EX-99.1

Published on March 9, 2022

RBC Capital Markets Financial Institutions Conference March 9, 2022 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2022 Huntington Bancshares Incorporated.

RBC Capital Markets Financial Institutions Conference Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID-19 pandemic and related variants and mutations and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the anticipated benefits of the transaction with TCF are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington does business; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2021 which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2

RBC Capital Markets Financial Institutions Conference Drive organic growth across all business segments Deliver sustainable, top quartile financial performance Stability and resilience through risk management; maintaining an aggregate moderate-to-low risk profile through-the-cycle Huntington: A Purpose-Driven Company Our Vision Become the country’s leading people-first, digitally powered bank Purpose Drives Performance 3 Our Purpose We make people’s lives better, help businesses thrive, and strengthen the communities we serve

RBC Capital Markets Financial Institutions Conference Key Messages 1 2 3 Confident on FY 2022 outlook – driving sustainable revenue growth, with cost savings on track for full realization and strong credit trends Well positioned to benefit from higher rates and dynamically managing the balance sheet 4 Continued evolution of Fair Play product set – reflecting market leadership since 2010 4 Executing on Commercial Banking strategic priorities - bolstering capital markets capabilities with the acquisition of an industry- leading middle market investment banking & advisory firm

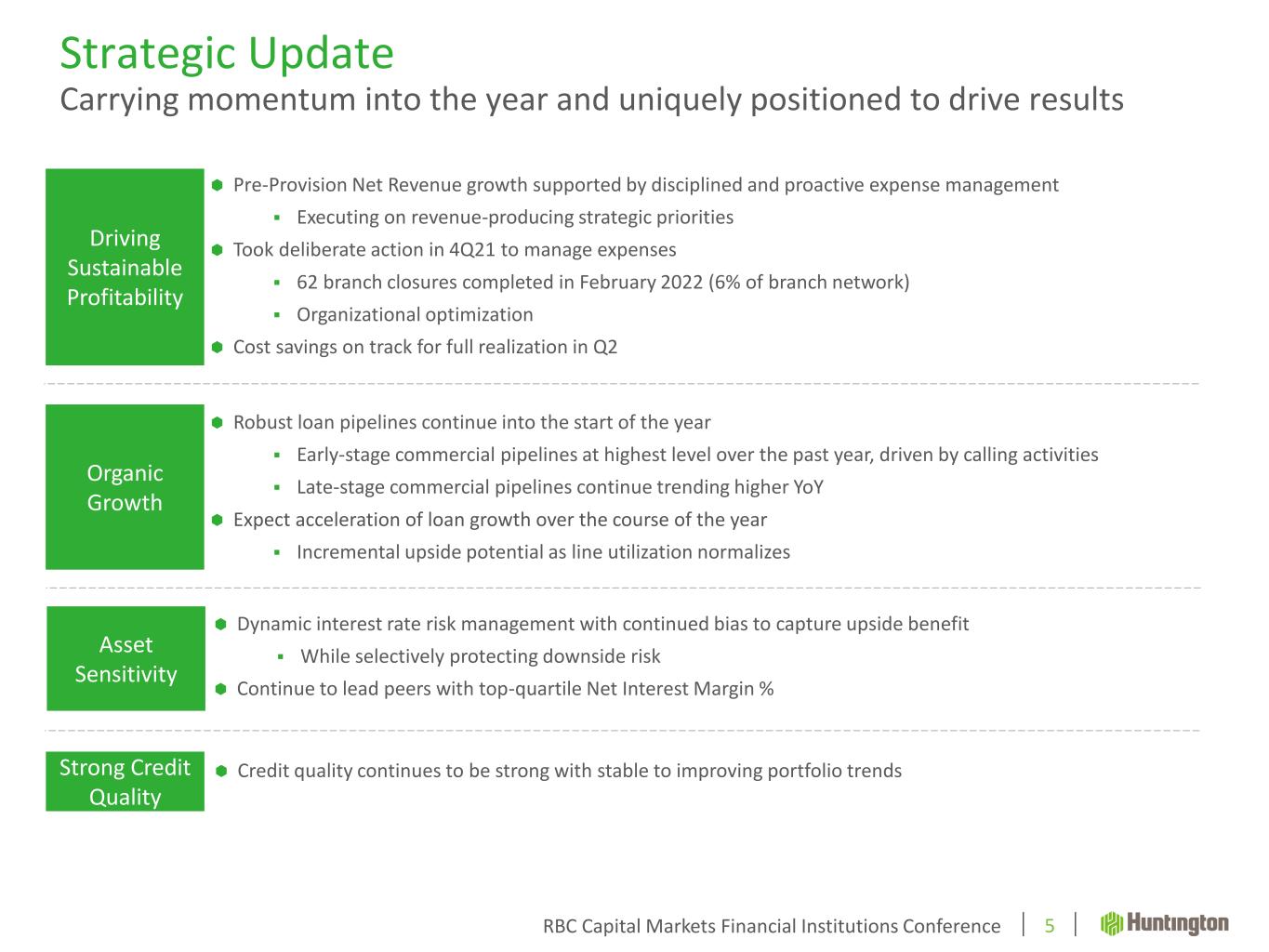

RBC Capital Markets Financial Institutions Conference Strategic Update Carrying momentum into the year and uniquely positioned to drive results Pre-Provision Net Revenue growth supported by disciplined and proactive expense management ▪ Executing on revenue-producing strategic priorities Took deliberate action in 4Q21 to manage expenses ▪ 62 branch closures completed in February 2022 (6% of branch network) ▪ Organizational optimization Cost savings on track for full realization in Q2 Driving Sustainable Profitability Organic Growth Asset Sensitivity Robust loan pipelines continue into the start of the year ▪ Early-stage commercial pipelines at highest level over the past year, driven by calling activities ▪ Late-stage commercial pipelines continue trending higher YoY Expect acceleration of loan growth over the course of the year ▪ Incremental upside potential as line utilization normalizes Dynamic interest rate risk management with continued bias to capture upside benefit ▪ While selectively protecting downside risk Continue to lead peers with top-quartile Net Interest Margin % 5 Strong Credit Quality Credit quality continues to be strong with stable to improving portfolio trends

