • Holds a bachelor’s degree in corporate communications from Ithaca College. • Renowned for her business, marketing, and communications expertise, including crisis readiness and management, she is a valuable member of our board of directors and the Technology Committee.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 2021 Proxy Statement | 19 |

Corporate Governance and the Board

|

Richard W. Neu

Director since: 2010 Age: 65

Committees: Audit Committee (Chair)

Other Current Public Tempur Sealy

|

• Retired Chairman of MCG Capital Corporation. He served as chairman of the board from 2009 to 2015, until its sale to PennantPark Floating Rate Capital Ltd. He also served as chief executive officer from October 2011 to November 2012. MCG was a Washington, D.C.-based publicly traded business development corporation providing financing to middle market companies throughout the United States. He first joined the MCG board in 2007, and served as a member of the audit, nominating and corporate governance, and the valuation and investment committees. • Served as executive vice president, chief financial officer, treasurer, and director for both Charter One Financial, Inc. and Charter One Bank from 1995 to 2004. He assumed this role following the merger of First Federal of Michigan and Charter One Financial, Inc. He joined First Federal of Michigan in 1985 as chief financial officer and was elected to the board of directors in 1992. • Serves on the board of Tempur Sealy International, Inc. since 2015 and is currently its lead director. He also serves on the Tempur Sealy compensation and audit committees. • Serves on the board of Oxford Square Capital Corp. since December 2016 and is currently chair of the Oxford Square Capital audit and nominating and corporate governance committees. He also serves on the Oxford Square Capital valuation and compensation committees. • Served on the board of the Dollar Thrifty Automotive Group from 2006 to 2012 until its sale to Hertz Corporation. He served as the lead director from December 2011 to November 2012 and served as chairman of the board from November 2010 to December 2011. He previously served as chairman of the audit committee and as a member of the corporate governance committee. • His professional experience includes seven years at a Big 4 public accounting firm, 20 years as a chief financial officer of a major regional bank holding company, and 14 years in a variety of public company board roles. • Holds a bachelor’s degree in business administration from Eastern Michigan University. • Possesses a comprehensive knowledge of our bank markets, as well as extensive knowledge of the banking industry. He has led numerous bank acquisitions and integrations. • His knowledge and diverse business experience, as well as financial acumen, make him a valued member of the board and chair of the board’s audit committee.

Key Experience and Skills:

|

||

|

|

||||

|

|

|

Kenneth J. Phelan

Director since: 2019 Age: 61

Committees: Compensation

Other Current Public Adtalem Global

|

• Senior Advisor, Oliver Wyman, Inc., global management consulting firm, since 2019. • Served as chief risk officer for the U.S. Department of the Treasury from 2014 to 2019. In this role he established the department’s office of risk management to provide senior Treasury and other Administration officials with analysis of key risks, including credit, market, liquidity, operational, governance, and reputational risks across the department. He also served as Acting Director for the Office of Financial Research, an independent bureau within the Treasury Department charged with supporting the Financial Stability Oversight Council and conducting research about systemic risk. • Served as chief risk officer for RBS Americas from 2011 to 2014. • Serves on the board of directors of Adtalem Global Education, Inc. where he is a member of the compensation committee and the external relations committee. • Holds a master’s degree in economics from Trinity College in Dublin, Ireland and a Juris Doctor degree from Villanova University. • Possesses broad risk oversight expertise as well as extensive knowledge of the banking industry. • His knowledge and experience strengthen the board’s governance and risk oversight and make him a key member of the board’s risk oversight committee.

