EX-99.1

Published on June 15, 2021

Morgan Stanley U.S. Financials, Payments, & CRE Conference June 15, 2021 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2021 Huntington Bancshares Incorporated. Exhibit 99.1

Morgan Stanley US Financials, Payments, & CRE Conference Disclaimer 2 CAUTION REGARDING FORWARD‐LOOKING STATEMENTS This communication may contain certain forward‐looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward‐looking statements. Forward‐looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward‐looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward‐looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID‐19 pandemic and its impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd‐ Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the anticipated benefits of the transaction with TCF Financial Corporation (“TCF”) are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington does business; the possibility that the proposed branch divestiture will not close when expected or at all because required regulatory approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the possibility that the branch divestiture may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the branch divestiture; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10‐K for the year ended December 31, 2020, which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward‐looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward‐looking statements to reflect circumstances or events that occur after the date the forward‐looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward‐looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

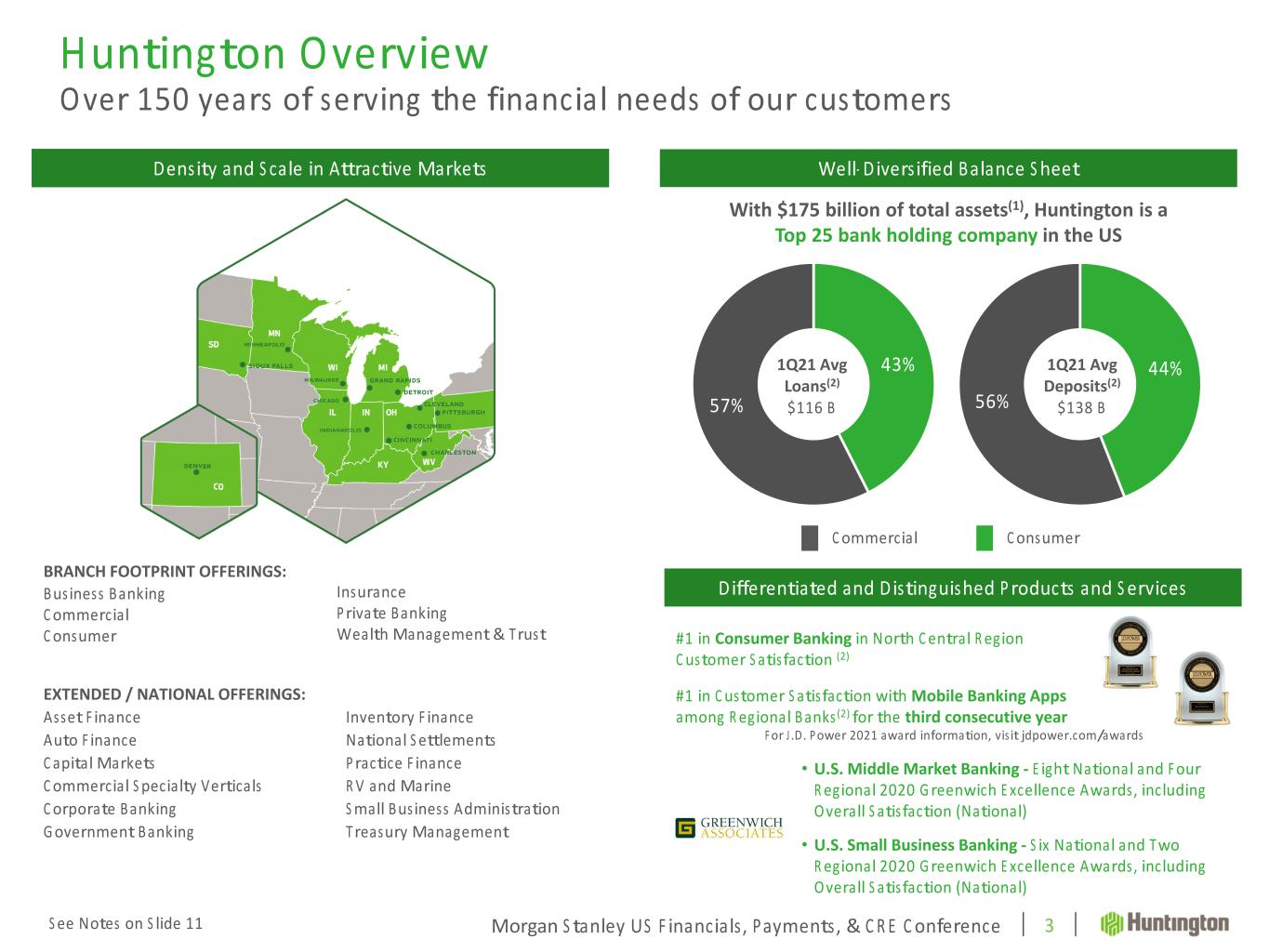

Morgan Stanley US Financials, Payments, & CRE Conference Huntington Overview Over 150 years of serving the financial needs of our customers 3 Density and Scale in Attractive Markets See Notes on Slide 11 Commercial Consumer Well‐Diversified Balance Sheet #1 in Customer Satisfaction with Mobile Banking Apps among Regional Banks(2) for the third consecutive year #1 in Consumer Banking in North Central Region Customer Satisfaction (2) For J.D. Power 2021 award information, visit jdpower.com/awards Differentiated