EXHIBIT 99.1

Published on June 10, 2020

Exhibit 99.1 Morgan Stanley Virtual U.S. Financials Conference June 10, 2020 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2020 Huntington Bancshares Incorporated.

Disclaimer CAUTION REGARDING FORWARD‐LOOKING STATEMENTS This communication contains certain forward‐looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward‐looking statements. Forward‐looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward‐looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward‐looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID‐19 pandemic and its impact on the global economy and financial market conditions and our business, results of operations and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd‐Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect our future results. Additional factors that could cause results to differ materially from those described above can be found in our 2019 Annual Report on Form 10‐K, as well as our subsequent Securities and Exchange Commission (“SEC”) filings, which are on file with the SEC and available in the “Investor Relations” section of our website, http://www.huntington.com, under the heading “Publications and Filings.” All forward‐looking statements speak only as of the date they are made and are based on information available at that time. We do not assume any obligation to update forward‐looking statements to reflect circumstances or events that occur after the date the forward‐looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward‐looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2020 Morgan Stanley Virtual U.S. Financials Conference 2

Current Strategic Priorities Focused on delivering top tier performance and superior customer experience Drive organic revenue growth across all business segments Expand expertise‐driven commercial and small business lending through proactive, personalized guidance Extend the reach of our corporate banking group through both geographic and vertical expansions Continue consumer mass affluent growth with focus on differentiated value proposition and digital capabilities Acquire and deepen customer relationships utilizing our superior customer experience and established OCR strategy across all businesses Develop and execute comprehensive expense management plan for 2020 & 2021 Reduced short‐term discretionary spend, such as travel and entertainment Accelerating long‐term structural cost reduction programs, including branch and facilities closures Maintain balance sheet strength to support our customers and communities Increased liquidity with a focus on core deposit growth Increased allowance for credit losses (ACL) meaningfully in 1Q20 with a proactive approach to identification of criticized loans Building capital levels by maintaining strong underlying earnings power, pausing share repurchases, and issuing $500 million of preferred equity in May 2020 2020 Morgan Stanley Virtual U.S. Financials Conference 3

