DEF 14A: Definitive proxy statements

Published on March 16, 2004

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12.

Huntington Bancshares Incorporated

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

NOTICE OF ANNUAL MEETING | |

| PROXY STATEMENT |

Huntington Bancshares Incorporated

Huntington Center

41 South High Street

Columbus, Ohio 43287

Richard A. Cheap

General Counsel and Secretary

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

The Thirty-Eighth Annual Meeting of Shareholders of Huntington Bancshares Incorporated will be held at the Columbus Convention Center, Ballroom 5, 400 N. High Street, Columbus, Ohio, on Tuesday, April 27, 2004, at 2:00 p.m., local Columbus, Ohio time, for the following purposes:

| (1) | To elect three directors to serve as Class II Directors until the 2007 Annual Meeting of Shareholders, and to elect one director to serve as a Class III Director until the 2005 Annual Meeting of Shareholders, and until their successors are elected. |

| (2) | To consider and act upon a proposal to approve the Management Incentive Plan, as amended and restated. |

| (3) | To consider and act upon a proposal to approve the 2004 Stock and Long-Term Incentive Plan. |

| (4) | To ratify the appointment of Deloitte & Touche LLP as independent auditors for Huntington Bancshares Incorporated for the year 2004. |

| (5) | To transact any other business which may properly come before the meeting. |

You will be welcome at the meeting, and we hope you can attend. Directors and officers of Huntington Bancshares Incorporated and representatives of its independent auditors will be present to answer your questions and to discuss its business.

Your vote is important. We urge you to vote as soon as possible so that your shares may be voted in accordance with your wishes. You may vote by executing and returning your proxy card, or by voting electronically over the Internet or by telephone. Please refer to the proxy card enclosed for information on voting electronically. If you attend the meeting, you may vote in person and the proxy will not be used.

Sincerely yours,

Richard A. Cheap

March 10, 2004

SHAREHOLDERS ARE REQUESTED TO VOTE THEIR PROXIES EITHER

ELECTRONICALLYBY TELEPHONE OR VIA THE INTERNETOR BY

SENDING THEIR PROXY CARDS IN THE ACCOMPANYING ENVELOPE

WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES

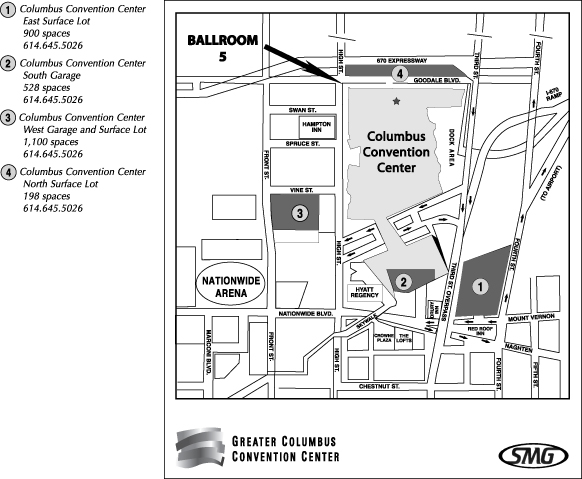

Location for 2004 Annual Meeting of Shareholders

Please note that Huntingtons 2004 Annual Meeting of Shareholders will be held in a new location -

The Columbus Convention Center

Ballroom 5

400 N. High Street

Columbus, Ohio

on Tuesday, April 27, 2004, at 2:00 p.m., local Columbus, Ohio time.

The Columbus Convention Center is just a few blocks north of the Huntington Center on High Street in downtown Columbus.

Complimentary parking will available in the Greater Columbus Convention Center parking lots. Ballroom 5 is most easily accessible from the North Parking Lot at Goodale and High Streets, or the West Garage at Vine and High Streets.

See the back of this Proxy Statement booklet for a map and directions.

PROXY STATEMENT

This Proxy Statement is provided on behalf of the Board of Directors of Huntington Bancshares Incorporated to solicit proxies to be voted at the Annual Meeting of Shareholders to be held on April 27, 2004, and at any adjournment. We are mailing this Proxy Statement, together with a proxy card or voting instruction card, starting on or about March 16, 2004, to Huntingtons shareholders entitled to vote at the Annual Meeting.

Voting Procedures

Shareholders of common stock of record at the close of business on February 20, 2004, are entitled to vote at the Annual Meeting. Huntington had 229,342,306 shares of common stock outstanding and entitled to vote on the record date.

Shareholders will have one vote on each matter submitted at the Annual Meeting for each share of common stock owned on the record date. The shares represented by a properly submitted proxy will be voted as directed provided the proxy is received by Huntington prior to the meeting. A properly executed proxy without specific voting instructions will be voted FOR the nominees for director named in this Proxy Statement, FOR the approval of the Management Incentive Plan, FOR the approval of the 2004 Stock and Long-Term Incentive Plan, and FOR the ratification of the appointment of Deloitte & Touche LLP as independent auditors for 2004. A properly submitted proxy will also confer discretionary authority to vote on any other matter which may properly come before the meeting.

A shareholder may vote by proxy by using the telephone, via the Internet, or by properly signing and submitting the enclosed proxy card. A shareholder has the power to revoke his or her proxy at any time before it is exercised by filing a written notice with Huntingtons Secretary prior to the meeting. Shareholders who attend the meeting may vote in person and their proxies will not be used.

Huntington will pay the expenses of soliciting proxies, including the reasonable charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of stock. Huntington representatives may solicit proxies by mail, telephone, electronic or facsimile transmission, or personal interview. Huntington has contracted with Morrow & Co., Inc. to assist in the solicitation of proxies for a fee of $7,500 plus out-of-pocket expenses.

Vote Required

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Huntington will constitute a quorum at the meeting. Under the law of Maryland, Huntingtons state of incorporation, abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum, but are not counted as votes cast at the meeting. Broker non-votes occur when brokers who hold their customers shares in street name submit proxies for such shares on some matters, but not others. Generally, this would occur when brokers have not received any instructions from their customers. In these cases, the brokers, as the holders of record, are permitted to vote on routine matters, which typically include the election of directors and ratification of independent auditors, but not on non-routine matters.

The election of each nominee for director requires the favorable vote of a plurality of all votes cast by the holders of common stock at a meeting at which a quorum is present. Only shares that are voted in favor of a particular nominee will be counted toward such nominees achievement of a plurality and thus broker non-votes and abstentions will have no effect. All other agenda items require the affirmative vote of a majority of all votes cast by the holders of common stock at a meeting at which a quorum is present for approval or ratification of the particular matter. Broker non-votes and abstentions will have no effect on these matters since they are not counted as votes cast at the meeting.

Election of Directors

Under Huntingtons Charter, the Board of Directors is divided into three classes, with terms of office that expire at successive annual meetings. The terms of the Class II DirectorsDavid P. Lauer, Kathleen H. Ransier, George A. Skestos, and Lewis R. Smoot, Sr.expire at this Annual Meeting. In addition, the term of Class III Director David L. Porteous, who was elected in October 2003 by the Board of Directors, expires at this Annual Meeting.

After nearly ten years of service, George A. Skestos and Lewis R. Smoot, Sr. are both retiring from the Board of Directors when their current terms expire at this Annual Meeting. Patricia T. Hayot resigned from the Board of Directors in January 2004 after eight years of service following the acceptance of a position which took her domicile out of the Midwest. Huntington has benefited from and is grateful for the wisdom and guidance provided by each of Ms. Hayot, Mr. Skestos, and Mr. Smoot.

1

With the input of the Boards Nominating and Corporate Governance Committee, which makes recommendations to the Board of Directors in regard to its size and composition, the number of authorized directors has been set at eleven, effective after this Annual Meeting. The Board of Directors proposes the election of four directors at this Meeting: three to serve as Class II Directors and one to serve as a Class III Director. Each nominee was reviewed and recommended for election by the Boards Nominating and Corporate Governance Committee.