Key Experience and Skills:

|

||

|

|

||||

|

| 20 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

|

David L. Porteous

Director since: 2003 Age: 68

Lead Director

Committees: Executive Committee

|

• Attorney at McCurdy, Wotila & Porteous, P.C. • Practiced law for more than 40 years with a focus on business, corporate, and municipal law, and government relations. • Prior to joining McCurdy, Wotila & Porteous, P.C., in 2008, he managed his own law practice for more than 20 years. • A recognized authority on economic development and has served on the boards of directors of the Michigan Economic Development Corporation, the Michigan Economic Growth Authority, where he was chairman of the executive committee, the Michigan Strategic Fund, where he was chairman, and the Michigan Chamber of Commerce. • Former director of the Federal Home Loan Bank of Indianapolis where he also chaired the audit committee. • A member of the board of trustees of Michigan State University for more than eight years and was chairman of the board from 2003 to 2006 and was a member of its finance and audit committees. • Served as a director of Jackson National Life Insurance of New York from 2002 to 2016, where he served as a member of the audit, risk and compensation committees. • Holds a bachelor’s degree from Michigan State University and a Juris Doctor degree from Thomas M. Cooley Law School - Western Michigan University. • Regularly lectures on corporate governance and was one of three finalists for the New York Stock Exchange 2015 Independent Lead Director of the Year award. • Has an extensive legal background and possesses valuable experience in corporate and finance related matters, as well as an extensive knowledge of Huntington’s markets. These attributes make him an effective lead director, member of the Risk Oversight Committee and chair of the Executive Committee and the Nominating and Corporate Governance Committee.

Key Experience and Skills:

|

||

|

|

||||

|

|

|

Stephen D. Steinour

Director since: 2009 Age: 62

Committees: Executive Committee

Other Current Public L Brands, Inc.

|

• Chairman, President and Chief Executive Officer of Huntington Bancshares Incorporated and The Huntington National Bank since January 2009. He joined Huntington from CrossHarbor Capital Partners in Boston, where he served as a managing partner. • Served in various executive roles for Citizens Financial Group in Providence, Rhode Island, from 1992 to 2008, with responsibilities for credit, risk management, wholesale and regional banking, consumer lending, technology, and operations among others. He was named president in 2005 and chief executive officer in 2007. • Serves on the Board of Directors of L Brands, Inc. and served on the Board of Directors of Exelon Corporation until April 2020. • A Trustee of The Ohio State University Wexner Medical Center. • Member of The Columbus Partnership and serves on its Executive Committee, is vice chair of the Columbus Downtown Development Corporation, and is vice chair of the Ohio Business Roundtable, and member of the Bank Policy Institute. • Served on the Board of Trustees of Liberty Property Trust, is a former Trustee of the Eisenhower Fellowships and the National Constitution Center and past Chairman of the Greater Philadelphia Chamber of Commerce. • Holds a bachelor’s degree in economics from Gettysburg College and completed the Stanford University Graduate School of Business Executive Program. • With more than 35 years of experience in all aspects of banking, he brings extensive leadership experience, as well as broad knowledge of the banking industry to the board and his role as chief executive officer.

Key Experience and Skills:

|

||

|

|

||||

|

|

| 2021 Proxy Statement | 21 |

Corporate Governance and the Board

Board Refreshment/Succession Planning

|

Our board of directors is committed to maintaining a well-rounded and effective board aligned with the company’s business strategy. | |

The board believes that one of its most important responsibilities is identifying, evaluating, and selecting candidates for the board. Board refreshment is viewed as a significant factor in overall board effectiveness and to assure alignment with our long-term strategy. At least annually the Nominating and Corporate Governance Committee assesses the size of the board and reviews the composition of the board to assure that the appropriate knowledge, skills, and experience are represented, in the Committee’s judgment. The board also believes that candid and thorough self-assessment is necessary to ensure that the board and board committees are productively and efficiently fulfilling their duties.

| The board of directors is committed to board refreshment. Eight new independent directors have joined our board since our 2016 annual meeting, ensuring fresh perspectives. The board also believes it is critical to maintain a range of board member tenures to ensure sufficient experience for board leadership positions and to ensure continuity and institutional knowledge through economic cycles and business climates. The tenures of our current board members range from one year to 17 years (as of the date of the 2021 annual meeting). |  |

Selection of Director Nominees

The Nominating and Corporate Governance Committee thoroughly reviews the qualifications of potential director candidates and makes recommendations to the full board. Each of the director nominees meets the standards listed below. Diversity is a priority and the board, and the Nominating and Corporate Governance Committee actively seek candidates who possess varied gender, race, ethnicity, age, and experience. The board believes that board membership should reflect the diversity of the markets in which we do business. From time-to-time the Nominating and Corporate Governance Committee will identify additional selection criteria for board membership, taking into consideration the company’s business strategy, the business environment, and current board composition.