and Distinguished Products and Services With $175 billion of total assets(1), Huntington is a Top 25 bank holding company in the US BRANCH FOOTPRINT OFFERINGS: Business Banking Commercial Consumer Insurance Private Banking Wealth Management & Trust EXTENDED / NATIONAL OFFERINGS: Asset Finance Auto Finance Capital Markets Commercial Specialty Verticals Corporate Banking Government Banking Inventory Finance National Settlements Practice Finance RV and Marine Small Business Administration Treasury Management 43% 57% 1Q21 Avg Loans(2) $116 B 44% 56% 1Q21 Avg Deposits(2) $138 B • U.S. Middle Market Banking ‐ Eight National and Four Regional 2020 Greenwich Excellence Awards, including Overall Satisfaction (National) • U.S. Small Business Banking ‐ Six National and Two Regional 2020 Greenwich Excellence Awards, including Overall Satisfaction (National)

Morgan Stanley US Financials, Payments, & CRE Conference Building the Leading People‐First, Digitally Powered Bank Creating a sustainable competitive advantage with focused investment in customer experience, product differentiation, and key growth initiatives 4 We are a Purpose‐driven company Our Purpose is to make people’s lives better, help businesses thrive, and strengthen the communities we serve Drive organic growth across all business segments Deliver a superior customer experience through differentiated products, digital capabilities, market segmentation, and tailored expertise Leverage the value of our brand, our deeply‐rooted leadership in our communities, and our market‐leading convenience to efficiently acquire, deepen, and retain client relationships Deliver sustainable, top quartile financial performance and efficiency Drive diversified revenue growth Leverage increased scale from the TCF acquisition Minimize earnings volatility through the cycle Deliver consistent annual positive operating leverage and top quartile returns on capital Be a source of stability and resilience through enterprise risk management & balance sheet strength Maintain an aggregate moderate‐to‐low, through‐the‐cycle risk profile Disciplined capital allocation and priorities (first fund organic growth, second maintain the dividend, and then other capital uses)

