EX-99.1

Published on March 10, 2021

RBC Capital Markets Financial Institutions Conference March 10, 2021 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2021 Huntington Bancshares Incorporated. Exhibit 99.1

RBC Capital Markets Financial Institutions Conference Disclaimer 2 CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the plans, objectives, expectations and intentions of Huntington and TCF, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID-19 pandemic and its impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd- Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement between Huntington and TCF; the outcome of any legal proceedings that may be instituted against Huntington or TCF; delays in completing the transaction; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); the failure to obtain shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington and TCF do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the ability to complete the transaction and integration of Huntington and TCF successfully; the dilution caused by Huntington’s issuance of additional shares of its capital stock in connection with the transaction; and other factors that may affect the future results of Huntington and TCF. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2020, which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC, and in TCF’s Annual Report on Form 10-K for the year ended December 31, 2020, which is on file with the SEC and available in the “Investor Relations” section of TCF’s website, http://www.ir.tcfbank.com, under the heading “Financial Information” and in other documents TCF files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Huntington nor TCF assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

RBC Capital Markets Financial Institutions Conference Building the Leading People-First, Digitally Powered Bank Creating a sustainable competitive advantage with focused investment in customer experience, product differentiation, and key growth initiatives 3 We are a Purpose-driven company Our Purpose is to make people’s lives better, help businesses thrive, and strengthen the communities we serve Drive organic growth across all business segments Deliver a superior customer experience through differentiated products, digital capabilities, market segmentation, and tailored expertise Leverage the value of our brand, our deeply-rooted leadership in our communities, and our market-leading convenience to efficiently acquire, deepen, and retain client relationships Deliver sustainable, top quartile financial performance and efficiency Drive diversified revenue growth while maintaining rigorous expense management discipline and maximizing returns on organic growth investments Minimize earnings volatility through the cycle Deliver top quartile returns on capital Be a source of stability and resilience through enterprise risk management & balance sheet strength Maintain an aggregate moderate-to-low, through-the-cycle risk profile Disciplined capital allocation and priorities (first fund organic growth, second maintain the dividend, and then other capital uses)

RBC Capital Markets Financial Institutions Conference Select Investments in 2021 Strategic Initiatives 4 Commercial Banking Consumer and Business Banking Wealth Management Transitioning sales to digital direct and digitally assisted Digital deepening Differentiated new products and features SBA lending geographic expansion Enterprise Digital onboarding & sales enablement enhancements Key expertise and capability hires Enhanced payment platforms Geographic expansion New digital onboarding experience Multiple digital payment enhancements Vehicle Finance Digital and in-branch unified, full-service advisory experience Digital account integration enhancements TCF integration Operational efficiency and enterprise tech enablement