David P. Lauer and Kathleen H. Ransier currently serve as Class II Directors of Huntington and are being nominated for reelection at this Annual Meeting. Mr. Lauer and Ms. Ransier were each elected at the 2003 Annual Meeting of Shareholders to fill new seats on the Board and serve one-year terms expiring in 2004. Karen A. Holbrook is also being nominated for election as a Class II Director at this Annual Meeting. The nominees for Class II Directors, if elected, will each serve a three-year term expiring at the 2007 Annual Meeting of Shareholders and until their successors are elected. David L. Porteous currently serves as a Class III Director and is being nominated for election as a Class III Director by the shareholders at this Annual Meeting. If elected, Mr. Porteous will serve a one-year term expiring at the 2005 Annual Meeting of Shareholders and until his successor is elected.

It is intended that, unless otherwise directed, the shares represented by a properly submitted proxy will be voted FOR the election of Ms. Holbrook, Mr. Lauer, and Ms. Ransier as Class II Directors, and FOR the election of Mr. Porteous as a Class III Director. Huntington has no reason to believe that any nominee will be unable or unwilling to serve as a director if elected. However, in the event that any of these nominees should become unavailable, the number of directors may be decreased pursuant to the Bylaws or the Board of Directors may designate a substitute nominee, for whom shares represented by a properly submitted proxy would be voted.

The Board of Directors recommends a vote FOR the election of each of the nominees for director.

The following tables set forth certain information concerning each nominee and each continuing director of Huntington.

CLASS II DIRECTORS

(NOMINEES FOR TERMS EXPIRING IN 2007)

| Name and Principal Occupation(1) |

Age |

Director Since |

Other Directorships(2) |

|||

| Karen A. Holbrook |

61 | | ||||

| President, |

||||||

| The Ohio State University |

||||||

| David P. Lauer |

61 | 2003 | AirNet Systems, Inc | |||

| Certified Public Accountant; |

Diamond Hill Investment | |||||

| Retired Managing Partner, Deloitte & Touche LLP, |

Group, Inc. | |||||

| Columbus, Ohio office |

R. G. Barry Corporation | |||||

| (1989-1997) |

Wendys International, Inc | |||||

| Kathleen H. Ransier |

56 | 2003 | ||||

| Partner, |

||||||

| Vorys, Sater, Seymour and Pease LLP, law firm |

||||||

2

CLASS III DIRECTORS

(TERMS EXPIRE IN 2005)

| Name and Principal Occupation(1) |

Age |

Director Since |

Other Directorships(2) |

|||

| Don M. Casto III |

59 | 1985 | ||||

| Principal / Chief Executive Officer, |

||||||

| CASTO, |

||||||

| real estate developers |

||||||

| Michael J. Endres |

56 | 2003 | Applied Innovation Inc. | |||

| Principal, Stonehenge Financial Holdings, Inc., |

Worthington Industries | |||||

| private equity investment firm |

||||||

| Wm. J. Lhota |

64 | 1990 | State Auto Financial | |||

| Principal, LHOTA SERVICES, providing ethics |

Corporation | |||||

| consulting and arbitration and mediation services; |

||||||

| Retired PresidentEnergy Delivery, |

||||||

| American Electric Power (2000-2001); |

||||||

| Retired Executive Vice President, American Electric |

||||||

| Power Service Corp., management, technical, and |

||||||

| professional subsidiary of American Electric Power |

||||||

| (1989 2001) |

||||||

| (NOMINEE FOR TERM EXPIRING IN 2005) | ||||||

| David L. Porteous |

51 | 2003 | ||||

| Attorney, |

||||||

| Porteous Law Office PC |

||||||

CLASS I DIRECTORS

(TERMS EXPIRE IN 2006)

| Name and Principal Occupation(1) |

Age |

Director Since |

Other Directorships(2) |

|||

| Raymond J. Biggs |

66 | 2002 | ||||

| Private Investor; |

||||||

| Retired Chairman and CEO, |

||||||

| Huntington Bancshares Michigan, Inc. (1990 1994) |

||||||

| John B. Gerlach, Jr. |

49 | 1999 | Lancaster Colony Corporation | |||

| Chairman, President, and Chief Executive Officer, |

||||||

| Lancaster Colony Corporation, |

||||||

| manufacturer and marketer of specialty food, |

||||||

| glassware, candles, and automotive accessories |

||||||

| Thomas E. Hoaglin |

54 | 2001 | The Gorman-Rupp Company | |||

| Chairman, President and Chief Executive Officer, |

||||||

| Huntington and The Huntington National Bank |

||||||

| Robert H. Schottenstein |

51 | 1997 | M/I Homes, Inc. | |||

| Vice Chairman, Chief Executive Officer & President, |

||||||

| M/I Homes, Inc., |

||||||

| homebuilding and development |

||||||

| (1) | Each nominee and continuing director has held, or been retired from, the various positions indicated or other executive positions with the same organizations (or predecessor organizations) for at least the past five years, except: |

| | Ms. Holbrook, who served as Senior Vice President for Academic Affairs and Provost at The University of Georgia from 1998 until she became President of The Ohio State University in October 2002. |

| | Mr. Lauer, who served as President and Chief Operating OfficerColumbus Commercial Operations, for Bank One, NA, Columbus, Ohio, from 1997 to 2001. Mr. Lauer also served as a director of Huntington Preferred Capital, Inc. from September 2002 to February 2003. |

3

| | Ms. Ransier, who was managing partner of Ransier & Ransier, LLP, Attorneys at Law, from 1976 to 2001, and Of Counsel to Vorys, Sater, Seymour and Pease LLP from 2001 to 2004. |

| | Mr. Endres, who served as Vice Chairman of Bank One Capital Corporation, an investment banking subsidiary of Bank One Corporation, from 1990 to 1999. |

| | Mr. Hoaglin, who joined Huntington in February 2001 and whose business experience is described under Executive Officers of Huntington below. Mr. Hoaglin is also a director of The Huntington National Bank. |

| (2) | Other directorships held in companies with a class of securities registered pursuant to Sections 12 or 15(d) of the Securities Exchange Act of 1934. |

Corporate Governance

The Board of Directors has standing Audit/Risk, Compensation, Executive, Nominating and Corporate Governance, and Pension Review Committees. The Board of Directors has approved a separate written charter for each of the standing committees. In addition, the Board of Directors has adopted a corporate governance program which includes Corporate Governance Guidelines and a Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics applies to all employees and, where applicable, to directors of Huntington and its affiliates. Huntingtons chief executive officer, chief financial officer, and principal accounting officer are also bound by a Financial Code of Ethics for Chief Executive Officer and Senior Financial Officers.

The Board of Directors and the Nominating and Corporate Governance Committee have reviewed and evaluated transactions and relationships with Board members to determine the independence of each of the members. The Board of Directors does not believe that any of its non-employee members have relationships with Huntington that would interfere with the exercise of independent judgment in carrying out his or her responsibilities as director. The Board and the Nominating and Corporate Governance Committee have determined that a majority of the Boards current members are, and a majority of the members of the Board following the 2004 Annual Shareholders Meeting will be, independent directors as the term is defined in the applicable listing standards of The Nasdaq Stock Market, Inc. The following directors and nominees have been determined to be independent under the Nasdaq definition: Raymond J. Biggs, Don M. Casto III, John B. Gerlach, Jr., Karen A. Holbrook, David. P. Lauer, Wm. J. Lhota, David L. Porteous, Kathleen H. Ransier, and George A. Skestos.

The Corporate Governance Guidelines provide that attendance at Board and committee meetings is of utmost importance. Directors are expected to attend the annual shareholders meetings and at least 75% of all regularly scheduled meetings of the Board and committees on which they serve. During 2003, the Board of Directors held a total of 10 regular and special meetings. Each director attended greater than 75% of the meetings of the full Board and the committees on which he or she served, except for Mr. Smoot who attended a majority of meetings but less than 75% due to unavoidable scheduling difficulties. Nine of 10 directors then serving attended the 2003 Annual Meeting of Shareholders.

Shareholders who wish to send communications to the Board of Directors may do so by following the procedure set forth on the Investor Relations pages of Huntingtons website at huntington.com.