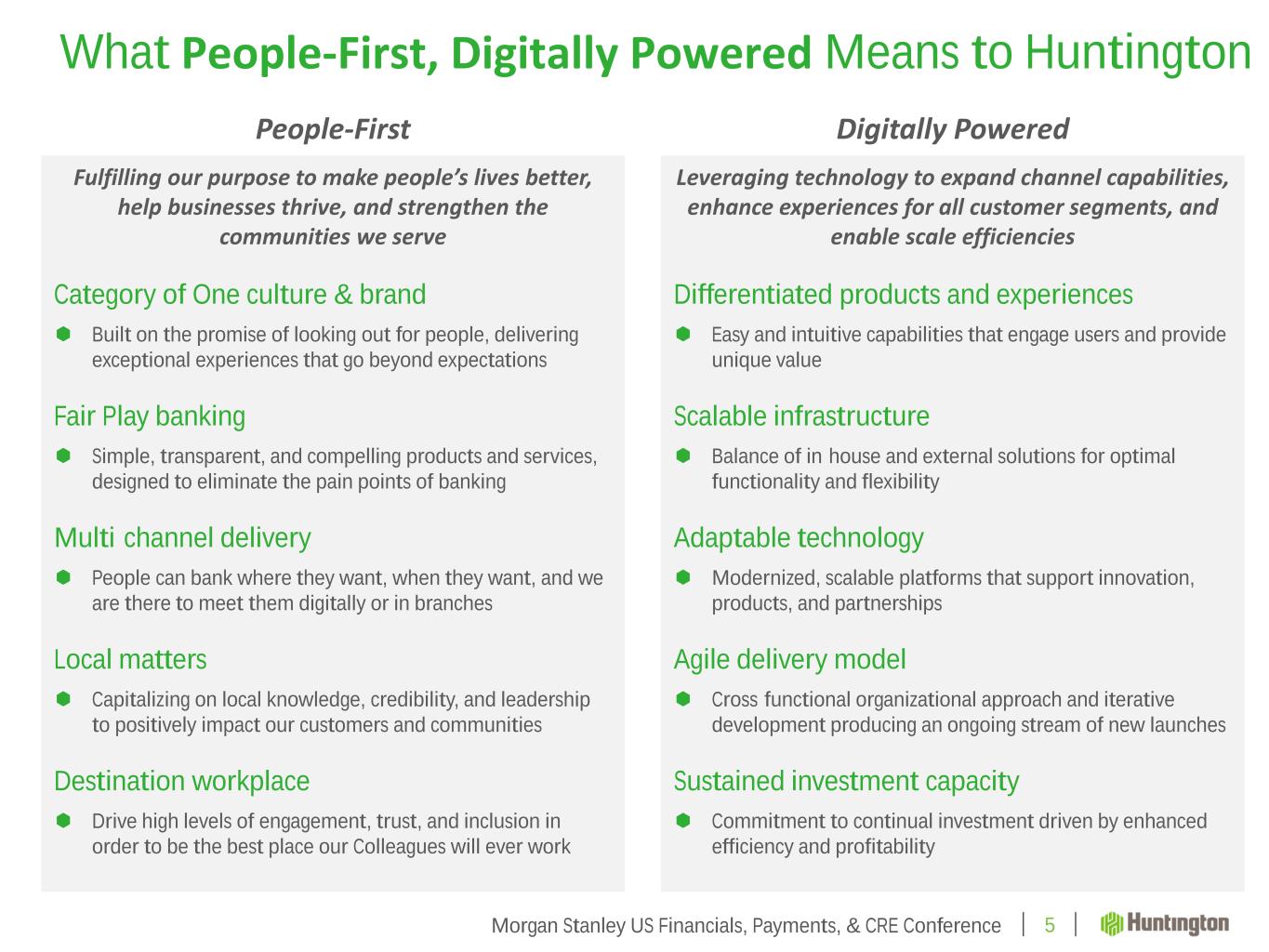

Morgan Stanley US Financials, Payments, & CRE Conference What People‐First, Digitally Powered Means to Huntington 5 Leveraging technology to expand channel capabilities, enhance experiences for all customer segments, and enable scale efficiencies Differentiated products and experiences Easy and intuitive capabilities that engage users and provide unique value Scalable infrastructure Balance of in‐house and external solutions for optimal functionality and flexibility Adaptable technology Modernized, scalable platforms that support innovation, products, and partnerships Agile delivery model Cross‐functional organizational approach and iterative development producing an ongoing stream of new launches Sustained investment capacity Commitment to continual investment driven by enhanced efficiency and profitability Digitally Powered Fulfilling our purpose to make people’s lives better, help businesses thrive, and strengthen the communities we serve Category of One culture & brand Built on the promise of looking out for people, delivering exceptional experiences that go beyond expectations Fair Play banking Simple, transparent, and compelling products and services, designed to eliminate the pain points of banking Multi‐channel delivery People can bank where they want, when they want, and we are there to meet them digitally or in branches Local matters Capitalizing on local knowledge, credibility, and leadership to positively impact our customers and communities Destination workplace Drive high levels of engagement, trust, and inclusion in order to be the best place our Colleagues will ever work People‐First

