425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on April 19, 2007

Filed

by

Huntington Bancshares Incorporated

Pursuant

to Rule 425 under the Securities Act of 1933

and

deemed

filed pursuant to Rule 14a-6(b)

of

the Securities Exchange Act of 1934

Subject

Company: Sky Financial Group, Inc.

(Commission

File No. 333-140897)

The

following excerpts are from Huntington’s 2007 first quarter earnings press

release and slide presentation.

*

*

*

“We

also

made very good progress in moving forward with our pending merger with Sky

Financial Group, Inc.,” he noted. “A lot of detailed planning is

underway. We remain highly confident that this merger should generate

significant shareholder value.”

*

*

*

On

December 20, 2006, the company announced its pending merger with Sky Financial

Group. This merger is subject to approval by Huntington and Sky

Financial shareholders, regulatory approvals, and other customary closing

conditions. As previously announced, the merger is expected to close

early in the 2007 third quarter and is estimated to be slightly accretive to

2007 reported earnings, excluding merger charges.

*

*

*

w

Sky Financial Group Merger Integration preparation proceeding as

planned

*

*

*

Franchise

Pro-forma Including

Impact of Pending

Merger of

Sky Financial Group

|

|

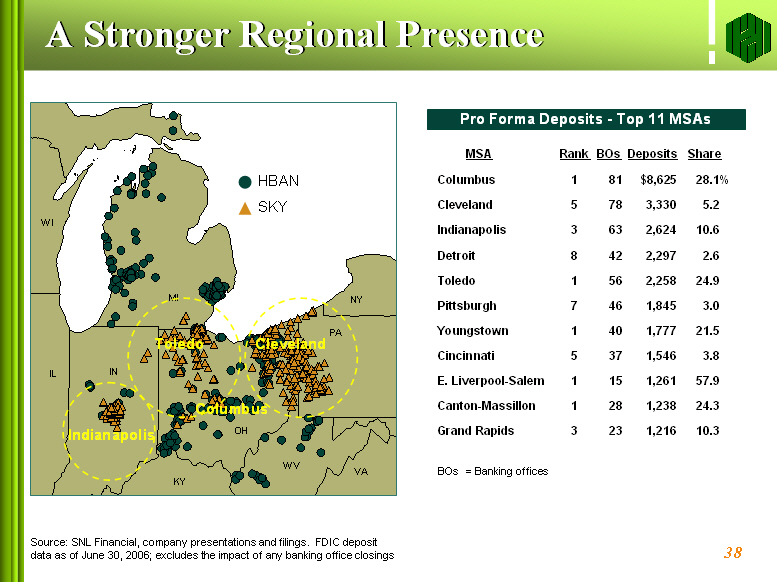

A Stronger Regional Presence

Pro Forma Deposits - Top 11 MSAs

MSA Rank BOs Deposits Share

Columbus 1 81 $8,625 28.1%

Cleveland 5 78 3,330 5.2

Indianapolis 3 63 2,624 10.6

Detroit 8 42 2,297 2.6

Toledo 1 56 2,258 24.9

Pittsburgh 7 46 1,845 3.0

Youngstown 1 40 1,777 21.5

Cincinnati 5 37 1,546 3.8

E. Liverpool-Salem 1 15 1,261 57.9

Canton-Massillon 1 28 1,238 24.3

Grand Rapids 3 23 1,216 10.3

BOs = Banking offices

Source: SNL Financial, company presentations and filings. FDIC deposit data as

of June 30, 2006; excludes the impact of any banking office closings

|

|

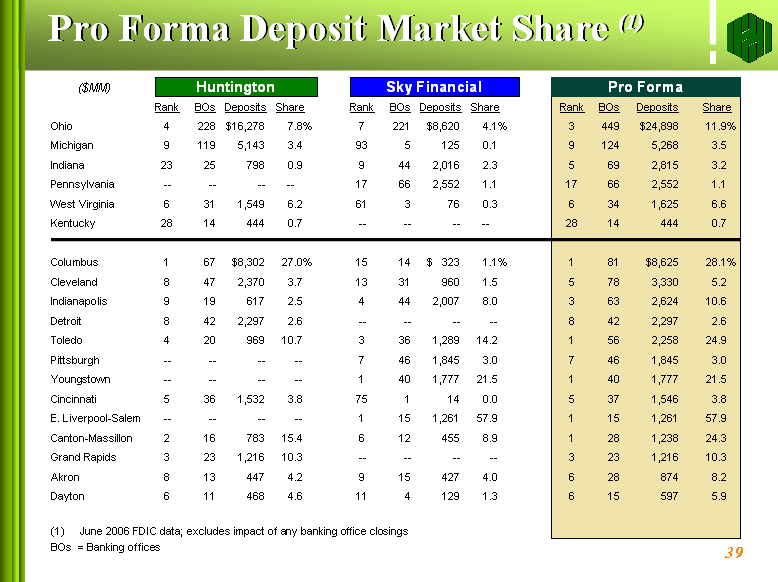

Pro Forma Deposit Market Share (1)