Board Committees

The table below indicates the membership of the Boards standing committees and the number of times the committees met in 2003.

| Directors and Number of Meetings |

Audit/Risk Committee |

Compensation Committee |

Executive Committee |

Nominating & Corporate |

Pension Review |

|||||

| Raymond J. Biggs |

Member | Chair | ||||||||

| Don M. Casto III |

Member | Chair | Chair | Member | ||||||

| Michael J. Endres |

Member | |||||||||

| John B. Gerlach, Jr. |

Chair | Member | Member | |||||||

| Thomas E. Hoaglin |

Member | |||||||||

| David P. Lauer |

Chair | |||||||||

| Wm. J. Lhota |

Member | |||||||||

| David L. Porteous |

Member | |||||||||

| Kathleen H. Ransier |

Member | |||||||||

| Robert H. Schottenstein |

||||||||||

| George A. Skestos |

Member | Member | Member | Member | ||||||

| Lewis R. Smoot, Sr. |

Member | |||||||||

| Number of Meetings |

17 | 4 | 0 | 5 | 1 |

4

Compensation Committee. The Compensation Committee discharges the Board of Directors responsibilities relating to executive officer and director compensation and equity-based compensation programs. Its duties and responsibilities include, in consultation with senior Management, establishing the companys general compensation philosophy and overseeing the development and implementation of compensation and stock option programs. The Compensation Committee also reviews and approves corporate goals and objectives relevant to the compensation of the chief executive officer, evaluates the performance of the chief executive officer in light of those goals and objectives, and sets the chief executive officers compensation level based on this evaluation. In addition, the Compensation Committee reviews and approves compensation and stock option programs applicable to the executive officers of Huntington. All members of the Compensation Committee have been determined to be independent as the term is defined under the applicable listing standards of Nasdaq.

Executive Committee. The Executive Committee considers matters brought before it by the chief executive officer. This Committee also considers matters and takes action that may require the attention of the Board of Directors or the exercise of the Boards powers or authority in the intervals between meetings of the Board.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committees primary responsibilities are to review annually the composition of the Board of Directors to assure that the appropriate knowledge, skills and experience are represented, in the Committees judgment, and to assure that the composition of the Board complies with applicable laws and regulations; review the qualifications of persons recommended for Board membership, including persons recommended by shareholders; discuss with the Board standards to be applied in making determinations as to the independence of directors; and review annually the effectiveness of the Board, including but not limited to, considering the size of the Board and the performance of individual directors as well as collective Board performance. Other primary responsibilities of this Committee include reviewing and making appropriate changes to the Corporate Governance Guidelines and the Code of Business Conduct and Ethics for Huntingtons directors, officers, and employees.

Each person recommended by the Nominating and Corporate Governance Committee for nomination to the Board of Directors must be an active leader in his or her business or profession and in his or her community. Diversity is considered by the Nominating and Corporate Governance Committee when evaluating nominees because the Board of Directors believes that board membership should reflect the diversity of Huntingtons markets. The Nominating and Corporate Governance Committee evaluates potential nominees, including persons recommended by shareholders, in accordance with these standards which are part of the Corporate Governance Guidelines. From time to time the Nominating and Corporate Governance Committee may develop specific additional selection criteria for Board membership, taking into consideration current board composition and ensuring that the appropriate knowledge, skills and experience are represented. There are no specific additional criteria at this time. Huntington generally does not pay any third parties to identify or evaluate, or assist in identifying or evaluating, potential nominees. Karen A. Holbrook, first-time nominee for director, was recommended by a non-management director and considered and approved by the Nominating and Corporate Governance Committee for recommendation to the shareholders for election.

Shareholders who wish to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may send a written notice to the Secretary at Huntingtons principal executive offices. The notice should indicate the name, age, and address of the person recommended, the persons principal occupation or employment for the last five years, other public company boards on which the person serves, whether the person would qualify as independent as the term is defined under the applicable listing standards of Nasdaq, and the class and number of shares of Huntington securities owned by the person. The Nominating and Corporate Governance Committee may require additional information to determine the qualifications of the person recommended. The notice should also state the name and address of, and the class and number of shares of Huntington securities owned by, the person or persons making the recommendation.

All members of the Nominating and Corporate Governance Committee have been determined to be independent as the term is defined under the applicable listing standards of Nasdaq. A copy of the Nominating and Corporate Governance Committees Charter is available on the Investor Relations pages of Huntingtons website at huntington.com.

Pension Review Committee. The Pension Review Committee provides recommendations to the Board of Directors in connection with actions taken by the Board in fulfillment of the duties and responsibilities delegated to Huntington and/or the Board pursuant to the provisions of Huntingtons retirement plans. In addition, the Pension Review Committee acts on behalf of the Board in fulfilling such duties and responsibilities as are delegated by written action of the Board. The Pension Review Committee also takes such actions as are specifically granted to the Committee pursuant to retirement plan documents.

Audit/Risk Committee. The Audit/Risk Committee provides assistance to the Board of Directors in fulfilling its oversight responsibility for the integrity of Huntingtons financial statements; the financial reporting process; the systems for

5

managing enterprise-wide risks; the systems of internal accounting and financial controls; the performance of the companys internal audit function, risk management functions, and independent auditors; the independent auditors qualifications and independence; and the compliance by the companys associates and directors with the Code of Business Conduct and Ethics, the Financial Code of Ethics, and legal and regulatory requirements. The primary responsibility of the Audit/Risk Committee is to oversee the companys financial reporting process on behalf of the Board and report the results of its activities to the Board. Other responsibilities include oversight of the independent auditors, oversight of the governance of enterprise-wide risk management activity, and the review and approval of all related party transactions. Additional information about the Audit/Risk Committee is set forth in the Report of the Audit/Risk Committee below.

Report of the Audit/Risk Committee

The following Report of the Audit/Risk Committee should not be deemed filed or incorporated by reference into any other document, including Huntingtons filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Huntington specifically incorporates this Report into any such filing by reference.

The Audit/Risk Committee is comprised of four of Huntingtons non-employee directors. David P. Lauer, who serves as Chairman of the Committee, qualifies as an audit committee financial expert as the term is defined in the rules of the Securities and Exchange Commission. All members of the Audit/Risk Committee have been determined to be independent as the term is defined under applicable listing standards of Nasdaq, including the more stringent criteria for audit committee members. The written charter of the Audit/Risk Committee, which was updated in February 2004, is included with this Proxy Statement as Appendix I.

The primary responsibility of the Audit/Risk Committee is to oversee Huntingtons financial reporting process and report to the full Board of Directors. In carrying out its duties, the Audit/Risk Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2003, with Huntingtons Management and with Huntingtons independent auditors, Ernst & Young LLP. This discussion included the selection, application, and disclosure of critical accounting policies. The Audit/Risk Committee has also reviewed with Ernst & Young LLP its judgment as to the quality, not just the acceptability, of Huntingtons accounting principles and such other matters required to be discussed under auditing standards generally accepted in the United States, including the Statements on Auditing Standards No. 61, as amended, Communication with Audit Committees.

In addition, the Audit/Risk Committee has reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with Ernst & Young LLP its independence from Huntington. Based on this review and discussion, and a review of the services provided by the outside auditors during 2003, the Audit/Risk Committee believes that the services provided by Ernst & Young LLP in 2003 are compatible with and do not impair Ernst & Youngs independence.

Based on these reviews and discussions, the Audit/Risk Committee recommended that the Board of Directors approve the audited financial statements for inclusion in Huntingtons Annual Report on Form 10-K for the year 2003 for filing with the Securities and Exchange Commission.

AUDIT/RISK COMMITTEE

David P. Lauer, Chairman

Wm. J. Lhota

David L. Porteous

Kathleen H. Ransier

6

Director Compensation

Only non-employee directors of Huntington receive compensation for their services as directors. Each non-employee director receives quarterly retainer payments at an annual rate of $27,000. The chairman of the Audit/Risk Committee receives an additional quarterly retainer payment at an annual rate of $7,500. Non-employee chairmen of all other standing committees of the Board of Directors receive additional quarterly retainer payments at an annual rate of $5,000. In addition, each non-employee director receives $1,500 for each Board or committee meeting ($2,500 for Audit/Risk Committee meetings) the director attends. Non-employee directors are paid $750 for each special, teleconference Board or committee meeting in which the director participates.