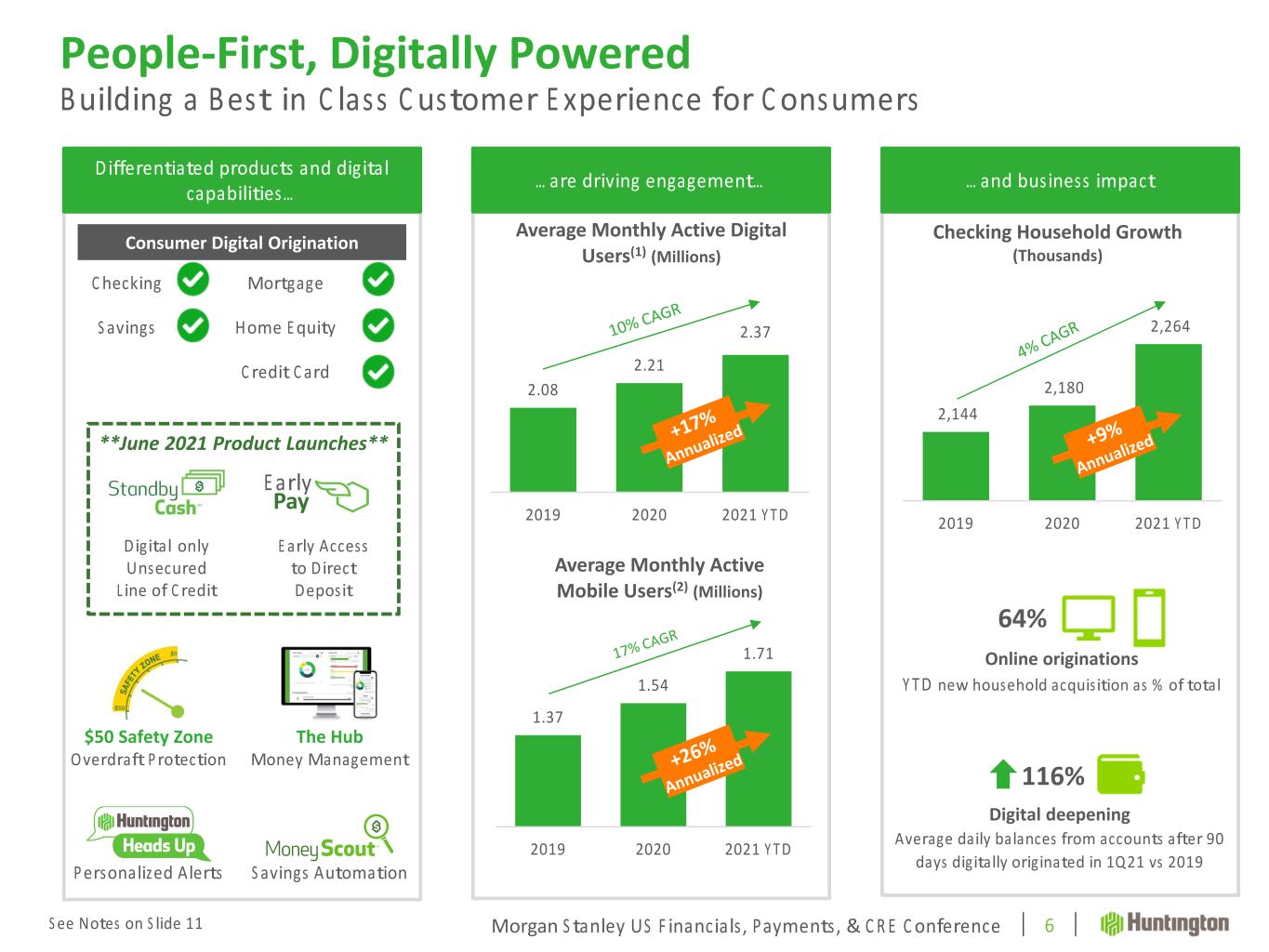

Morgan Stanley US Financials, Payments, & CRE Conference People‐First, Digitally Powered Building a Best‐in‐Class Customer Experience for Consumers 6 **June 2021 Product Launches** Digital‐only Unsecured Line of Credit Early Access to Direct Deposit 2,144 2,180 2,264 2019 2020 2021 YTD Checking Household Growth (Thousands) Differentiated products and digital capabilities… …are driving engagement… …and business impact 2.08 2.21 2.37 2019 2020 2021 YTD Average Monthly Active Digital Users(1) (Millions) 1.37 1.54 1.71 2019 2020 2021 YTD Average Monthly Active Mobile Users(2) (Millions) 64% 116% Online originations YTD new household acquisition as % of total Digital deepening Average daily balances from accounts after 90 days digitally originated in 1Q21 vs 2019 Early Pay Consumer Digital Origination Checking Mortgage Savings Home Equity Credit Card Personalized Alerts The Hub Money Management Savings Automation $50 Safety Zone Overdraft Protection See Notes on Slide 11

