425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on December 21, 2006

Filed by Huntington Bancshares Incorporated

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Sky Financial Group, Inc.

(Commission File No. 001-14473)

Huntington Sky

A Value Added Combination

---

A Stronger Regional Presence

December 21, 2006

1

|

|

Meeting Participants

Huntington

Tom Hoaglin

- -- Chairman, President and Chief Executive Officer

Don Kimble

- -- Executive Vice President -- Chief Financial Officer

Jay Gould

- -- Senior Vice President -- Investor Relations

Sky

Marty Adams

- -- Chairman, President and Chief Executive Officer

2

|

|

Presentation Overview

o Why this transaction?

o A value added combination

o A stronger regional presence

o Organizational structure

o Low execution risk

o Appendix

3

|

|

Why This Transaction?

A Huntington Perspective

- ------------------------

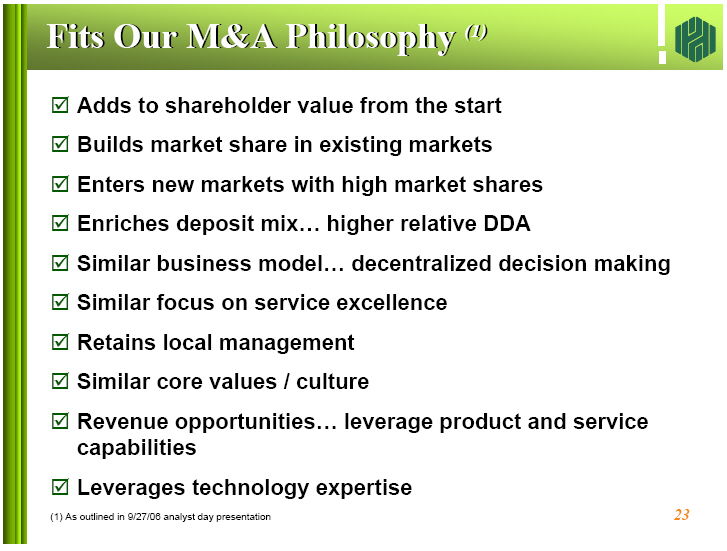

o Fits our M&A philosophy and pricing parameters

-- Creates shareholder value

-- Improves market share in existing markets

-- Expands into new markets with significant market shares

-- Increases customer convenience

-- Compatible cultures of local decision-making and focus on

customer service excellence

A Sky Financial Perspective

- ---------------------------

o Provides attractive shareholder returns

-- Receive an immediate premium

-- Will also participate in value created by the merger

o Enhances customer convenience and gives access to a broader array of products

and services

o Retains local management

o Compatible cultures

4

|

|

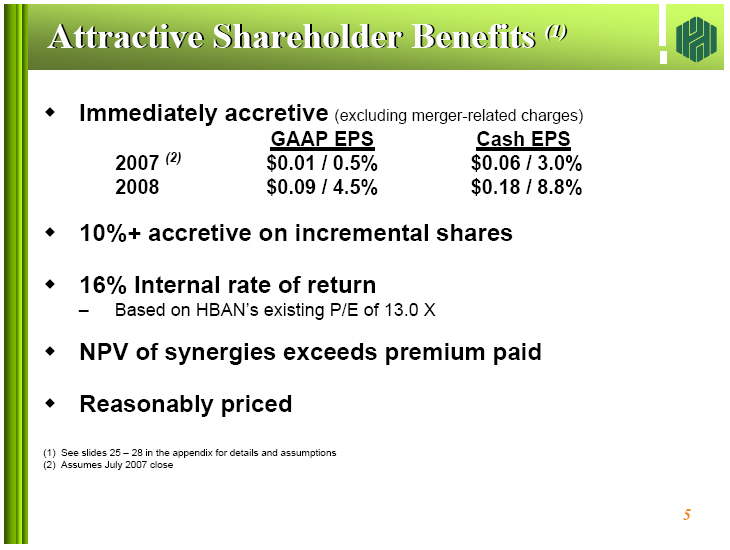

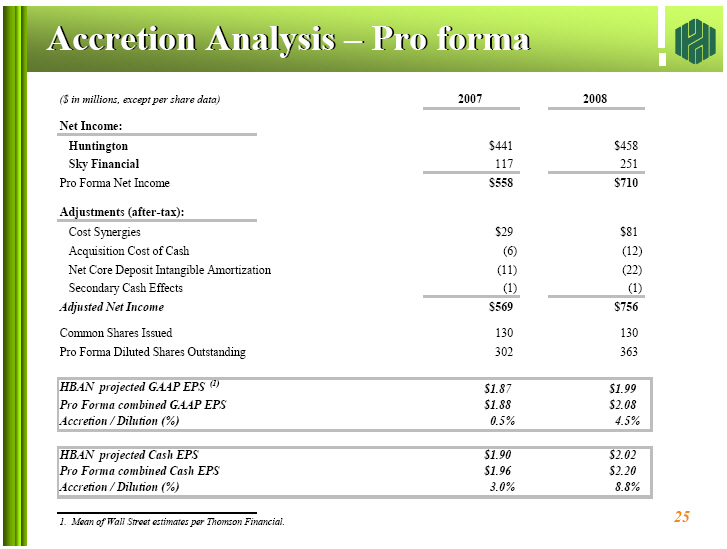

Attractive Shareholder Benefits (1)

o Immediately accretive (excluding merger-related charges)

GAAP EPS Cash EPS

-------- --------

2007 (2) $0.01 / 0.5% $0.06 / 3.0%

2008 $0.09 / 4.5% $0.18 / 8.8%

o 10%+ accretive on incremental shares

o 16% Internal rate of return

-- Based on HBAN's existing P/E of 13.0 X

o NPV of synergies exceeds premium paid

o Reasonably priced

(1) See slides 25 -- 28 in the appendix for details and assumptions

(2) Assumes July 2007 close

5

|

|

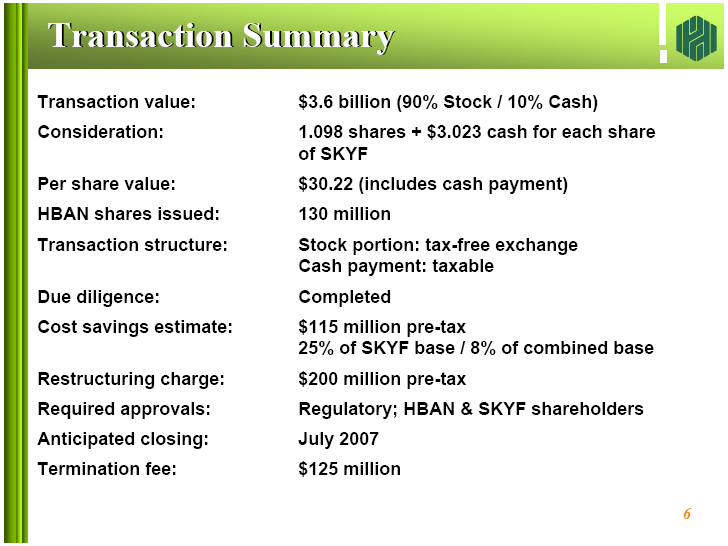

Transaction Summary

Transaction value: $3.6 billion (90% Stock / 10% Cash)

Consideration: 1.098 shares + $3.023 cash for each share

of SKYF

Per share value: $30.22 (includes cash payment)

HBAN shares issued: 130 million

Transaction structure: Stock portion: tax-free exchange

Cash payment: taxable

Due diligence: Completed

Cost savings estimate: $115 million pre-tax

25% of SKYF base / 8% of combined base

Restructuring charge: $200 million pre-tax

Required approvals: Regulatory; HBAN & SKYF shareholders

Anticipated closing: July 2007

Termination fee: $125 million

6

|

|

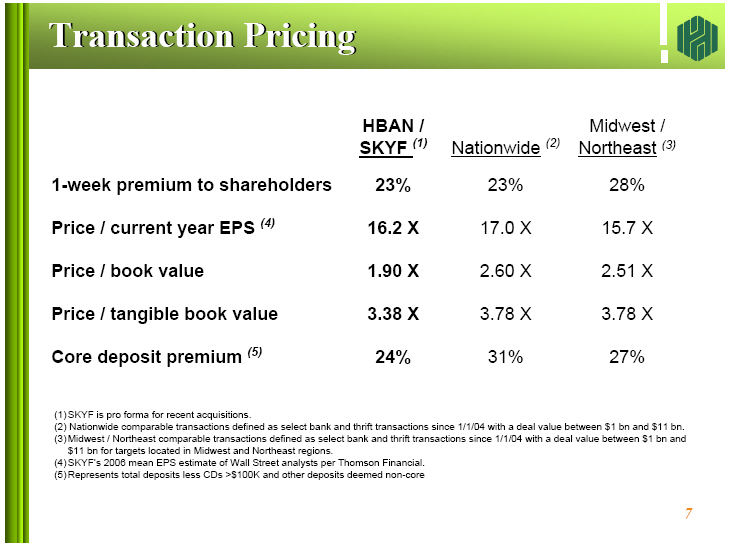

Transaction Pricing

HBAN / Midwest /

SKYF(1) Nationwide(2) Northeast(3)

------- ------------- ------------

1-week premium to shareholders 23% 23% 28%

Price / current year EPS (4) 16.2X 17.0X 15.7X

Price / book value 1.90X 2.60X 2.51X

Price / tangible book value 3.38X 3.78X 3.78X

Core deposit premium (5) 24% 31% 27%

(1) SKYF is pro forma for recent acquisitions.