Huntington considers stock option grants to non-employee directors on an annual basis in amounts determined at the discretion of the Compensation Committee. Options to purchase 7,500 shares of Huntington common stock were granted on July 15, 2003, to each of the non-employee directors. These options, which were granted under Huntingtons 2001 Stock and Long-Term Incentive Plan, have an exercise price equal to the average of the high and low market price of the underlying shares on the date of grant, or $20.4075 per share. The options become exercisable in equal increments on each of the first three anniversaries of the date of grant. Generally, the exercise price of options may be paid for in cash or in shares of Huntington common stock.

All or any portion of the cash compensation otherwise payable to a director may be deferred if such director elects to participate in the Huntington Bancshares Incorporated Deferred Compensation Plan and Trust for Huntington Bancshares Incorporated Directors. The plan allows the members of the Board of Directors to elect to defer receipt of all or a portion of the compensation payable to them in the future for services as directors. Huntington transfers cash equal to the compensation deferred pursuant to the plan to a trust fund where it is allocated to the accounts of the participating directors. The trustee of the plan has broad investment discretion over the trust fund and is authorized to invest in many forms of securities and other instruments, including Huntington common stock. During 2003, the trustee invested the trust fund primarily in Huntington common stock. Distribution of a directors account will be made either in a lump sum or in equal annual installments over a period of not more than ten years, as elected by each director. Such distribution will commence upon the earlier of 30 days after the attainment of an age specified by the director at the time the deferral election was made, or within 30 days of the directors termination as a director. All of the assets of the plan including the assets of the trust fund are subject to the claims of the creditors of Huntington. The rights of a director or his or her beneficiaries to any of the assets of the plan are no greater than the rights of an unsecured general creditor of Huntington. Directors who are also employees of Huntington do not receive compensation as directors and, therefore, are ineligible to participate in this deferred compensation plan.

Transactions with Directors and Executive Officers

Indebtedness of Management

Some of the directors, nominees for election as directors, and executive officers of Huntington are customers of Huntingtons affiliated financial and lending institutions and have transactions with such affiliates in the ordinary course of business. Directors, nominees, and executive officers of Huntington also may be affiliated with entities which are customers of Huntingtons affiliated financial and lending institutions and which enter into transactions with such affiliates in the ordinary course of business. Transactions with directors, nominees, executive officers, and their affiliates have been on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the time for comparable transactions with others and did not involve more than the normal risk of collectibility or present other unfavorable features.

Certain Other Transactions

Raymond J. Biggs, a director of Huntington, served as an officer of Huntington Bancshares Michigan, Inc. from 1990 to 1994, following Huntingtons acquisition of First Macomb Bank, of which Mr. Biggs was an executive officer. Mr. Biggs currently receives periodic payments from Huntington, which amounts represent the negotiated settlement of supplemental retirement and other benefits payable to Mr. Biggs under a Supplemental Retirement Income Agreement previously entered into between Mr. Biggs and First Macomb Bank. The negotiated benefits, as agreed upon in 1995, are annual payments of $15,159 for fifteen years from 1995, and monthly payments of $13,142.20 beginning in August of 2002 and continuing for fifteen years.

Huntington Mezzanine Opportunities Inc., a wholly-owned subsidiary of Huntington, established in 2002 a private corporate mezzanine investment fund, providing financing in transaction amounts up to $10 million to assist middle market companies primarily in the Midwest with growth or acquisition strategies. Stonehenge Mezzanine Partners LLC serves as the asset manager to develop and manage the fund, which is its sole purpose. Under the investment management agreement, Stonehenge Mezzanine Partners LLC receives a quarterly management fee equal to the greater of a fixed amount or a set

7

percentage of the mezzanine loan balances. For the first five years of the agreement, the minimum quarterly management fee is equal to $262,500; thereafter the minimum is $62,500. Stonehenge Mezzanine Partners LLC is also eligible to receive a percentage of profits based on the performance of the investments. Michael J. Endres, a director of Huntington, has a 20% equity interest in Stonehenge Mezzanine Partners, LLC.

Kathleen H. Ransier, a director of Huntington, is a partner with the law firm Vorys, Sater, Seymour and Pease LLP. None of Huntington or its subsidiaries engage or otherwise utilize the services of this law firm. However, other attorneys with Vorys, Sater, Seymour and Pease LLP currently represent an estate and related trust which The Huntington National Bank serves as fiduciary. The law firms fees are paid from the assets of the estate or trust, as is generally the case when the firm represents a bank in a fiduciary capacity. The amount of fees for these services is significantly below 5% of the firms annual gross revenues. From time to time, other attorneys with Vorys, Sater, Seymour and Pease LLP may represent other estates and/or trusts which The Huntington National Bank serves as fiduciary. In such cases, the firm would be selected at the specific request or recommendation of the testator, grantor, or beneficiaries, as the case may be, but only if The Huntington National Bank, in the exercise of its fiduciary duties, believes the representation to be appropriate.

The Huntington National Bank has a mortgage correspondent program in which numerous lenders participate, including M/I Financial Corp., a mortgage banking subsidiary of M/I Homes, Inc. Robert H. Schottenstein, a director of Huntington, serves as Vice Chairman, Chief Executive Officer, and President of M/I Homes, Inc. Under the program, The Huntington National Bank establishes the types of mortgage loans it desires to acquire from time to time and the terms at which it will purchase them. Approved lenders may tender complying loans in accordance with the programs terms and conditions. During 2003, The Huntington National Bank purchased loans from M/I Financial Corp. under the program totaling $67,559,810.

In 2000, The Huntington National Bank began a two-phase renovation project, including life safety code improvements, at Huntingtons 17 South High Street building in Columbus, Ohio. Phase II of the project commenced in January 2003 and is expected to be completed in April 2004. The 17 South High Street building houses a large banking office of The Huntington National Bank as well as approximately 33 tenants. Based on the involvement of The Sherman R. Smoot Company of Ohio in the early planning stages as well as in construction of Phase I and its participation in preconstruction design and development of Phase II, officers of The Huntington National Bank deemed it to be in the best interest of the bank to engage The Sherman R. Smoot Company of Ohio to act as construction manager to support the implementation of the project scope, schedule, and budget for Phase II renovations. The Sherman R. Smoot Company of Ohio is being paid a fee of $361,980 for its services related to Phase II. Lewis R. Smoot, Sr., who is a director of Huntington, is President and Chief Executive Officer of The Sherman R. Smoot Company of Ohio. Mr. Smoot is also President, Chief Executive Officer, and 87.68% owner of The Smoot Corporation, which is the parent company of The Sherman R. Smoot Company of Ohio.

8

Ownership of Voting Stock

The following table sets forth the beneficial ownership of Huntington common stock by each of Huntingtons directors, nominees for directors, the chief executive officer, and the four next most highly compensated executive officers as of February 4, 2004 (1).

| Name of Beneficial Owner |

Shares of Beneficially |

Percent of Class |

||||||

| Ronald C. Baldwin |

193,467 | (4 | ) | (6 | ) | |||

| Daniel B. Benhase |

112,502 | (4 | ) | (6 | ) | |||

| Raymond J. Biggs |

1,762,469 | (3 | )(5) | (6 | ) | |||

| Don M. Casto III |

284,828 | (3 | )(5) | (6 | ) | |||

| Richard A. Cheap |

99,137 | (4 | ) | (6 | ) | |||

| Michael J. Endres |

23,351 | (5 | ) | (6 | ) | |||

| John B. Gerlach, Jr. |

1,619,986 | (3 | )(5) | (6 | ) | |||

| Thomas E. Hoaglin |

715,868 | (3 | )(4) | (6 | ) | |||

| Karen A. Holbrook |

0 | (6 | ) | |||||

| David P. Lauer |

15,614 | (3 | ) | (6 | ) | |||

| Wm. J. Lhota |

95,063 | (3 | )(5) | (6 | ) | |||

| Michael J. McMennamin |

168,989 | (3 | )(4) | (6 | ) | |||

| David L. Porteous |

435,252 | (3 | )(5) | (6 | ) | |||

| Kathleen H. Ransier |

3,000 | (3 | ) | (6 | ) | |||

| Robert H. Schottenstein |

65,960 | (5 | ) | (6 | ) | |||

| George A. Skestos |

57,974 | (5 | ) | (6 | ) | |||

| Lewis R. Smoot, Sr. |

137,307 | (3 | )(5) | (6 | ) | |||

| Directors as a group (12 in group) |

5,216,673 | (3 | )(4)(5) | 2.28 | % | |||

| Executive Officers as a group (7 in group) |

1,376,112 | (3 | )(4) | (6 | ) | |||

| Directors and Executive Officers as a group (18 in group) |

5,876,917 | (3 | )(4)(5) | 2.55 | % | |||

| (1) | With respect to shares of common stock held in Huntingtons Investment and Tax Savings Plan (401(k) plan), Supplemental Stock Purchase and Tax Savings Plan, and deferred compensation plans for directors, shares are included as of the last statement date, December 31, 2003. |