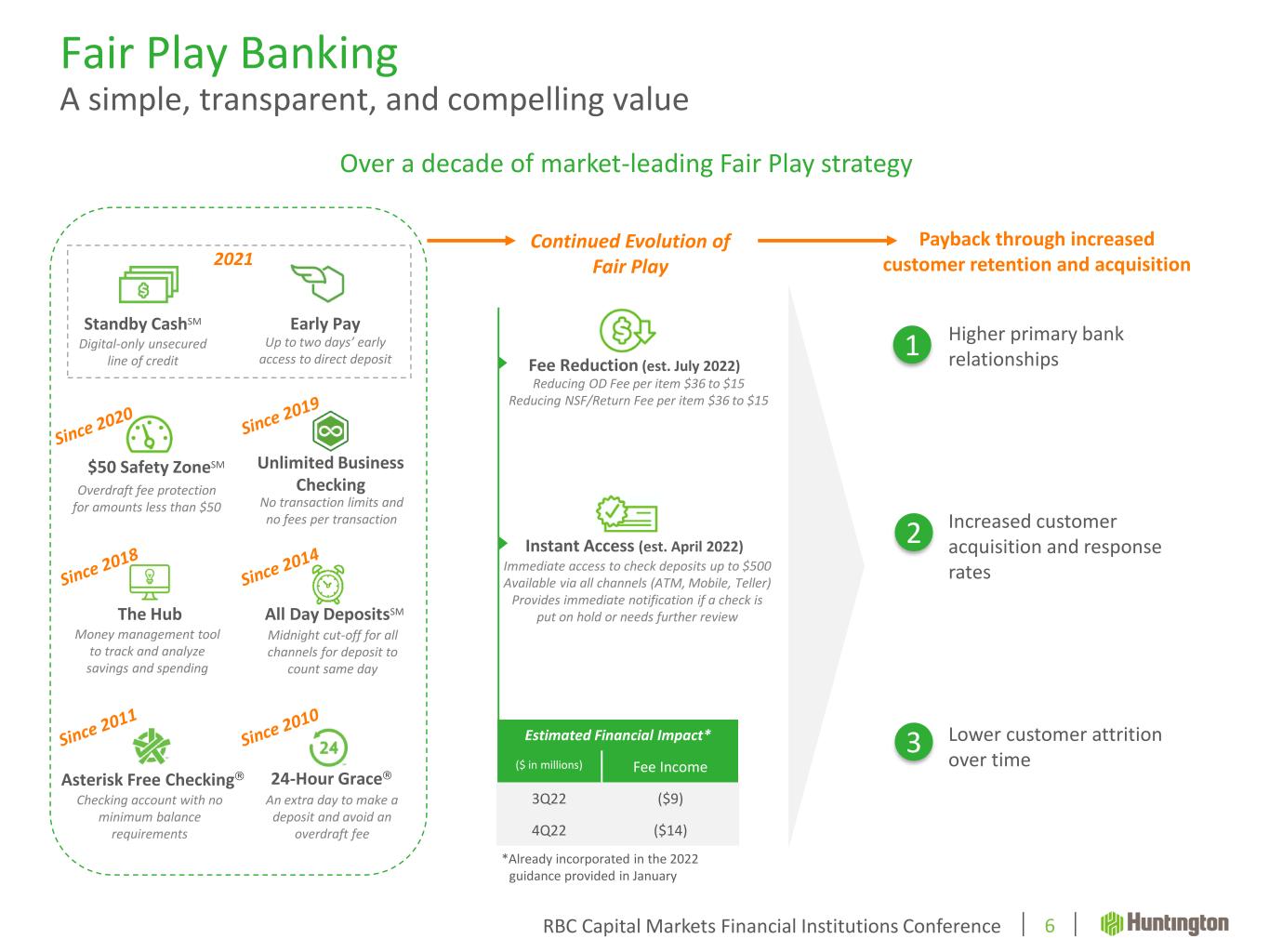

RBC Capital Markets Financial Institutions Conference Fair Play Banking A simple, transparent, and compelling value 24-Hour Grace An extra day to make a deposit and avoid an overdraft fee $50 Safety ZoneSM Overdraft fee protection for amounts less than $50 Asterisk Free Checking Checking account with no minimum balance requirements All Day DepositsSM Midnight cut-off for all channels for deposit to count same day The Hub Money management tool to track and analyze savings and spending Unlimited Business Checking No transaction limits and no fees per transaction Over a decade of market-leading Fair Play strategy Standby CashSM Digital-only unsecured line of credit Early Pay Up to two days’ early access to direct deposit Payback through increased customer retention and acquisition2021 Continued Evolution of Fair Play Higher primary bank relationships Increased customer acquisition and response rates Lower customer attrition over time 1 2 3 Fee Reduction (est. July 2022) Reducing OD Fee per item $36 to $15 Reducing NSF/Return Fee per item $36 to $15 Instant Access (est. April 2022) Immediate access to check deposits up to $500 Available via all channels (ATM, Mobile, Teller) Provides immediate notification if a check is put on hold or needs further review Estimated Financial Impact* ($ in millions) Fee Income 3Q22 ($9) 4Q22 ($14) 6 *Already incorporated in the 2022 guidance provided in January

