EXHIBIT 99.1

Published on May 16, 2017

Welcome

©2017 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Huntington Bancshares Incorporated

2017 Barclays Americas Select Franchise Conference

May 16, 2017

Exhibit 99.1

Disclaimer

2

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals,

projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements

that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements.

Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar

expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking

statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause

actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political,

or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board;

volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and

services; success, impact, and timing of our business strategies, including market acceptance of any new products or services

implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews,

reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and

the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the

anticipated benefits of the merger with FirstMerit Corporation are not realized when expected or at all, including as a result of the impact of,

or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the

areas where we do business; diversion of management’s attention from ongoing business operations and opportunities; potential adverse

reactions or changes to business or employee relationships, including those resulting from the completion of the merger with FirstMerit

Corporation; our ability to complete the integration of FirstMerit Corporation successfully; and other factors that may affect our future

results. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on

Form 10-K for the year ended December 31, 2016, and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended

March 31, 2017, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor

Relations” section of our website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents we file

with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not

assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-

looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such

statements.

3

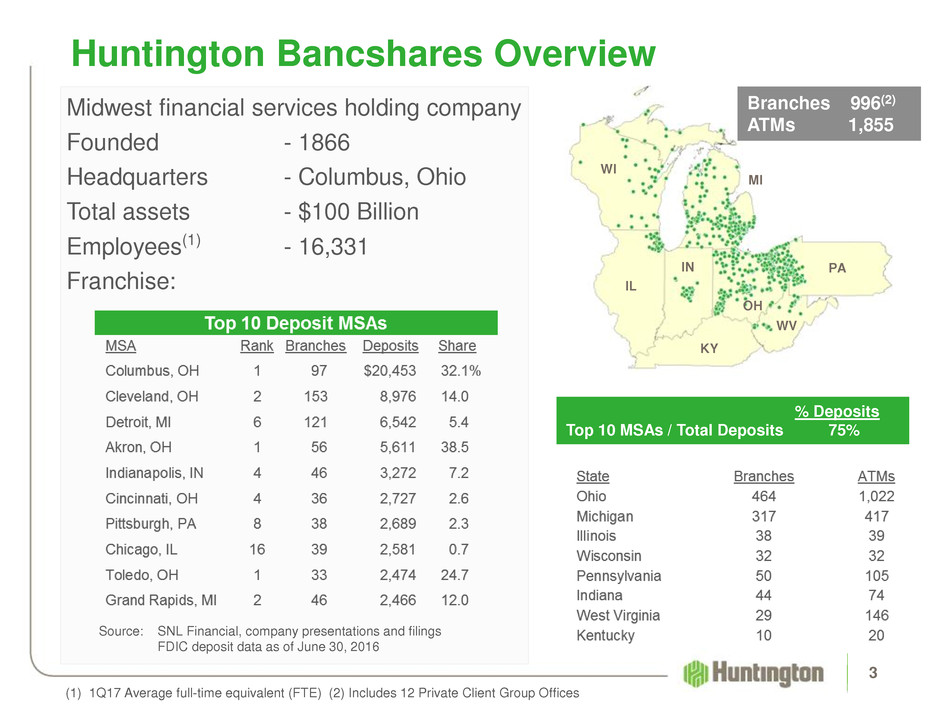

Huntington Bancshares Overview

Midwest financial services holding company

Founded - 1866

Headquarters - Columbus, Ohio

Total assets - $100 Billion

Employees(1) - 16,331

Franchise:

(1) 1Q17 Average full-time equivalent (FTE) (2) Includes 12 Private Client Group Offices

Branches 996(2)

ATMs 1,855

% Deposits

Top 10 MSAs / Total Deposits 75%

Source: SNL Financial, company presentations and filings

FDIC deposit data as of June 30, 2016

MI

WI

IL

IN PA

WV

KY

OH

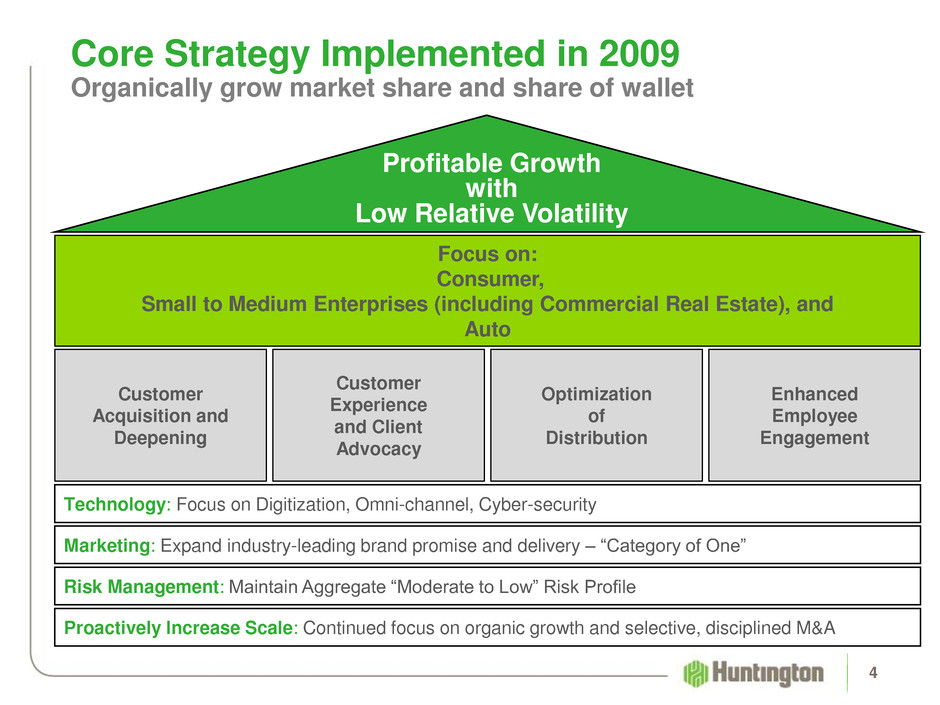

Core Strategy Implemented in 2009

Organically grow market share and share of wallet

4

Marketing: Expand industry-leading brand promise and delivery – “Category of One”

Technology: Focus on Digitization, Omni-channel, Cyber-security

Profitable Growth

with

Low Relative Volatility

Customer

Experience

and Client

Advocacy

Optimization

of

Distribution

Enhanced

Employee

Engagement

Customer

Acquisition and

Deepening

Risk Management: Maintain Aggregate “Moderate to Low” Risk Profile

Proactively Increase Scale: Continued focus on organic growth and selective, disciplined M&A

Focus on:

Consumer,

Small to Medium Enterprises (including Commercial Real Estate), and

Auto

5

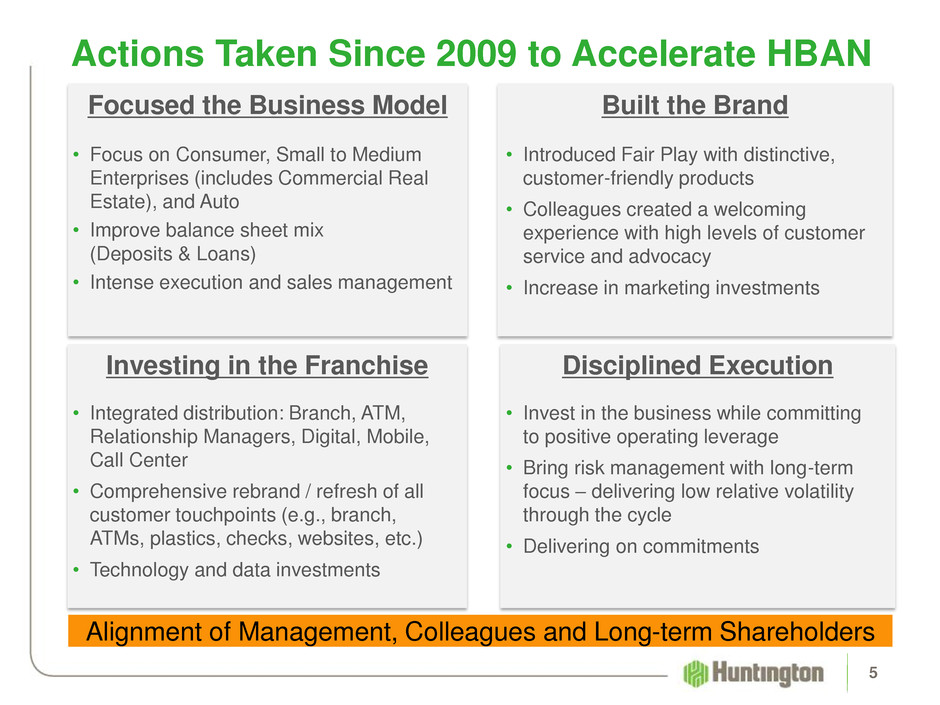

Actions Taken Since 2009 to Accelerate HBAN

Focused the Business Model

Investing in the Franchise

Built the Brand

Disciplined Execution

• Focus on Consumer, Small to Medium

Enterprises (includes Commercial Real

Estate), and Auto

• Improve balance sheet mix

(Deposits & Loans)

• Intense execution and sales management

• Introduced Fair Play with distinctive,

customer-friendly products

• Colleagues created a welcoming

experience with high levels of customer

service and advocacy

• Increase in marketing investments

• Integrated distribution: Branch, ATM,

Relationship Managers, Digital, Mobile,

Call Center

• Comprehensive rebrand / refresh of all

customer touchpoints (e.g., branch,

ATMs, plastics, checks, websites, etc.)

• Technology and data investments

• Invest in the business while committing

to positive operating leverage

• Bring risk management with long-term

focus – delivering low relative volatility

through the cycle

• Delivering on commitments

Alignment of Management, Colleagues and Long-term Shareholders

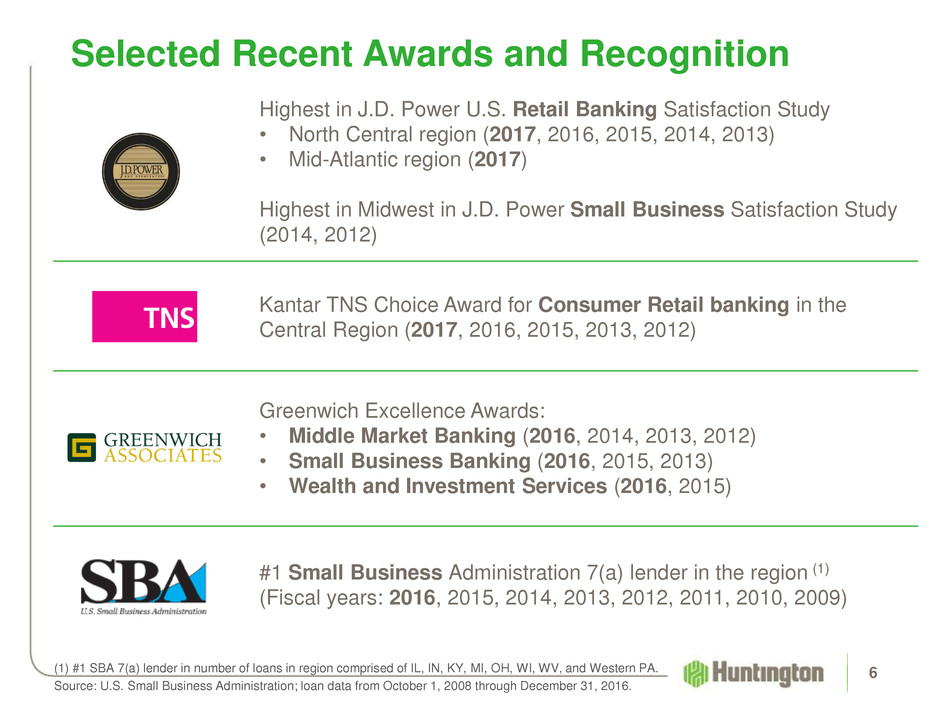

Selected Recent Awards and Recognition

6

#1 Small Business Administration 7(a) lender in the region (1)

(Fiscal years: 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009)

Greenwich Excellence Awards:

• Middle Market Banking (2016, 2014, 2013, 2012)

• Small Business Banking (2016, 2015, 2013)

• Wealth and Investment Services (2016, 2015)

Highest in J.D. Power U.S. Retail Banking Satisfaction Study

• North Central region (2017, 2016, 2015, 2014, 2013)

• Mid-Atlantic region (2017)

Highest in Midwest in J.D. Power Small Business Satisfaction Study

(2014, 2012)

Kantar TNS Choice Award for Consumer Retail banking in the

Central Region (2017, 2016, 2015, 2013, 2012)

(1) #1 SBA 7(a) lender in number of loans in region comprised of IL, IN, KY, MI, OH, WI, WV, and Western PA.

Source: U.S. Small Business Administration; loan data from October 1, 2008 through December 31, 2016.

7

FirstMerit Acquisition: Classic In-market Deal

Expense Savings Drive Compelling Economics, while Revenue

Enhancement Opportunities Provide Long-Term Upside

Strong Cultural and Strategic Fit

• Complementary businesses with similar cultures & customer profiles

• Pro forma #2 deposit market share in Ohio, significantly enhanced

presence in Michigan

• Entrance into attractive Chicago & Wisconsin markets –

emphasizing business focus

Compelling Economics

• Provides opportunity to accelerate achievement of long-term

financial goals

300+ bp expected improvement in ROTCE

400+ bp expected improvement in Efficiency Ratio

• On track to achieve 40% cost savings within one year of closing;