| (2) | Except as otherwise noted, none of the named individuals shares with another person either voting or investment power as to the shares reported. Figures include the following number of shares of common stock which could have been acquired within 60 days of February 4, 2004, under stock options awarded under Huntingtons stock option plans: |

| Mr. Baldwin |

169,201 | Mr. Schottenstein | 33,401 | |||

| Mr. Benhase |

91,334 | Mr. Skestos | 31,661 | |||

| Mr. Casto |

37,793 | Mr. Smoot | 39,257 | |||

| Mr. Cheap |

77,588 | Directors as a group | 803,251 | |||

| Mr. Gerlach |

33,401 | Executive officers as |

||||

| Mr. Hoaglin |

596,600 | a group |

1,153,283 | |||

| Mr. Lhota |

39,257 | Directors and Executive |

||||

| Mr. McMennamin |

135,867 | Officers as a group | 1,359,934 |

| (3) | Figures include 5,277 shares, 8,405 shares, 50,812 shares, 4,599 shares, 99,638 shares, 1,500 shares, and 3,417 shares of common stock owned by members of the immediate families of Messrs. Biggs, Casto, Gerlach, Lauer, Porteous, Ms. Ransier, and Mr. Smoot, respectively; 1,753,838 shares owned by MSR Family Limited Partnership, of which Mr. Biggs is general partner; 1,066,147 shares owned by the John B. Gerlach Trust, of which Mr. Gerlach is trustee and beneficiary; 375,874 shares owned by the Gerlach Foundation, of which Mr. Gerlach is an officer and trustee; 6,436 shares owned by Lancaster Lens, Inc., of which Mr. Gerlach is an executive officer; 35,431 shares owned by Lehrs, Inc. of which Mr. Gerlach is a director and executive officer; 1,790 shares owned by Darby Road Company, of which Mr. Gerlach is a director and the holder of one-third shareholder interest; 3,133 shares owned by Darby Road Limited Partnership, of which Darby Road Company is general partner; 77,400 shares owned jointly by Mr. Hoaglin and his spouse; 16,777 shares owned jointly by Mr. Lhota and his spouse; 10,500 shares owned jointly by Mr. McMennamin and his spouse; 289,523 shares owned jointly by Mr. Porteous and his spouse, and 23,452 shares owned by The Smoot Corporation, of which Mr. Smoot is President. |

9

| (4) | Figures include shares of common stock held as of December 31, 2003, in Huntingtons Supplemental Stock Purchase and Tax Savings Plan as follows: 1,266 for Mr. Baldwin, 1,168 for Mr. Benhase, 2,530 for Mr. Cheap, 5,892 for Mr. Hoaglin, 3,122 for Mr. McMennamin, and 16,334 for all executive officers as a group. Prior to the distribution from this plan to the participants, voting and dispositive power for the shares allocated to the accounts of participants is held by The Huntington National Bank, as trustee of the plan. |

| (5) | Figures include shares of common stock held as of December 31, 2003, in Huntingtons deferred compensation plans for directors as follows: 3,354 for Mr. Biggs, 93,895 for Mr. Casto, 1,351 for Mr. Endres, 12,696 for Mr. Gerlach, 9,012 for Mr. Lhota, 499 for Mr. Porteous, 19,928 for Mr. Schottenstein, and 35,843 for Mr. Smoot. Prior to the distribution from the deferred compensation plans to the participants, voting and dispositive power for the shares allocated to the accounts of participants is held by The Huntington National Bank, as trustee of the plans. |

| (6) | Less than 1%. |

As of December 31, 2003, no person was known by Huntington to be the beneficial owner of more than 5% of the outstanding shares of Huntington common stock, except as follows:

| Name and Address of Beneficial Owner |

Shares of Common Stock Beneficially Owned |

Percent of Class |

||

| The Huntington National Bank Huntington Center 41 South High Street Columbus, Ohio 43287 |

14,550,713(1) | 6.36% |

| (1) | These shares are held in various fiduciary capacities in the ordinary course of business under numerous trust relationships by The Huntington National Bank. As fiduciary, The Huntington National Bank has sole power to dispose of 2,032,834 of these shares, shared power to dispose of 3,061,095 of these shares, sole power to vote 5,939,066 of these shares, and shared power to vote 8,400,098 of these shares. |

As of December 31, 2003, Messrs. Baldwin, Benhase, and Cheap owned 2,000, 800, and 100 shares, respectively, and Mr. McMennamins spouse owned 3,000 shares (for which Mr. McMennamin disclaims beneficial ownership) of Class C Preferred Shares, $25.00 par value, issued by Huntington Preferred Capital, Inc. These executive officers owned, individually and collectively, less than 1% of the Class C Preferred Shares outstanding on December 31, 2003. Huntington Preferred Capital, Inc. is a subsidiary of Huntington.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Huntingtons officers, directors, and persons who are beneficial owners of more than ten percent of Huntington common stock to file reports of ownership and changes in ownership with the SEC. Reporting persons are required by SEC regulations to furnish Huntington with copies of all Section 16(a) forms filed by them. To the best of its knowledge, and following a review of the copies of Section 16(a) forms received by it, Huntington believes that, during 2003, all filing requirements applicable for reporting persons were met.

10

Executive Compensation

The following table sets forth the compensation paid by Huntington and its subsidiaries to Huntingtons Chief Executive Officer and each of the next four most highly compensated executive officers, for each of the last three fiscal years ended December 31, 2003.

Summary Compensation Table

| Name and Principal Position(1) |

Year |

Annual Compensation |

Long-Term Compensation |

All Other |

||||||||||||

| Salary($)(2) |

Bonus($)(3) |

Other |

Awards |

Payouts |

||||||||||||

| Securities SARs(5) |

LTIP Payouts($)(6) |

|||||||||||||||

| Thomas E. Hoaglin |

2003 | 824,615 | 786,900 | (4 | ) | 300,000 | (6 | ) | 34,128 | |||||||

| Chairman, President and |

2002 | 800,000 | 480,000 | (4 | ) | 300,000 | (6 | ) | 33,714 | |||||||

| CEO |

2001 | 683,077 | 250,000 | (4 | ) | 497,000 | (6 | ) | 6,800 | |||||||

| Ronald C. Baldwin |

2003 | 504,046 | 462,838 | (4 | ) | 110,000 | (6 | ) | 20,162 | |||||||

| Vice Chairman |

2002 | 486,308 | 291,785 | (4 | ) | 110,000 | (6 | ) | 8,000 | |||||||

| 2001 | 334,327 | -0- | (4 | ) | 174,600 | (6 | ) | 2,740 | ||||||||

| Michael J. McMennamin |

2003 | 418,492 | 435,851 | (4 | ) | 110,000 | (6 | ) | 21,540 | |||||||

| Vice Chairman and Chief |

2002 | 404,846 | 242,908 | (4 | ) | 110,000 | (6 | ) | 20,932 | |||||||

| Financial Officer |

2001 | 330,769 | 215,000 | (4 | ) | 99,600 | (6 | ) | 6,800 | |||||||

| Richard A. Cheap |

2003 | 281,238 | 230,352 | (4 | ) | 30,000 | (6 | ) | 11,250 | |||||||

| General Counsel and |

2002 | 266,300 | 133,150 | (4 | ) | 30,000 | (6 | ) | 12,366 | |||||||

| Secretary |

2001 | 252,308 | 159,250 | (4 | ) | 38,500 | (6 | ) | 10,892 | |||||||

| Daniel B. Benhase |

2003 | 294,038 | 205,216 | (4 | ) | 60,000 | (6 | ) | 11,762 | |||||||

| Executive Vice President, |

2002 | 283,077 | 141,538 | (4 | ) | 60,000 | (6 | ) | 11,323 | |||||||

| Huntington National Bank |

2001 | 240,385 | 137,500 | (4 | ) | 63,400 | (6 | ) | 9,903 | |||||||

| (1) | Mr. Hoaglin joined Huntington as President and Chief Executive Officer in February 2001. Mr. Baldwin joined Huntington in April 2001. |