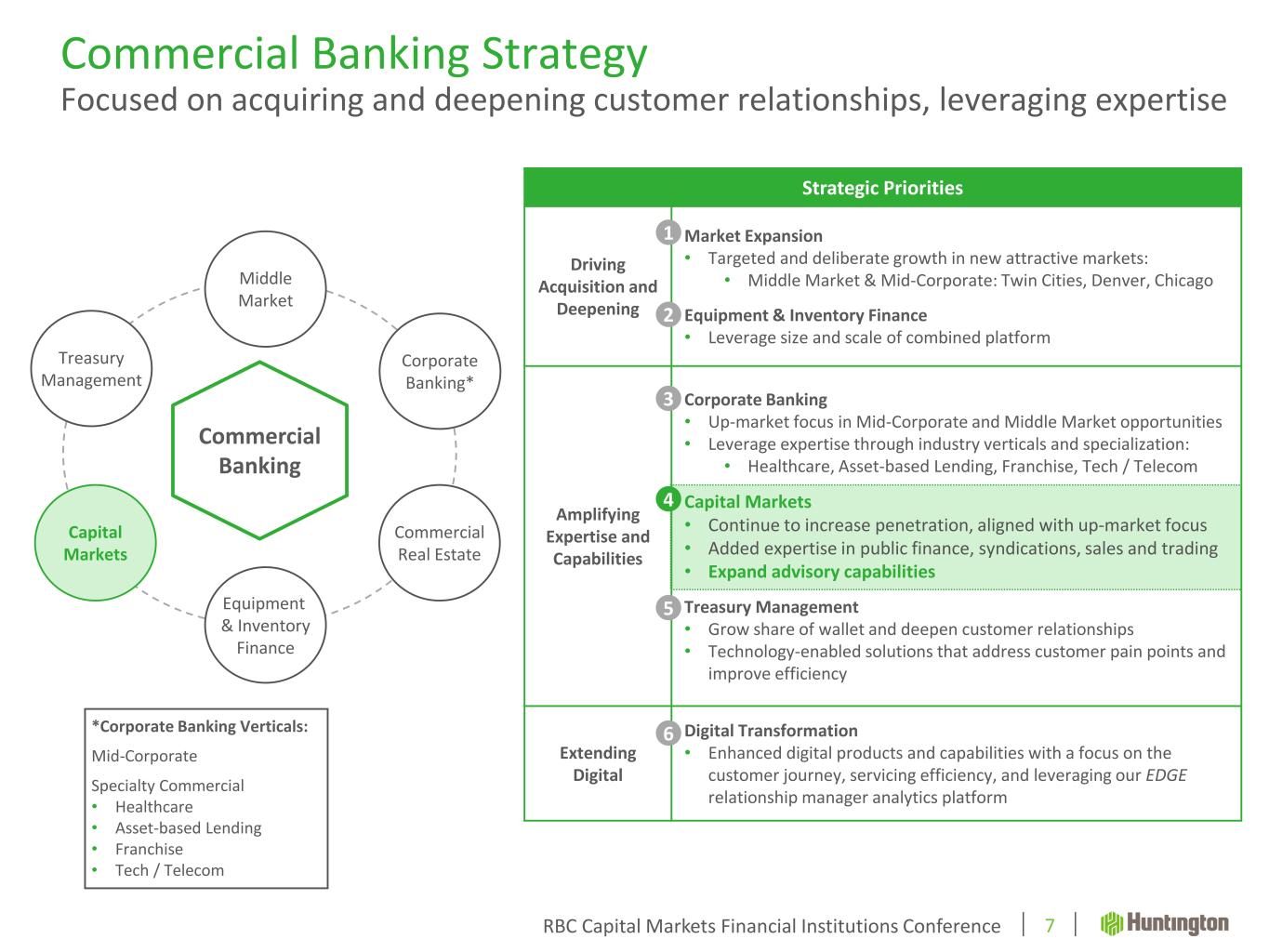

RBC Capital Markets Financial Institutions Conference Strategic Priorities Driving Acquisition and Deepening Market Expansion • Targeted and deliberate growth in new attractive markets: • Middle Market & Mid-Corporate: Twin Cities, Denver, Chicago Equipment & Inventory Finance • Leverage size and scale of combined platform Amplifying Expertise and Capabilities Corporate Banking • Up-market focus in Mid-Corporate and Middle Market opportunities • Leverage expertise through industry verticals and specialization: • Healthcare, Asset-based Lending, Franchise, Tech / Telecom Capital Markets • Continue to increase penetration, aligned with up-market focus • Added expertise in public finance, syndications, sales and trading • Expand advisory capabilities Treasury Management • Grow share of wallet and deepen customer relationships • Technology-enabled solutions that address customer pain points and improve efficiency Extending Digital Digital Transformation • Enhanced digital products and capabilities with a focus on the customer journey, servicing efficiency, and leveraging our EDGE relationship manager analytics platform Commercial Banking Strategy Focused on acquiring and deepening customer relationships, leveraging expertise Commercial Banking Middle Market Corporate Banking* Commercial Real Estate Equipment & Inventory Finance Capital Markets Treasury Management 7 *Corporate Banking Verticals: Mid-Corporate Specialty Commercial • Healthcare • Asset-based Lending • Franchise • Tech / Telecom 1 2 3 4 5 6