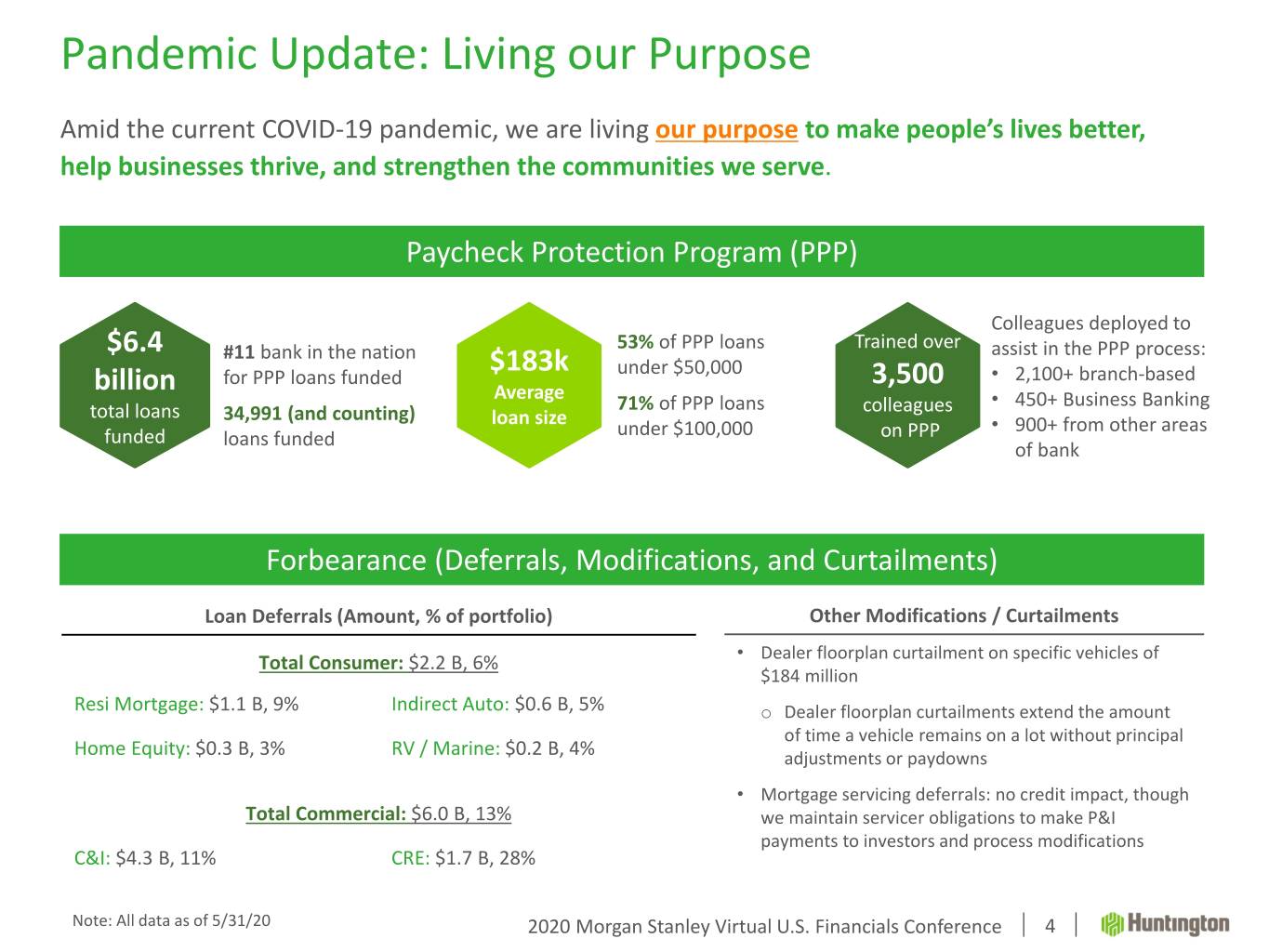

Pandemic Update: Living our Purpose Amid the current COVID‐19 pandemic, we are living our purpose to make people’s lives better, help businesses thrive, and strengthen the communities we serve. Paycheck Protection Program (PPP) Colleagues deployed to $6.4 53% of PPP loans Trained over #11 bank in the nation $183k assist in the PPP process: billion for PPP loans funded under $50,000 3,500 • 2,100+ branch‐based Average • 450+ Business Banking total loans 34,991 (and counting) 71% of PPP loans colleagues loan size • 900+ from other areas funded loans funded under $100,000 on PPP of bank Forbearance (Deferrals, Modifications, and Curtailments) Loan Deferrals (Amount, % of portfolio) Other Modifications / Curtailments • Total Consumer: $2.2 B, 6% Dealer floorplan curtailment on specific vehicles of $184 million Resi Mortgage: $1.1 B, 9% Indirect Auto: $0.6 B, 5% o Dealer floorplan curtailments extend the amount of time a vehicle remains on a lot without principal Home Equity: $0.3 B, 3% RV / Marine: $0.2 B, 4% adjustments or paydowns • Mortgage servicing deferrals: no credit impact, though Total Commercial: $6.0 B, 13% we maintain servicer obligations to make P&I payments to investors and process modifications C&I: $4.3 B, 11% CRE: $1.7 B, 28% Note: All data as of 5/31/20 2020 Morgan Stanley Virtual U.S. Financials Conference 4