(2) Nationwide comparable transactions defined as select bank and thrift

transactions since 1/1/04 with a deal value between $1 bn and $11 bn.

(3) Midwest / Northeast comparable transactions defined as select bank and

thrift transactions since 1/1/04 with a deal value between $1 bn and $11 bn for

targets located in Midwest and Northeast regions.

(4) SKYF's 2006 mean EPS estimate of Wall Street analysts per Thomson Financial.

(5) Represents total deposits less CDs >$100K and other deposits deemed

non-core

7

|

|

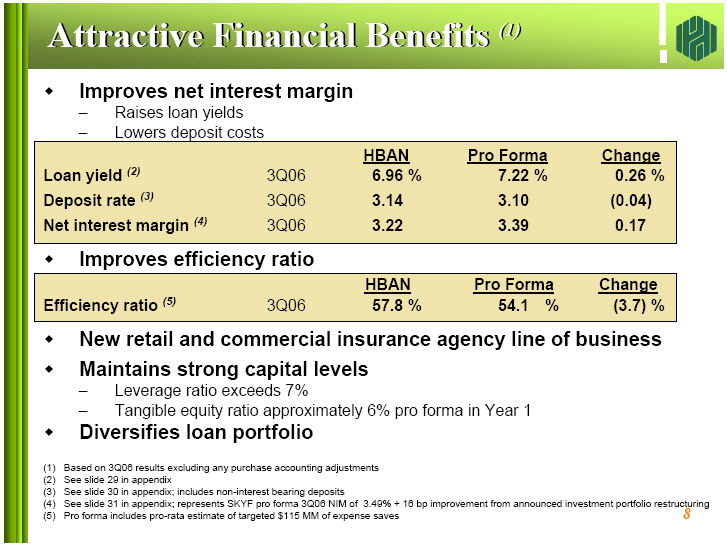

Attractive Financial Benefits (1)

o Improves net interest margin

-- Raises loan yields

-- Lowers deposit costs

- -------------------------------------------------------------------------------

HBAN Pro Forma Change

---- --------- ------

Loan yield (2) 3Q06 6.96% 7.22% 0.26%

Deposit rate (3) 3Q06 3.14 3.10 (0.04)

Net interest margin (4) 3Q06 3.22 3.39 0.17

- -------------------------------------------------------------------------------

o Improves efficiency ratio

- -------------------------------------------------------------------------------

HBAN Pro Forma Change

---- --------- ------

Efficiency ratio (5) 3Q06 57.8% 54.1% (3.7)%

- -------------------------------------------------------------------------------

o New retail and commercial insurance agency line of business

o Maintains strong capital levels

-- Leverage ratio exceeds 7%

-- Tangible equity ratio approximately 6% pro forma in Year 1

o Diversifies loan portfolio

(1) Based on 3Q06 results excluding any purchase accounting adjustments

(2) See slide 29 in appendix

(3) See slide 30 in appendix; includes non-interest bearing deposits

(4) See slide 31 in appendix; represents SKYF pro forma 3Q06 NIM of 3.49% +

16 bp improvement from announced investment portfolio restructuring

(5) Pro forma includes pro-rata estimate of targeted $115 MM of expense saves

8

|

|

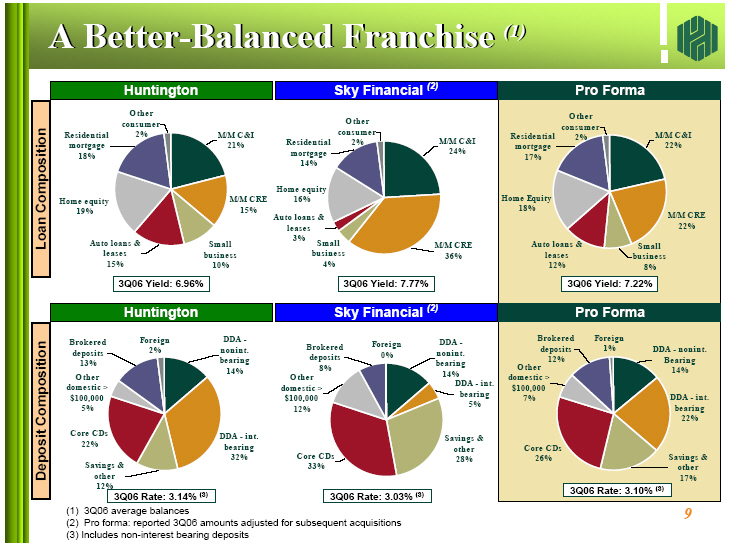

A Better-Balanced Franchise (1)

