Filed Pursuant to Rule 424(b)(3)

Registration No. 333-285441

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 23, 2026

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated February 28, 2025)

Huntington Bancshares Incorporated

$ Floating Rate Senior Notes due 20

$ % Fixed-to-Floating Rate Senior Notes due 20

$ % Fixed-to-Fixed Rate Subordinated Notes due 20

We are offering $ aggregate principal amount of our floating rate senior notes due , 20 (the “floating rate senior notes”), $ aggregate principal amount of our % fixed-to-floating rate senior notes due , 20 (the “fixed-to-floating rate senior notes,” and together with the floating rate senior notes, the “senior notes”) and $ aggregate principal amount of our % fixed-to-fixed rate subordinated notes due , 20 (the “subordinated notes” and, together with the senior notes, the “notes”).

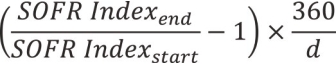

The floating rate senior notes will mature on , 20 (the “floating rate senior notes Maturity Date”). The floating rate senior notes will accrue interest from (and including) , 2026 (the “senior notes Issue Date”) to (but excluding) the floating rate senior notes Maturity Date at a floating rate equal to a benchmark rate based on the Compounded SOFR Index Rate (as defined in “Description of Notes—Senior Notes—Calculation of the Benchmark”) plus basis points per annum.

The fixed-to-floating rate senior notes will mature on , 20 (the “fixed-to-floating rate senior notes Maturity Date”). The fixed-to-floating rate senior notes will accrue interest from (and including) the senior notes Issue Date to (but excluding) , 20 at a fixed rate of % per annum, and from (and including) , 20 to (but excluding) the senior notes Maturity Date at a floating rate equal to a benchmark rate based on the Compounded SOFR Index Rate (as defined in “Description of Notes—Senior Notes—Calculation of the Benchmark”) plus basis points per annum.

The subordinated notes will mature on , 20 (the “subordinated notes Maturity Date” and, together with the floating rate senior notes Maturity Date and the fixed-to-floating rate senior notes Maturity Date, each, a “Maturity Date”). The subordinated notes will accrue interest from (and including) , 2026 (the “subordinated notes Issue Date”) to (but excluding) , 20 (the “subordinated notes Reset Date”) at a fixed rate of % per annum, and from (and including) the subordinated notes Reset Date to (but excluding) the subordinated notes Maturity Date at a rate per annum which will be the Five-year U.S. Treasury Rate (as defined herein) as of the subordinated notes Reset Determination Date (as defined herein) plus % per annum.

We have the option to redeem the senior notes, at the applicable times and at the applicable redemption price set forth under “Description of Notes—Senior Notes—Optional Redemption,” and we have the option to redeem the subordinated notes, at the applicable times and at the applicable redemption price set forth under “Description of Notes—Subordinated Notes—Optional Redemption.” Holders of any notes redeemed will also receive accrued and unpaid interest thereon to (but excluding) the applicable date of redemption. The notes will not be subject to repayment at the option of the holder at any time prior to maturity and will not be entitled to any sinking fund. See “Description of Notes—Senior Notes—Optional Redemption” and “Description of Notes—Subordinated Notes—Optional Redemption” in this prospectus supplement.

The senior notes will be unsecured and unsubordinated obligations of Huntington Bancshares Incorporated, a Maryland corporation, and will rank equally with all of our other unsecured and unsubordinated indebtedness. The subordinated notes will be unsecured and subordinated in right of payment to the payment of our existing and future Senior Debt (as defined herein), will rank equal in right of payment to all of our existing and future indebtedness ranking on a parity with the subordinated notes and will be senior to any liabilities and other obligations of ours that rank junior and not equally with or prior to the subordinated notes. The notes will not be guaranteed by any of our subsidiaries. See “Description of Notes” in this prospectus supplement.

The notes will be issued only in registered book-entry form, in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

The notes will not be listed on any securities exchange. Currently there is no public market for the notes.

Investing in the notes involves risks. See “Risk Factors” beginning on page S-

11 of this prospectus supplement and in “Item 1A—Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2024 and of our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025, June 30, 2025, and September 30, 2025 filed with the U.S. Securities and Exchange Commission (the “SEC”) to read about factors you should consider before investing in the notes.

| | | | | | | | | |

Per Floating Rate Senior Note | | | % | | | % | | | % |

Floating Rate Senior Note Total | | | $ | | | $ | | | $ |

Per Fixed-to-Floating Rate Senior Note | | | % | | | % | | | % |

Fixed-to-Floating Rate Senior Note Total | | | $ | | | $ | | | $ |

Per Subordinated Note | | | % | | | % | | | % |

Subordinated Note Total | | | $ | | | $ | | | $ |

| | | | | | | | | |

(1)

| Plus accrued interest, if any, from , 2026, if settlement occurs after that date. |

None of the SEC, any state securities commission, the Federal Deposit Insurance Corporation (the “FDIC”), the Board of Governors of the Federal Reserve System (the “Federal Reserve”) nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The notes are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the FDIC or any other governmental agency or instrumentality.

The underwriters expect to deliver the notes in book-entry form only through the facilities of The Depository Trust Company for the accounts of its participants, including Clearstream Banking, société anonyme, and Euroclear Bank S.A./N.V., as operator of the Euroclear System, against payment in New York, New York on or about , 2026.

Our affiliates may use this prospectus supplement and the accompanying prospectus in connection with offers and sales of the notes in the secondary market. These affiliates may act as principal or agent in those transactions. Secondary market sales will be made at prices related to market prices at the time of sale.

Joint Book-Running Managers

| | | | | | | | | |

Citigroup | | | Goldman Sachs & Co. LLC | | | J.P. Morgan | | | Huntington Capital Markets |

| | | | | | | | | |

Prospectus Supplement dated , 2026.