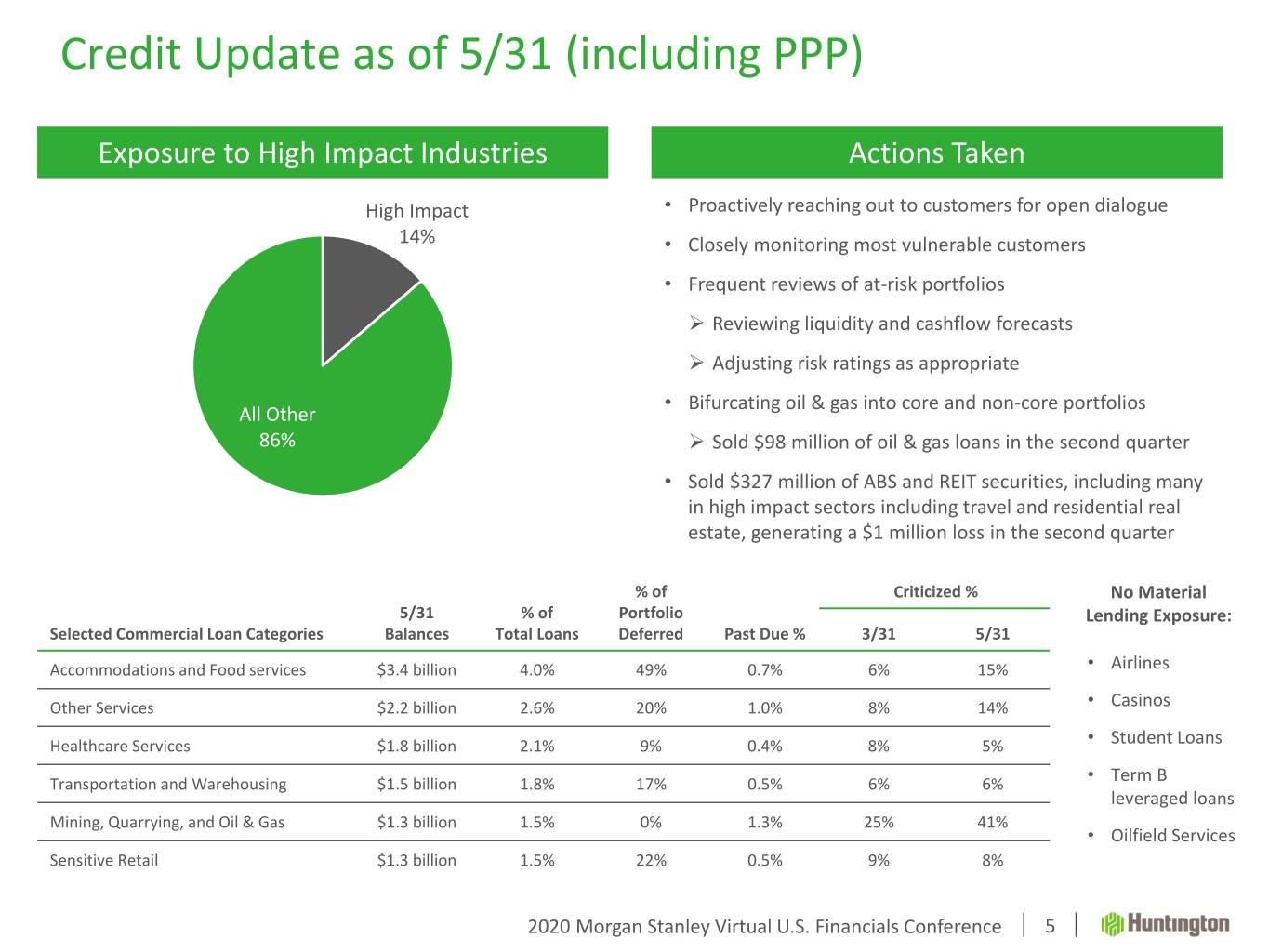

Credit Update as of 5/31 (including PPP) Exposure to High Impact Industries Actions Taken High Impact • Proactively reaching out to customers for open dialogue 14% • Closely monitoring most vulnerable customers • Frequent reviews of at‐risk portfolios Reviewing liquidity and cashflow forecasts Adjusting risk ratings as appropriate • Bifurcating oil & gas into core and non‐core portfolios All Other 86% Sold $98 million of oil & gas loans in the second quarter • Sold $327 million of ABS and REIT securities, including many in high impact sectors including travel and residential real estate, generating a $1 million loss in the second quarter % of Criticized % No Material 5/31 % of Portfolio Lending Exposure: Selected Commercial Loan Categories Balances Total Loans Deferred Past Due % 3/31 5/31 Accommodations and Food services $3.4 billion 4.0% 49% 0.7% 6% 15% • Airlines Other Services $2.2 billion 2.6% 20% 1.0% 8% 14% • Casinos Healthcare Services $1.8 billion 2.1% 9% 0.4% 8% 5% • Student Loans • Transportation and Warehousing $1.5 billion 1.8% 17% 0.5% 6% 6% Term B leveraged loans Mining, Quarrying, and Oil & Gas $1.3 billion 1.5% 0% 1.3% 25% 41% • Oilfield Services Sensitive Retail $1.3 billion 1.5% 22% 0.5% 9% 8% 2020 Morgan Stanley Virtual U.S. Financials Conference 5