|

||

|

Director Qualifications

Factors considered by the Committee and the board in their review of potential candidates include whether the candidate:

• has exhibited behavior that indicates he or she is committed to the highest ethical standards; • has special skills, expertise, and background that would complement the attributes of the existing directors, taking into consideration the diverse businesses, communities, and geographies in which the company operates; • has achieved prominence in his or her business, governmental, or professional activities, and has built the capacity that demonstrates the ability to make the kind of important and sensitive judgments that the board is called upon to make; • will challenge management while working constructively as part of a team in an environment of trust; and • will be able to devote sufficient time and energy to the performance of his or her duties as a director. |

||

| 22 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

Regular Self-Assessment

|

Candid and thorough self-assessment is also necessary to ensure that the board and board committees are productively and efficiently fulfilling their duties and to shape the board for Huntington’s continued success. | |

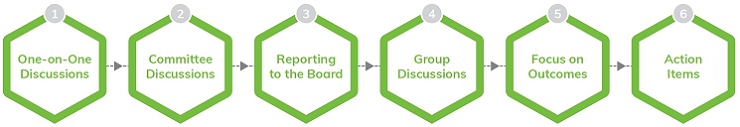

The Nominating and Corporate Governance Committee oversees a self-assessment process for the board and its committees each year. Regular evaluation is critical to assess strengths and identify areas for improvement. Although the specific method or methods of evaluation may vary, the annual self-assessment process is designed to ensure that board members have the opportunity to speak openly and candidly. Periodically, the board will engage an experienced third party to facilitate the board’s self-assessment and assessments of individual directors.

In addition to participating in the annual self-assessment process, directors are encouraged to raise any topics related to board performance and effectiveness at any time with the independent lead director, the chair of the Nominating and Corporate Governance Committee, the chair of an applicable committee, the chairman of the board, or the board, as appropriate. The lead independent director makes a point to engage one-on-one with each board member throughout the year.

The 2020 evaluation included consideration of how well the board handled, and was equipped to handle, the challenges resulting from the COVID-19 pandemic.

The following sets forth the process for the board’s 2020 self-assessment:

|

Prior to the board’s and committees’ full evaluation, the lead director, who also serves as the chair of the Nominating and Corporate Governance Committee, held individual discussions with each director to obtain their candid feedback on board operations, functioning, and performance, among other topics. |

|

Each committee conducted a self-assessment of its own operations and performance and on topics applicable to the committee. Committee self-assessments were facilitated by each committee’s chair. |

|

Following the one-on-one discussions, the independent lead director provided a summary of those discussions to the independent directors during an executive session of the board. |

|

The self-assessment process solicited the board’s and committees’ feedback in areas such as: |

| • | board composition, competencies, dynamics, structure, and operations | |

| • | critical oversight responsibilities, including business strategy, risk management and governance, and succession planning | |

| • | relations with regulators | |

| • | executive performance and the working relationship with management | |

| • | information presented to the board | |

| • | director engagement | |

| • | board training | |

| • | expectations of the chairman, independent lead director, and committee chairs | |

| • | building board strength | |

| • | sustainability and ESG |

| 2021 Proxy Statement | 23 |

Corporate Governance and the Board

|

The board continued to place additional emphasis on outcomes. Following the completion of the self-assessment process, the board determined follow-up actions. |

|

Any follow-up action items were implemented into action plans. As a direct result of the 2020 self-assessment process the board: |

| • | Reinforced its focus on succession planning for senior executive roles | |

| • | Reinforced its commitment to maintain a board that is refreshed, diverse, and aligned with strategy | |

| • | Further enhanced agenda planning and materials to facilitate open discussion |

Shareholder Nominations

Shareholders may recommend director candidates for consideration by the Nominating and Corporate Governance Committee by sending a written notice to the Corporate Secretary at Huntington Bancshares Incorporated, Huntington Center, 41 South High Street, Columbus, Ohio 43287. The notice should indicate the name, age, and address of the person recommended, the person’s principal occupation or employment for the last five years, other public company boards on which the person serves, whether the person would qualify as independent as the term is defined under the Marketplace Rules of the Nasdaq Stock Market, and the class and number of shares of Huntington securities owned by the person. The Nominating and Corporate Governance Committee may require additional information to determine the qualifications of the person recommended. The notice should also state the name and address of, and the class and number of shares of our securities owned by, the person or persons making the recommendation. There have been no material changes to the shareholder recommendation process since we last disclosed this item.