~75% of planned cost savings implemented to date

• Revenue enhancements provide additional long-term earnings

upside opportunity; already executing on business plans Copyright Nasdaq 2016

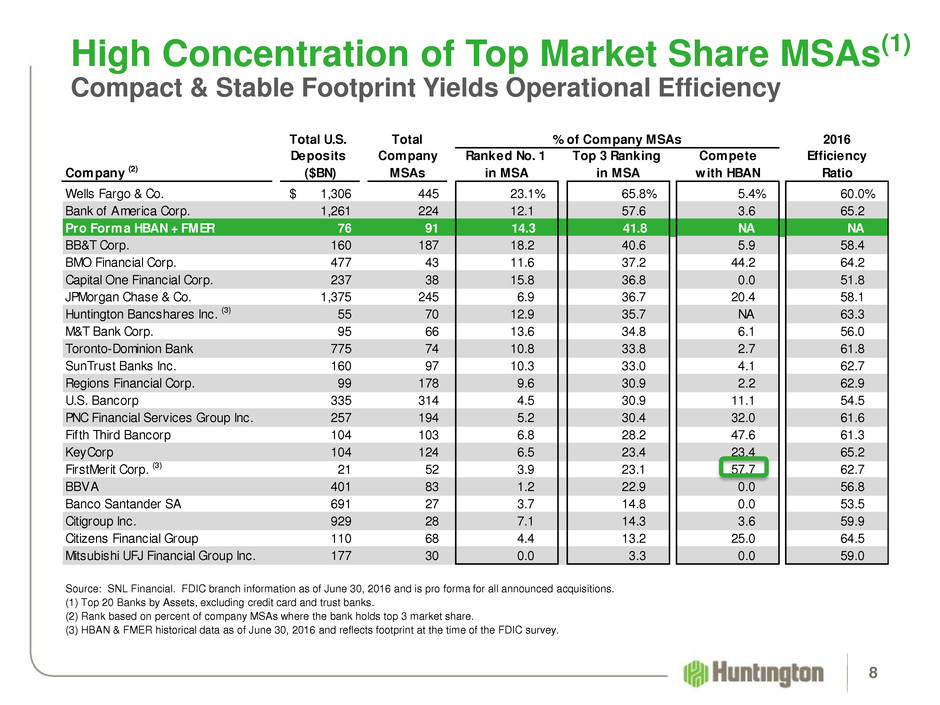

Total U.S. Total % of Company MSAs 2016

Deposits Company Ranked No. 1 Top 3 Ranking Compete Efficiency

Company (2) ($BN) MSAs in MSA in MSA with HBAN Ratio

Wells Fargo & Co. 1,306$ 445 23.1% 65.8% 5.4% 60.0%

Bank of America Corp. 1,261 224 12.1 57.6 3.6 65.2

Pro Forma HBAN + FMER 76 91 14.3 41.8 NA NA

BB&T Corp. 160 187 18.2 40.6 5.9 58.4

BMO Financial Corp. 477 43 11.6 37.2 44.2 64.2

Capital One Financial Corp. 237 38 15.8 36.8 0.0 51.8

JPMorgan Chase & Co. 1,375 245 6.9 36.7 20.4 58.1

Huntington Bancshares Inc. (3) 55 70 12.9 35.7 NA 63.3

M&T Bank Corp. 95 66 13.6 34.8 6.1 56.0

Toronto-Dominion Bank 775 74 10.8 33.8 2.7 61.8

SunTrust Banks Inc. 160 97 10.3 33.0 4.1 62.7

Regions Financial Corp. 99 178 9.6 30.9 2.2 62.9

U.S. Bancorp 335 314 4.5 30.9 11.1 54.5

PNC Financial Services Group Inc. 257 194 5.2 30.4 32.0 61.6

Fifth Third Bancorp 104 103 6.8 28.2 47.6 61.3

KeyCorp 104 124 6.5 23.4 23.4 65.2

FirstMerit Corp. (3) 21 52 3.9 23.1 57.7 62.7

BBVA 401 83 1.2 22.9 0.0 56.8

Banco Santander SA 691 27 3.7 14.8 0.0 53.5

Citigroup Inc. 929 28 7.1 14.3 3.6 59.9

Citizens Financial Group 110 68 4.4 13.2 25.0 64.5

Mitsubishi UFJ Financial Group Inc. 177 30 0.0 3.3 0.0 59.0

8

High Concentration of Top Market Share MSAs(1)

Compact & Stable Footprint Yields Operational Efficiency

Source: SNL Financial. FDIC branch information as of June 30, 2016 and is pro forma for all announced acquisitions.

(1) Top 20 Banks by Assets, excluding credit card and trust banks.

(2) Rank based on percent of company MSAs where the bank holds top 3 market share.

(3) HBAN & FMER historical data as of June 30, 2016 and reflects footprint at the time of the FDIC survey.

9

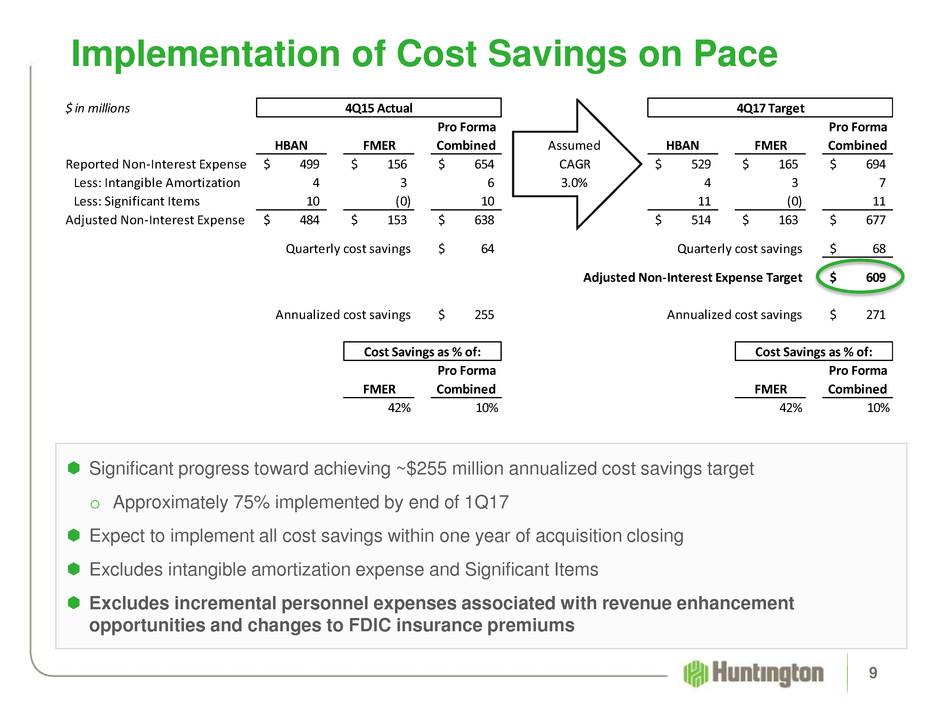

Implementation of Cost Savings on Pace

Significant progress toward achieving ~$255 million annualized cost savings target

o Approximately 75% implemented by end of 1Q17

Expect to implement all cost savings within one year of acquisition closing

Excludes intangible amortization expense and Significant Items

Excludes incremental personnel expenses associated with revenue enhancement

opportunities and changes to FDIC insurance premiums

$ in millions 4Q15 Actual 4Q17 Target

Pro Forma Pro Forma

HBAN FMER Combined Assumed HBAN FMER Combined

Reported Non-Interest Expense 499$ 156$ 654$ CAGR 529$ 165$ 694$

Less: Intangible Amortization 4 3 6 3.0% 4 3 7

Less: Significant Items 10 (0) 10 11 (0) 11

Adjusted Non-Interest Expense 484$ 153$ 638$ 514$ 163$ 677$

Quarterly cost savings 64$ Quarterly cost savings 68$

Adjusted Non-Interest Expense Target 609$

Annualized cost savings 255$ Annualized cost savings 271$

Cost Savings as % of: Cost Savings as % of:

Pro Forma Pro Forma

FMER Combined FMER Combined

42% 10% 42% 10%

10

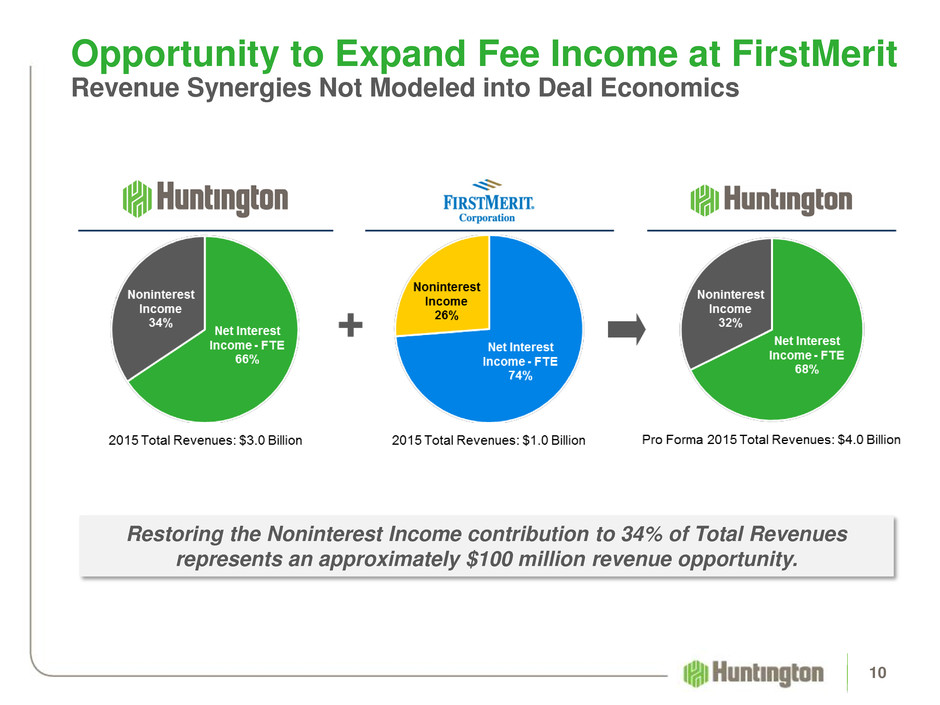

Opportunity to Expand Fee Income at FirstMerit

Revenue Synergies Not Modeled into Deal Economics

Restoring the Noninterest Income contribution to 34% of Total Revenues

represents an approximately $100 million revenue opportunity.

11

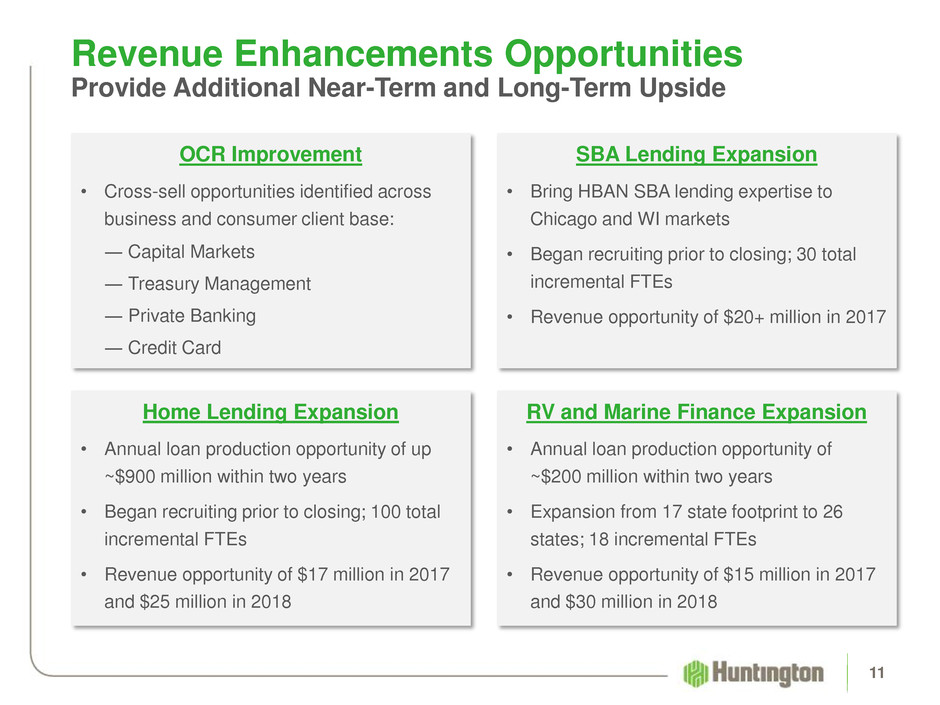

Revenue Enhancements Opportunities

Provide Additional Near-Term and Long-Term Upside

Home Lending Expansion

• Annual loan production opportunity of up

~$900 million within two years

• Began recruiting prior to closing; 100 total

incremental FTEs

• Revenue opportunity of $17 million in 2017

and $25 million in 2018

OCR Improvement

• Cross-sell opportunities identified across

business and consumer client base:

― Capital Markets

― Treasury Management

― Private Banking

― Credit Card

SBA Lending Expansion

• Bring HBAN SBA lending expertise to

Chicago and WI markets

• Began recruiting prior to closing; 30 total

incremental FTEs

• Revenue opportunity of $20+ million in 2017

RV and Marine Finance Expansion

• Annual loan production opportunity of

~$200 million within two years

• Expansion from 17 state footprint to 26

states; 18 incremental FTEs

• Revenue opportunity of $15 million in 2017

and $30 million in 2018

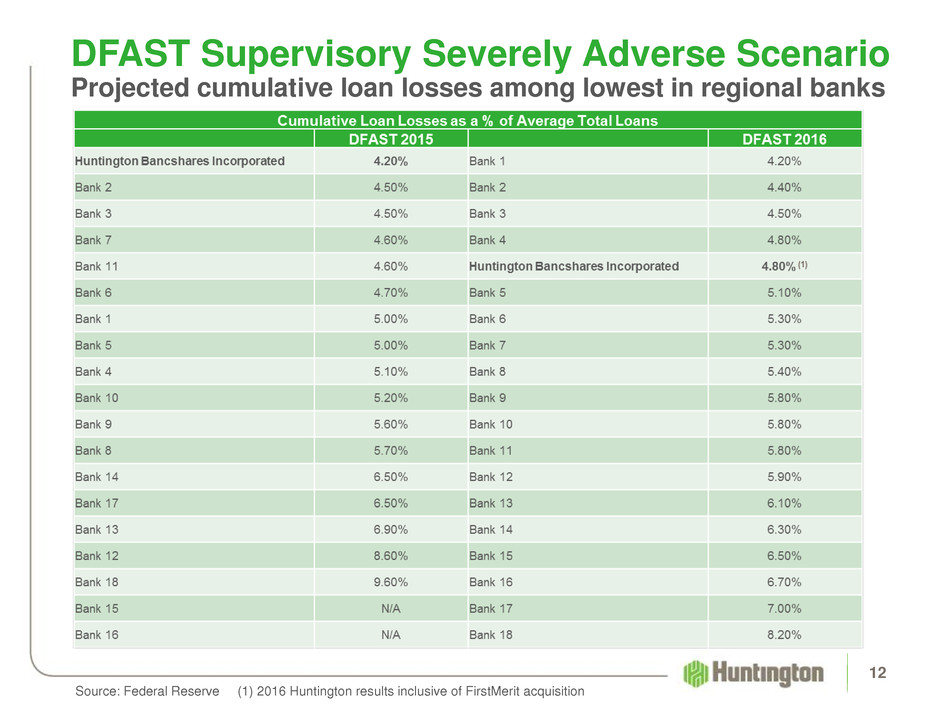

DFAST Supervisory Severely Adverse Scenario

Projected cumulative loan losses among lowest in regional banks

12

Source: Federal Reserve (1) 2016 Huntington results inclusive of FirstMerit acquisition

13

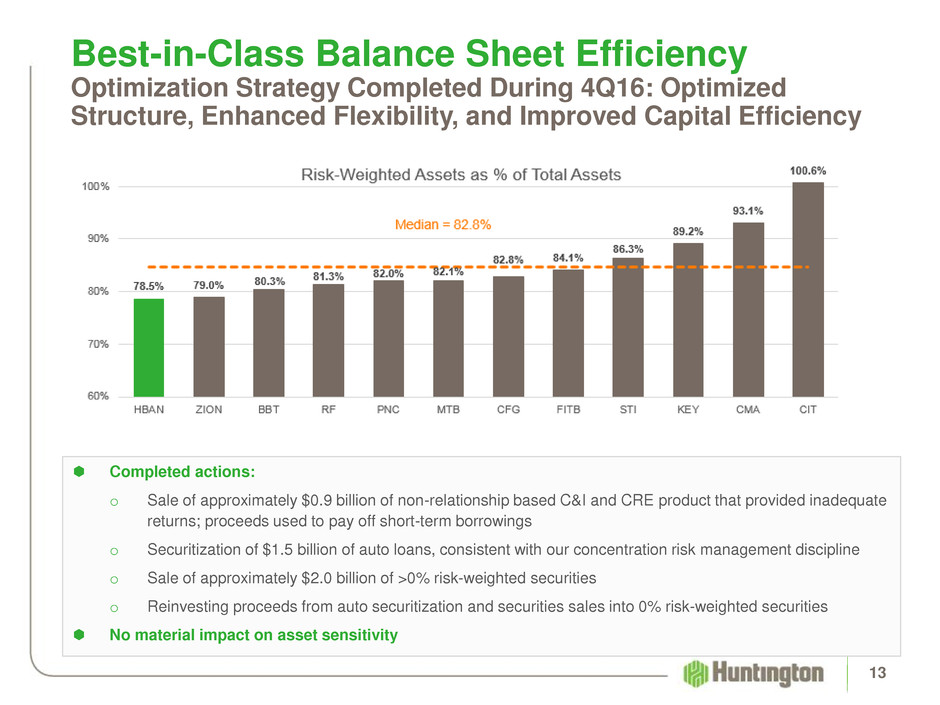

Best-in-Class Balance Sheet Efficiency

Optimization Strategy Completed During 4Q16: Optimized

Structure, Enhanced Flexibility, and Improved Capital Efficiency

Completed actions:

o Sale of approximately $0.9 billion of non-relationship based C&I and CRE product that provided inadequate

returns; proceeds used to pay off short-term borrowings

o Securitization of $1.5 billion of auto loans, consistent with our concentration risk management discipline

o Sale of approximately $2.0 billion of >0% risk-weighted securities

o Reinvesting proceeds from auto securitization and securities sales into 0% risk-weighted securities

No material impact on asset sensitivity

14

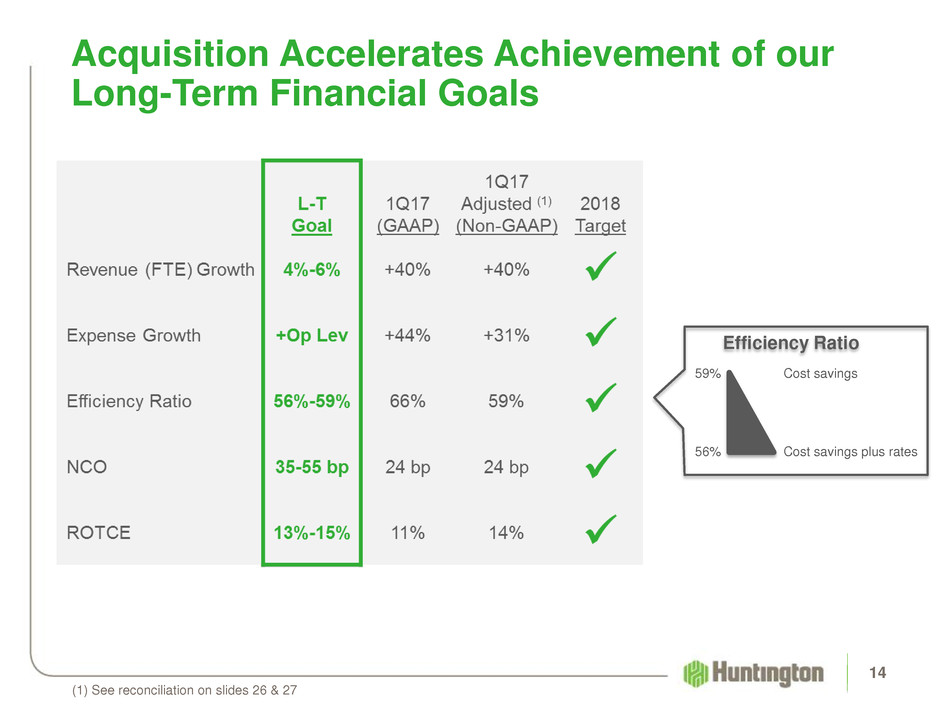

Acquisition Accelerates Achievement of our

Long-Term Financial Goals

59% Cost savings

56% Cost savings plus rates

Efficiency Ratio

(1) See reconciliation on slides 26 & 27

Substantially complete with FirstMerit integration; confidence in delivery of

cost savings and revenue enhancements

Focused on three areas with sustainable competitive advantages

o Consumer

o Small to Medium Enterprises (including Commercial Real Estate)

