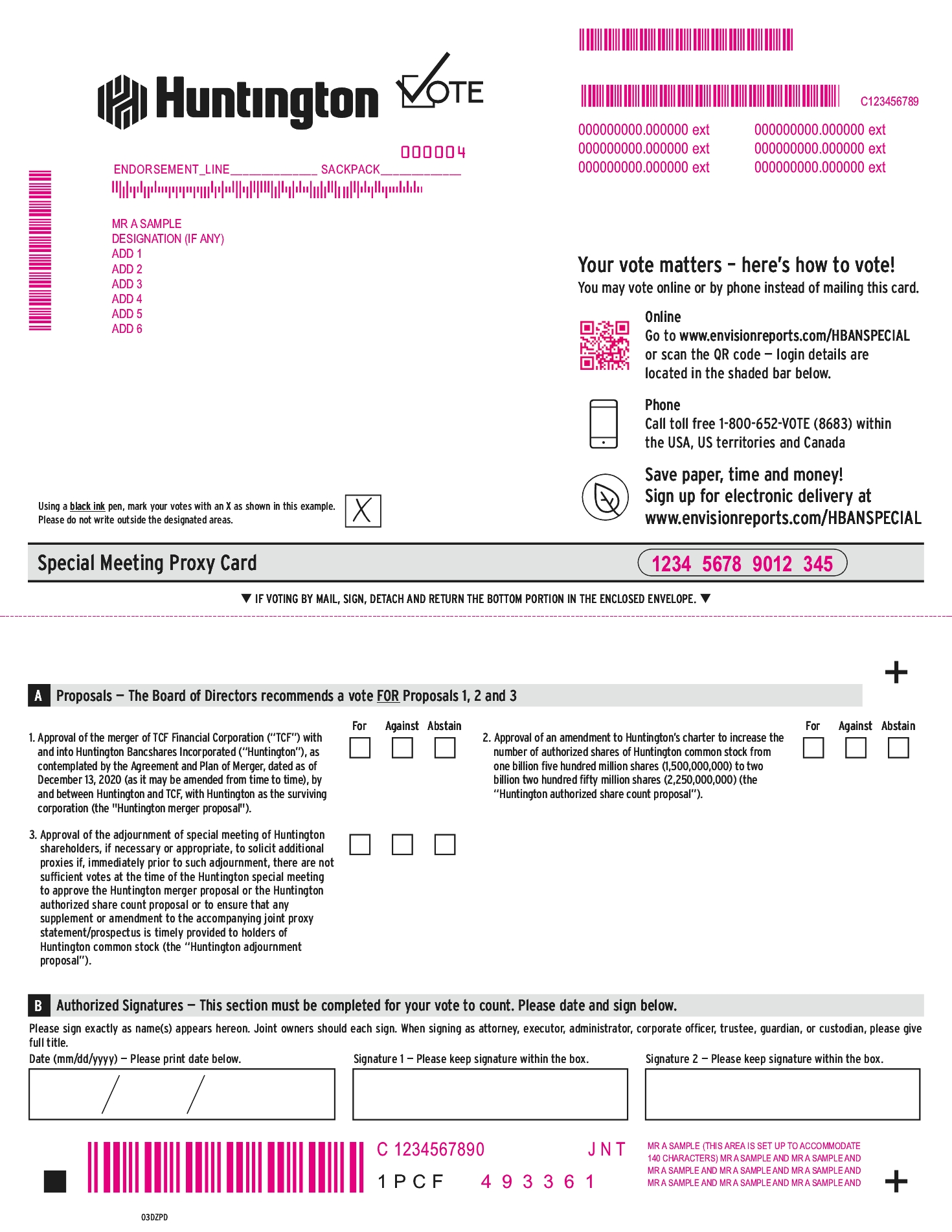

To the Shareholders of Huntington Bancshares Incorporated and TCF Financial Corporation

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

On behalf of the boards of directors of Huntington Bancshares Incorporated (“Huntington”) and TCF Financial Corporation (“TCF”), we are pleased to enclose this joint proxy statement/prospectus relating to the proposed merger between Huntington and TCF. We are requesting that you take certain actions as a holder of Huntington common stock or a holder of TCF common stock.

The boards of directors of Huntington and TCF (the “Huntington board of directors” and the “TCF board of directors,” respectively) have each unanimously approved an agreement to merge our two companies. Pursuant to the Agreement and Plan of Merger, dated as of December 13, 2020, by and between Huntington and TCF (as amended from time to time, the “merger agreement”), TCF will merge with and into Huntington (the “merger”), with Huntington as the surviving corporation (the “surviving corporation,” the “combined company,” or “Huntington,” as the case may be).

The proposed merger will bring together two purpose-driven organizations with a deep commitment to the customers and communities they serve. With a history of caring for customers and colleagues, the new organization will have a top 5 rank in approximately 70% of its deposit markets in Illinois, Indiana, Michigan, Minnesota, Ohio, Wisconsin, West Virginia, Denver and Pittsburgh (excluding all deposits above $0.5 billion at any branch), and will leverage its scale to serve customer needs through a distinctive, “People-First, Digitally-Powered” customer experience. The combined company, as of September 30, 2020, would have had approximately $168 billion in assets, $117 billion in loans, and $134 billion in deposits. We believe that the merger will provide the opportunity for deeper investments in our communities and a better experience for our customers. We anticipate that the combined company will be a top regional bank, with the scale to compete and the passion to serve. We believe that the merger will be a great benefit to all of our stakeholders and will drive significant opportunities for our team members.