Loan Composition

Deposit Composition

(1) 3Q06 average balances

(2) Pro forma: reported 3Q06 amounts adjusted for subsequent acquisitions

(3) Includes non-interest bearing deposits

9

|

|

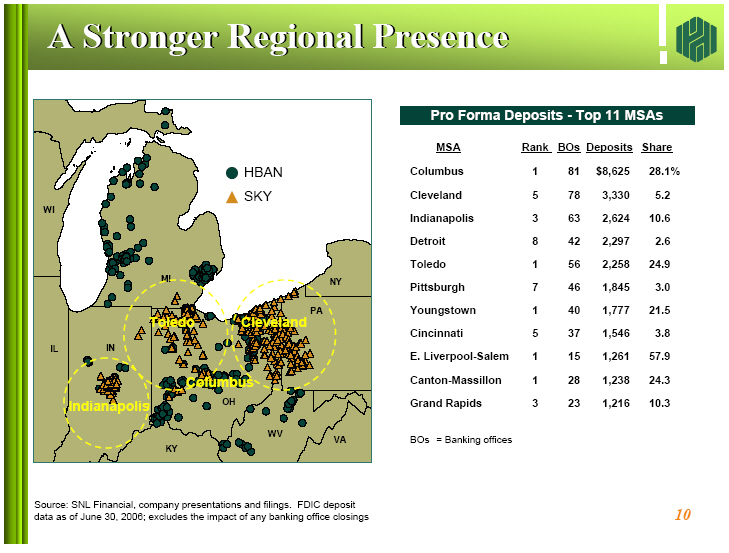

A Stronger Regional Presence

- --------------------------------

Pro Forma Deposits - Top 11 MSAs

- --------------------------------

MSA Rank BOs Deposits Share

- --- ---- --- -------- -----

Columbus 1 81 $8,625 28.1%

Cleveland 5 78 3,330 5.2

Indianapolis 3 63 2,624 10.6

Detroit 8 42 2,297 2.6

Toledo 1 56 2,258 24.9

Pittsburgh 7 46 1,845 3.0

Youngstown 1 40 1,777 21.5

Cincinnati 5 37 1,546 3.8

E. Liverpool-Salem 1 15 1,261 57.9

Canton-Massillon 1 28 1,238 24.3

Grand Rapids 3 23 1,216 10.3

BOs = Banking offices

Source: SNL Financial, company presentations and filings. FDIC deposit data as

of June 30, 2006; excludes the impact of any banking office closings

10

|

|

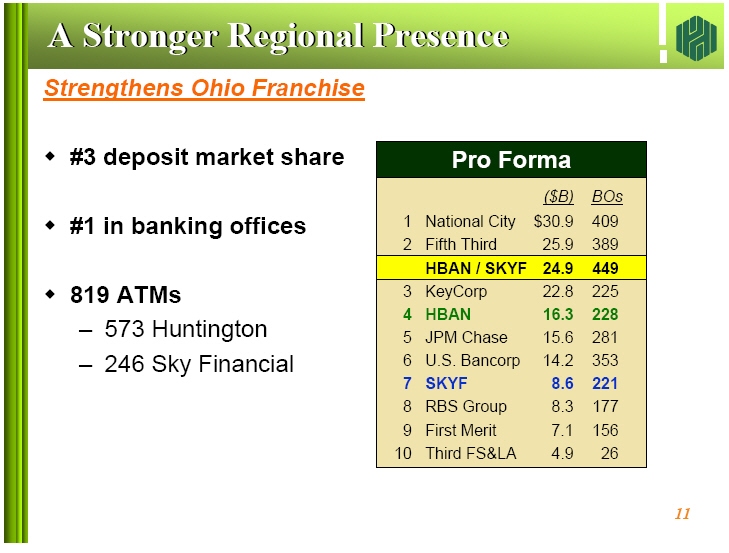

A Stronger Regional Presence

Strengthens Ohio Franchise

- --------------------------

o #3 deposit market share -----------------------------------

Pro Forma

o #1 in banking offices -----------------------------------

($B) BOs

o 819 ATMs ---- ---

-- 573 Huntington 1 National City $30.9 409

-- 246 Sky Financial 2 Fifth Third 25.9 389

-----------------------------------

x Leverages technology expertise

-----------------------------------

3 KeyCorp 22.8 225

4 HBAN 16.3 228

5 JPM Chase 15.6 281

6 U.S. Bancorp 14.2 353

7 SKYF 8.6 221

8 RBS Group 8.3 177

9 First Merit 7.1 156

10 Third FS&LA 4.9 26

-----------------------------------

11

|

|

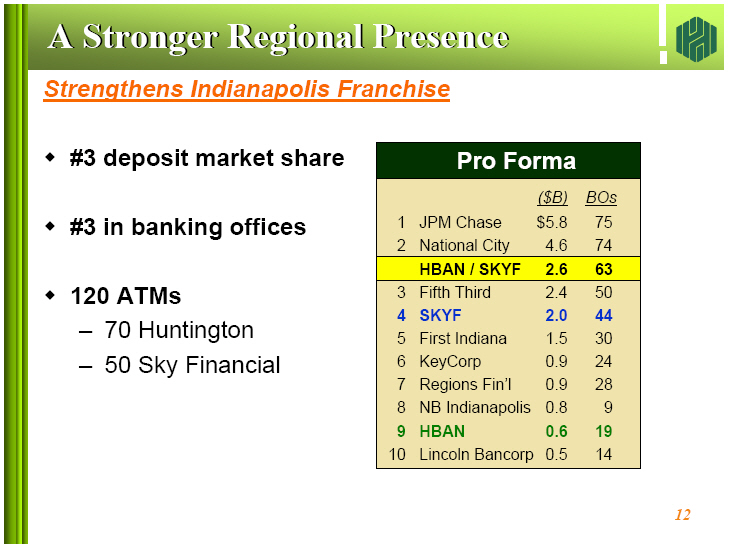

A Stronger Regional Presence

Strengthens Indianapolis Franchise

- ----------------------------------

o #3 deposit market share ----------------------------------------

Pro Forma

o #3 in banking offices ----------------------------------------

($B) BOs

o 120 ATMs ---- ---

-- 70 Huntington 1 JPM Chase $5.8 75

-- 50 Sky Financial 2 National City 4.6 74

----------------------------------------

HBAN / SKYF 2.6 63

----------------------------------------

3 Fifth Third 2.4 50

4 SKYF 2.0 44

5 First Indiana 1.5 30

6 KeyCorp 0.9 24

7 Regions Fin'l 0.9 28

8 NB Indianapolis 0.8 9

9 HBAN 0.6 19

10 Lincoln Bancorp 0.5 14

----------------------------------------

12

|

|

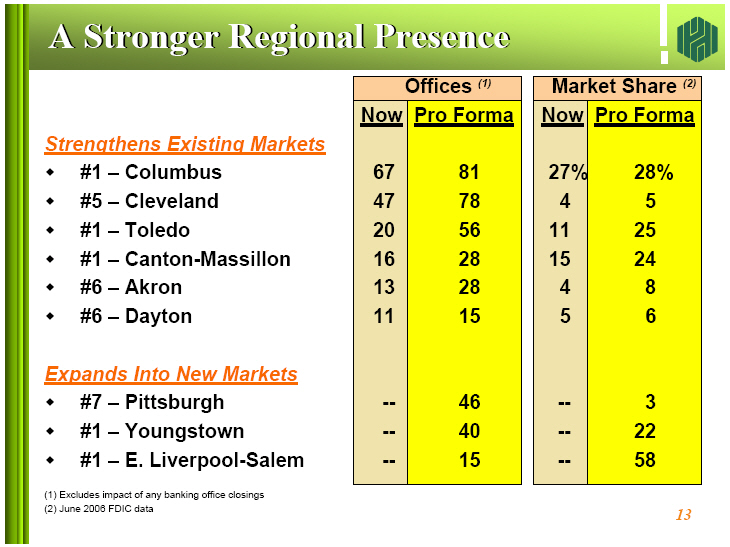

A Stronger Regional Presence

Offices (1) Market Share (2)

-------------- ----------------

Now Pro Forma Now Pro Forma

--- --------- --- ---------

Strengthens Existing Markets

- ----------------------------

#1 -- Columbus 67 81 27% 28%

#5 -- Cleveland 47 78 4 5

#1 -- Toledo 20 56 11 25

#1 -- Canton-Massillon 16 28 15 24

#6 -- Akron 13 28 4 8

#6 -- Dayton 11 15 5 6

Expands Into New Markets

- ------------------------

#7 -- Pittsburgh -- 46 -- 3

#1 -- Youngstown -- 40 -- 22

#1 -- E. Liverpool-Salem -- 15 -- 58

(1) Excludes impact of any banking office closings

(2) June 2006 FDIC data

13

|

|

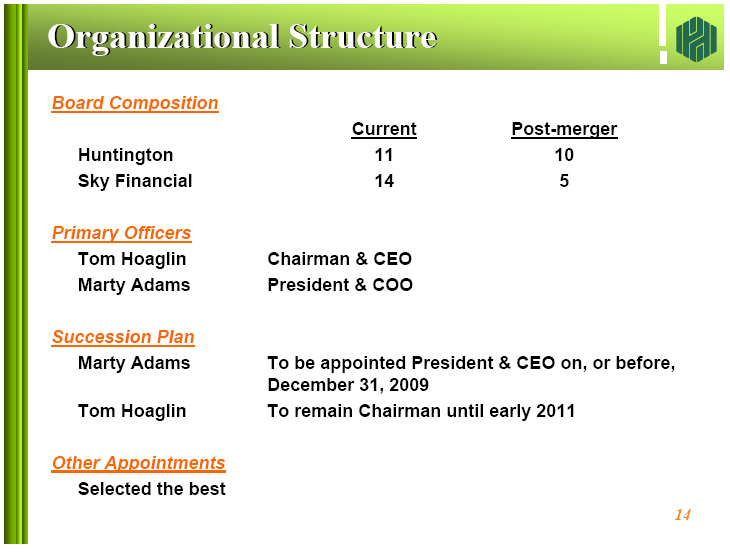

Organizational Structure

Board Composition

- -----------------

Current Post-merger

------- -----------

Huntington 11 10

Sky Financial 14 5

Primary Officers

- ----------------

Tom Hoaglin Chairman & CEO

Marty Adams President & COO

Succession Plan

- ---------------

Marty Adams To be appointed President & CEO on, or before,

December 31, 2009

Tom Hoaglin To remain Chairman until early 2011

Other Appointments

- ------------------

Selected the best

14

|

|

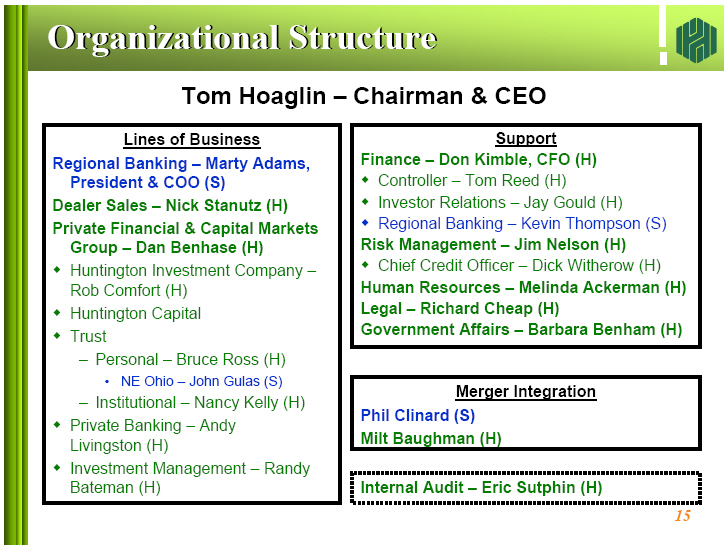

Organizational Structure

Tom Hoaglin -- Chairman & CEO

- ---------------------------------------------- ---------------------------------------------

Lines of Business Support

----------------- -------

Regional Banking -- Marty Adams, Finance -- Don Kimble, CFO (H)

President & COO (S) o Controller -- Tom Reed (H)

Dealer Sales -- Nick Stanutz (H) o Investor Relations -- Jay Gould (H)

Private Financial & Capital Markets o Regional Banking -- Kevin Thompson (S)