o Auto

Consistent core strategy since 2009

o Delivered on growth strategies with sustained investment

o Enhancing execution to drive further performance improvement

o Meaningful investment in people, technology, and brand

o Disciplined risk management – Aggregate moderate-to-low risk profile

Driving core deposit and loan growth through disciplined execution and a

differentiated customer experience

Focus on delivery of consistent through-the-cycle shareholder returns

High level of colleague and shareholder alignment

Important Messages

15

Appendix

16

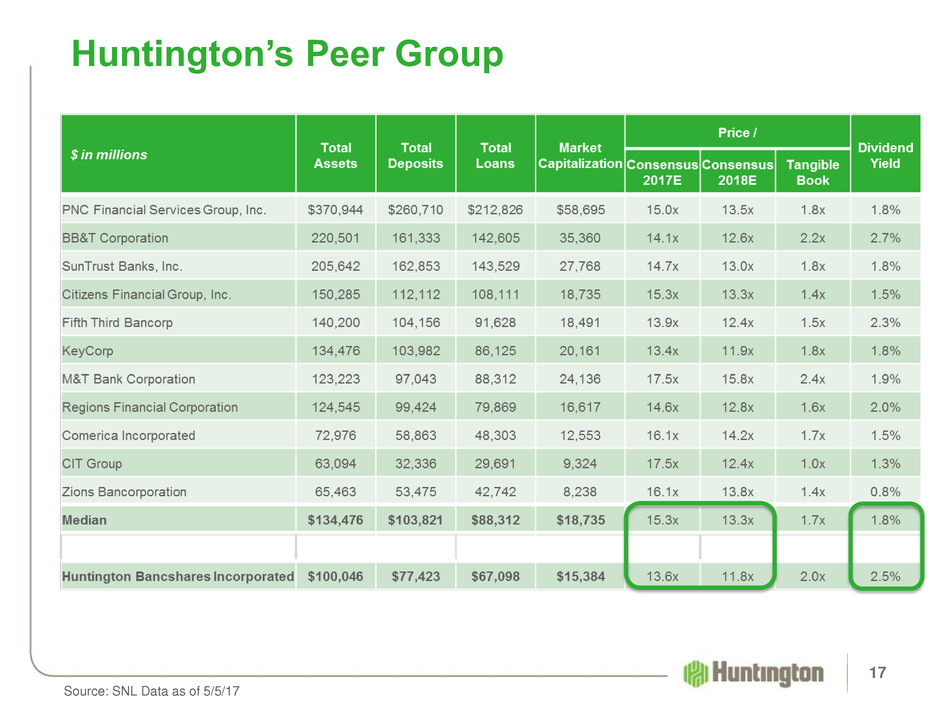

Huntington’s Peer Group

17

Source: SNL Data as of 5/5/17

Deeply Engaged, Diverse Board of Directors

Lizabeth Ardisana

Principal / CEO, ASG Renaissance, LLC

Gina D. France

President and CEO, France Strategic

Partners LLC

Eddie R. Munson

Retired Managing Partner and Director,

KPMG LLC

Ann ("Tanny") B. Crane

President and CEO, Crane Group Company

J. Michael Hochschwender

President and CEO, The Smithers Group

Richard W. Neu

Chairman, MCG Capital Corporation;

Retired CFO and Treasurer, Charter One

Financial

Robert S. Cubbin

Retired President and CEO, Meadowbrook

Insurance Group

Chris Inglis

Distinguished Visiting Professor of Cyber

Studies, U.S. Naval Academy; retired Deputy

Director, National Security Agency

David L. Porteous

Attorney, McCurdy Wotila & Porteous, P.C.;

Lead Director, Huntington Bancshares

Steven G. Elliott

Retired Senior Vice Chairman, BNY Mellon

Peter J. Kight

Private Investor; former Chairman/CEO and

founder, Checkfree

Kathleen H. Ransier

Retired Partner, Vorys, Sater, Seymour and

Pease LLP

Michael J. Endres

Senior Advisor, Stonehenge Partners LLC

Jonathan A. Levy

Managing Partner and co-founder, Redstone

Investments

Stephen D. Steinour

Chairman, President, and CEO,

Huntington Bancshares Incorporated

18

• Board defined aggregate moderate-to-low risk appetite

• Board and CEO set the “Tone at the Top”

• Strong risk management processes; 3 lines of defense, data driven,

concentrations & limits, high accountability

• Significant investment in risk management personnel and process

• “Everyone Owns Risk” around an aggregate moderate-to-low risk culture

• Disciplined management of credit risk – hold limits, concentrations limits,

timely approval process, active portfolio management with very good MIS

• Liquidity significantly enhanced by change in funding mix and industry

leading customer share of wallet

• Belief that managing lower credit risk will reduce earnings volatility providing

more stable returns and higher capital generation over time

• Higher capital generation will provide more flexibility and strength, as well as

drive higher creation of shareholder value

Risk Management is at the Core of

Huntington’s Evolution

19

Management and Shareholder Alignment

20

Incentive plan structures

Hold-to-retirement / exit requirements on equity grants and awards

Short-term incentive plan cash payout capped at 100% of target for executive leadership and senior

managers; portions above 100% paid in RSUs (restricted stock units)

Long-term incentive plan paid with combination of PSUs (performance share units), RSUs, and

stock options – all have multi-year vesting

Clawback provisions in all incentive compensation plans

Insider ownership

Equity ownership targets for CEO, Executive Leadership Team (ELT), and select senior managers

Directors, ELT, and colleagues collectively represent the fifth largest shareholder (more than 27

million shares; 3% of total shares outstanding)

CEO Steinour is largest known individual shareholder (as of December 31, 2016, owned 3.4 million

common shares; almost 7x the guideline and 43x base salary)

o Since joining Huntington in January 2009, CEO Steinour has purchased more than 1.5 million

shares in open market transactions

HBAN has instituted mechanisms to drive a high level of management and

shareholder alignment, focusing decision making on long-term returns while

maintaining our aggregate moderate-to-low risk profile.

Our Commitment to Environmental, Social, &

Governance (ESG)

21

• Published in May 2017, our first ESG Annual Report

signals our commitment to provide transparency and

accountability in alignment with global standards for

environmental, social, and governance considerations.

• While the report is new, our commitment to ESG is a

reaffirmation of our long-held commitment to do the

right thing for our shareholders, customers,

colleagues, and communities.

• We have established an enterprise ESG strategy

integrated with our core performance objectives, led by

executive management, and a newly formed Corporate

ESG Committee with accountability to the Board of

Directors Nominating and Governance Committee.