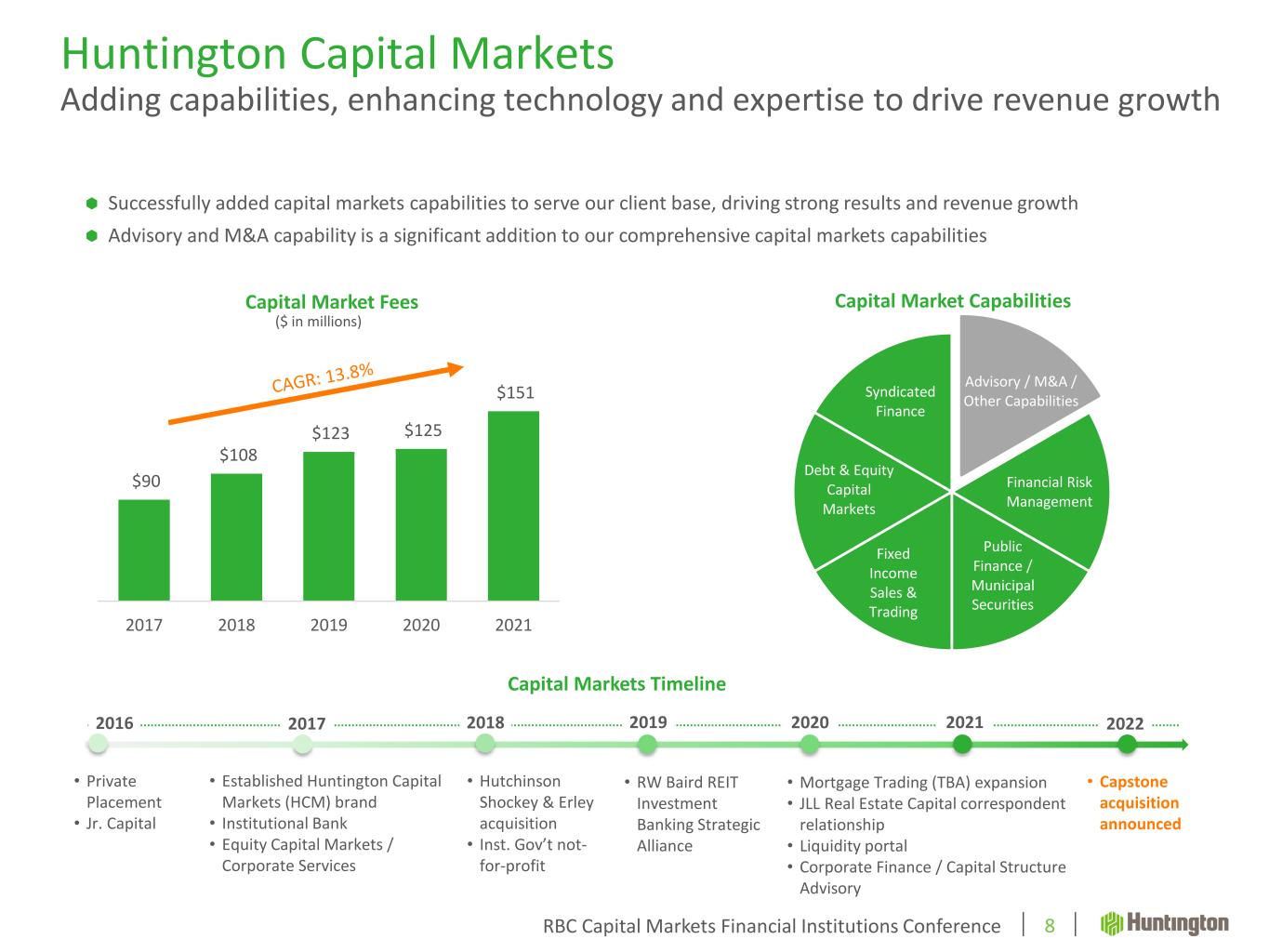

RBC Capital Markets Financial Institutions Conference Capital Market Capabilities Huntington Capital Markets Adding capabilities, enhancing technology and expertise to drive revenue growth 8 Capital Market Fees • Capstone acquisition announced • Hutchinson Shockey & Erley acquisition • Inst. Gov’t not- for-profit 2018 2020 20222016 2017 2019 2021 ($ in millions) Successfully added capital markets capabilities to serve our client base, driving strong results and revenue growth Advisory and M&A capability is a significant addition to our comprehensive capital markets capabilities • Private Placement • Jr. Capital • Established Huntington Capital Markets (HCM) brand • Institutional Bank • Equity Capital Markets / Corporate Services A • Mortgage Trading (TBA) expansion • JLL Real Estate Capital correspondent relationship • Liquidity portal • Corporate Finance / Capital Structure Advisory Capital Markets Timeline • RW Baird REIT Investment Banking Strategic Alliance Advisory / M&A Other Capabilities Advisory / M&A / Other Capabilities Financial Risk Management Public Finance / Municipal Securities Fixed Income Sales & Trading Debt & Equity Capital Markets Syndicated Finance $90 $108 $123 $125 $151 2017 2018 2019 2020 2021