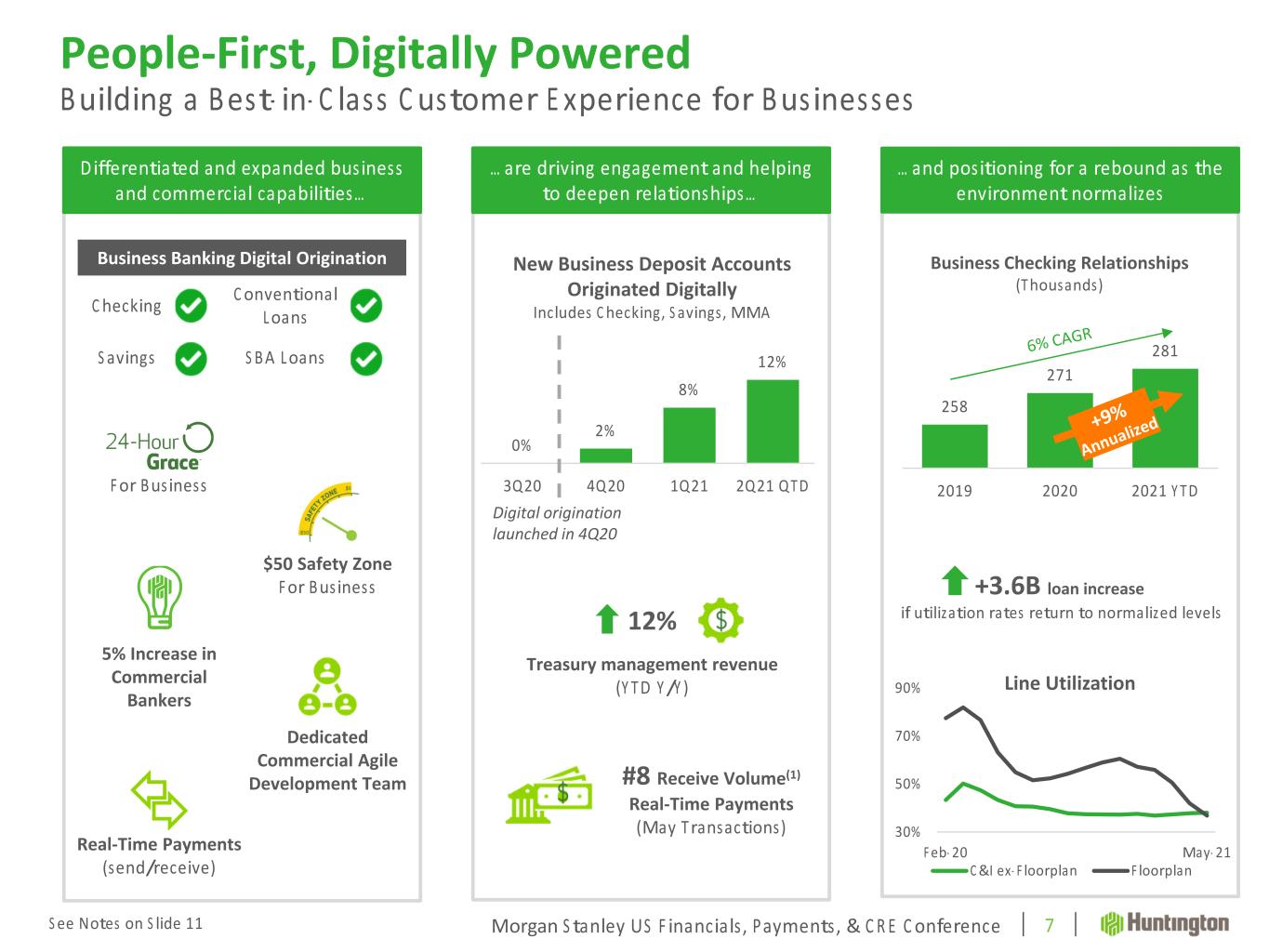

Morgan Stanley US Financials, Payments, & CRE Conference 30% 50% 70% 90% Feb‐20 May‐21 Line Utilization C&I ex‐Floorplan Floorplan +3.6B loan increase if utilization rates return to normalized levels People‐First, Digitally Powered Building a Best‐in‐Class Customer Experience for Businesses 5% Increase in Commercial Bankers Dedicated Commercial Agile Development Team 0% 2% 8% 12% 3Q20 4Q20 1Q21 2Q21 QTD New Business Deposit Accounts Originated Digitally Includes Checking, Savings, MMA 258 271 281 2019 2020 2021 YTD Differentiated and expanded business and commercial capabilities… …are driving engagement and helping to deepen relationships… …and positioning for a rebound as the environment normalizes $50 Safety Zone For Business 12% Treasury management revenue (YTD Y/Y) #8 Receive Volume(1) Real‐Time Payments (May Transactions) Business Checking Relationships (Thousands) 7 Digital origination launched in 4Q20 For Business Business Banking Digital Origination Checking Conventional Loans Savings SBA Loans Real‐Time Payments (send/receive) See Notes on Slide 11