Group -- Dan Benhase (H) Risk Management -- Jim Nelson (H)

o Huntington Investment Company -- o Chief Credit Officer -- Dick Witherow (H)

Rob Comfort (H) Human Resources -- Melinda Ackerman (H)

o Huntington Capital Legal -- Richard Cheap (H)

o Trust Government Affairs -- Barbara Benham (H)

-- Personal -- Bruce Ross (H) ---------------------------------------------

o NE Ohio -- John Gulas (S)

-- Institutional -- Nancy Kelly (H) ---------------------------------------------

o Private Banking -- Andy Merger Integration

Livingston (H) ------------------

o Investment Management -- Randy Phil Clinard (S)

Bateman (H) Milt Baughman (H)

- ---------------------------------------------- ---------------------------------------------

---------------------------------------------

Internal Audit -- Eric Sutphin (H)

---------------------------------------------

15

|

|

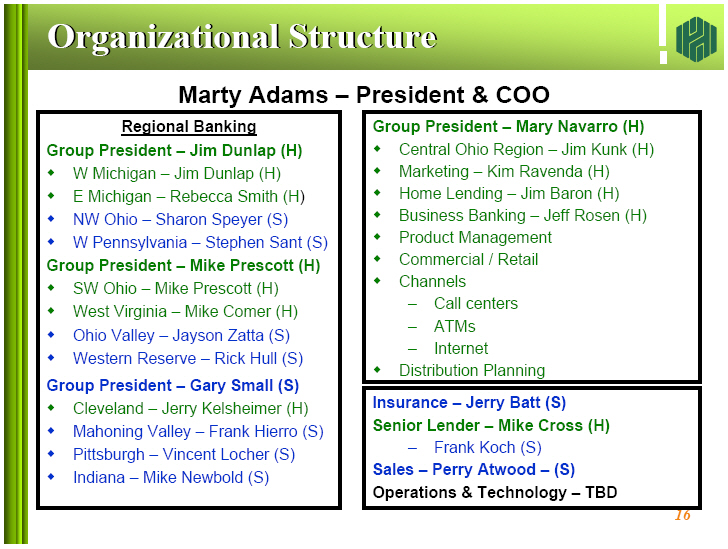

Organizational Structure

Marty Adams -- President & COO

- ------------------------------------- -------------------------------------

Regional Banking Group President -- Mary Navarro (H)

---------------- o Central Ohio Region -- Jim Kunk (H)

Group President -- Jim Dunlap (H) o Marketing -- Kim Ravenda (H)

o W Michigan -- Jim Dunlap (H) o Home Lending -- Jim Baron (H)

o E Michigan -- Rebecca Smith (H) o Business Banking -- Jeff Rosen (H)

o NW Ohio -- Sharon Speyer (S) o Product Management

o W Pennsylvania -- Stephen Sant (S) o Commercial / Retail

o Channels

Group President -- Mike Prescott (H) -- Call centers

o SW Ohio -- Mike Prescott (H) -- ATMs

o West Virginia -- Mike Comer (H) -- Internet

o Ohio Valley -- Jayson Zatta (S) o Distribution Planning

o Western Reserve -- Rick Hull (S) -------------------------------------

Group President -- Gary Small (S) -------------------------------------

o Cleveland -- Jerry Kelsheimer (H) Insurance -- Jerry Batt (S)

o Mahoning Valley -- Frank Hierro (S) Senior Lender -- Mike Cross (H)

o Pittsburgh -- Vincent Locher (S) -- Frank Koch (S)

o Indiana -- Mike Newbold (S) Sales -- Perry Atwood -- (S)

- ------------------------------------- Operations & Technology -- TBD

-------------------------------------

16

|

|

Low Execution / Integration Risk

o Significant due diligence completed

o Retention and familiarity of local management

o Key appointments already decided

o Similar business model

-- Local decision making

-- Focus on service excellence

o Common cultures

o Low credit risk

o Conservative cost saves

o Manageable integration risk

-- Experienced teams

-- Single bank charter

-- Single technology platform

o Fits our M&A philosophy

17

|

|

Basis of Presentation

Use of Pro Forma data

- ---------------------

This presentation contains Pro Forma financial measures where management

believes it to be helpful in understanding how the proposed merger with Sky

Financial Group will impact Huntington's results of operations or financial

position. The data represent actual reported information as of September 30,

2006 for both organizations, combined arithmetically, with no adjustments for

purchase accounting made, unless otherwise noted. The data for Sky Financial

Group also include Union Federal Bank reported information on a similar pro

forma basis, as this transaction was completed by Sky Financial Group

subsequent to September 30, 2006.

Use of non-GAAP financial measures

- ----------------------------------

This presentation contains GAAP financial measures and non-GAAP financial

measures where management believes it to be helpful in understanding

Huntington's results of operations or financial position. Where non-GAAP

financial measures are used, the comparable GAAP financial measure, as well as

the reconciliation to the comparable GAAP financial measure, can be found in

the current quarter earnings press release, this presentation, or in the

Quarterly Financial Review supplement to the current Earnings Press Release,

which can be found on Huntington's website at huntington-ir.com.

Annualized data

- ---------------

Certain returns, yields, performance ratios, or growth rates for a quarter are

"annualized" in this presentation to represent an annual time period. This is

done for analytical and decision -making purposes to better discern underlying

performance trends when compared to full-year or year-over-year amounts. For

example, loan growth rates are most often expressed in terms of an annual rate

like 8%. As such, a 2% growth rate for a quarter would represent an annualized

8% growth rate.

Fully taxable equivalent interest income and net interest margin

- ----------------------------------------------------------------

Income from tax-exempt earnings assets is increased by an amount equivalent to

the taxes that would have been paid if this income had been taxable at

statutory rates. This adjustment puts all earning assets, most notably

tax-exempt municipal securities and certain lease assets, on a common basis

that facilitates comparison of results to results of competitors.

Earnings per share equivalent data

- ----------------------------------

Significant and/or one-time income or expense items may be expressed on a per

common share basis. This is done for analytical and decision -making purposes

to better discern underlying trends in total corporate earnings per share

performance excluding the impact of such items. Investors may also find this

information helpful in their evaluation of the company's financial performance

against published earnings per share consensus amounts, which typically exclude

the impact of significant and/or one-time items. Earnings per share equivalents

are usually calculated by applying a 35% effective tax rate to a pre-tax amount

to derive an after-tax amount which is divided by the average shares

outstanding during the respective reporting period. Occasionally, when the item

involves special tax treatment, the after-tax amount is separately disclosed,

with this then being the amount used to calculate the earnings per share

equivalent.

Rounding

- --------

Please note that columns of data in the following slides may not add due to

rounding.

NM or nm

- --------

Percent changes of 100% or more are shown as "nm" or "not meaningful" . Such

large percent changes typically reflect the impact of one-time items within the

measured periods. Since the primary purpose of showing a percent change is for

discerning underlying performance trends, such large percent changes are

"not meaningful" for this purpose.

18

|

|

Forward Looking Statements

This presentation contains certain forward -looking statements, including

certain plans, expectations, goals, and projections, and including statements

about the benefits of the merger between Huntington and Sky Financial Group,

which are subject to numerous assumptions, risks, and uncertainties.

Actual results could differ materially from those contained or implied by such

statements for a variety of factors including: the businesses of Huntington and

Sky Financial Group may not be integrated successfully or such integration may

take longer to accomplish than expected; the expected cost savings and any

revenue synergies from the merger may not be fully realized within the expected

timeframes; disruption from the merger may make it more difficult to maintain

relationships with clients, associates, or suppliers; the required governmental

approvals of the merger may not be obtained on the proposed terms and schedule;

Huntington and/or Sky Financial Group's stockholders may not approve the

merger; changes in economic conditions; movements in interest rates;

competitive pressures on product pricing and services; success and timing of

other business strategies; the nature, extent, and timing of governmental

actions and reforms; and extended disruption of vital infrastructure; and other

factors described in Huntington's 2005 Annual Report on Form 10-K, Sky

Financial Group's 2005 Annual Report on Form 10-K, and documents subsequently

filed by Huntington and Sky Financial Group with the Securities and Exchange

Commission.

All forward-looking statements included in this news release are based on

information available at the time of the release. Neither Huntington nor Sky

Financial Group assume any obligation to update any forward -looking

statement.

19

|

|

Additional Information About the Merger and Where to Find It

Huntington and Sky Financial Group will be filing relevant documents concerning

the transaction with the Securities and Exchange Commission, including a

registration statement on Form S-4 which will include a proxy

statement/prospectus. Stockholders will be able to obtain a free copy of the

proxy statement/prospectus, as well as other filings containing information

about Huntington and Sky Financial Group, at the Securities and Exchange

Commission's internet site (http://www. sec.gov). Copies of the proxy

statement/prospectus and the filings with the Securities and Exchange

Commission that will be incorporated by reference in the proxy

statement/prospectus can also be obtained, without charge, by directing a

request to Huntington Bancshares Incorporated, Huntington Center, 41 South High

Street, Columbus, Ohio 43287, Attention: Investor Relations, 614-480-4060, or

Sky Financial Group, 221 South Church Street, Bowling Green, Ohio, 43402. The

final proxy statement / prospectus will be mailed to stockholders of Huntington

and Sky Financial Group.