In the merger, holders of TCF common stock will receive 3.0028 shares (the “exchange ratio” and such shares, the “merger consideration”) of Huntington common stock for each share of TCF common stock they own. Holders of Huntington common stock will continue to own their existing shares of Huntington common stock. Based on the closing price of Huntington common stock on the Nasdaq Global Select Market (the “NASDAQ”) on December 11, 2020, the last trading day before public announcement of the merger, the exchange ratio represented approximately $38.83 in value for each share of TCF common stock. Based on the closing price of Huntington common stock on the NASDAQ on February 11, 2021, the last practicable trading day before the date of this joint proxy statement/prospectus, of $14.31, the exchange ratio represented approximately $42.97 in value for each share of TCF common stock. The value of the Huntington common stock at the time of completion of the merger could be greater than, less than or the same as the value of Huntington common stock on the date of this joint proxy statement/prospectus. We urge you to obtain current market quotations of Huntington common stock (trading symbol “HBAN”) and TCF common stock (trading symbol “TCF”).

In addition, each share of TCF series C preferred stock issued and outstanding immediately prior to the effective time of the merger will be converted into the right to receive one (1) share of a newly issued series of Huntington preferred stock having the terms set forth in the merger agreement (“new Huntington preferred stock”). Likewise, following the completion of the merger, each outstanding TCF depositary share representing a 1/1000th interest in a share of TCF series C preferred stock will become a Huntington depositary share representing a 1/1000th interest in a share of new Huntington preferred stock. The TCF depositary shares representing a 1/1000th interest in a share of TCF series C preferred stock are currently listed on the NASDAQ under the symbol “TCFCP.” The new Huntington depositary shares representing a 1/1000th interest in a share of new Huntington preferred stock are expected to be listed on the NASDAQ upon completion of the merger.

The merger is intended to qualify as a “reorganization” for U.S. federal income tax purposes. Accordingly, U.S. holders (as defined in “Material U.S. Federal Income Tax Consequences of the Merger”) of TCF common stock generally will not recognize any gain or loss for U.S. federal income tax purposes on the exchange of shares of TCF common stock for Huntington common stock in the merger, except with respect to any cash received instead of fractional shares of common stock of the combined company. For more information regarding the tax consequences of the merger, see the section entitled “Material U.S. Federal Income Tax Consequences of the Merger.”

Based on the number of shares of TCF common stock outstanding as of February 11, 2021, Huntington expects to issue approximately 458 million shares of Huntington common stock to holders of TCF common stock in the aggregate in the merger. Based on the number of shares of TCF common stock outstanding as of February 11, 2021 and the number of shares of Huntington common stock outstanding as of February 11, 2021, we estimate that, following the completion of the merger, former holders of TCF common stock will own approximately thirty-one percent (31%) of the combined company and former holders of Huntington common stock will own approximately sixty-nine percent (69%) of the combined company.

The special meeting of holders of TCF common stock will be held virtually on March 25, 2021 at www.virtualshareholdermeeting.com/TCF2021SGM, at 3:30 p.m., Eastern Time. The special meeting of holders of Huntington common stock will be held virtually on March 25, 2021 at www.meetingcenter.io/207906613, at 3:30 p.m., Eastern Time. At our respective special meetings, in addition to other business, we will each ask our holders of common stock to approve the merger. Information about these meetings and the merger is contained in this joint proxy statement/prospectus.

In particular, see “Risk Factors” beginning on page 42. We urge you to read this joint proxy statement/prospectus carefully and in its entirety.

Holders of TCF series C preferred stock and holders of depositary shares representing TCF series C preferred stock are not entitled to, and are not requested to, vote at the TCF special meeting. Holders of Huntington preferred stock and holders of depositary shares representing Huntington preferred stock are not entitled to, and are not requested to, vote at the Huntington special meeting. Whether or not you plan to attend your company’s respective virtual special meeting, please vote as soon as possible to make sure that your shares are represented at the meeting. If your shares are held in the name of a broker, bank, trustee or other nominee, please follow the instructions provided to you by such record holder. If you do not vote, it will have the same effect as voting “AGAINST” the merger.

Each of our boards of directors unanimously recommends that holders of common stock vote “FOR” each of the proposals to be considered at the respective meetings. We strongly support this combination of our companies and join our boards in their recommendations.

|

|

|

|

|

|

Stephen D. Steinour

Chairman of the Board, President and Chief Executive Officer

Huntington Bancshares Incorporated

|

|

|

Gary Torgow

Executive Chairman of the Board

TCF Financial Corporation

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the merger or determined if this document is accurate or complete. Any representation to the contrary is a criminal offense.

The securities to be issued in the merger are not savings or deposit accounts or other obligations of any bank or non-bank subsidiary of either Huntington or TCF, and they are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

This joint proxy statement/prospectus is dated February 17, 2021, and is first being mailed to holders of Huntington common stock and holders of TCF common stock on or about February 17, 2021.