Appendix

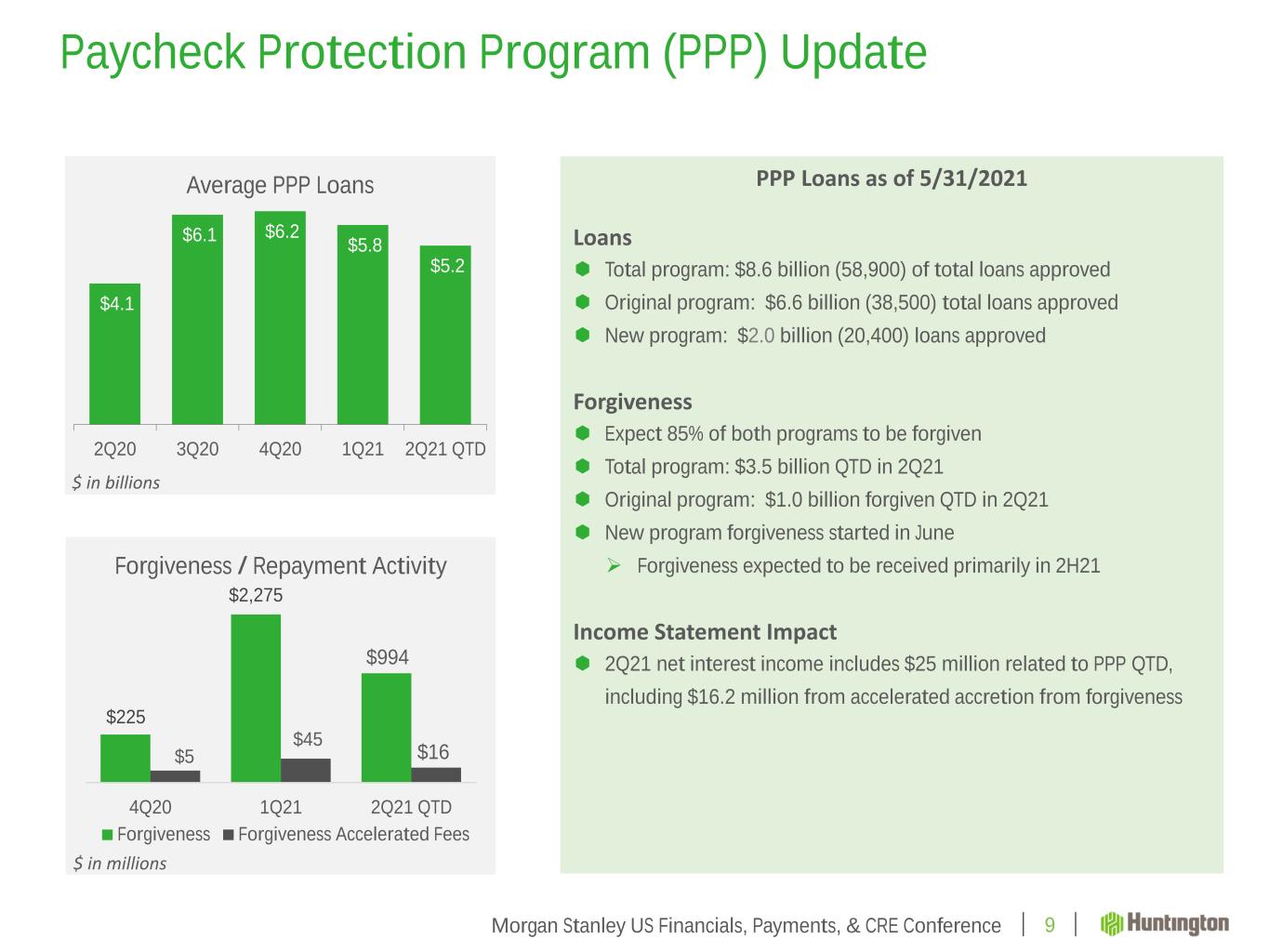

Morgan Stanley US Financials, Payments, & CRE Conference $225 $2,275 $5 $45 4Q20 1Q21 2Q21 QTD Forgiveness / Repayment Activity Forgiveness Forgiveness Accelerated Fees Paycheck Protection Program (PPP) Update 9 PPP Loans as of 5/31/2021 Loans Total program: $8.6 billion (58,900) of total loans approved Original program: $6.6 billion (38,500) total loans approved New program: $2.0 billion (20,400) loans approved Forgiveness Expect 85% of both programs to be forgiven Total program: $3.5 billion QTD in 2Q21 Original program: $1.0 billion forgiven QTD in 2Q21 New program forgiveness started in June Forgiveness expected to be received primarily in 2H21 Income Statement Impact 2Q21 net interest income includes $25 million related to PPP QTD, including $16.2 million from accelerated accretion from forgiveness $4.1 $6.1 $6.2 $5.8 $5.2 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 2Q20 3Q20 4Q20 1Q21 2Q21 QTD Average PPP Loans $ in billions $ in millions $16 $994