Director Retirement Policy

Our bylaws provide that no person shall be nominated or elected a director of the company after having attained the age of 72 years, unless the board of directors, or the Nominating and Corporate Governance Committee, first determines that this age restriction shall not apply to a particular individual. This exception to the age limit enhances our ability to maintain a well-rounded board of directors with the appropriate skills, and to not unduly limit the service of highly qualified individuals. In accordance with the Corporate Governance Guidelines, any determination that the age restriction shall not be applicable to any person shall be made only after consideration of whether such person brings a specific expertise to the board; has valuable industry specific knowledge and experience; holds unique relationships with third parties, such as regulators; has capacity to devote time to special projects; has developed significant institutional knowledge; or possesses some other attributes or qualifications deemed essential by the board of directors or the Nominating and Corporate Governance Committee. Any determination that the age restriction shall not apply shall be made not more than three times with respect to any one person.

| 24 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

Board Role and Responsibilities

The Board’s Role in Risk Oversight

|

We have a deeply engrained risk management culture, including our board-defined through-the-cycle aggregate moderate-to-low risk appetite. | |

We rely on comprehensive risk management processes to identify, measure, monitor, control and report risks, and to aggregate risks across the enterprise. This system enables the board to establish a mutual understanding with management of the effectiveness of the company’s risk management practices and capabilities, to review the company’s risk exposure, and to elevate certain key risks for discussion at the board level.

Our Risk Governance and Risk Appetite Framework (the Framework) serves as the foundation for consistent and effective risk management. It outlines the seven types of risk that the company faces: compliance risk; credit risk; operational risk; liquidity risk; market risk; reputation risk; and strategic risk. It describes components of our risk management approach, including our risk appetite and risk management processes, with a focus on the role of all colleagues in managing risk. The Framework also defines the aggregate risk levels and types of risk our board and management believe appropriate to achieve the company’s strategic objectives and business plans.

While the board has three board committees that primarily oversee implementation of this desired risk appetite and the monitoring of our risk profile -- the Risk Oversight Committee, the Audit Committee and the Technology Committee -- the full board is engaged in discussing all risks. All standing board committees report their deliberations and actions at each full board meeting. Noteworthy issues from each committee agenda are called to the attention of the full board in advance. In addition, all directors have access to information provided to each committee, and all scheduled committee meetings are open to all directors. The directors regularly communicate directly with members of senior management, and the board and committees regularly meet in executive session without management present.

| 2021 Proxy Statement | 25 |

Corporate Governance and the Board

The role of each of the board committees is further described under “Board Structure and Responsibilities.”

|

Board of Directors • Direct oversight on risks related to company strategy and leadership. Our through-the-cycle aggregate moderate-to-low risk appetite is an integral part of our strategy and strategic planning process. |

|

• Meets frequently with senior management and is devoted to review of strategic priorities. • The CEO reserves time at the beginning of every board meeting to discuss priorities and initiatives. • Periodically, special board sessions are held to discuss and analyze specific possible risk scenarios, such as cybersecurity incident simulations. • Oversees succession planning for the positions of the CEO and other members of the executive leadership team. |