22

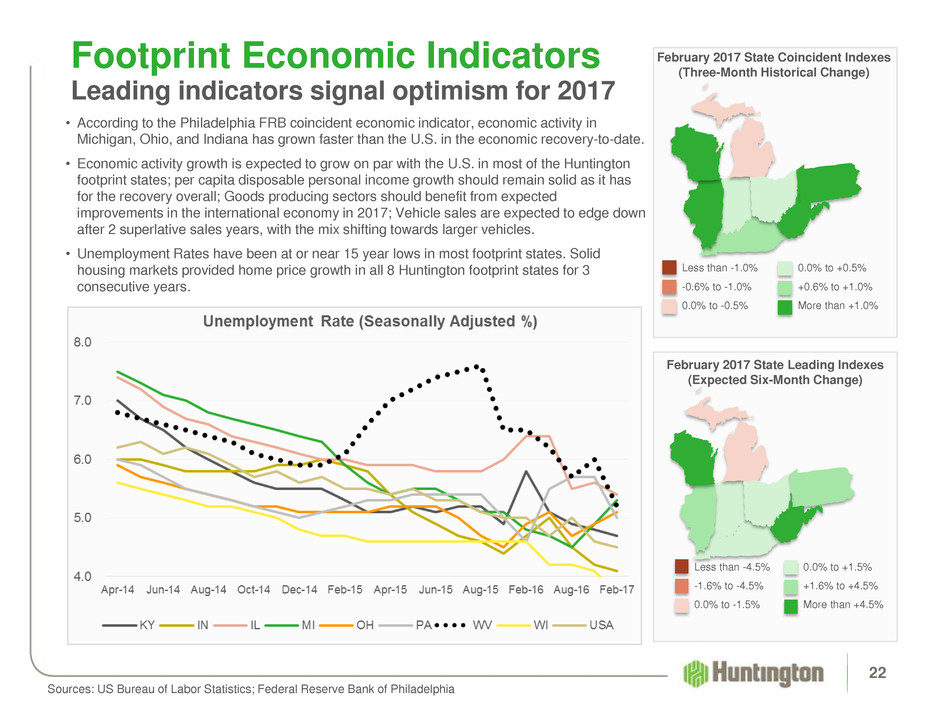

Footprint Economic Indicators

Leading indicators signal optimism for 2017

Sources: US Bureau of Labor Statistics; Federal Reserve Bank of Philadelphia

• According to the Philadelphia FRB coincident economic indicator, economic activity in

Michigan, Ohio, and Indiana has grown faster than the U.S. in the economic recovery-to-date.

• Economic activity growth is expected to grow on par with the U.S. in most of the Huntington

footprint states; per capita disposable personal income growth should remain solid as it has

for the recovery overall; Goods producing sectors should benefit from expected

improvements in the international economy in 2017; Vehicle sales are expected to edge down

after 2 superlative sales years, with the mix shifting towards larger vehicles.

• Unemployment Rates have been at or near 15 year lows in most footprint states. Solid

housing markets provided home price growth in all 8 Huntington footprint states for 3

consecutive years.

February 2017 State Leading Indexes

(Expected Six-Month Change)

Less than -4.5%

-1.6% to -4.5%

0.0% to -1.5%

0.0% to +1.5%

+1.6% to +4.5%

More than +4.5%

Less than -1.0%

-0.6% to -1.0%

0.0% to -0.5%

0.0% to +0.5%

+0.6% to +1.0%

More than +1.0%

February 2017 State Coincident Indexes

(Three-Month Historical Change)

23

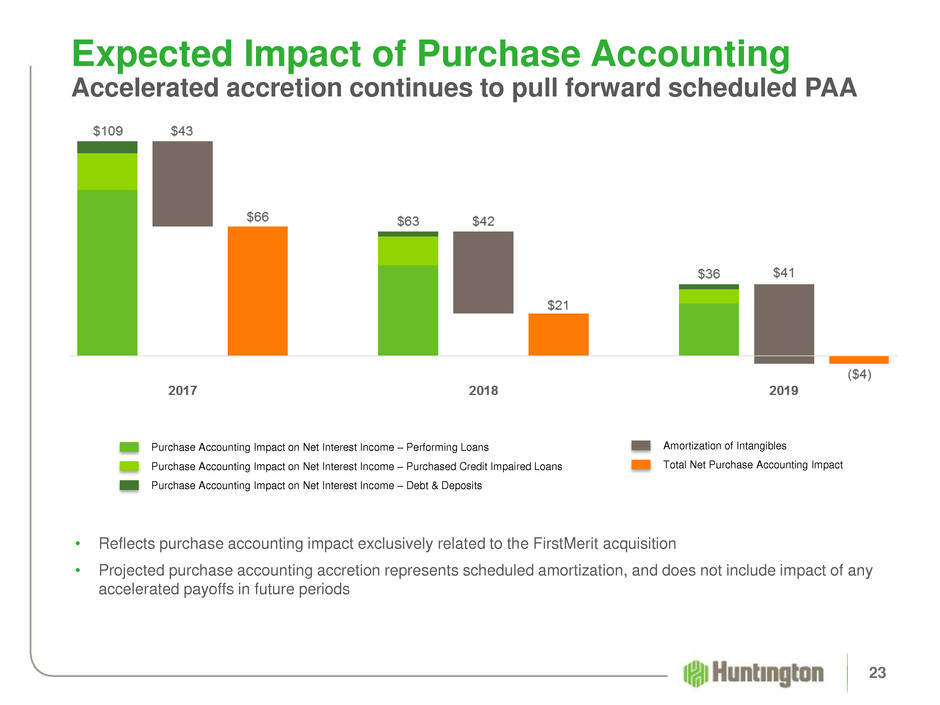

Expected Impact of Purchase Accounting

Accelerated accretion continues to pull forward scheduled PAA

• Reflects purchase accounting impact exclusively related to the FirstMerit acquisition

• Projected purchase accounting accretion represents scheduled amortization, and does not include impact of any

accelerated payoffs in future periods

Purchase Accounting Impact on Net Interest Income – Purchased Credit Impaired Loans

Purchase Accounting Impact on Net Interest Income – Debt & Deposits

Amortization of Intangibles Purchase Accounting Impact on Net Interest Income – Performing Loans

Total Net Purchase Accounting Impact

24

FirstMerit Acquisition Milestones

Effectively Managing Execution Risk is THE Immediate Focus

Back Office

Consolidations

(1Q17)

Acquisition

Closing

Integration Execution

Branch

Divestiture

Closing

(4Q16)

Network &

Equipment

Upgrades, and

Permanent

Signage Installed

(4Q16)

Standalone

Applications

and Systems

Conversions,

ATMs

deployed

(3Q16)

Subsidiary

Bank

Merger

Completed

FirstMerit has the potential to transform our efficiency and return profiles.

Ensuring a successful integration is our primary focus.