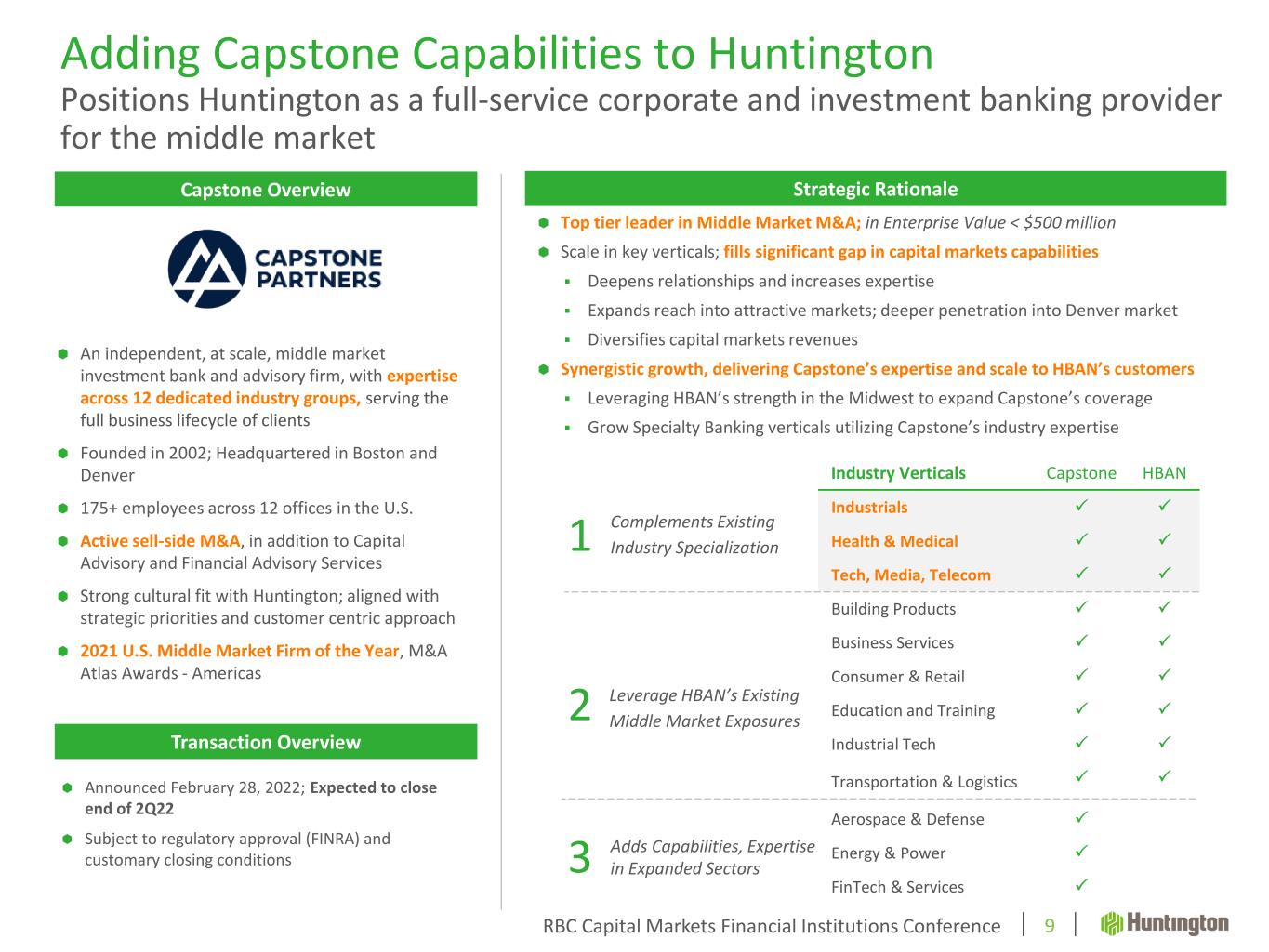

RBC Capital Markets Financial Institutions Conference Adding Capstone Capabilities to Huntington Positions Huntington as a full-service corporate and investment banking provider for the middle market 9 Industry Verticals Capstone HBAN Industrials Health & Medical Tech, Media, Telecom Building Products Business Services Consumer & Retail Education and Training Industrial Tech Transportation & Logistics Aerospace & Defense Energy & Power FinTech & Services Complements Existing Industry Specialization Leverage HBAN’s Existing Middle Market Exposures Adds Capabilities, Expertise in Expanded Sectors 1 2 3 Capstone Overview An independent, at scale, middle market investment bank and advisory firm, with expertise across 12 dedicated industry groups, serving the full business lifecycle of clients Founded in 2002; Headquartered in Boston and Denver 175+ employees across 12 offices in the U.S. Active sell-side M&A, in addition to Capital Advisory and Financial Advisory Services Strong cultural fit with Huntington; aligned with strategic priorities and customer centric approach 2021 U.S. Middle Market Firm of the Year, M&A Atlas Awards - Americas Top tier leader in Middle Market M&A; in Enterprise Value < $500 million Scale in key verticals; fills significant gap in capital markets capabilities ▪ Deepens relationships and increases expertise ▪ Expands reach into attractive markets; deeper penetration into Denver market ▪ Diversifies capital markets revenues Synergistic growth, delivering Capstone’s expertise and scale to HBAN’s customers ▪ Leveraging HBAN’s strength in the Midwest to expand Capstone’s coverage ▪ Grow Specialty Banking verticals utilizing Capstone’s industry expertise Announced February 28, 2022; Expected to close end of 2Q22 Subject to regulatory approval (FINRA) and customary closing conditions Strategic Rationale Transaction Overview