Stockholders are urged to read the proxy statement/prospectus, and other

relevant documents filed with the Securities and Exchange Commission regarding

the proposed transaction when they become available, because they will contain

important information.

The directors and executive officers of Huntington and Sky Financial Group and

other persons may be deemed to be participants in the solicitation of proxies

in respect of the proposed merger. Information regarding Huntington's directors

and executive officers is available in its proxy statement filed with the SEC

by Huntington on March 8, 2006. Information regarding Sky Financial Group's

directors and executive officers is available in its proxy statement filed with

the SEC by Sky Financial Group on February 23, 2006. Other information

regarding the participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be

contained in the proxy statement/prospectus and other relevant materials to be

filed with the SEC when they become available.

20

|

|

A Value Added Combination

---

A Stronger Regional Presence

21

|

|

Appendix

22

|

|

Fits Our M&A Philosophy (1)

x Adds to shareholder value from the start

x Builds market share in existing markets

x Enters new markets with high market shares

x Enriches deposit mix... higher relative DDA

x Similar business model... decentralized decision making

x Similar focus on service excellence

x Retains local management

x Similar core values / culture

x Revenue opportunities... leverage product and service capabilities

x Leverages technology expertise

23

(1) As outlined in 9/27/06 analyst day presentation

|

|

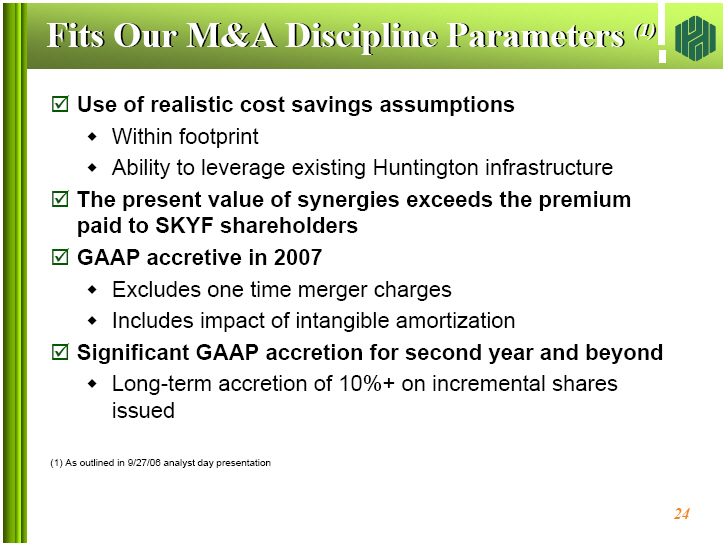

Fits Our M&A Discipline Parameters (1)

x Use of realistic cost savings assumptions

o Within footprint

o Ability to leverage existing Huntington infrastructure

x The present value of synergies exceeds the premium paid to SKYF shareholders

x GAAP accretive in 2007

o Excludes one time merger charges

o Includes impact of intangible amortization

x Significant GAAP accretion for second year and beyond

o Long-term accretion of 10%+ on incremental shares issued

(1) As outlined in 9/27/06 analyst day presentation

24

|

|

Accretion Analysis ~ Pro forma

($ in millions, except per share data) 2007 2008

----------- ----------

Net Income:

- ------------------------------------------

Huntington $441 $458

Sky Financial 117 251

----------- ----------

Pro Forma Net Income $558 $710

Adjustments (after-tax):

- ------------------------------------------

Cost Synergies $ 29 $81

Acquisition Cost of Cash (6) (1)

Net Core Deposit Intangible Amortization (11) (2)

Secondary Cash Effects (1) (1)

----------- ----------

Adjusted Net Income $569 $756

Common Shares Issued 130 130

Pro Forma Diluted Shares Outstanding 302 363

- ------------------------------------------------------------------------

HBAN projected GAAP EPS (1) $1.87 $1.99

Pro Forma combined GAAP EPS $1.88 $2.08

Accretion / Dilution (%) 0.5% 4.%

- ------------------------------------------------------------------------

HBAN projected Cash EPS $1.90 $2.02

Pro Forma combined Cash EPS $1.96 $2.20

Accretion / Dilution (%) 3.0% 8.%

- ------------------------------------------------------------------------

1. Mean of Wall Street estimates per Thomson Financial. 25

|

|

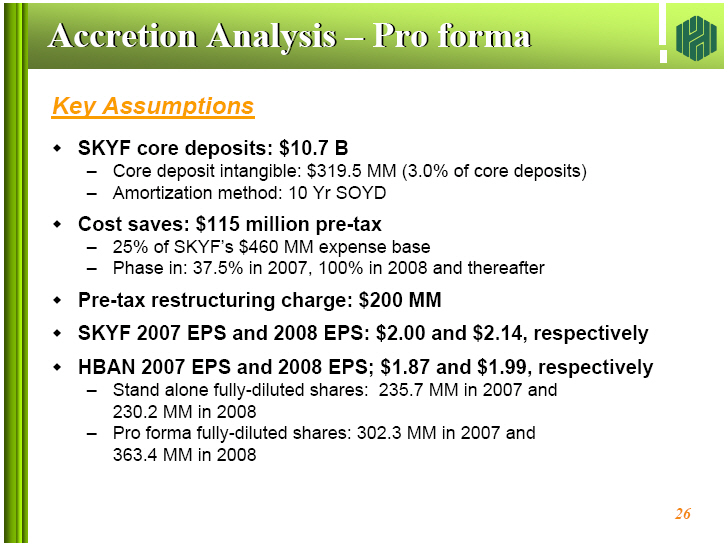

Accretion Analysis ~ Pro forma

Key Assumptions

o SKYF core deposits: $10.7 B

- Core deposit intangible: $319.5 MM (3.0% of core deposits)

- Amortization method: 10 Yr SOYD

o Cost saves: $115 million pre-tax

- 25% of SKYF~s $460 MM expense base

- Phase in: 37.5% in 2007, 100% in 2008 and thereafter

o Pre-tax restructuring charge: $200 MM

o SKYF 2007 EPS and 2008 EPS: $2.00 and $2.14, respectively

o HBAN 2007 EPS and 2008 EPS; $1.87 and $1.99, respectively

- Stand alone fully-diluted shares: 235.7 MM in 2007 and 230.2 MM in 2008

- Pro forma fully-diluted shares: 302.3 MM in 2007 and 363.4 MM in 2008

26

|

|

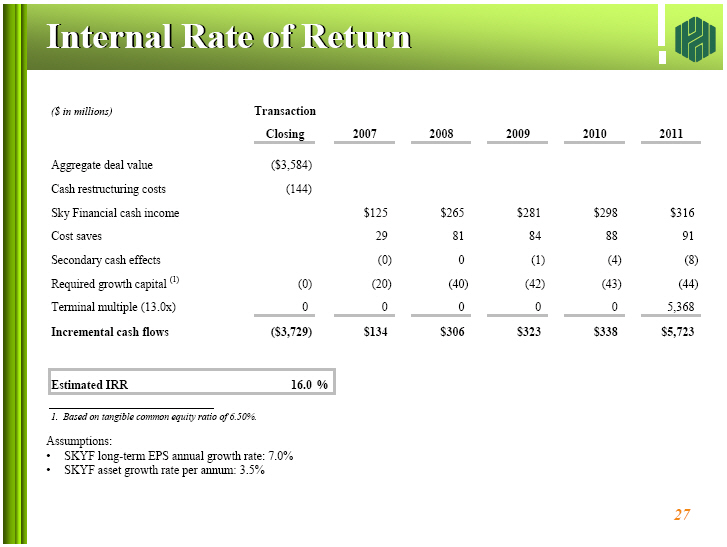

Internal Rate of Return

($ in millions) Transaction

Closing 2007 2008 2009 2010 2011

-----------------------------------------------------------

Aggregate deal value ($ 3,584)

Cash restructuring costs (144)

Sky Financial cash income $ 125 $ 265 $ 281 $ 298 $ 316

Cost saves 29 81 84 88 91

Secondary cash effects (0) 0 (1) (4) (8)

Required growth capital (1) (0) (20) (40) (42) (43) (44)