Mock

Branch

Conversions

(4Q16)

Colleague

Onboarding

and Training

(1Q17)

Final Systems &

Applications

Conversions

(April 2017 -

Complete)

Management &

Organizational

Changes

Implemented

(3Q16)

Branch

Conversions &

Consolidations

(1Q17)

Core Systems

Conversions

(1Q17)

Network &

Equipment

Upgrades, and

Permanent

Signage Installed

(3Q16)

Standalone

Applications

and Systems

Conversions,

ATMs

deployed

(4Q16)

Mock

Branch

Conversions

(1Q17)

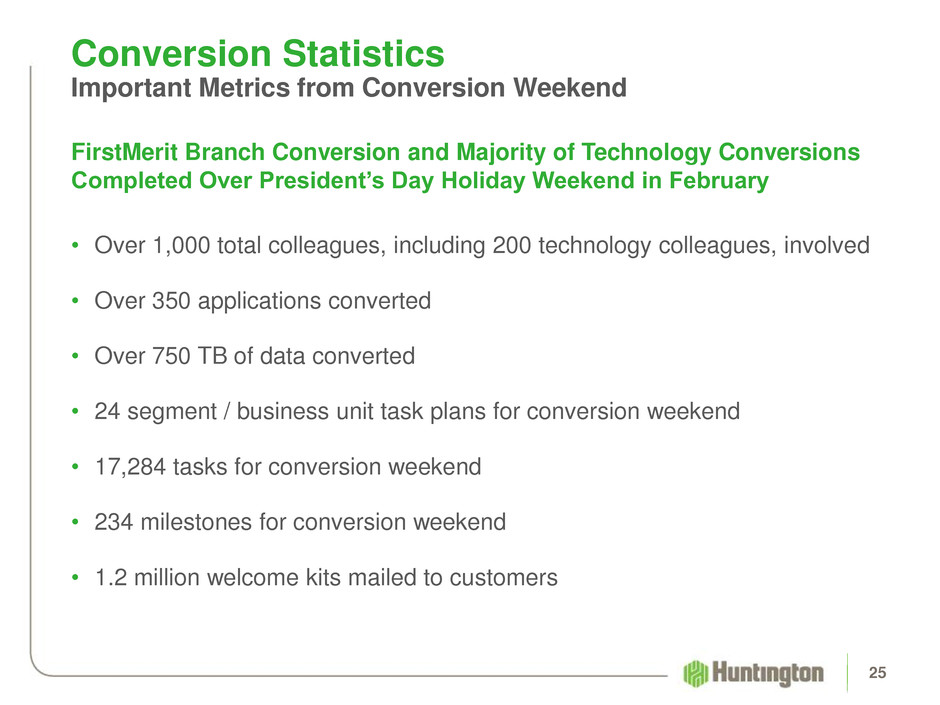

FirstMerit Branch Conversion and Majority of Technology Conversions

Completed Over President’s Day Holiday Weekend in February

• Over 1,000 total colleagues, including 200 technology colleagues, involved

• Over 350 applications converted

• Over 750 TB of data converted

• 24 segment / business unit task plans for conversion weekend

• 17,284 tasks for conversion weekend

• 234 milestones for conversion weekend

• 1.2 million welcome kits mailed to customers

25

Conversion Statistics

Important Metrics from Conversion Weekend

26

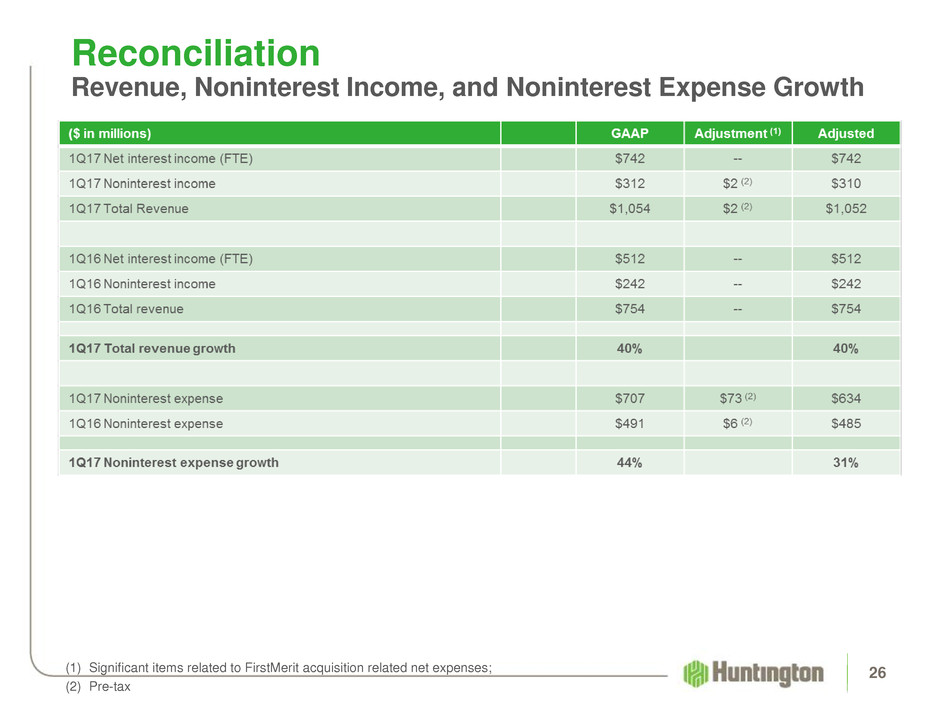

Reconciliation

Revenue, Noninterest Income, and Noninterest Expense Growth

(1) Significant items related to FirstMerit acquisition related net expenses;

(2) Pre-tax

27

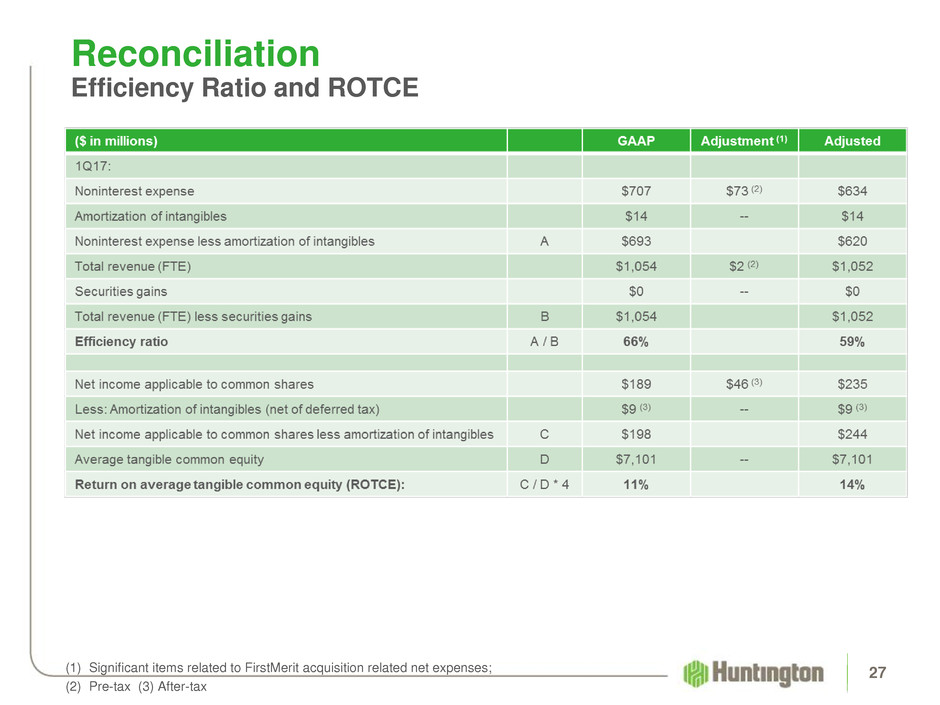

Reconciliation

Efficiency Ratio and ROTCE

(1) Significant items related to FirstMerit acquisition related net expenses;

(2) Pre-tax (3) After-tax