EX-99.1

Published on February 15, 2023

Welcome.® 2023 Bank of America Financial Services Conference February 15, 2023 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2023 Huntington Bancshares Incorporated.

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID-19 pandemic and related variants and mutations and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the anticipated benefits of the transaction with TCF are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington does business; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2021, and in its subsequent Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, June 30, 2022, and September 30, 2022, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward- looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward- looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2

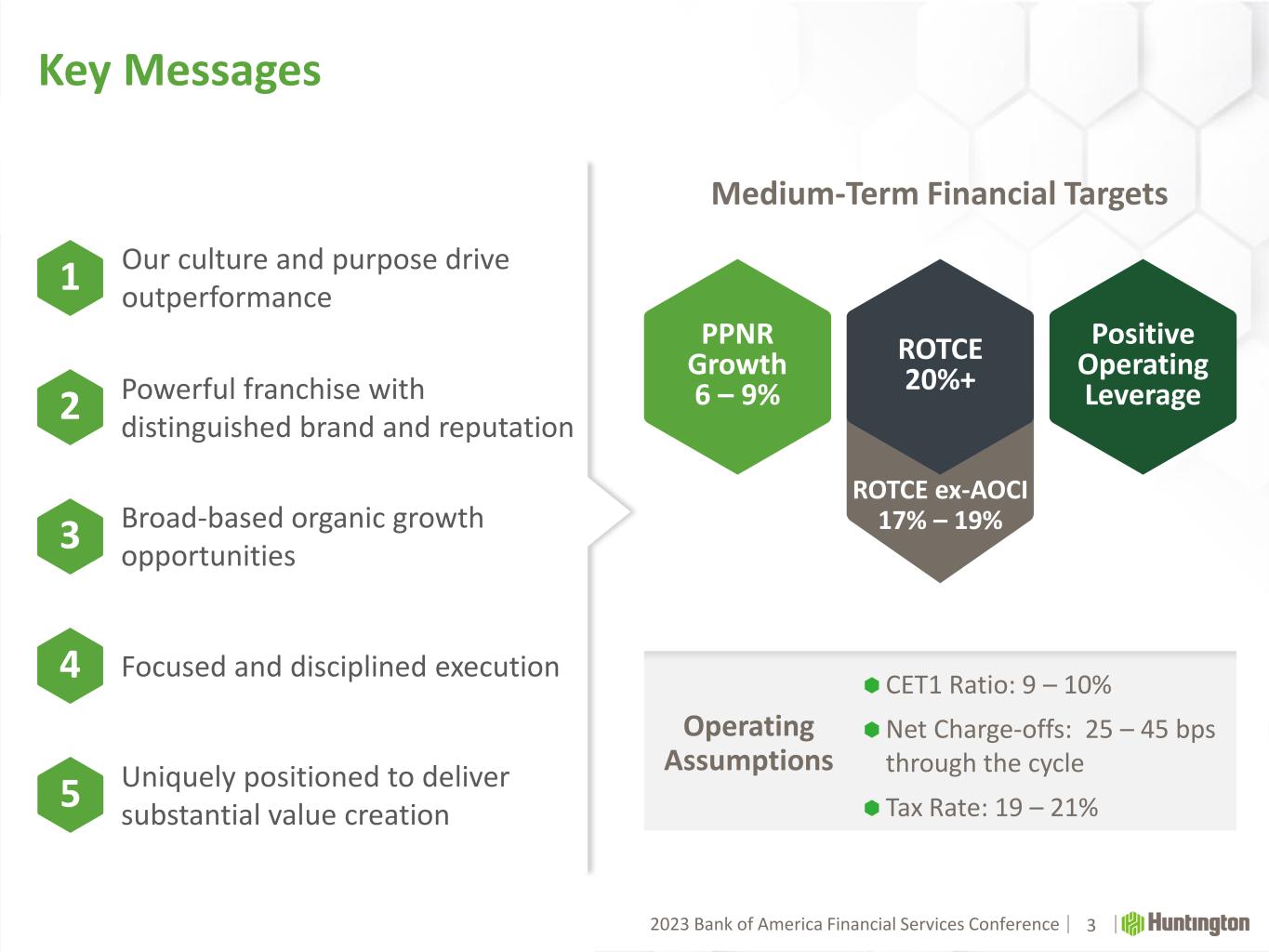

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Key Messages Operating Assumptions CET1 Ratio: 9 – 10% Net Charge-offs: 25 – 45 bps through the cycle Tax Rate: 19 – 21% PPNR Growth 6 – 9% Positive Operating Leverage ROTCE 20%+ 3 ROTCE ex-AOCI 17% – 19% 1 2 3 4 5 Medium-Term Financial Targets Focused and disciplined execution Uniquely positioned to deliver substantial value creation Our culture and purpose drive outperformance Powerful franchise with distinguished brand and reputation Broad-based organic growth opportunities

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Positioned to Outperform 4 Incremental investments in technology development, marketing, revenue-linked key personnel additions Strategic investments share of total expenses continues to increase Increased CET1 QoQ to 9.4% Flexibility with $1bln share repurchase authorization ACL coverage ratio 1.90%, above peer median of 1.45% 26.0% ROTCE (4Q22); 19.8% adjusted ROTCE ex AOCI Investing In Sustainable Revenue Growth Disciplined Expense Management Self-funding strategic, revenue-producing investments Well controlled underlying “run the bank” core expense growth Strong Capital Robust Reserves Top Tier Profitability Profile Operating from a Position of Strength Proactively Executing Strategic Priorities