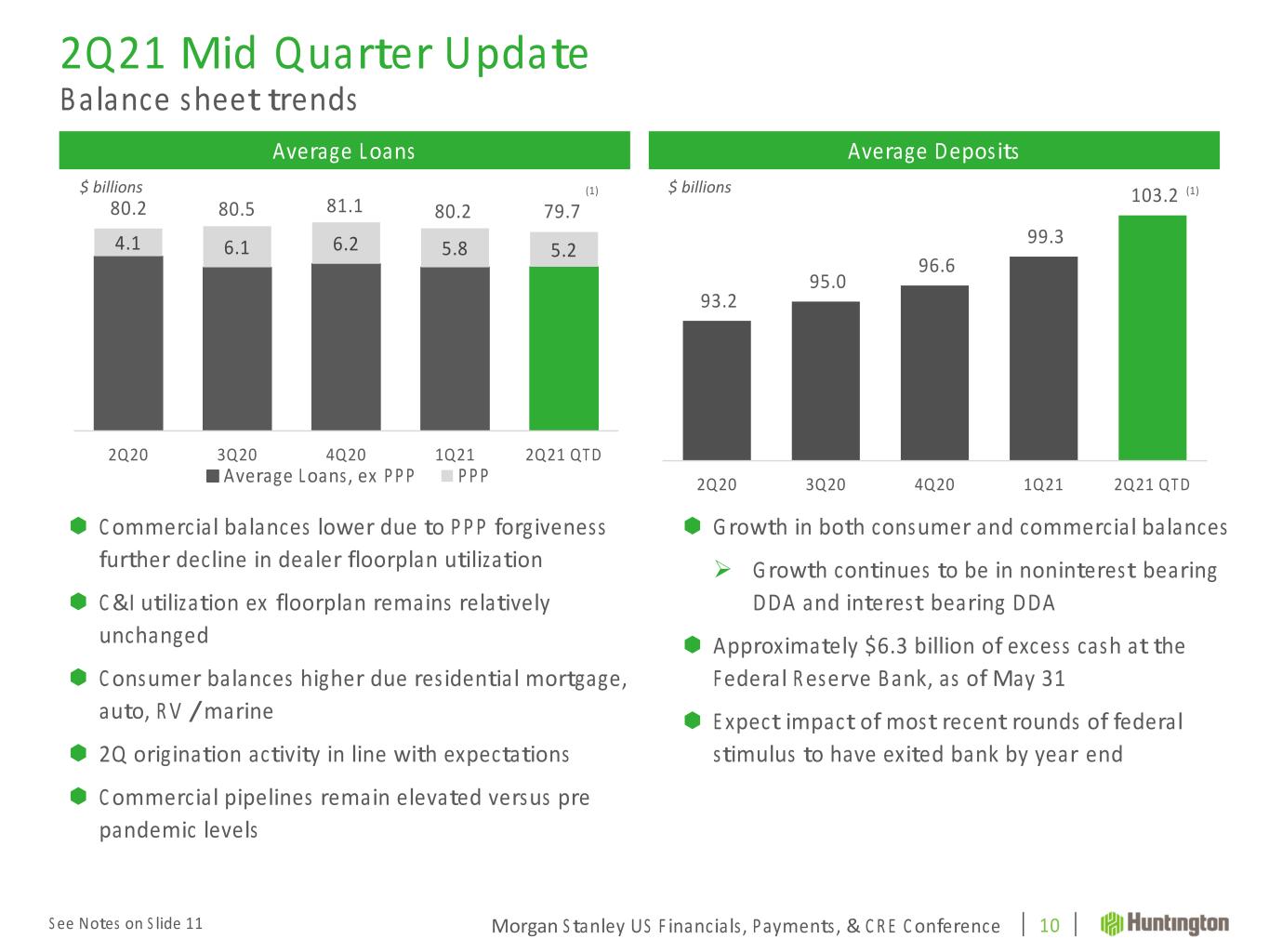

Morgan Stanley US Financials, Payments, & CRE Conference 4.1 6.1 6.2 5.8 5.2 2Q20 3Q20 4Q20 1Q21 2Q21 QTD Average Loans, ex‐PPP PPP 2Q21 Mid‐Quarter Update Balance sheet trends 10 Average DepositsAverage Loans $ billions Commercial balances lower due to PPP forgiveness further decline in dealer floorplan utilization C&I utilization ex‐floorplan remains relatively unchanged Consumer balances higher due residential mortgage, auto, RV / marine 2Q origination activity in line with expectations Commercial pipelines remain elevated versus pre‐ pandemic levels 93.2 95.0 96.6 99.3 103.2 2Q20 3Q20 4Q20 1Q21 2Q21 QTD $ billions Growth in both consumer and commercial balances Growth continues to be in noninterest‐bearing DDA and interest‐bearing DDA Approximately $6.3 billion of excess cash at the Federal Reserve Bank, as of May 31 Expect impact of most recent rounds of federal stimulus to have exited bank by year‐end (1) (1) 80.2 80.5 81.1 80.2 79.7 See Notes on Slide 11

Morgan Stanley US Financials, Payments, & CRE Conference Notes 11 Slide 3: 1. Total assets were calculated by adding the corresponding HBAN and TCF Financial Corporation amounts from their 3/31/21 filings and do not include any purchase accounting adjustments. 2. For J.D. Power 2021 award information, visit jdpower.com/awards. Huntington received the highest score among regional banks in the J.D. Power 2021 U.S. Banking Mobile App Satisfaction Study of customers’ satisfaction with their financial institution’s mobile applications for banking account management. Huntington received the highest ranking in Customer Satisfaction with Consumer Banking in the North Central Region of the J.D. Power 2021 U.S. Retail Banking Satisfaction Study. Slide 6: 1. Active digital users – users of all web and/or mobile platforms who logged in at least once each month of the quarter. 2. Active mobile users – users of all mobile platforms who logged in at least once each month of the quarter. Slide 7: 1. Eighth largest receive volume during May among banks participating in The Clearing House’s RTP (Real‐Time Payments) network Slide 10: 1. QTD through 5/31/21