| (2) | The 2003 base annual salary for each of the named executive officers was $800,000 for Mr. Hoaglin, $489,000 for Mr. Baldwin, $406,000 for Mr. McMennamin, $272,808 for Mr. Cheap, and $285,269 for Mr. Benhase. The 2003 salary figures in the table reflect the impact of pay that was made to all exempt employees, including these individuals, for their work from December 21, 2003 through December 31, 2003. This pay reflected a decision to change the payroll frequency for exempt employees from bi-weekly to semi-monthly. In certain years a bi-weekly payment frequency resulted in pay greater than an exempt employees stated annual salary. Switching to semi-monthly payment frequency assures annual pay for any year will be no more than an exempt employees stated annual salary. This pay amounted to $24,615 for Mr. Hoaglin, $15,046 for Mr. Baldwin, $12,492 for Mr. McMennamin, $8,430 for Mr. Cheap, and $8,769 for Mr. Benhase. Had Huntington not made the change in payroll frequency, these amounts would have been paid to each of these officers on January 2, 2004. Salary figures include amounts deferred pursuant to the Huntington Investment and Tax Savings Plan and the Supplemental Stock Purchase and Tax Savings Plan. |

| (3) | Annual cash incentive awards under Huntingtons Incentive Compensation Plan are reported in this column. These bonus figures include amounts which the named executive officers have elected to defer under the terms of Huntingtons Executive Deferred Compensation Plan. The amount reported for Mr. Hoaglin for 2003 also includes a negotiated payment under his Employment Agreement, which was payable after the end of 2002, of $138,900. |

| (4) | For each year indicated other compensation for each of the named executive officers was less than $50,000 and less than 10% of the total annual salary and bonus reported for the named executive. |

| (5) | The numbers in this column represent shares of Huntingtons common stock underlying grants of stock options considered annually. As previously reported, the figures indicated for 2001 for Messrs. Hoaglin, Baldwin, and McMennamin also include stock options received in February 2002 which were granted in lieu of all or a portion of cash incentive bonus which the executive officer would have otherwise received for 2001. |

| (6) | Huntingtons Long-Term Incentive Compensation Plan measures Huntingtons performance over multiple-year, overlapping cycles. There were no payouts to report for 2003 or 2001 since a cycle did not end during either of these |

11

| years. Each of the named executive officers was selected to participate in the cycle which began on January 1, 2000, and ended on December 31, 2002. Awards for this cycle, based on a comparison of Huntingtons three-year return on average equity to a three year average return on average equity of a peer group, were not yet determinable when last years Proxy Statement went to press. After year-end reports for a peer group of financial institutions were reviewed, it was determined that there were no awards payable for this cycle under the terms of the plan. |

| (7) | Figures in this column primarily represent amounts contributed by Huntington to the Huntington Investment and Tax Savings Plan and the Supplemental Stock Purchase and Tax Savings Plan. For 2003, $8,000 was contributed for each of the named executive officers under the Huntington Investment and Tax Savings Plan. Also for 2003, Huntington contributed to the Supplemental Stock Purchase and Tax Savings Plan: $26,128 for Mr. Hoaglin, $13,540 for Mr. McMennamin, $3,250 for Mr. Cheap, and $3,762 for Mr. Benhase. |

Employment and Executive Agreements

Employment Agreement

Under an Employment Agreement effective February 15, 2004, Mr. Hoaglin will be employed as Huntingtons Chairman, President, and Chief Executive Officer through February 14, 2007, with automatic three-year renewals unless sooner terminated. Mr. Hoaglins Employment Agreement provides that his annual base salary will be not less than $800,000, and that he will participate in Huntingtons incentive compensation plans, stock and long-term incentive plans, retirement plans, and other benefits afforded to executive officers. Mr. Hoaglin will be entitled to receive security services and protection from time to time as appropriate under the circumstances, including but not limited to, detection and alarm systems at his residences and personal security escorts.

The Employment Agreement may be terminated by either Mr. Hoaglin or Huntington upon written notice delivered to the other party at least 60 days prior to the expiration of the initial term or any renewal term. In addition, Huntington may terminate the agreement in the event Mr. Hoaglin becomes disabled, which disability continues for more than six consecutive months during a twelve month period. In such event, Mr. Hoaglin will be entitled to his full compensation to the date of termination. Thereafter Mr. Hoaglin will be entitled to two-thirds of his base salary, less any benefits he receives from any of Huntingtons disability insurance programs, until the earlier of termination of the disability or the end of the then current three-year term. Mr. Hoaglins compensation and benefits would be reinstated upon his return to employment. In the event Mr. Hoaglins employment is terminated for cause, he will be entitled to receive only the compensation which he earned under Huntingtons incentive compensation plans as of the date of termination. In the event Mr. Hoaglins employment is terminated by Huntington without cause, Mr. Hoaglin will be entitled to his minimum base salary, awards under the incentive compensation plans at not less than target levels, plus retirement and fringe benefits until the end of the then current three-year term or for two years after such termination, whichever period is longer. Mr. Hoaglin will be entitled to the same severance package if he were to terminate the agreement during the initial term for good reason. Good reason means the withholding from Mr. Hoaglin of authority, duties, responsibilities, and status consistent with his position, the removal of Mr. Hoaglin from the board of directors of Huntington, or breach of the agreement by Huntington. In the event of Mr. Hoaglins death during the term of the agreement, his base salary will continue to be paid to his beneficiary for six months following the date of death. Any incentive compensation to which he would have been entitled will also be paid to his beneficiary. In the event that Huntington undergoes a change of control, Mr. Hoaglin will be entitled to the benefits set forth in an Executive Agreement between Mr. Hoaglin and Huntington, as described below.

In the event Mr. Hoaglins employment is terminated as the result of disability, without cause, or pursuant to a change of control, Mr. Hoaglin has no duty to mitigate his damages by seeking other employment, and Huntington has no right to set off against amounts payable under the Employment Agreement any compensation which he may receive from future employment. If Mr. Hoaglins employment is terminated for any reason other than for cause, Huntington will provide Mr. Hoaglin and his spouse health insurance coverage comparable to the coverage provided during employment until the earlier of such time as Mr. Hoaglin is entitled to health care coverage under another employers plan, Mr. Hoaglin is eligible for medicare or other comparable program, or he is entitled to health care insurance pursuant to any health care insurance plan provided by Huntington to retired employees.

If Huntington is required to prepare an accounting restatement due to material non-compliance by Huntington, as a result of misconduct, with any financial reporting requirement under the federal securities laws, Mr. Hoaglin will reimburse Huntington for all amounts received under Huntingtons incentive compensation plans during the twelve month period following the first public issuance or filing with the Securities and Exchange Commission of the financial document embodying such financial reporting requirement, and any profits realized from the sale of securities of Huntington during the twelve month period, unless the application of this provision has been exempted by the Securities and Exchange Commission. If the Compensation Committee determines that Mr. Hoaglin has engaged in a serious breach of conduct, the

12

Compensation Committee may terminate any award under any stock plan or require Mr. Hoaglin to repay any gain realized on the exercise of an award in accordance with the terms of the stock plan. In addition, if Mr. Hoaglin is found guilty of misconduct by any judicial or administrative authority in connection with any formal investigation by the Securities and Exchange Commission or other federal state or regulatory investigation, the Compensation Committee may require the repayment of any gain realized on the exercise of an award under any stock plan without regard to the timing of the determination of misconduct in relation to the timing of the exercise of the award.