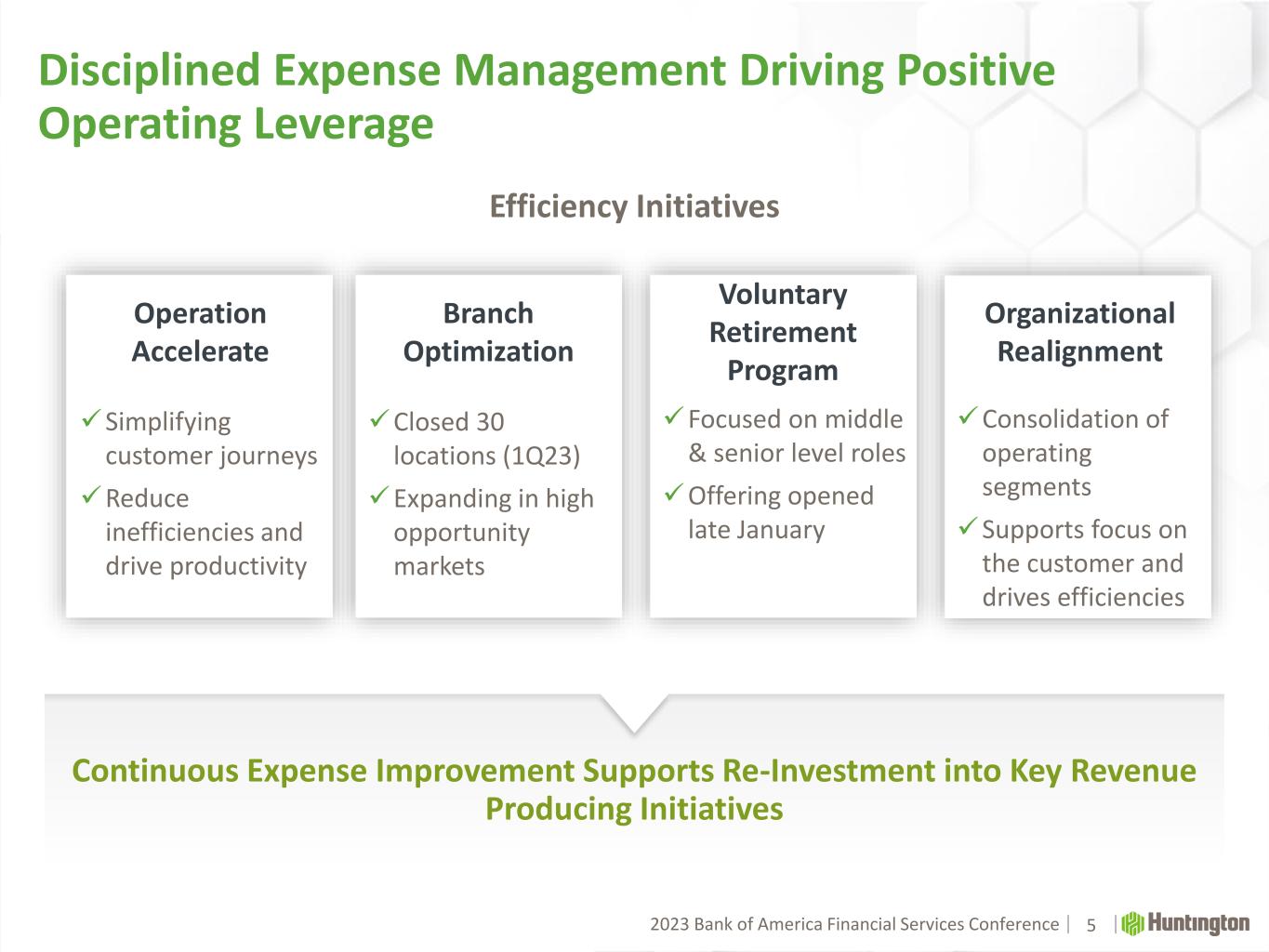

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Disciplined Expense Management Driving Positive Operating Leverage 5 Efficiency Initiatives Continuous Expense Improvement Supports Re-Investment into Key Revenue Producing Initiatives Operation Accelerate Branch Optimization Organizational Realignment Voluntary Retirement Program ✓Simplifying customer journeys ✓Reduce inefficiencies and drive productivity ✓Consolidation of operating segments ✓Supports focus on the customer and drives efficiencies ✓Focused on middle & senior level roles ✓Offering opened late January ✓Closed 30 locations (1Q23) ✓Expanding in high opportunity markets