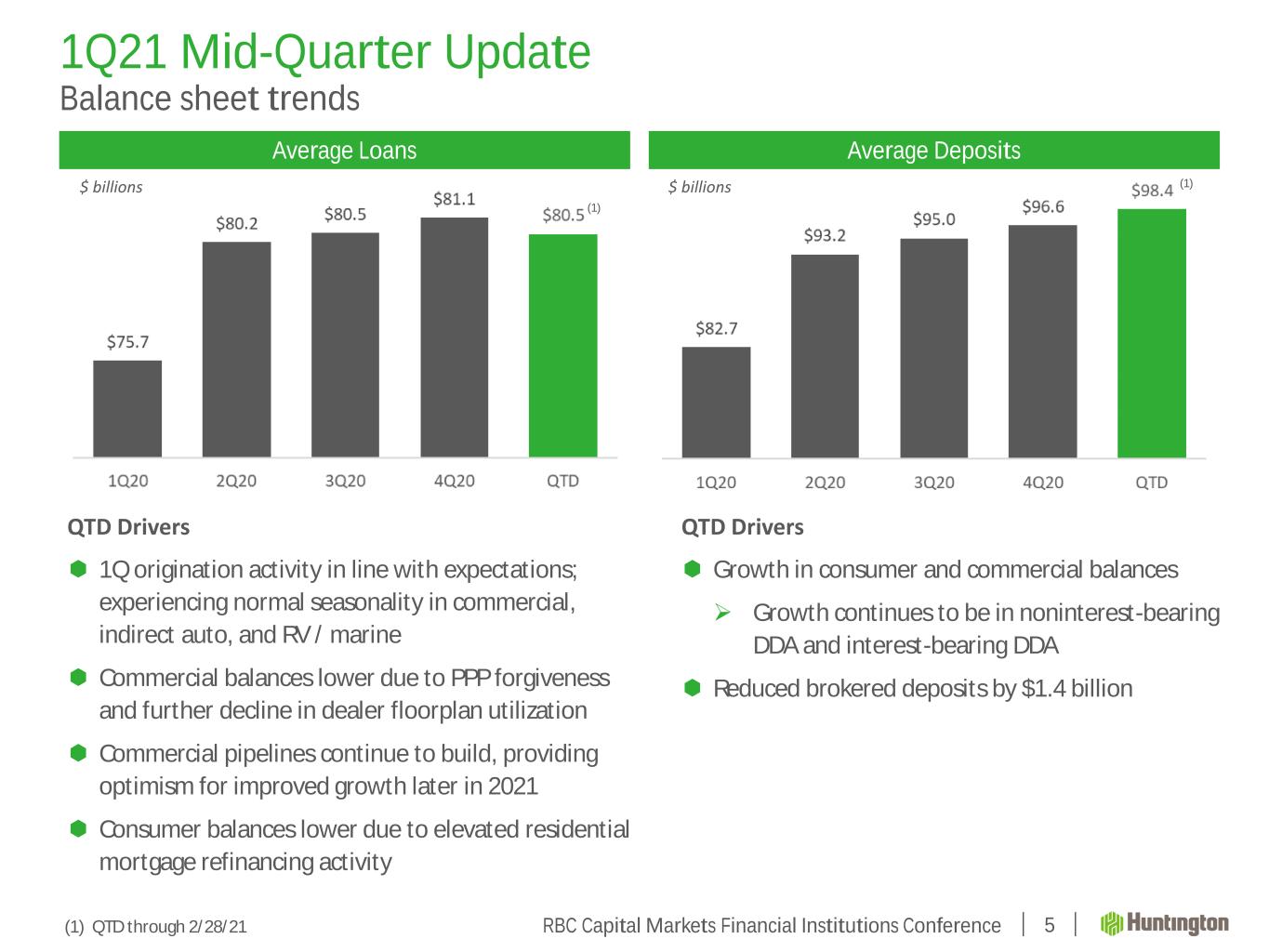

RBC Capital Markets Financial Institutions Conference 1Q21 Mid-Quarter Update Balance sheet trends 5 Average DepositsAverage Loans $ billions QTD Drivers 1Q origination activity in line with expectations; experiencing normal seasonality in commercial, indirect auto, and RV / marine Commercial balances lower due to PPP forgiveness and further decline in dealer floorplan utilization Commercial pipelines continue to build, providing optimism for improved growth later in 2021 Consumer balances lower due to elevated residential mortgage refinancing activity $ billions QTD Drivers Growth in consumer and commercial balances Growth continues to be in noninterest-bearing DDA and interest-bearing DDA Reduced brokered deposits by $1.4 billion (1) (1) (1) QTD through 2/28/21