Terminal multiple (13.0x) 0 0 0 0 0 5,368

-----------------------------------------------------------

Incremental cash flows ($ 3,729) $ 134 $ 306 $ 323 $ 338 $5,723

- -----------------------------------------------------------

Estimated IRR 16.0%

- -----------------------------------------------------------

1. Based on tangible common equity ratio of 6.50% .

Assumptions:

o SKYF long-term EPS annual growth rate: 7.0%

o SKYF asset growth rate per annum: 3.5%

27

|

|

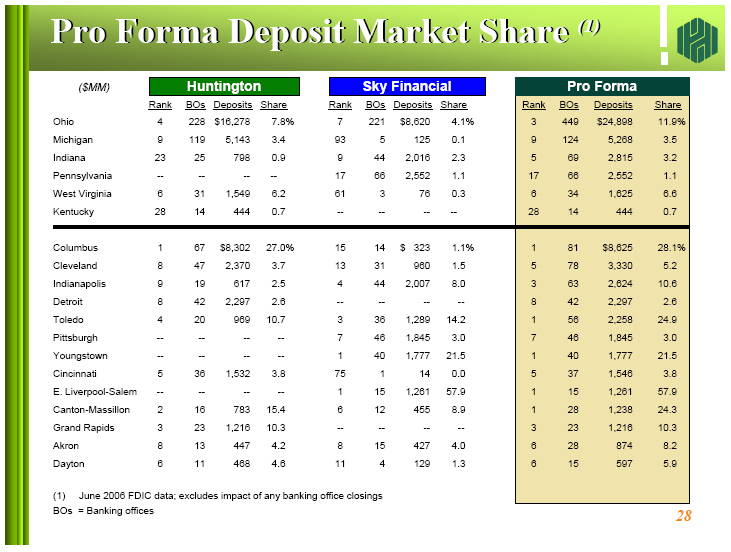

Pro Forma Deposit Market Share (1)

($MM) Huntington Sky Financial Pro Forma

Rank BOs Deposits Share Rank BOs Deposits Share Rank BOs Deposits Share

---- --- -------- ----- ---- --- -------- ----- ---- ----- ---------- -----

Ohio 4 228 $ 16,278 7.8% 7 221 $ 8,620 4.1% 3 449 $ 24,898 11.9%

Michigan 9 119 5,143 3.4 93 5 125 0.1 9 124 5,268 3.5

Indiana 23 25 798 0.9 9 44 2,016 2.3 5 69 2,815 3.2

Pennsylvania -- -- -- -- 17 66 2,552 1.1 17 66 2,552 1.1

West Virginia 6 31 1,549 6.2 61 3 76 0.3 6 34 1,625 6.6

Kentucky 28 14 444 0.7 -- -- -- -- 28 14 444 0.7

- ---------------------------------------------------------------------------------------------------------------

Columbus 1 67 $ 8,302 27.0% 15 14 $ 323 1.1% 1 81 $ 8,625 28.1%

Cleveland 8 47 2,370 3.7 13 31 960 1.5 5 78 3,330 5.2

Indianapolis 9 19 617 2.5 4 44 2,007 8.0 3 63 2,624 10.6

Detroit 8 42 2,297 2.6 -- -- -- -- 8 42 2,297 2.6

Toledo 4 20 969 10.7 3 36 1,289 14.2 1 56 2,258 24.9

Pittsburgh -- -- -- -- 7 46 1,845 3.0 7 46 1,845 3.0

Youngstown -- -- -- -- 1 40 1,777 21.5 1 40 1,777 21.5

Cincinnati 5 36 1,532 3.8 75 1 14 0.0 5 37 1,546 3.8

E. Liverpool-Salem -- -- -- -- 1 15 1,261 57.9 1 15 1,261 57.9

Canton-Massillon 2 16 783 15.4 6 12 455 8.9 1 28 1,238 24.3

Grand Rapids 3 23 1,216 10.3 -- -- -- -- 3 23 1,216 10.3

Akron 8 13 447 4.2 8 15 427 4.0 6 28 874 8.2

Dayton 6 11 468 4.6 11 4 129 1.3 6 15 597 5.9

(1) June 2006 FDIC data; excludes impact of any banking office

closings BOs = Banking offices

28

|

|

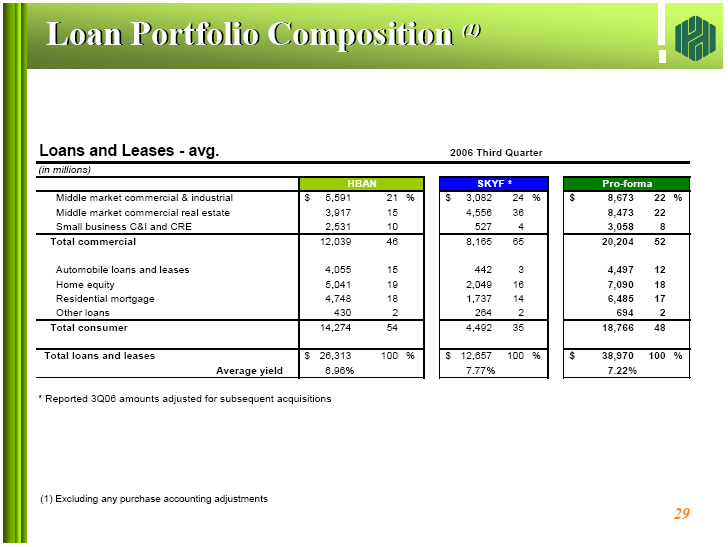

Loan Portfolio Composition (1)

Loans and Leases - avg. 2006 Third Quarter

- ----------------------------------------------------------------------------------------------------------------

(in millions)

- ----------------------------------------------------------------------------------------------------------------

HBAN SKYF * Pro-forma

- ----------------------------------------------------------------------------------------------------------------

Middle market commercial & industrial $ 5,591 21% $ 3,082 24% $ 8,673 22%

Middle market commercial real estate 3,917 15 4,556 36 8,473 22

Small business C&I and CRE 2,531 10 527 4 3,058 8

- ----------------------------------------------------------------------------------------------------------------

Total commercial 12,039 46 8,165 65 20,204 52

Automobile loans and leases 4,055 15 442 3 4,497 12

Home equity 5,041 19 2,049 16 7,090 18

Residential mortgage 4,748 18 1,737 14 6,485 17

Other loans 430 2 264 2 694 2

- ----------------------------------------------------------------------------------------------------------------

Total consumer 14,274 54 4,492 35 18,766 48

- ----------------------------------------------------------------------------------------------------------------

Total loans and leases $ 26,313 100% $ 12,657 100% $ 38,970 100%

Average yield 6.96% 7.77% 7.22%

- ----------------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments

29

|

|

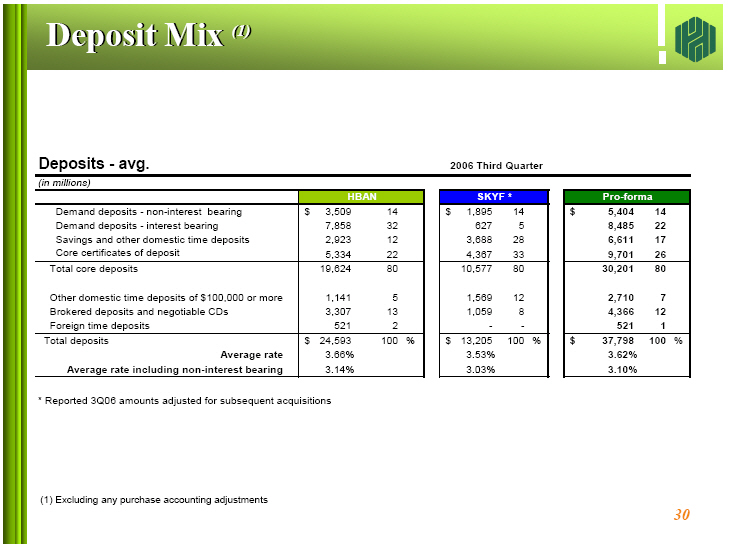

Deposit Mix (1)

Deposits - avg. 2006 Third Quarter

- ----------------------------------------------------------------------------------------------------------------

(in millions)

- ----------------------------------------------------------------------------------------------------------------

HBAN SKYF * Pro-forma

- ----------------------------------------------------------------------------------------------------------------

Demand deposits - non-interest bearing $ 3,509 14 $ 1,895 14 $ 5,404 14

Demand deposits - interest bearing 7,858 32 627 5 8,485 22

Savings and other domestic time deposits 2,923 12 3,688 28 6,611 17

Core certificates of deposit 5,334 22 4,367 33 9,701 26

- ----------------------------------------------------------------------------------------------------------------

Total core deposits 19,624 80 10,577 80 30,201 80

Other domestic time deposits of $100,000 or more 1,141 5 1,569 12 2,710 7

Brokered deposits and negotiable CDs 3,307 13 1,059 8 4,366 12

Foreign time deposits 521 2 - - 521 1

- ----------------------------------------------------------------------------------------------------------------