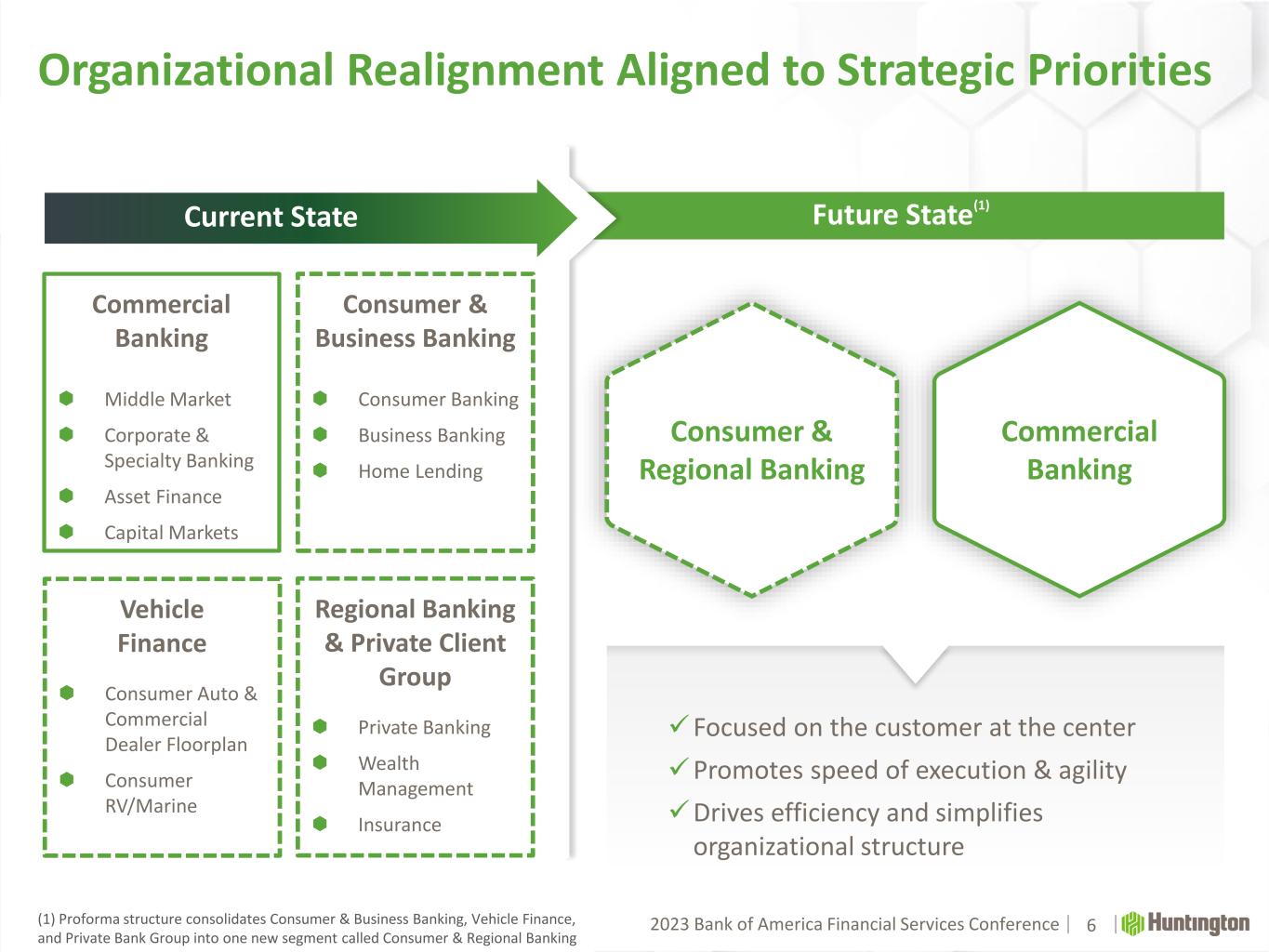

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Organizational Realignment Aligned to Strategic Priorities 6 Future State(1) Regional Banking & Private Client Group Private Banking Wealth Management Insurance Commercial Banking Middle Market Corporate & Specialty Banking Asset Finance Capital Markets Consumer & Regional Banking Vehicle Finance Consumer Auto & Commercial Dealer Floorplan Consumer RV/Marine Commercial Banking Consumer & Business Banking Consumer Banking Business Banking Home Lending Current State ✓Focused on the customer at the center ✓Promotes speed of execution & agility ✓Drives efficiency and simplifies organizational structure (1) Proforma structure consolidates Consumer & Business Banking, Vehicle Finance, and Private Bank Group into one new segment called Consumer & Regional Banking

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Strategic Investments for Sustainable Growth 7 Key Initiatives (2023)Operating Investments(1) Technology Development New consumer products (marketplace and deepening) Expanded capabilities in wealth and advisory Commercial origination and servicing Enhanced payment capabilities (card and TM) Operation Accelerate (use and access to data | ease of transacting | improved customer experience) Investment in Mobile and AI platform Marketing Customer acquisition and brand awareness Marketing technology – personalized delivery and targeting Personnel Additions Specialty banking verticals Climate finance 2021 2022 2023 1 Increased Capacity Utilized to Self-fund Strategic Initiatives to Drive Sustainable Growth 2 3 (1) Defined as expenses related to funding of technology development, marketing, and select additions of new personnel that can drive those initiatives. 20%+ CAGR 20%

Bank of America Financial Services Conference 20232023 Bank of America F nancial Services Co f rence Purposeful Execution Towards Our Long-Term Strategy 8 Investing for sustainable profitable growth Differentiating our culture, brand, and customer experience Optimizing for top quartile performance and value creation