Board Committees

|

|

|||||

|

Risk Oversight Committee |

Audit Committee |

|||||

|

• Assists the board of directors in overseeing the company’s enterprise-wide risk management function consistent with its strategy and risk appetite, including: • oversight of its policies and risk control infrastructure for compliance risk, credit risk, operational risk, liquidity risk, market risk, reputation risk, and strategic risk; • management’s establishment and operation of the Framework, including review and approval of the Framework and of the company’s risk appetite metrics; • the risk management organization including the chief risk officer and risk management budget; • approval and monitoring of the company’s capital position and plan supporting our overall through-the-cycle aggregate moderate-to-low risk profile; • the risk governance structure; • compliance with applicable laws and regulations; and • determining adherence to the board’s stated risk appetite. • Oversees our capital management and planning process, and ensures that the amount and quality of capital are adequate in relation to expected and unexpected risks and that our capital levels exceed “well-capitalized” requirements. • At minimum quarterly, receives reports directly from the chief risk officer. |

• Assists the board in overseeing the integrity of the consolidated financial statements, including: • policies, procedures, and practices regarding the preparation of financial statements, the financial reporting process, disclosures, and internal control over financial reporting; the internal audit department and the independent registered public accounting firm’s qualifications and independence; • compliance with our Financial Code of Ethics for the chief executive officer and senior financial officers; • compliance with corporate securities trading policies; • compliance with legal and regulatory requirements applicable to the company’s financial statements; and • financial risk exposures. • The chief internal auditor reports directly to the Audit Committee. |

|||||

| 26 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

|

||

| Compensation Committee | ||

|

• Through the Compensation Committee, the board of directors seeks to ensure that compensation plans are designed and administered to drive sustainable, long-term results in an effective and ethical manner, while not exposing the organization to material risks. • Reviews and evaluates the company’s compensation policies and practices and the relationship among risk, risk management, and compensation to ensure that incentive compensation practices appropriately balance risk and financial results, incentives do not encourage unnecessary and excessive risk taking or expose the company to imprudent risks, the incentive programs are compatible with effective controls and risk management, incentive programs are supported by strong corporate governance, and the compensation policies are not likely to have a material adverse effect on the company. See “Risk Assessment of Incentive Compensation” below for additional information. • Meets regularly with members of senior management, including the chief financial officer.

• Supports the board of directors with succession planning for key management positions. |

||

|

|

|

||||||||

|

Technology Committee • Assists the board of directors in fulfilling its oversight responsibilities with respect to all technology and innovation strategies and plans developed by management, information and cyber security risk management program, and the third-party risk management program. |

Community Development Committee • Promotes the company’s mission of local involvement and leadership in the communities where the company is located and where its colleagues work. • Considers matters relating to community development and involvement, philanthropy, government affairs, fair and responsible lending, and inclusion. |

Nominating and Corporate Governance Committee • Oversees the company’s commitment to ESG issues and the company’s ESG practices and activities strategy. • Receives periodic updates from management with respect to ESG issues, risks and reporting, including with respect to energy conservation and environmental sustainability. |

||||||||

A number of overlapping topics are overseen by more than one committee. On a regular basis, the Risk Oversight and Audit Committees meet in joint session to cover matters relevant to both. Matters overseen by both committees include reviews of annual and quarterly reports, methodology and level of the allowance for credit losses, and conduct risk. The Risk Oversight Committee and the Audit Committee routinely hold executive sessions with our key officers engaged in both accounting and risk management. In addition, while the Technology Committee has primary oversight over cyber risk, this topic is also discussed periodically in joint session with the Risk Oversight Committee.

All board committee meeting agendas are reviewed for ESG-related topics and flagged for both awareness and discussion among the broader board.

|

||

|

Oversight of Cybersecurity

Huntington’s board has had a dedicated Technology Committee since 2013 to assist the board in fulfilling its oversight responsibilities with respect to the vital role of technology and innovation strategies. The Technology Committee is currently chaired by John C. (Chris) Inglis, Distinguished Visiting Professor of Cyber Studies at the U.S. Naval Academy. Mr. Inglis is a renowned expert and a frequent speaker on cyberspace and cybersecurity issues.

In addition to tech innovation and strategy, while the Technology Committee has primary oversight over cyber risk, this topic is also discussed periodically in joint session with the Risk Oversight Committee which has primary oversight of information security. |

||

| 2021 Proxy Statement | 27 |

Corporate Governance and the Board

Oversight of ESG

|

Our Board is engaged and invested in the long-term sustainability of our business and aligned with shareholder interests. | |

We approach environmental, social, and governance (“ESG”) issues with a purpose-focused strategy that leverages our economic impact.