($MM) Huntington

Rank BOs Deposits Share

Ohio 4 228 $16,278 7.8%

Michigan 9 119 5,143 3.4

Indiana 23 25 798 0.9

Pennsylvania -- -- -- --

West Virginia 6 31 1,549 6.2

Kentucky 28 14 444 0.7

Columbus 1 67 $ 8,302 27.0%

Cleveland 8 47 2,370 3.7

Indianapolis 9 19 617 2.5

Detroit 8 42 2,297 2.6

Toledo 4 20 969 10.7

Pittsburgh -- -- -- --

Youngstown -- -- -- --

Cincinnati 5 36 1,532 3.8

E. Liverpool-Salem -- -- -- --

Canton-Massillon 2 16 783 15.4

Grand Rapids 3 23 1,216 10.3

Akron 8 13 447 4.2

Dayton 6 11 468 4.6

Sky Financial Pro Forma

Rank BOs Deposits Share Rank BOs Deposits Share

7 221 $ 8,620 4.1% 3 449 $24,898 11.9%

93 5 125 0.1 9 124 5,268 3.5

9 44 2,016 2.3 5 69 2,815 3.2

17 66 2,552 1.1 17 66 2,552 1.1

61 3 76 0.3 6 34 1,625 6.6

-- -- -- -- 28 14 444 0.7

15 14 $ 323 1.1% 1 81 $ 8,625 28.1%

13 31 960 1.5 5 78 3,330 5.2

4 44 2,007 8.0 3 63 2,624 10.6

-- -- -- -- 8 42 2,297 2.6

3 36 1,289 14.2 1 56 2,258 24.9

7 46 1,845 3.0 7 46 1,845 3.0

1 40 1,777 21.5 1 40 1,777 21.5

75 1 14 0.0 5 37 1,546 3.8

1 15 1,261 57.9 1 15 1,261 57.9

6 12 455 8.9 1 28 1,238 24.3

-- -- -- -- 3 23 1,216 10.3

9 15 427 4.0 6 28 874 8.2

11 4 129 1.3 6 15 597 5.9

(1) June 2006 FDIC data; excludes impact of any banking office closings

BOs = Banking offices

|

|

*

*

*

Additional

Information About the Huntington and Sky Financial Group Merger and Where

to

Find It

In

connection with the proposed merger of Huntington Bancshares Incorporated

and

Sky Financial Group, Huntington and Sky Financial will be filing relevant

documents concerning the transaction with the Securities and Exchange

Commission. On April 19, 2007, Huntington filed Amendment No. 2 to the

registration statement on Form S-4 with the Securities and Exchange Commission,

which includes a proxy statement/prospectus. Stockholders will be able to

obtain

a free copy of the proxy statement/prospectus, as well as other filings

containing information about Huntington and Sky Financial, at the Securities

and

Exchange Commission’s internet site (http://www.sec.gov). Copies of the

proxy statement/prospectus and the filings with the Securities and Exchange

Commission that will be incorporated by reference in the proxy

statement/prospectus can also be obtained, without charge, by directing a

request to Huntington, Huntington Center, 41 South High Street, Columbus,

Ohio

43287, Attention: Investor Relations, 614-480-4060, or Sky Financial, 221

South

Church Street, Bowling Green, Ohio, 43402. The final proxy statement/prospectus

will be mailed to stockholders of Huntington and Sky Financial.

Stockholders

are urged to read the proxy statement/prospectus, and other relevant documents

filed with the Securities and Exchange Commission regarding the proposed

transaction when they become available, because they will contain important

information.

The

directors and executive officers of Huntington and Sky Financial and other

persons may be deemed to be participants in the solicitation of proxies in

respect of the proposed merger. Information regarding Huntington’s directors and

executive officers is available in its proxy statement included in the

registration statement filed with the SEC by Huntington on April 19, 2007.

Information regarding Sky Financial’s directors and executive officers is

available in its proxy statement filed with the SEC by Sky Financial on February

23, 2006. Other information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the proxy statement/prospectus and other

relevant materials to be filed with the SEC when they become

available.