Total deposits $ 24,593 100% $ 13,205 100% $ 37,798 100%

Average rate 3.66% 3.53% 3.62%

Average rate including non-interest bearing 3.14% 3.03% 3.10%

- ----------------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments

30

|

|

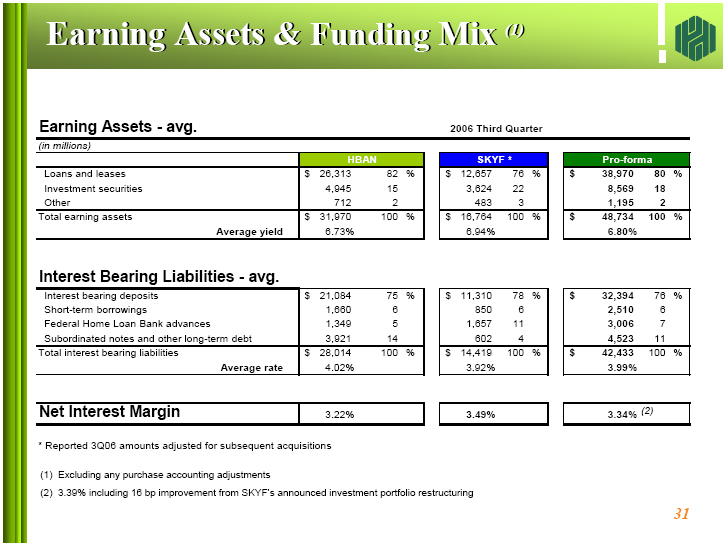

Earning Assets & Funding Mix (1)

Earning Assets - avg. 2006 Third Quarter

- --------------------------------------------------------------------------------------------------------------

(in millions)

- --------------------------------------------------------------------------------------------------------------

HBAN SKYF * Pro-forma

- --------------------------------------------------------------------------------------------------------------

Loans and leases $ 26,313 82% $ 12,657 76% $ 38,970 80%

Investment securities 4,945 15 3,624 22 8,569 18

Other 712 2 483 3 1,195 2

- --------------------------------------------------------------------------------------------------------------

Total earning assets $ 31,970 100% $ 16,764 100% $ 48,734 100%

Average yield 6.73% 6.94% 6.80%

- --------------------------------------------------------------------------------------------------------------

Interest Bearing Liabilities - avg.

- --------------------------------------------------------------------------------------------------------------

Interest bearing deposits $ 21,084 75% $ 11,310 78% $ 32,394 76%

Short-term borrowings 1,660 6 850 6 2,510 6

Federal Home Loan Bank advances 1,349 5 1,657 11 3,006 7

Subordinated notes and other long-term debt 3,921 14 602 4 4,523 11

- --------------------------------------------------------------------------------------------------------------

Total interest bearing liabilities $ 28,014 100% $ 14,419 100% $ 42,433 100%

Average rate 4.02% 3.92% 3.99%

- --------------------------------------------------------------------------------------------------------------

Net Interest Margin 3.22% 3.49% 3.34% (2)

- --------------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments

(2) 3.39% including 16 bp improvement from SKYF~s announced investment portfolio restructuring

31

|

|

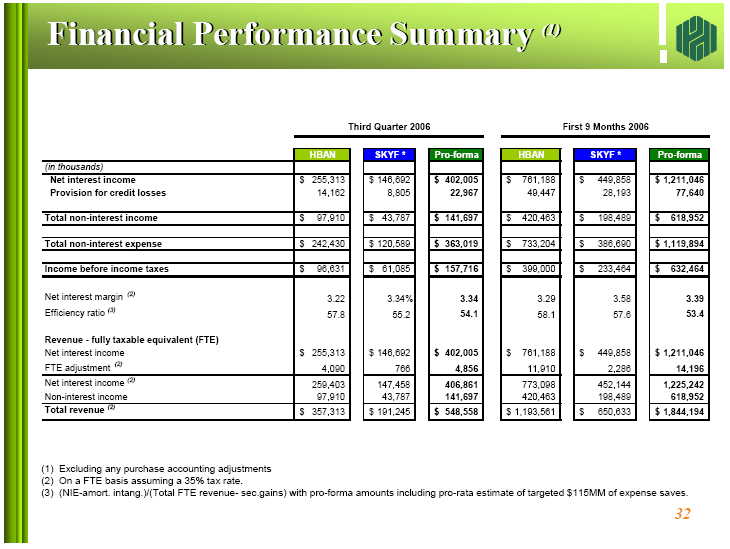

Financial Performance Summary (1)

Third

Quarter First 9 Months

2006 2006

------------------------------------------------------------------

HBAN SKYF * Pro-forma HBAN SKYF * Pro-forma

- ------------------------------------------------------------------------------------------------------------

(in thousands)

- ------------------------------------------------------------------------------------------------------------

Net interest income $255,313 $146,692 $402,005 $ 761,188 $449,858 $1,211,046

Provision for credit losses 14,162 8,805 22,967 49,447 28,193 77,640

- ------------------------------------------------------------------------------------------------------------

Total non-interest income $ 97,910 $ 43,787 $141,697 $ 420,463 $198,489 $ 618,952

- ------------------------------------------------------------------------------------------------------------

Total non-interest expense $242,430 $120,589 $363,019 $ 733,204 $386,690 $1,119,894

- ------------------------------------------------------------------------------------------------------------

Income before income taxes $ 96,631 $ 61,085 $157,716 $ 399,000 $233,464 $ 632,464

- ------------------------------------------------------------------------------------------------------------

Net interest margin (2) 3.22 3.34% 3.34 3.29 3.58 3.39

Efficiency ratio (3) 57.8 55.2 54.1 58.1 57.6 53.4

Revenue - fully taxable equivalent (FTE)

Net interest income $255,313 $146,692 $402,005 $ 761,188 $449,858 $1,211,046

FTE adjustment (2) 4,090 766 4,856 11,910 2,286 14,196

- ------------------------------------------------------------------------------------------------------------

Net interest income (2) 259,403 147,458 406,861 773,098 452,144 1,225,242

Non-interest income 97,910 43,787 141,697 420,463 198,489 618,952

- ------------------------------------------------------------------------------------------------------------

Total revenue (2) $357,313 $191,245 $548,558 $1,193,561 $650,633 $1,844,194

- ------------------------------------------------------------------------------------------------------------

(1) Excluding any purchase accounting adjustments

(2) On a FTE basis assuming a 35% tax rate.

(3) (NIE-amort. intang.)/(Total FTE revenue- sec.gains) with pro-forma amounts including pro-rata estimate

of targeted $115MM of expense saves.

32

|

|

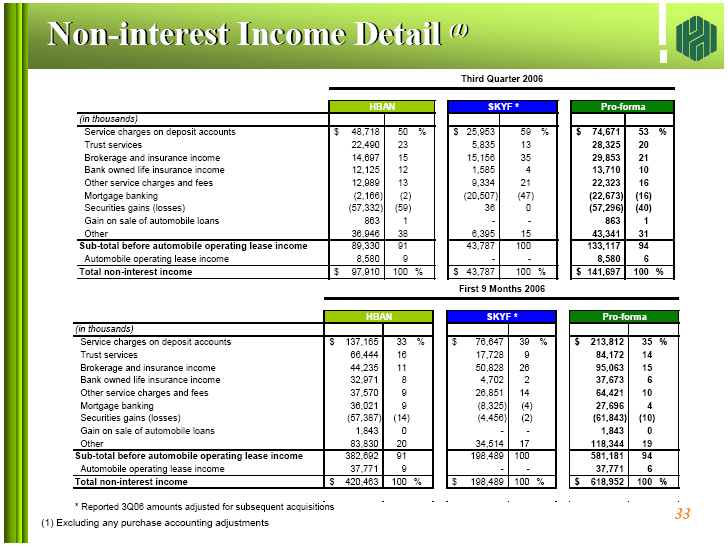

Non-interest Income Detail (1)

Third Quarter 2006

---------------------------------------------------------

HBAN SKYF * Pro-forma

- ---------------------------------------------------------------------------------------------------------------

(in thousands)

- ---------------------------------------------------------------------------------------------------------------

Service charges on deposit accounts $ 48,718 50% $ 25,953 59% $ 74,671 53%

Trust services 22,490 23 5,835 13 28,325 20

Brokerage and insurance income 14,697 15 15,156 35 29,853 21

Bank owned life insurance income 12,125 12 1,585 4 13,710 10

Other service charges and fees 12,989 13 9,334 21 22,323 16

Mortgage banking (2,166) (2) (20,507) (47) (22,673) (16)

Securities gains (losses) (57,332) (59) 36 0 (57,296) (40)

Gain on sale of automobile loans 863 1 - - 863 1

Other 36,946 38 6,395 15 43,341 31

- ---------------------------------------------------------------------------------------------------------------

Sub-total before automobile operating lease income 89,330 91 43,787 100 133,117 94