Executive Agreements

Huntington has entered into Executive Agreements with each of the persons named in the Summary Compensation Table. These Executive Agreements were entered into as part of Huntingtons corporate strategy to provide protection for, and thus retain, its well-qualified executive officers notwithstanding any actual or threatened change in control of Huntington. Change in control generally includes:

| | the acquisition by any person of beneficial ownership of 25% or more of Huntingtons outstanding voting securities; |

| | a change in the composition of the Board of Directors if a majority of the new directors were not appointed or nominated by the directors currently sitting on the Board of Directors or their subsequent nominees; |

| | a merger involving Huntington where Huntingtons shareholders immediately prior to the merger own less than 51% of the combined voting power of the surviving entity immediately after the merger; |

| | the dissolution of Huntington; and |

| | a disposition of assets, reorganization, or other corporate event involving Huntington which would have the same effect as any of the above-described events. |

Under each Executive Agreement, Huntington or its successor must provide severance benefits to the executive officer if such officers employment is terminated (other than on account of the officers death or disability or for cause):

| | by Huntington, at any time within 36 months after a change in control; |

| | by Huntington, at any time prior to a change in control but after commencement of any discussions with a third party relating to a possible change in control involving such third party if the executive officers termination is in contemplation of such possible change in control and such change in control is actually consummated within 12 months after the date of such executive officers termination; |

| | by the executive officer voluntarily with good reason at any time within 36 months after a change in control of Huntington; and |

| | by the executive officer voluntarily with good reason at any time after commencement of change in control discussions if such change in control is actually consummated within 12 months after the date of such officers termination. |

Under the Executive Agreements, good reason generally means the assignment to the executive officer of duties which are materially (and, in the case of Messrs. Benhase and Cheap, adversely) different from such duties prior to the change in control, a reduction in such officers salary or benefits, or a demand to relocate to an unacceptable location, made by Huntington or its successor either after a change in control or after the commencement of change in control discussions if such change or reduction is made in contemplation of a change in control and such change in control is actually consummated within 12 months after such change or reduction. An executive officers determination of good reason will be conclusive and binding upon the parties if made in good faith, except that, if the executive officer is serving as Chief Executive Officer of Huntington immediately prior to a change in control, the occurrence of a change in control will be conclusively deemed to constitute good reason.

In addition to accrued compensation, bonuses, and vested benefits and stock options, the executive officers severance benefits payable under the Executive Agreements include:

| | a lump-sum cash payment equal to three times (or, in the case of Messrs. Benhase and Cheap, two and one-half times) the officers highest base annual salary; |

| | a lump-sum cash payment equal to three times (or, in the case of Messrs. Benhase and Cheap, two and one-half times) the highest annual incentive compensation to which the officer would be entitled; |

| | a lump sum cash payment equal to one and one-half times the highest long-term incentive compensation to which the officer would be entitled; |

| | thirty-six months of continued insurance benefits; and |

| | thirty-six months of additional service credited for purposes of retirement benefits. |

13

Each Executive Agreement also provides that Huntington will pay the executive officer such amounts as would be necessary to compensate such officer for any excise tax paid or incurred due to any severance payment or other benefit provided under the Executive Agreement. However, if Mr. Benhases or Mr. Cheaps severance payments and benefits would be subject to any excise tax, but would not be subject to such tax if the total of such payments and benefits were reduced by 10% or less, then such payments and benefits will be reduced by the minimum amount necessary (not to exceed 10% of such payments and benefits) so that Huntington will not have to pay an excess severance payment and Mr. Benhase and Mr. Cheap will not be subject to an excise tax.

The Executive Agreements provide that, for a period of five years after any termination of the executive officers employment, Huntington will provide the executive officer with coverage under a standard directors and officers liability insurance policy at its expense, and will indemnify, hold harmless, and defend the executive to the fullest extent permitted under Maryland law against all expenses and liabilities reasonably incurred by the executive in connection with or arising out of any action, suit, or proceeding in which he may be involved by reason of having been a director or officer of Huntington or any subsidiary.

Huntington must pay the cost of counsel (legal and accounting) for an executive officer in the event such officer is required to enforce any of the rights granted under his Executive Agreement. In addition, the executive officer is entitled to prejudgment interest on any amounts found to be due to him in connection with any action taken to enforce such officers rights under the Executive Agreement at a rate equal to the prime commercial rate of The Huntington National Bank or its successor in effect from time to time plus 4%.

The Executive Agreements for Messrs. Hoaglin and Baldwin are in effect through December 31, 2004, and the Executive Agreements for Messrs. McMennamin, Benhase, and Cheap are in effect through December 31, 2005. All Executive Agreements are subject to automatic two-year renewals and to an extension for thirty-six months after any month in which a change of control occurs. An Executive Agreement will terminate if the employment of the executive officer terminates other than under circumstances which trigger the severance benefits.

Option Grants in Last Fiscal Year

Individual Grants

| Name |

Number of Securities Underlying Options Granted(#)(1) |

Percent of Total Options Granted to Employees in Fiscal Year(%) |

Exercise ($/sh) |

Expiration Date |

Grant Date Present Value($)(2) |

|||||||

| Thomas E. Hoaglin |

300,000 | 8.39 | $ | 20.4075 | 7/15/2013 | $ | 1,698,000 | |||||

| Ronald C. Baldwin |

110,000 | 3.08 | 20.4075 | 7/15/2013 | 622,600 | |||||||

| Michael J. McMennamin |

110,000 | 3.08 | 20.4075 | 7/15/2013 | 622,600 | |||||||

| Richard A. Cheap |

30,000 | .84 | 20.4075 | 7/15/2013 | 169,800 | |||||||

| Daniel B. Benhase |

60,000 | 1.68 | 20.4075 | 7/15/2013 | 339,600 | |||||||

| (1) | All options granted expire ten years from the date of grant. The options become exercisable in equal increments on each of the first three anniversaries of the date of grant. Options not yet exercised are canceled upon a termination of employment for any reason other than death, retirement under one or more of Huntingtons retirement plans, termination following a change in control of Huntington, or a disposition (other than a change in control) of substantially all of the stock or assets of Huntington, in which case all options become exercisable immediately as of such employment termination date and remain exercisable for a specified period following the termination depending on the type of termination. Generally, the exercise price of options and any tax which Huntington withholds in connection with the exercise of any stock option may be satisfied by payment in cash or in shares of Huntington common stock. None of the options has a reload feature. |

| (2) | The dollar amounts in this column were determined using the Black-Scholes option-pricing model, a method for estimating the present value of stock options based on assumptions about the stocks price volatility and dividend rate as well as interest rates. Because of the unpredictability of the assumptions required, the Black-Scholes model, or any other valuation model, is incapable of accurately predicting Huntingtons stock price or placing an accurate present value on options to purchase its stock. The assumptions used in performing the calculations were: (a) a risk-free rate of return equal to the zero-coupon United States Treasury Bond rate in effect on the date of the grant of 4.49% based on a term equal to the expected life of the option; (b) an expected dividend yield of 3.37% based on Huntingtons current common stock dividend; (c) an expected volatility of 33.8% based primarily on Huntingtons historical daily stock price volatility over the past six years; and (d) an expected option life of six years from date of grant to date of exercise, which is based on historical experience. No adjustments were made to account for vesting requirements, non-transferability, or risk of |

14

| forfeiture. Any appreciation in the market value of Huntington stock would benefit all shareholders and would be dependent in part upon the efforts of the named executive officers. The present values set forth in the table should not be viewed in any way as a forecast of the performance of Huntington common stock, which will be influenced by future events and unknown factors. The total of the grant date values indicated in the table for all stock options granted in 2003 to the named executive officers was $3,452,600, representing approximately .07% of the value of all shares of Huntington outstanding on July 15, 2003, which was the date on which the majority of stock options were granted during the year. |