As a public company, our economic impact begins with our commitment to delivering sustainable, long-term shareholder value through top-tier performance, while maintaining a through-the-cycle aggregate moderate-to-low risk appetite and well-capitalized position. As a regional bank, our economic impact includes helping individuals and families reach their goals of financial stability and homeownership; providing businesses, especially small and mid-sized businesses, with the resources to grow; serving and uplifting the under-banked; and working in partnership to create prosperous and resilient communities.

At Huntington, we focus on the ESG issues that are most important to our business and our stakeholders.

Because we believe “purpose drives performance”, our enterprise ESG commitment is closely integrated with our core performance objectives. Led by executive management, we have adopted a performance management framework that incorporates governance, strategy, and operations grounded in the considerations most material to our stakeholders. This framework ensures that we formalize and standardize our approach to integrating ESG considerations into our board and executive management, business strategy, and business platforms.

ESG Program Objectives

To ensure that we focus our ESG strategic commitment on opportunities that are most important to our key stakeholders, Huntington completed an ESG materiality assessment during 2017. Working with a third-party consultant, we started our process by considering key sustainability / ESG reporting frameworks, ratings, and rankings (including the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB)), and developed a broad list of topics. We then narrowed our focus to issues that are most relevant in the regional banking sector and to Huntington. The prioritization process included leaders representing nearly every function within the company. We also convened small-group focus sessions organized around each of our key stakeholders.

| 28 | Huntington Bancshares Incorporated |

Corporate Governance and the Board

We deliberately took an integrated approach to conducting our assessment by directly considering our risk management priorities, overall corporate strategy, and purpose. Our efforts focused on evaluating topics based on both their importance to key stakeholders and to Huntington, and our ability to impact those topics. We recognize that each issue in our assessment is important, but the final results focus us on a relative prioritization of the most important issues. The assessment clearly defines Huntington’s most important stakeholder and business priorities*:

|

||

|

Most important to stakeholders and business priorities: |

||

|

• Financial performance • Corporate governance and transparency • Enterprise risk management • Customer service, satisfaction, and advocacy • Diversity, equity, and inclusion • Ethical practices and purpose-driven culture • Data security and customer privacy • Fair and responsible banking |

||

| * | Based on the materiality assessment to determine issues of greatest importance to Huntington’s stakeholders and importance to the business. In a few cases, the exact wording from the original assessment of certain topics has been adjusted to reflect the latest terminology being used by the company and in the industry. |

ESG Performance Management Framework

Our ESG Program recognizes that sustainable business practices are crucial to our long-term success and shareholder value creation.

|

||

|

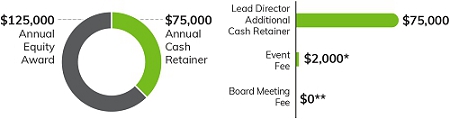

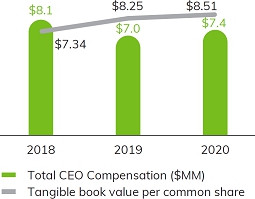

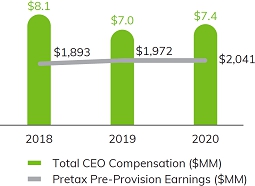

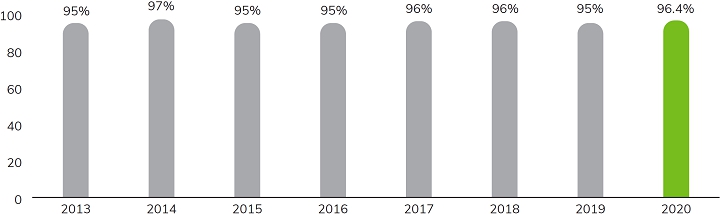

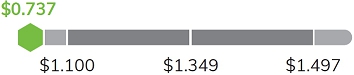

Long-Term Value Creation