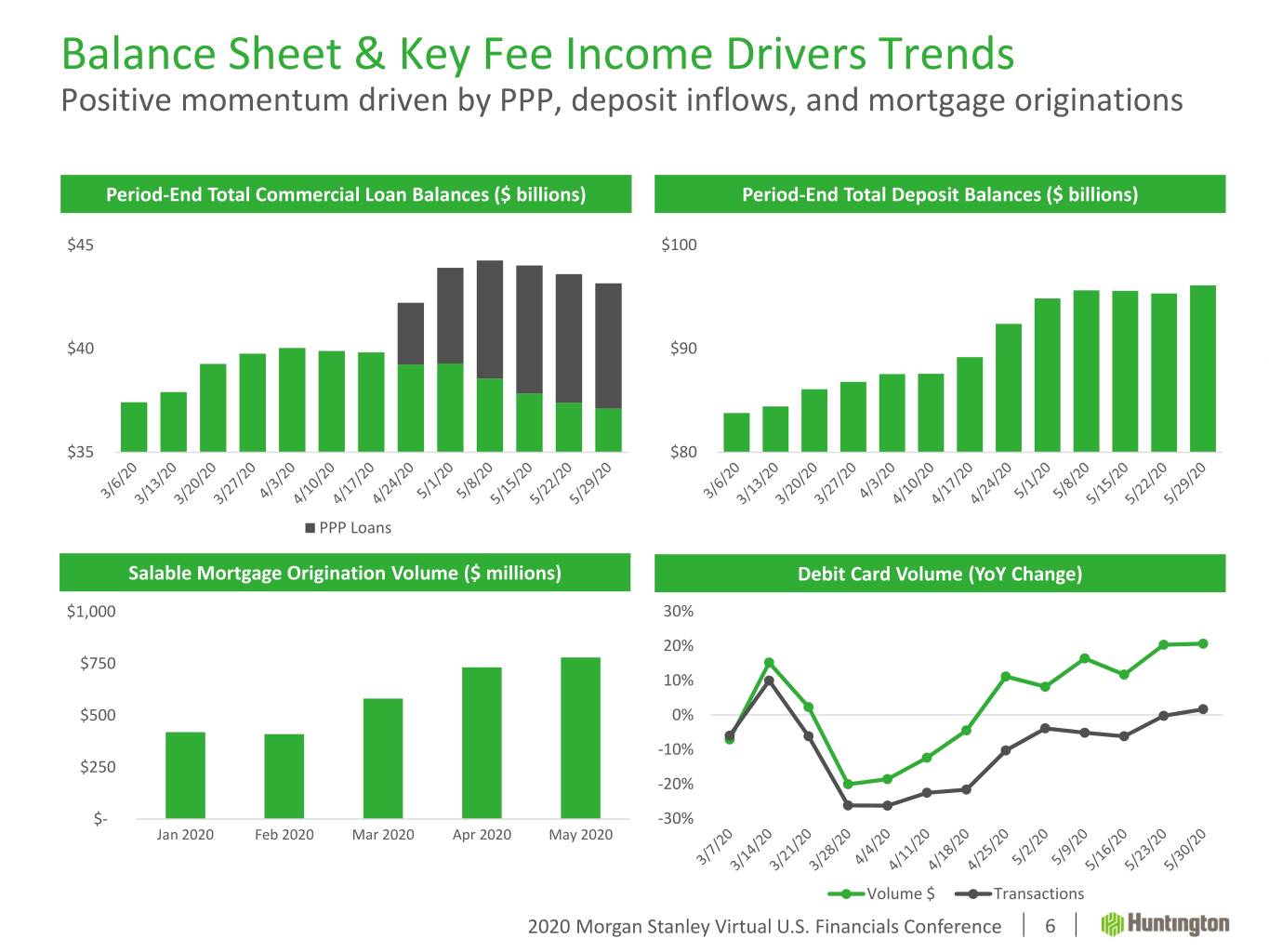

Balance Sheet & Key Fee Income Drivers Trends Positive momentum driven by PPP, deposit inflows, and mortgage originations Period‐End Total Commercial Loan Balances ($ billions) Period‐End Total Deposit Balances ($ billions) $45 $100 $40 $90 $35 $80 PPP Loans Salable Mortgage Origination Volume ($ millions) Debit Card Volume (YoY Change) $1,000 30% 20% $750 10% $500 0% ‐10% $250 ‐20% $‐ ‐30% Jan 2020 Feb 2020 Mar 2020 Apr 2020 May 2020 Volume $ Transactions 2020 Morgan Stanley Virtual U.S. Financials Conference 6