Aggregated Option Exercises in Last Fiscal Year

And Fiscal Year-End Option Values

| Name |

Shares on |

Value |

Number of Securities Underlying Unexercised Options at Fiscal Year- End(#) |

Value of Unexercised In-the-Money(2) Options at Fiscal Year-End($) |

|||||

| Exercisable/ Unexercisable |

Exercisable/ Unexercisable |

||||||||

| Thomas E. Hoaglin |

N/A | N/A |

596,600/ 500,400 |

$ |

3,764,921/ 1,426,996 |

||||

| Ronald C. Baldwin |

N/A | N/A |

169,201/ 225,399 |

|

997,808/ 837,040 |

||||

| Michael J. McMennamin |

N/A | N/A |

135,867/ 208,733 |

|

765,949/ 711,961 |

||||

| Richard A. Cheap |

N/A | N/A |

77,588/ 58,733 |

|

353,385/ 206,810 |

||||

| Daniel B. Benhase |

N/A | N/A |

91,334/ 117,066 |

|

558,229/ 411,874 |

||||

| (1) | None of the named executive officers exercised stock options during 2003. |

| (2) | An option is in-the-money if the fair market value of the underlying common stock exceeds the exercise price of the option. |

Long-Term Incentive PlanAwards in Last Fiscal Year

| Name |

Number of Units, or Other Rights |

Performance or Payout |

Estimated Future Payouts Under Non-Stock Price-Based Plan($)(2) |

||||||||||||

|

Threshold |

Target |

Maximum |

|||||||||||||

| Thomas E. Hoaglin |

(1 | ) | (1 | ) | $ | 80,000 | $ | 500,000 | $ | 2,000,000 | |||||

| Ronald C. Baldwin |

(1 | ) | (1 | ) | 48,900 | 305,625 | 1,222,500 | ||||||||

| Michael J. McMennamin |

(1 | ) | (1 | ) | 40,600 | 253,750 | 1,015,000 | ||||||||

| Richard A. Cheap |

(1 | ) | (1 | ) | 27,400 | 109,600 | 438,400 | ||||||||

| Daniel B. Benhase |

(1 | ) | (1 | ) | 28,500 | 142,500 | 570,000 | ||||||||

| (1) | Each of the named executive officers was selected by the Compensation Committee of the Board of Directors to participate in a three-year long-term award cycle under the 2001 Stock and Long-Term Incentive Plan which began on January 1, 2002, and will end on December 31, 2004. |

| (2) | Long-term awards under the 2001 Stock and Long-Term Incentive Plan are based on Huntingtons performance over two-, three-, or four-year cycles. Huntingtons performance goals for the 2002 2004 cycle are based on a comparison of return on average shareholders equity to a peer group. The peer group for the cycle consists of twenty comparably sized commercial banks that are publicly traded and that emphasize traditional banking services, of which Huntington approximates the median in terms of assets and net revenue, plus three larger banks located in Ohio. Awards based on a percentage of base salary will be paid if Huntingtons performance achieves the established threshold or higher. Any awards for the 2002 2004 cycle will be paid in the first half of 2005 when Huntington can determine relative performance for the cycle. No awards will be paid if Huntingtons performance is below the threshold level. The figures in the table are based on salaries as of December 31, 2003. |

15

Pension Plan Table

| Remuneration |

Years of Service |

|||||||||||

| 15 |

20 |

25 |

30 |

35 |

40 |

|||||||

| $500,000 |

$137,376 | $185,728 | $234,079 | $266,756 | $291,756 | $316,756 | ||||||

| 550,000 |

151,589 | 204,940 | 258,291 | 294,256 | 321,756 | 349,256 | ||||||

| 600,000 |

165,801 | 224,153 | 282,504 | 321,756 | 351,756 | 381,756 | ||||||

| 650,000 |

180,014 | 243,365 | 306,716 | 349,256 | 381,756 | 414,256 | ||||||

| 900,000 |

251,076 | 339,428 | 427,779 | 486,756 | 531,756 | 576,756 | ||||||

| 975,000 |

272,395 | 368,246 | 464,098 | 528,006 | 576,756 | 625,506 | ||||||

| 1,075,000 |

300,820 | 406,671 | 512,523 | 583,006 | 636,756 | 690,506 | ||||||

| 1,175,000 |

239,245 | 445,096 | 560,948 | 638,006 | 696,756 | 755,506 | ||||||

| 1,375,000 |

386,095 | 521,946 | 657,798 | 748,006 | 816,756 | 885,506 | ||||||

| 1,650,000 |

464,264 | 627,615 | 790,966 | 899,256 | 981,756 | 1,064,256 | ||||||

The table above illustrates the operation of Huntingtons Retirement Plan and Supplemental Retirement Income Plan, known as the SRIP, by showing various annual benefits assuming various levels of final average compensation and years of credited service. The SRIP provides benefits according to the same benefit formula as the Retirement Plan, except that benefits under the SRIP are not limited by Sections 401(a)(17) and 415 of the Internal Revenue Code. Code Section 401(a)(17) limits the annual amount of compensation that may be taken into account when calculating benefits under the Retirement Plan. For 2003, this limit was $200,000. Code Section 415 limits the annual benefit amount that a participant may receive under the Retirement Plan. For 2003, this amount was $160,000. An employee who: (a) is a participant in the Retirement Plan; (b) has been nominated by the Compensation Committee; and (c) earns compensation in excess of the limitation imposed by Code Section 401(a)(17) or whose benefit exceeds the limitation of Code Section 415(b), is eligible to participate in the SRIP. In addition, employees whose final benefits under the Retirement Plan are reduced due to elective deferral of compensation under the Huntington Executive Deferred Compensation Plan are also eligible to participate in the SRIP.

The maximum years of credited service recognized by the Retirement Plan and the SRIP is forty. Years of credited service in addition to those actually earned by a participant may be granted by the Pension Review Committee for the purposes of determining benefits under the SRIP. Benefit figures shown are computed on the assumption that participants retire at age 65. The normal form of benefit under both the Retirement Plan and the SRIP is a life annuity.

Each of the executive officers named in the Summary Compensation Table were participants in the SRIP during 2003. The compensation covered for these named executive officers by the Retirement Plan and the SRIP is the average of the total paid, in the five consecutive highest years of the executive officers career with Huntington, of base salary and 50% of bonus. Bonuses are taken into account for the year in which paid rather than earned. The estimated credited years of service, as of December 31, 2003, are 2.92 for Mr. Hoaglin, 2.75 for Mr. Baldwin, 3.58 for Mr. McMennamin, 5.67 for Mr. Cheap, and 3.58 for Mr. Benhase.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed of Don M. Casto III, John B. Gerlach, Jr., and George A. Skestos. None of the members is or has ever been an officer of Huntington or its subsidiaries.

Board Compensation Committee Report on Executive Compensation

The following Report on Executive Compensation should not be deemed filed or incorporated by reference into any other document, including Huntingtons filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Huntington specifically incorporates this Report into any such filing by reference.

The Compensation Committee of the Board of Directors oversees Huntingtons executive compensation programs. The Committee met four times in 2003 to review and approve executive compensation matters.

Huntingtons executive compensation philosophy is designed to meet four primary goals:

| 1. | Ensure a strong linkage between corporate, unit, and individual performance and total compensation. |

| 2. | Integrate compensation programs with Huntingtons annual and long-term strategic goals. |

| 3. | Encourage long-term strategic management and enhancement of shareholder value through equity awards. |

16

| 4. | Attract and retain key executives critical to the long-term success of Huntington by providing a fully competitive reward package that is appropriately sensitive to performance. |

These principles are reflected in the key components of Huntingtons executive compensation programs which consist of base salary, annual incentive awards, and long-term incentive awards. Huntingtons executive compensation programs are regularly evaluated to ensure that they continue to reinforce shareholder interests and support the goals of Huntingtons executive compensation philosophy.

Mr. Hoaglin and Huntington have entered into an Employment Agreement which, among other things, established for Mr. Hoaglin a minimum base salary and participation in Huntingtons compensation plans. Increases in the minimum base salary and the specific level of participation in the incentive compensation plans is determined by the Committee based on the factors described below. Mr. Hoaglins Employment Agreement is described in greater detail above under Employment and Executive Agreements.

Base Salary

An executive officers base salary and subsequent adjustments are typically considered annually and are determined relative to the following factors: individual and business unit performance, scope of responsibility and accountability, comparison with industry pay practices, and cost of living considerations. The Committee feels that all of these factors are significant and the relevance of each varies from executive to executive. Therefore, no specific weight has been assigned to these factors in the evaluation of an executive officers base salary.