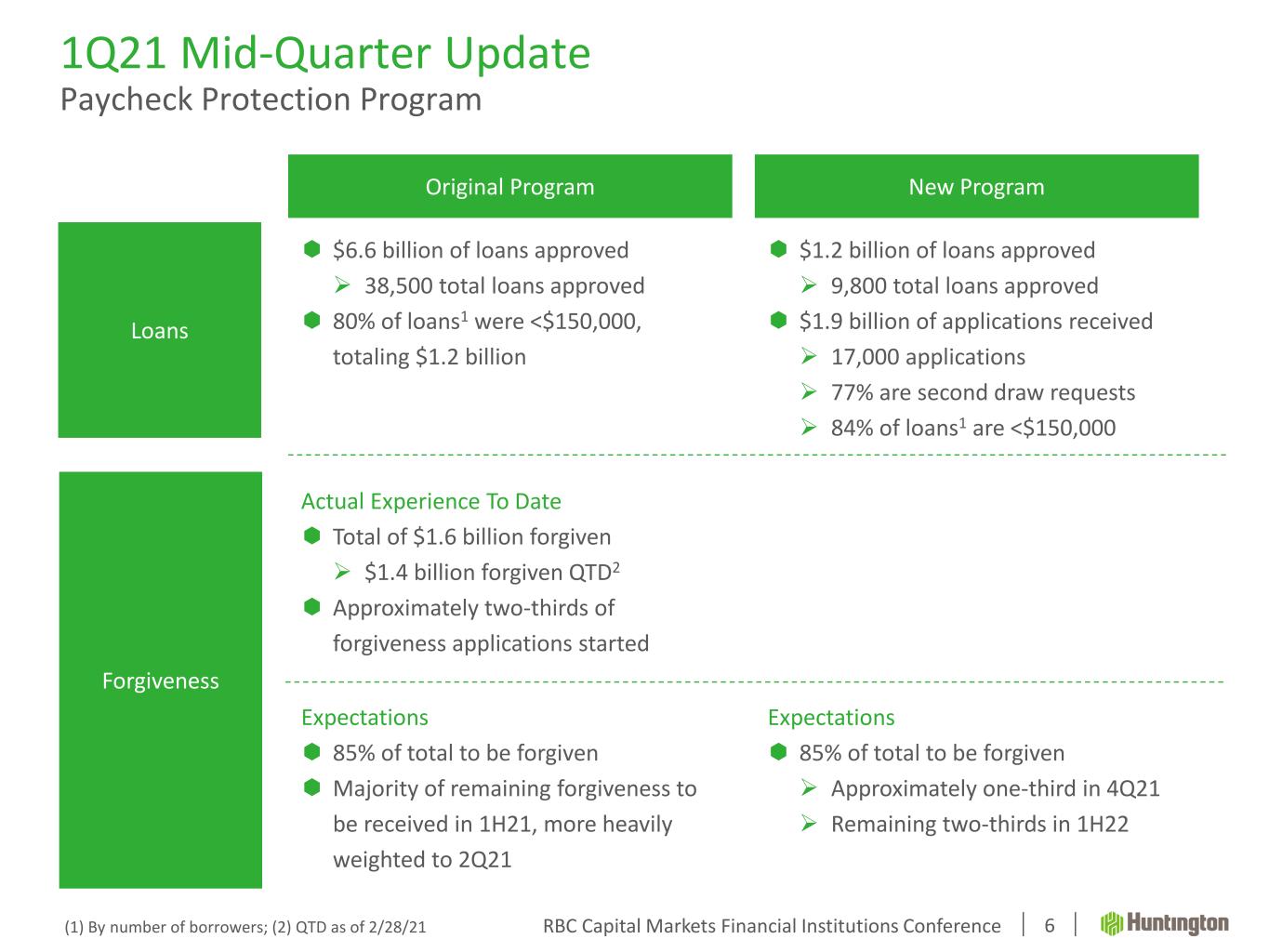

RBC Capital Markets Financial Institutions Conference 1Q21 Mid-Quarter Update Paycheck Protection Program 6 New ProgramOriginal Program $6.6 billion of loans approved 38,500 total loans approved 80% of loans1 were <$150,000, totaling $1.2 billion $1.2 billion of loans approved 9,800 total loans approved $1.9 billion of applications received 17,000 applications 77% are second draw requests 84% of loans1 are <$150,000 (1) By number of borrowers; (2) QTD as of 2/28/21 Loans Forgiveness Actual Experience To Date Total of $1.6 billion forgiven $1.4 billion forgiven QTD2 Approximately two-thirds of forgiveness applications started Expectations 85% of total to be forgiven Majority of remaining forgiveness to be received in 1H21, more heavily weighted to 2Q21 Expectations 85% of total to be forgiven Approximately one-third in 4Q21 Remaining two-thirds in 1H22