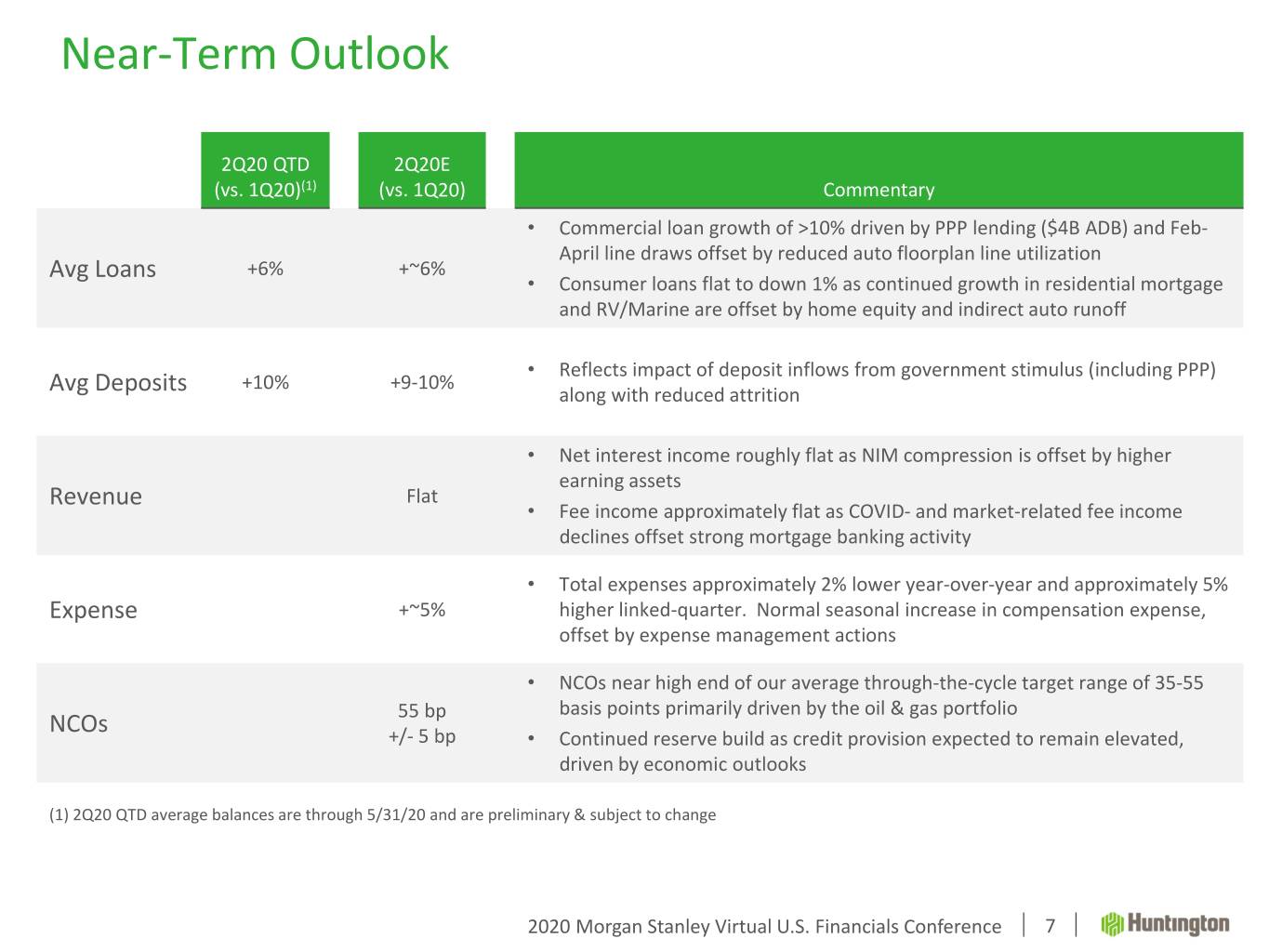

Near‐Term Outlook 2Q20 QTD 2Q20E (vs. 1Q20)(1) (vs. 1Q20) Commentary • Commercial loan growth of >10% driven by PPP lending ($4B ADB) and Feb‐ April line draws offset by reduced auto floorplan line utilization Avg Loans +6% +~6% • Consumer loans flat to down 1% as continued growth in residential mortgage and RV/Marine are offset by home equity and indirect auto runoff • Reflects impact of deposit inflows from government stimulus (including PPP) +10% +9‐10% Avg Deposits along with reduced attrition • Net interest income roughly flat as NIM compression is offset by higher earning assets Revenue Flat • Fee income approximately flat as COVID‐ and market‐related fee income declines offset strong mortgage banking activity • Total expenses approximately 2% lower year‐over‐year and approximately 5% Expense +~5% higher linked‐quarter. Normal seasonal increase in compensation expense, offset by expense management actions • NCOs near high end of our average through‐the‐cycle target range of 35‐55 basis points primarily driven by the oil & gas portfolio NCOs 55 bp +/‐ 5 bp • Continued reserve build as credit provision expected to remain elevated, driven by economic outlooks (1) 2Q20 QTD average balances are through 5/31/20 and are preliminary & subject to change 2020 Morgan Stanley Virtual U.S. Financials Conference 7