Automobile operating lease income 8,580 9 - - 8,580 6

- ---------------------------------------------------------------------------------------------------------------

Total non-interest income $ 97,910 100% $ 43,787 100% $141,697 100%

- ---------------------------------------------------------------------------------------------------------------

First 9 Months 2006

---------------------------------------------------------

HBAN SKYF * Pro-forma

- ---------------------------------------------------------------------------------------------------------------

(in thousands)

- ---------------------------------------------------------------------------------------------------------------

Service charges on deposit accounts $137,165 33% $ 76,647 39% $213,812 35%

Trust services 66,444 16 17,728 9 84,172 14

Brokerage and insurance income 44,235 11 50,828 26 95,063 15

Bank owned life insurance income 32,971 8 4,702 2 37,673 6

Other service charges and fees 37,570 9 26,851 14 64,421 10

Mortgage banking 36,021 9 (8,325) (4) 27,696 4

Securities gains (losses) (57,387) (14) (4,456) (2) (61,843) (10)

Gain on sale of automobile loans 1,843 0 - - 1,843 0

Other 83,830 20 34,514 17 118,344 19

- ---------------------------------------------------------------------------------------------------------------

Sub-total before automobile operating lease income 382,692 91 198,489 100 581,181 94

Automobile operating lease income 37,771 9 - - 37,771 6

- ---------------------------------------------------------------------------------------------------------------

Total non-interest income $420,463 100% $198,489 100% $618,952 100%

- ---------------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments 33

|

|

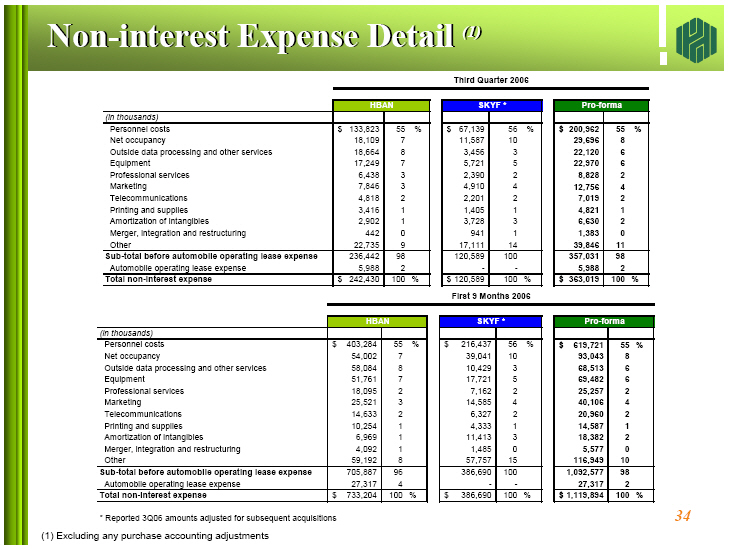

Non-interest Expense Detail (1)

Third Quarter 2006

----------------------------------------------------

HBAN SKYF * Pro-forma

- ---------------------------------------------------------------------------------------------------------

(in thousands)

- ---------------------------------------------------------------------------------------------------------

Personnel costs $133,823 55% $ 67,139 56% $ 200,962 55%

Net occupancy 18,109 7 11,587 10 29,696 8

Outside data processing and other services 18,664 8 3,456 3 22,120 6

Equipment 17,249 7 5,721 5 22,970 6

Professional services 6,438 3 2,390 2 8,828 2

Marketing 7,846 3 4,910 4 2,756 4

Telecommunications 4,818 2 2,201 2 7,019 2

Printing and supplies 3,416 1 1,405 1 4,821 1

Amortization of intangibles 2,902 1 3,728 3 6,630 2

Merger, integration and restructuring 442 0 941 1 1,383 0

Other 22,735 9 17,111 14 39,846 11

- ---------------------------------------------------------------------------------------------------------

Sub-total before automobile operating lease expense 236,442 98 120,589 100 357,031 98

Automobile operating lease expense 5,988 2 - - 5,988 2

- ---------------------------------------------------------------------------------------------------------

Total non-interest expense $242,430 100% $120,589 100% $ 363,019 100%

- ---------------------------------------------------------------------------------------------------------

First 9 Monhs 2006

----------------------------------------------------

HBAN SKYF * Pro-forma

- ---------------------------------------------------------------------------------------------------------

(in thousands)

- ---------------------------------------------------------------------------------------------------------

Personnel costs $403,284 55% $216,437 56% $ 619,721 55%

Net occupancy 54,002 7 39,041 10 93,043 8

Outside data processing and other services 58,084 8 10,429 3 68,513 6

Equipment 51,761 7 17,721 5 69,482 6

Professional services 18,095 2 7,162 2 25,257 2

Marketing 25,521 3 14,585 4 40,106 4

Telecommunications 14,633 2 6,327 2 20,960 2

Printing and supplies 10,254 1 4,333 1 14,587 1

Amortization of intangibles 6,969 1 11,413 3 18,382 2

Merger, integration and restructuring 4,092 1 1,485 0 5,577 0

Other 59,192 8 57,757 15 116,949 10

- ---------------------------------------------------------------------------------------------------------

Sub-total before automobile operating lease expense 705,887 96 386,690 100 1,092,577 98

Automobile operating lease expense 27,317 4 - - 27,317 2

- ---------------------------------------------------------------------------------------------------------

Total non-interest expense $733,204 100% $386,690 100% $1,119,894 100%

- ---------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments 34

|

|

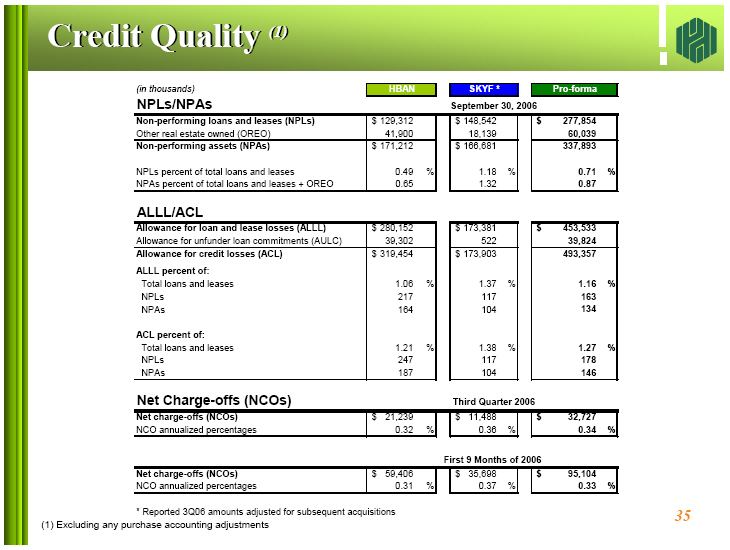

Credit Quality (1)

-----------------------------------------------

(in thousands) HBAN SKYF * Pro-forma

-----------------------------------------------

NPLs/NPAs September 30, 2006

- ----------------------------------------------------------------------------------------------------------

Non-performing loans and leases (NPLs) $129,312 $148,542 $277,854

Other real estate owned (OREO) 41,900 18,139 60,039

- ----------------------------------------------------------------------------------------------------------

Non-performing assets (NPAs) $171,212 $166,681 337,893

NPLs percent of total loans and leases 0.49% 1.18% 0.71%

NPAs percent of total loans and leases + OREO 0.65 1.32 0.87

- ----------------------------------------------------------------------------------------------------------

ALLL/ACL

- ----------------------------------------------------------------------------------------------------------

Allowance for loan and lease losses (ALLL) $280,152 $173,381 $453,533

Allowance for unfunder loan commitments (AULC) 39,302 522 39,824

- ----------------------------------------------------------------------------------------------------------

Allowance for credit losses (ACL) $319,454 $173,903 493,357

ALLL percent of:

Total loans and leases 1.06% 1.37% 1.16%

NPLs 217 117 163

NPAs 164 104 134

ACL percent of:

Total loans and leases 1.21% 1.38% 1.27%

NPLs 247 117 178

NPAs 187 104 146

- ----------------------------------------------------------------------------------------------------------

Net Charge-offs (NCOs) Third Quarter 2006

- ----------------------------------------------------------------------------------------------------------

Net charge-offs (NCOs) $ 21,239 $ 11,488 $ 32,727

NCO annualized percentages 0.32% 0.36% 0.34%

- ----------------------------------------------------------------------------------------------------------

First 9 Months of 2006

- ----------------------------------------------------------------------------------------------------------

Net charge-offs (NCOs) $ 59,406 $ 35,698 $ 95,104

NCO annualized percentages 0.31% 0.37% 0.33%

- ----------------------------------------------------------------------------------------------------------

* Reported 3Q06 amounts adjusted for subsequent acquisitions

(1) Excluding any purchase accounting adjustments

35

|

|