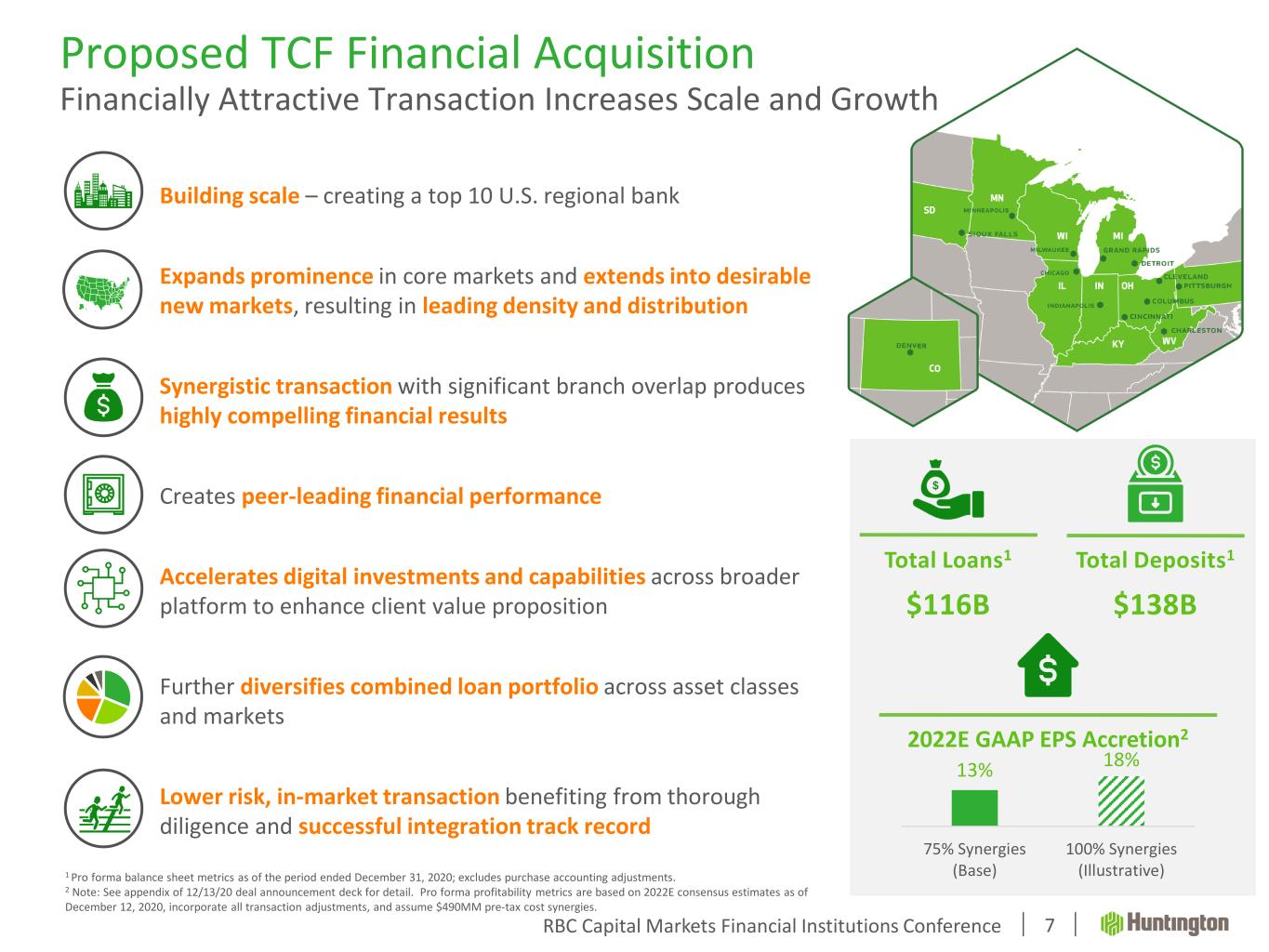

RBC Capital Markets Financial Institutions Conference 13% 18% 75% Synergies (Base) 100% Synergies (Illustrative) Proposed TCF Financial Acquisition Financially Attractive Transaction Increases Scale and Growth 7 Building scale – creating a top 10 U.S. regional bank Expands prominence in core markets and extends into desirable new markets, resulting in leading density and distribution Synergistic transaction with significant branch overlap produces highly compelling financial results Creates peer-leading financial performance Accelerates digital investments and capabilities across broader platform to enhance client value proposition Further diversifies combined loan portfolio across asset classes and markets Lower risk, in-market transaction benefiting from thorough diligence and successful integration track record Total Loans1 $116B Total Deposits1 $138B 2022E GAAP EPS Accretion2 1 Pro forma balance sheet metrics as of the period ended December 31, 2020; excludes purchase accounting adjustments. 2 Note: See appendix of 12/13/20 deal announcement deck for detail. Pro forma profitability metrics are based on 2022E consensus estimates as of December 12, 2020, incorporate all transaction adjustments, and assume $490MM pre-tax cost synergies.