Important Messages Building long‐term shareholder value Consistent organic growth Maintain aggregate moderate‐to‐low risk appetite Minimize earnings volatility through the cycle Disciplined capital allocation Focus on top quartile financial performance relative to peers Strategic focus on Customer Experience High level of colleague and shareholder alignment Board, management, and colleague ownership collectively represent top 10 shareholder 2020 Morgan Stanley Virtual U.S. Financials Conference 8

Basis of Presentation Use of Non‐GAAP Financial Measures This document contains GAAP financial measures and non‐GAAP financial measures where management believes it to be helpful in understanding Huntington’s results of operations or financial position. Where non‐GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this document, conference call slides, or the Form 8‐K related to this document, all of which can be found in the Investor Relations section of Huntington’s website, http://www.huntington.com. Annualized Data Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision‐making purposes to better discern underlying performance trends when compared to full‐year or year‐over‐ year amounts. For example, loan and deposit growth rates, as well as net charge‐off percentages, are most often expressed in terms of an annual rate like 8%. As such, a 2% growth rate for a quarter would represent an annualized 8% growth rate. Fully‐Taxable Equivalent Interest Income and Net Interest Margin Income from tax‐exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at statutory rates. This adjustment puts all earning assets, most notably tax‐exempt municipal securities and certain lease assets, on a common basis that facilitates comparison of results to results of competitors. Earnings per Share Equivalent Data Significant income or expense items may be expressed on a per common share basis. This is done for analytical and decision‐ making purposes to better discern underlying trends in total corporate earnings per share performance excluding the impact of such items. Investors may also find this information helpful in their evaluation of our financial performance against published earnings per share mean estimate amounts, which typically exclude the impact of Significant Items. Earnings per share equivalents are usually calculated by applying an effective tax rate to a pre‐tax amount to derive an after‐tax amount, which is divided by the average shares outstanding during the respective reporting period. Occasionally, when the item involves special tax treatment, the after‐tax amount is disclosed separately, with this then being the amount used to calculate the earnings per share equivalent. 2020 Morgan Stanley Virtual U.S. Financials Conference 9

Basis of Presentation Rounding Please note that columns of data in this document may not add due to rounding. Significant Items From time to time, revenue, expenses, or taxes are impacted by items judged by management to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that their outsized impact is believed by management at that time to be infrequent or short term in nature. We refer to such items as “Significant Items”. Most often, these Significant Items result from factors originating outside the company – e.g., regulatory actions/assessments, windfall gains, changes in accounting principles, one‐time tax assessments/refunds, and litigation actions. In other cases they may result from management decisions associated with significant corporate actions out of the ordinary course of business – e.g., merger/restructuring charges, recapitalization actions, and goodwill impairment. Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in market and economic environment conditions, as a general rule volatility alone does not define a Significant Item. For example, changes in the provision for credit losses, gains/losses from investment activities, and asset valuation write‐downs reflect ordinary banking activities and are, therefore, typically excluded from consideration as a Significant Item. Management believes the disclosure of “Significant Items”, when appropriate, aids analysts/investors in better understanding corporate performance and trends so that they can ascertain which of such items, if any, they may wish to include/exclude from their analysis of the company’s performance ‐ i.e., within the context of determining how that performance differed from their expectations, as well as how, if at all, to adjust their estimates of future performance accordingly. To this end, management has adopted a practice of listing “Significant Items” in our external disclosure documents (e.g., earnings press releases, quarterly performance discussions, investor presentations, Forms 10‐Q and 10‐K). “Significant Items” for any particular period are not intended to be a complete list of items that may materially impact current or future period performance. A number of items could materially impact these periods, including those which may be described from time to time in Huntington’s filings with the Securities and Exchange Commission. 2020 Morgan Stanley Virtual U.S. Financials Conference 10